Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons of volumes.

Today we look at 1Q22 Volume and market share for:

- USD Swaps (LIBOR, OIS, SOFR)

- EUR Swaps (EURIBOR, OIS, €STR)

- GBP Swaps (LIBOR, SONIA)

- JPY Swaps (IBOR, TONA)

- AUD Swaps (BBSW, AONIA)

- CAD Swaps (IBOR, CORRA)

- EMEA Swaps

- AsiaPac Swaps

- LatAm Swaps

Onto the charts, data and details.

Volumes and Market Share

For major currencies and regions, vanilla swaps referencing IBORs and OIS Swaps referencing RFRs.

We use single-side gross notional and cleared volume over a period, either a Year, a Quarter or a Month.

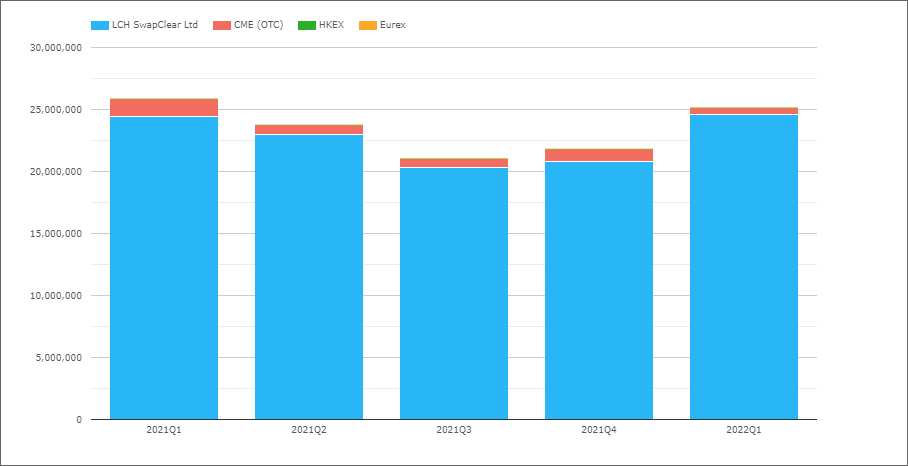

USD Swaps (Libor)

- 2022Q1 with $25.2 trillion compared to $25.9 trillion in 2021Q1

- At first glance surprisingly high given the move to SOFR, but one explained by the fact that FRA volume has moved into single-period swaps (SPS), see next chart below

- LCH SwapClear with $24.6 trillion in 2022Q1 and $24.4 trillion in 2021Q1

- CME OTC with $0.5 trillion in 2022Q1 and $1.4 trillion in 2021Q1

- 2022Q1 Share is LCH 97.8% and CME 2.2%, compared to 94.5% v 5.5% in 2021Q1, but not really an apples to apples comparison given the FRA issue noted above

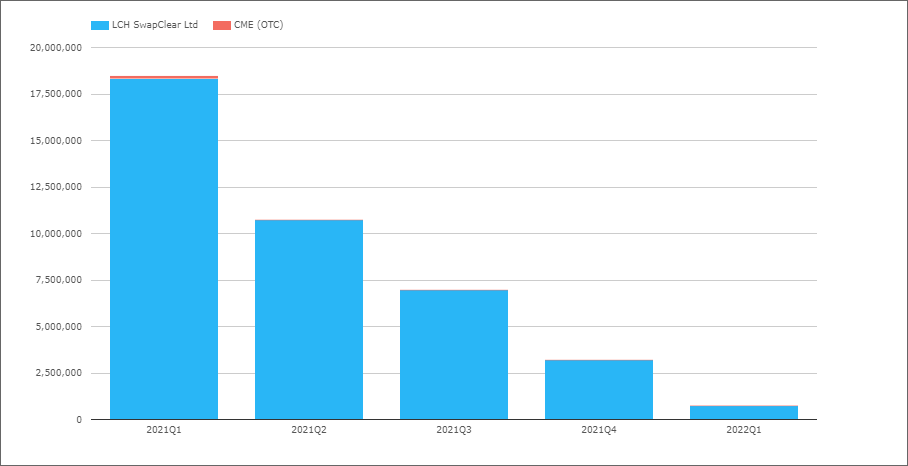

A chart showing USD FRAs by quarter for the same period is illustrative.

- 2022Q1 with just $0.7 trillion compared to $18.5 trillion in 2021Q1

- A large chunk of the vanished FRA volumes is now in the IRS 2022Q1 figures as SPS

- As well as a reduced FRA use for portfolio rate reset management given SOFR uptake

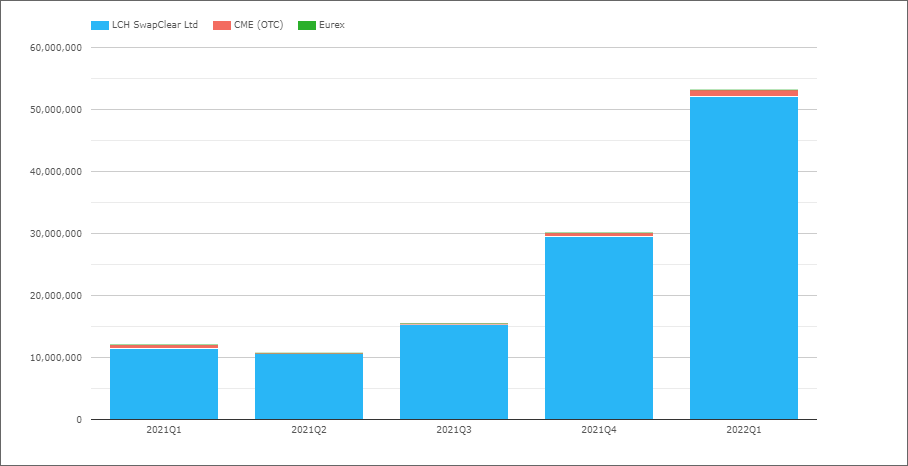

USD OIS (All)

Referencing either Fed Funds or SOFR.

- 2022Q1 with $53.2 trillion compared to $12.1 trillion in 2021Q1 and $30 trillion in 2021Q4

- A spectacular increase, driven by SOFR uptake and FedFunds activity due to Fed rate rise expectations

- LCH SwapClear with $52.1 trillion in 2022Q1 and $11.4 trillion in 2021Q1

- CME OTC with $1.1 trillion in 2022Q1 and $0.7 trillion in 2021Q1

- 2022Q1 Share is LCH 97.9% and CME 2.1%, compared to 94.4% v 5.6% in 2021Q1

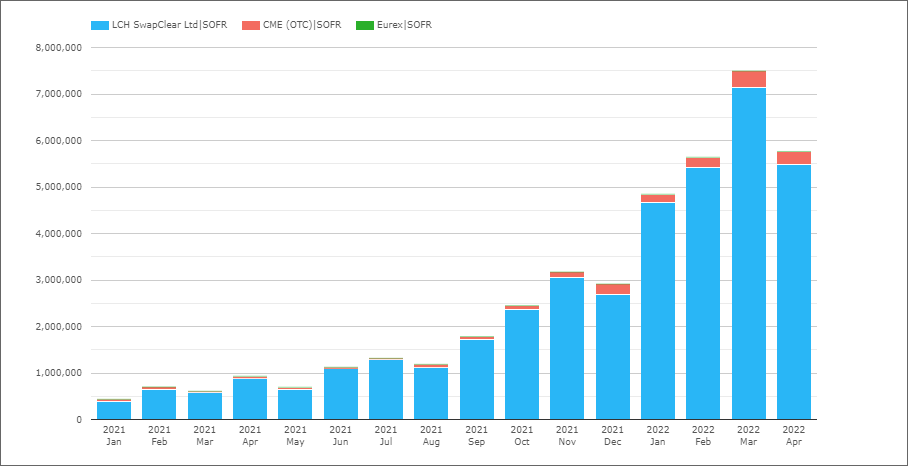

USD Swaps (SOFR)

Next isolating Swaps that reference SOFR, either OIS or Basis, volumes by month.

- March 2022 with a record high of $7.5 trillion

- 2022Q1 with $18 trillion, up from $1.75 trillion in 2021Q1, an

- Explaining 40% of the $40 trillion increase in OIS shown in the previous section

- 2022Q1 Share is LCH 95.8% and CME 4.2%, compared to 93.6% v 6.3% in 2021Q1

That’s all for USD for today.

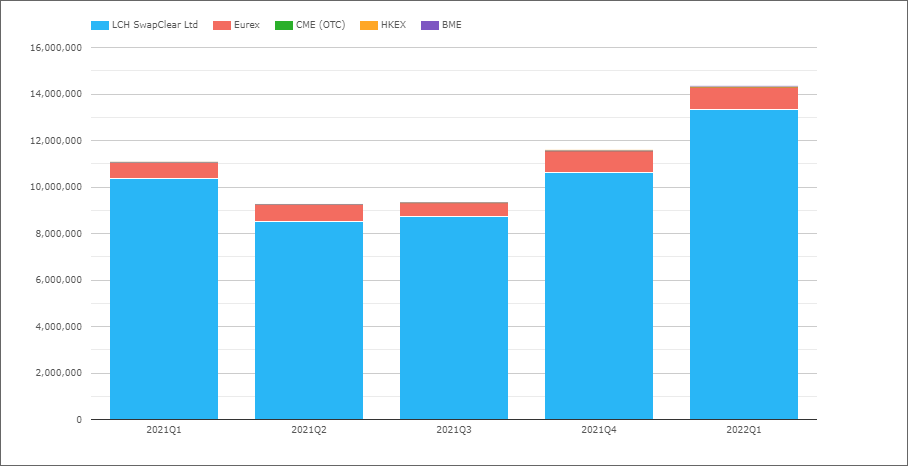

EUR Swaps (Euribor)

- 2022Q1 with €14.3 trillion compared to €11.1 trillion in 2021Q1

- LCH SwapClear with €13.3 trillion in 2022Q1 and €10.4 trillion in 2021Q1

- Eurex with €0.96 trillion in 2022Q1 and €0.68 trillion in 2021Q1

- 2022Q1 market share is LCH 93.3%, Eurex 6.7%

- While 2021Q1 share was 93.8% and 6.1% respectively

Eurex quarterly share of 6.1%, 7.9%, 6.5%, 8.2% and 6.7% respectively in the past five quarters, showing a mixed trend with gains followed by losses in QoQ share.

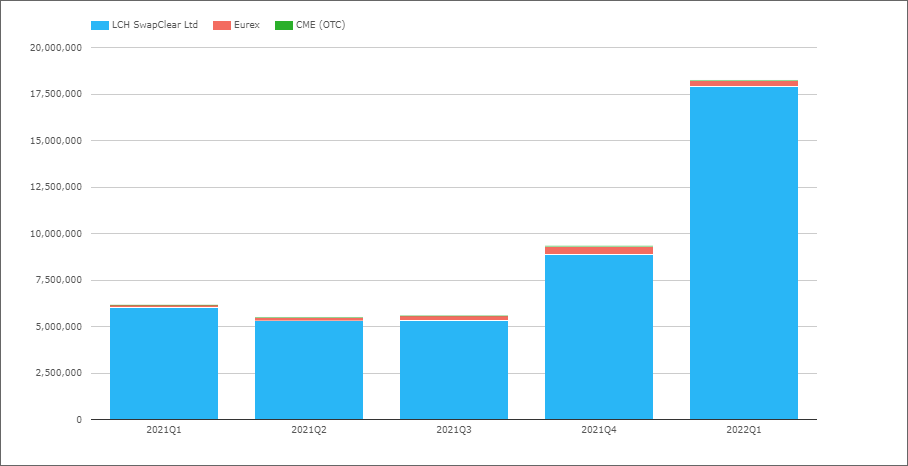

EUR OIS (All)

Referencing either EONIA or €STR.

- 2022Q1 with €44.8 trillion compared to €6.2 trillion in 2021Q1

- A spectacular increase, similar to that we see in USD OIS (above)

- LCH SwapClear with €17.9 trillion in 2022Q1 and €6 trillion in 2021Q1

- Eurex with €0.34 trillion in 2022Q1 and €0.16 trillion in 2021Q1

- 2022Q1 market share is LCH 98.2%, Eurex 1.8%

- While 2021Q1 share was 97.4% and 2.6% respectively

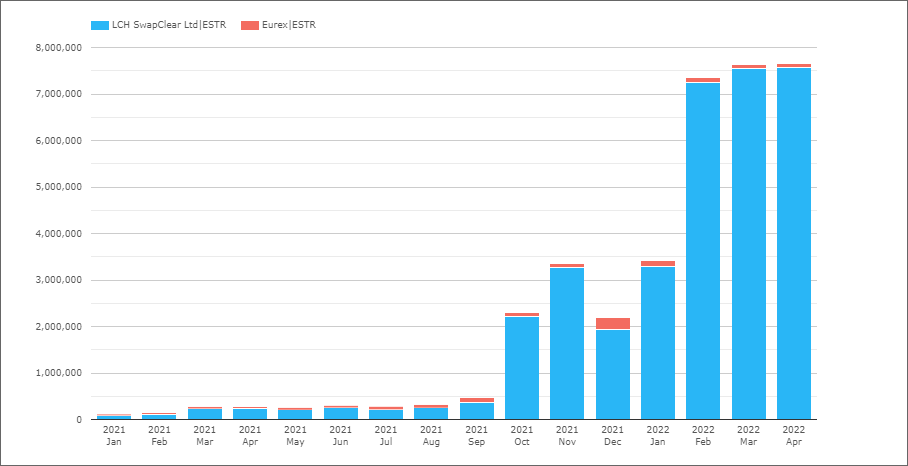

EUR Swaps (€STR)

Next isolating Swaps that reference €STR, either OIS or Basis.

- A huge pick up in October as the €STR reference replaced EONIA for Swaps

- (even though EONIA has been fixed off €STR for some time now)

- March 2022 and April 2022, each with €7.6 trillion

- 2022Q1 with €18.4 trillion, up from €0.53 trillion in 2021Q1

- Explaining 46% of the €39 trillion increase in OIS shown for these quarters in the previous section

- 2022Q1 Share is LCH 98.1% and Eurex 1.9%, compared to 81% v 19% in 2021Q1

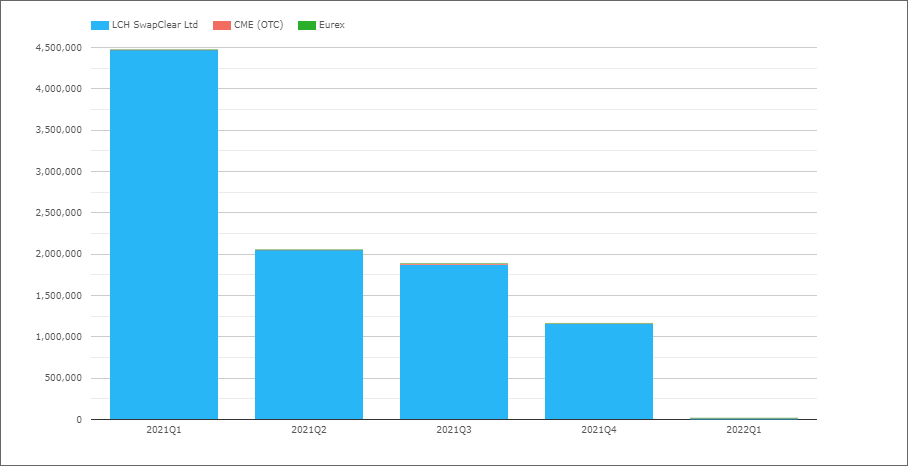

GBP Swaps (Libor)

GBP Swaps single-sided gross notional in gbp millions

- A nice chart showing the end GBP Libor (after 30+ years of swaps trading)

- A tiny amount of £17 billion in 2022Q1, down from £4.5 trillion in 2021Q1

Let’s move onto the replacement rate, SONIA.

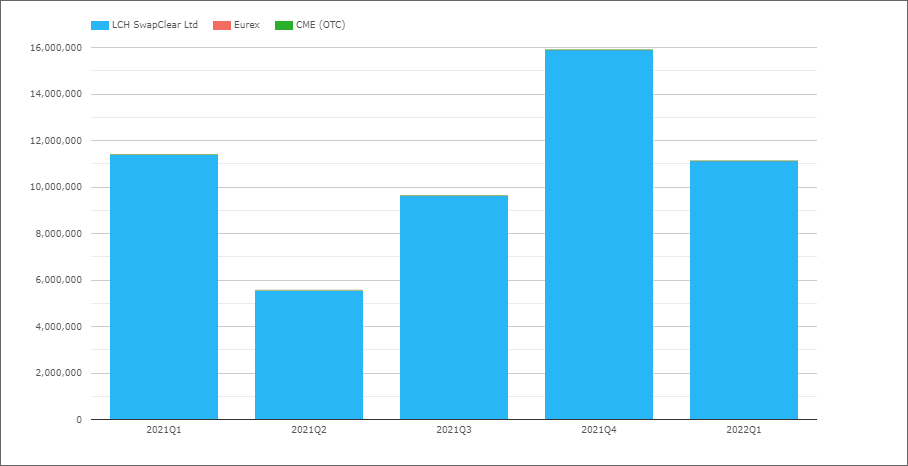

GBP OIS (SONIA)

- 2021Q4 with £16 trillion, the highest quarter since 2020Q1 (not shown) with £18 trillion

- 2022Q1 with £11.1 trillion, down from 2021Q4 and the £11.4 trillion in 2021Q1

- LCH SwapClear with 99.9% share

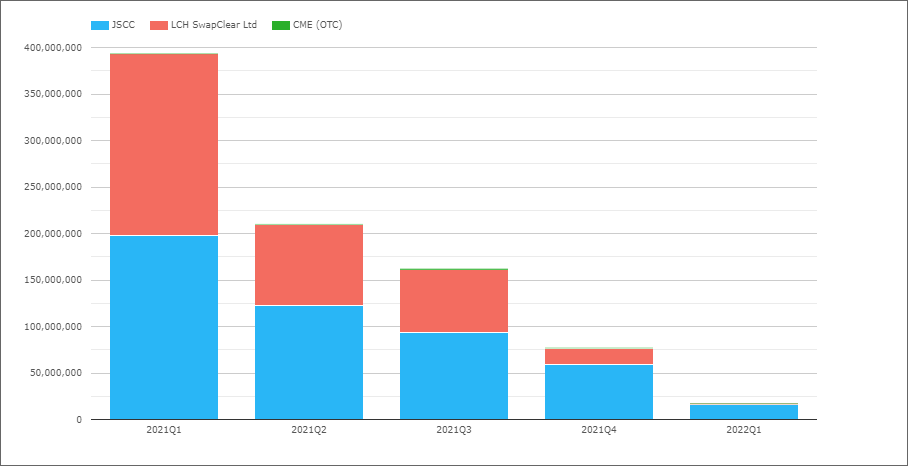

JPY Swaps (IBOR)

- Another nice chart showing the end JPY Libor (while Tibor remains at JSCC)

- A tiny amount of Y17 billion in 2022Q1, down from Y394 trillion in 2021Q1

Let’s move onto the replacement rate, TONA.

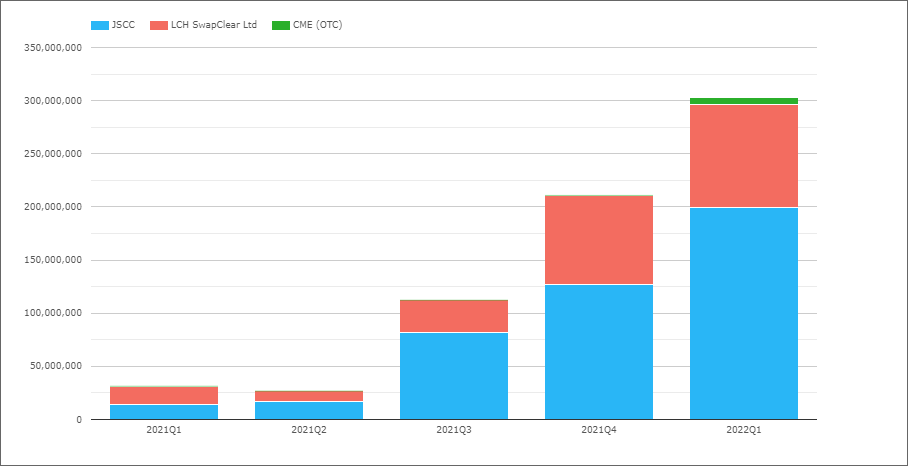

JPY OIS (TONA)

- 2022Q1 with Y303 trillion compared to Y211 trillion in 2021Q4 and Y31 trillion in 2021Q1

- A spectacular increase, driven by the end of JPY Libor and move to the RFR TONA

- JSCC with Y200 trillion in 2022Q1, compared to Y127 trillion in 2021Q4

- LCH SwapClear with Y96 trillion in 2022Q1, compared to Y84 trillion in 2021Q4

- CME OTC with Y6.7 trillion in 2022Q1

- 2022Q1 Share is JSCC 66%, LCH 31.8% and CME 2.2%

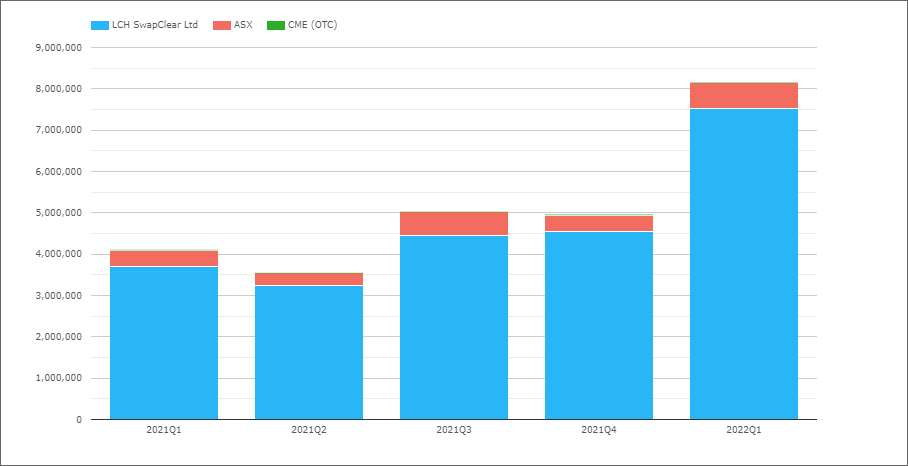

AUD Swaps

As Australia is a multi-rate jurisdiction with both AONIA and BBSW, we will chart both OIS and IRS products togather.

- 2022Q1 with A$8.2 trillion, compared to A$4.1 trillion in 2021Q1

- LCH SwapClear with A$7.5 trillion in 2022Q1 and A$3.7 trillion in 2021Q1

- ASX with A$0.6 trillion in 2022Q1 and A$0.4 trillion in 2021Q1

- 2022Q1 Share is LCH 92.3% and ASX 7.7%, compared to 90.2% v 9.7% in 2021Q1

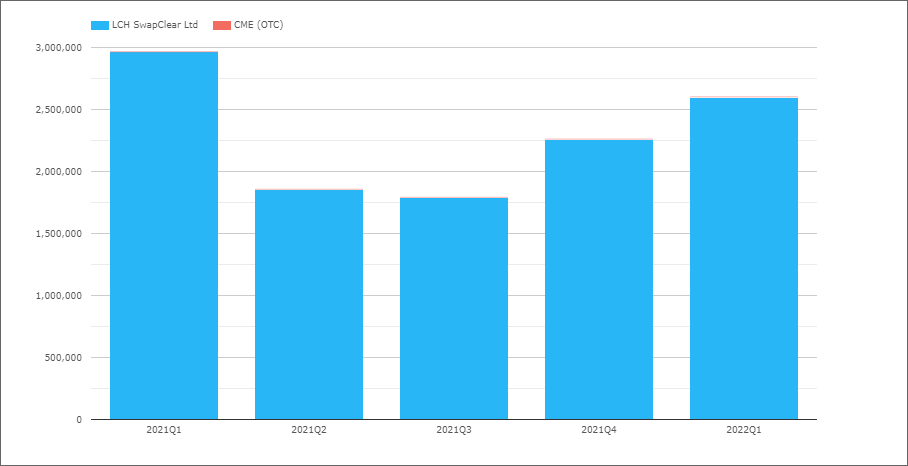

CAD Swaps (IBOR)

- 2022Q1 with C$2.6 trillion, compared to C$3 trillion in 2021Q1

- LCH SwapClear with 99.8% of the volume

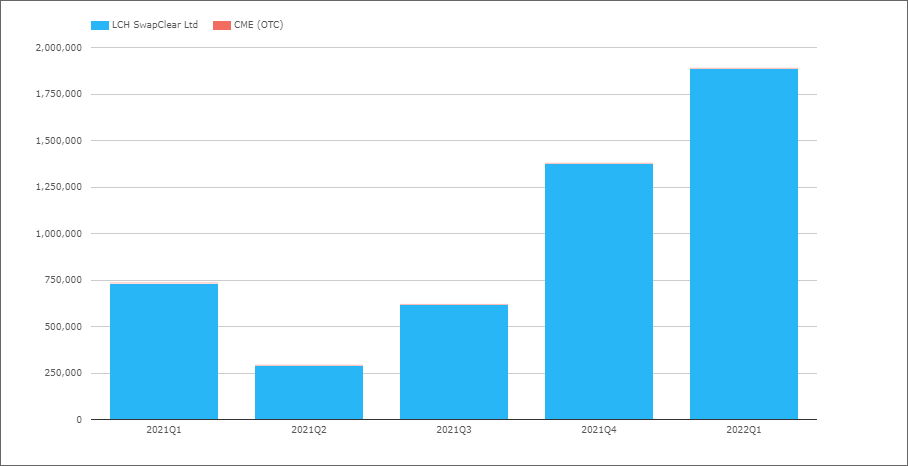

CAD OIS (CORRA)

- 2022Q1 with C$1.9 trillion, up from C$1.4 trillion and C$0.6 trillion in prior quarters

- Though still well below the record high of C$4.5 trillion in 2020Q1

- LCH SwapClear with 100% of the volume

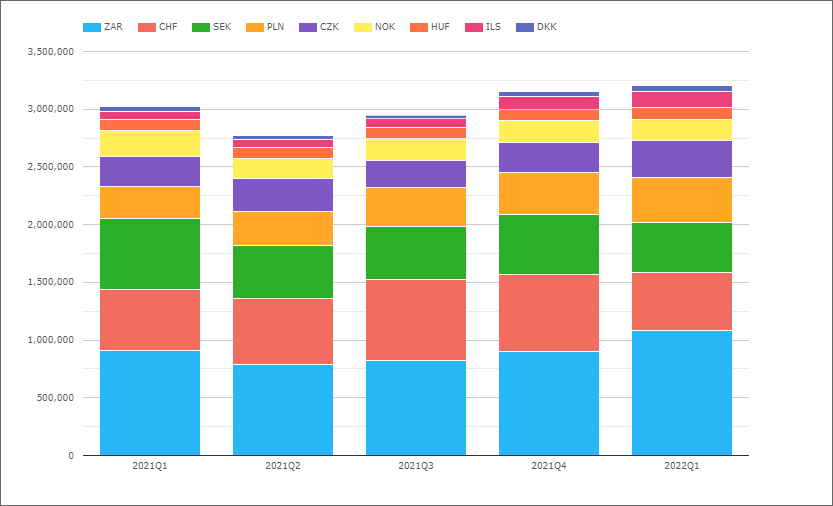

EMEA Swaps

Now let’s switch to EMEA Swaps (all types) and volumes by currency.

- Each quarter with @ $3 trillion of volume

- ZAR the largest in 2022Q1 with $1.1 trillion

- CHF next with $500 billion

- SEK with $440 billion

- PLN with $385 billion

- CZK with $325 billion

- NOK with $175 billion

- ILS with $136 billion

- HUF with $109 billion

- DKK with $53 billion

Not shown in the chart is market share by CCP, where LCH has >99% share in every currency except for:

- PLN, LCH with 91%, KDPW 5.4%, CME 3.6%

- SEK, LCH with 95%, Nasdaq OMX with 5%

- HUF, LCH with 96.7%, CME with 3.3%

- CZK, LCH with 97.6%, CME with 2.4%

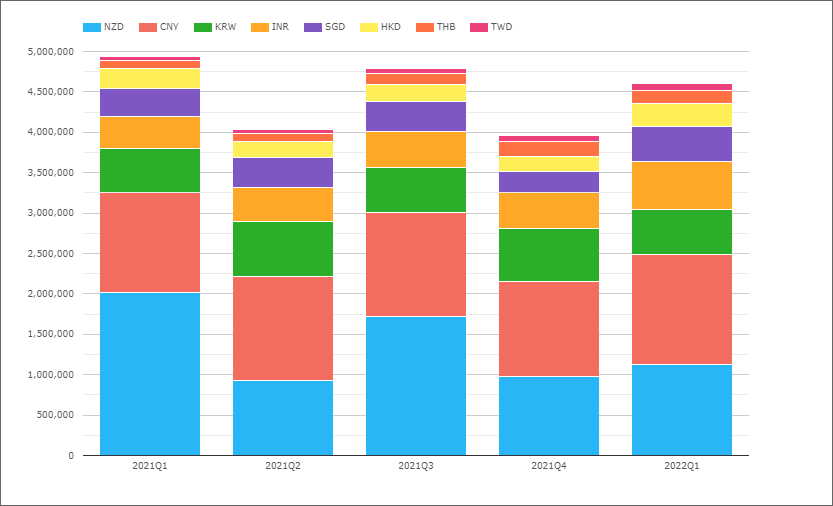

AsiaPac Swaps

Now let’s switch to AsiaPac Swaps (all types) and volumes by currency.

- Each quarter comparable, in the $4 trillion to $5 trillion range

- So materially larger than the $3 trillion for EMEA

- CNY the largest in 2022Q1 with $1.36 trillion

- NZD next with $1.1 trillion

- INR with $590 billion

- KRW with $570 billion

- SGD with $425 billion

- HKD with $290 billion

- THB with $165 billion

- TWD with $83 billion

Not shown in the chart is market share by CCP, where LCH has 100% share in every currency except for:

- CNY, Shanghai with 50%, LCH with 49.8%, HKEX 0.2%

- INR, LCH with 63.7%, CCIL with 36.5%

- HKD, LCH with 96.8%, HKEX with 2.5%, CME with 0.7%

LatAm Swaps

And last but not least, lets look at LatAm Swaps.

- Each quarter comparable, in the $1.8 trillion to $2.8 trillion range

- So lower than EMEA or LatAm

- MXN the largest in 2022Q1 with $1.6 trillion

- BRL next with $600 billion

- CLP with $390 billion

- COP with $210 billion

Not shown in the chart is market share by CCP, where for 2022Q1:

- MXN, CME with 91.5%, Asigna/Mexder 6.6%, LCH 1.8%

- BRL, CME 98.7%, LCH 1.3%

- CLP, CME 98.5%, LCH 1.5%

- COP, CME 97.5%, LCH 2.5%

That’s It

17 Charts for an overview.

Still a lot more data to look at.

Maturity tenor for Volume and Open Interest by currency.

IR Futures in all the major currencies and US Treasury volumes.

Credit Derivatives and FX Derivatives.

For more details, please contact us for a CCPView demonstration.

Couldn’t the same CCP retain the same colour code across the report Amir?

Not so easy to do, as charts automatically assign colors based on size and woudl be tricky to assign specific colors to each CCP and for these to work nicley in all circumstances. I guess in a white paper with more time, we would do this.

A recent Risk.net article stated that Eurex has 22% share of cleared EUR-denominated interest rate swaps.

Do you have any idea where the discrepancy with your number comes from?

Yes sure, the numbers I used were volumes for EUR Swaps only for Q1.

If I were to include all of IRD, so Swaps and FRAs, the Eurex share would be higher at 13%.

And chnaging from Volume in a period to Outstanding Notional on 31-Mar-22 for all IRD gives 22%.

Generally we prefer to look at volume excludind FRAs (as thease are non-price forming trades generated by Reset, Matchbook).

But including FRAs and using notional outstanding are all valid statistics.

Thanks for clearing that up