- The ISDA-Clarus RFR Adoption Indicator jumped to a new all-time high of 43.8% in April 2022.

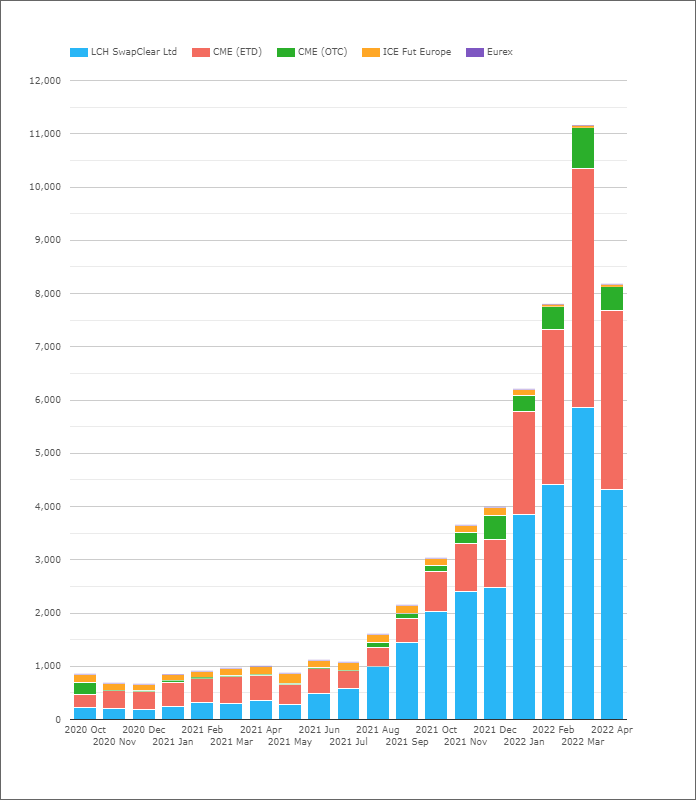

- This has been driven by increased SOFR adoption, hitting a new high of 47%.

- SOFR is now comfortably the largest RFR market. More SOFR risk traded ($8bn DV01) last month than all other RFRs combined.

- 22.8% of EUR risk traded versus €STR, a new high.

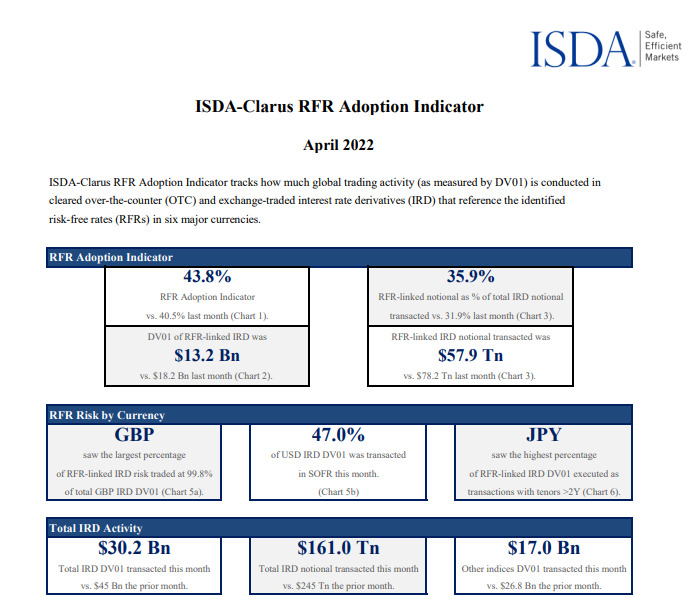

The ISDA-Clarus RFR Adoption Indicator for April 2022 has now been published.

Showing;

- A new all-time high of 43.8% for the overall RFR Adoption Indicator.

- April 2022 was the thirteenth consecutive monthly increase in RFR adoption, dating back to March 2021.

- SOFR adoption increased to another all time high of 47%.

- Virtually 100% of trading is now in RFRs for CHF, JPY and GBP. There is little reason to expect this to change in the future.

- It was quite a subdued month in terms of overall trading activity. That could be due to Easter holidays or that Q1 was so busy.

Total Activity

RFR Adoption was, once again, exceptionally strong last month. As a result, let’s look at something that wasn’t quite so strong – overall activity in Interest Rates.

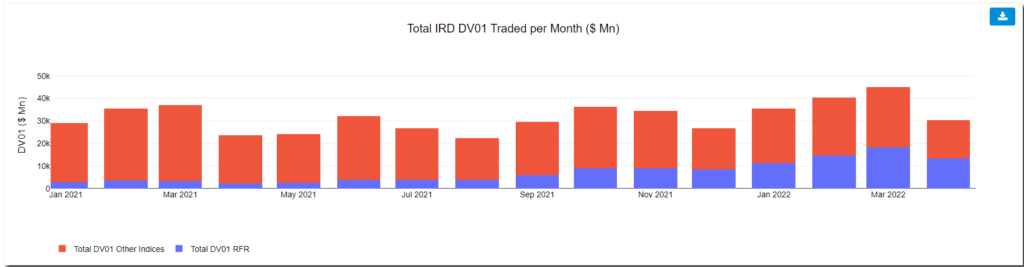

It is strange to report that total IRD trading (i.e. across both IBORs and RFRs) was down by over 32% in the month:

Showing;

- Total DV01 traded each month across everything – swaps and futures, IBORs and RFRs

- The amount of DV01 traded dropped to $30bn last month.

- That is the lowest since December last year.

- It is also below the rolling 12 month average, which has been above $30.3bn for the whole of 2022.

- However, it is pretty much in line (slightly higher in fact) with the monthly average for 2021.

It is hard to put April 2022 activity in context. There was a lot going on in financial markets, and there was a lot going on in Fixed Income! Just look at the yield moves in 2Y and 10Y SOFR swaps for example during the month:

10Y SOFR:

And 2Y SOFR:

2Y SOFR has been as high as 2.80%, having been as low as 1.80% as recently as mid-March. In the month of April, there was a move higher in Rates of 35 basis points. Not a small move in any stretch of the imagination.

10Y SOFR saw bigger moves, moving from 2.15% up to 2.75%. 60 basis points is serious stuff! Still, at least the curve isn’t inverted anymore…

Maybe the relative lack of activity can be taken as a good thing? The Fed communicated well to the market that a 50bp hike was coming, and that the pricing-in of the chance of a 75bp move was only on small volumes? It will be interesting to see how things shake out this month.

SOFR

Despite such a drop in activity, the amount of SOFR risk traded was the second largest of all time. Over $8.1bn of SOFR-linked DV01 was transacted, only bettered by March 2022. A 6% jump to 47% SOFR was also impressive – I think that is the second largest increase on record.

In Summary

- With CHF, JPY and GBP RFR Adoption at close to 100%, the focus is firmly on SOFR adoption.

- USD SOFR is seeing a very fast uptake right now, and reached 47% of all traded volumes in April 2022.

- The speed of increase is impressive, and much as we saw with GBP in 2021, the move higher is pretty relentless month on month.

- Surprisingly, the amount of interest rate risk traded last month was well below the levels traded in Q1 2022.

- I am really intrigued to see if May 2022 activity will rebound. The data will tell us.