It’s been a year since the first SEF executed trade. Whether you’ve been subscribing to our data services, peeking in on the freeview versions of these tools, or just reading our blogs, you probably have a good idea about how its all gone down over the past year. I thought it worthwhile to share a general update on what we’ve seen over this year.

A BRIEF HISTORY OF TIME (IN SEF)

So how would you summarize the past year? Let me take a crack at it.

August 2013

- Towards the end of last August, I wrote my first blog on SEF’s (and in fact my first blog ever). Interesting to look back on that blog now.

- There were only 12 SEF’s with paperwork into the CFTC; Bloomberg was the only fully approved SEF, and Tullet Prebon had only just submitted their documents. No sign of Tradition or BGC.

September 2013

- By the end of September, there were 19 SEF’s with paperwork in. The CFTC had given temporary registration status to 16 of them in September, bringing the total number of registered SEFs up to 17.

- In my final blog of the month I joked about what was more likely – someone trading a swap on a SEF or someone buying Obamacare online?

- I recall I was due to be in NY for October 2nd and one of the IDBs had organized a meeting with me for that day. I commented “Aren’t you going to be busy on SEF Day 1?” The answer was no, hence my forecast for October 2nd being a bit dull.

October 2013

- We began collecting and aggregating SEF data on the very first day of SEF Activity (October 2). I commented in my blogs about just how difficult it was to aggregate the data. Every SEF had different formats, some were not publishing the currency of the trades, others quoting in thousands or millions, some reporting in protected PDF format, on and on and on. This led me to write a blog specifically on the topic of proposed SEF reporting standards.

- By the end of the month, there were 21 SEF’s with applications in.

- By middle of the month, the first MAT submissions were in. Javelin was first with their blanket MAT filing for IRS. Followed 4 days later by TrueEx, then Tradeweb (who added credit), and MarketAxess snuck theirs in October 31.

- The IDB’s, particularly ICAP, had the lions share of activity in rates and FX. Bloomberg was reporting the majority of Credit.

November 2013

- No-action relief for non-onboarded clients expired on November 1. Funny to look back and think that there were all these clients just dying to use SEF’s before they were properly papered and onboarded! The data backed this up, showing only a minor drop in D2C SEF data following the no-action relief expiration.

- Chairman Gensler spoke at SEFCON in NY, where he pointed fingers at a couple SEF’s for not behaving nicely, in the context of an “All to All” marketplace. His guidance on “Impartial Access” meant that barriers such as self-clearing status need to be removed by the SEF’s. Hence the doors for the agency execution folks such as UBS Neo were cracked open a notch.

December 2013

- Bloomberg got their MAT submission in on 5-Dec, with nothing really added in terms of content.

- Javelin and TrueEx also modified their original filings. Javelin’s was toned down greatly, based largely upon comment letters, to put it nicely!

- TrueEx reported their first compaction cycle.

- Clarus reported SEF activity in blogs dated Christmas Eve and New Years Eve!

- Lastly, over the course of November through January, the CFTC issued guidance and no-action relief in defining a “US Person” to include US branches of non-US swap dealers. This, along with the holiday downtime, led me to my first (and only) attempt at a cartoon. I will publish it again here, because every joke is better the second time around, particularly when you have to explain it. (Please note the McDonalds hamburgers in the second caption, making the swap between UK and French banks subject to CFTC trade level requirements). Now you get it? You see, McDonalds is a US company…. eh forget it. I’ll hang up my crayons.

January 2014

- The CFTC had January to provide commentary on the MAT submissions. The October submissions were to be “blessed” by January, with a subsequent 1 month lead time until the products being MAT. We pondered what the CFTC could really do (they couldn’t reject them could they?) and guessed that they would phase in some of the more complex packages.

- By later in the month, the Javelin submission had been certified for the most active USD and EUR tenors, and the CFTC failed to clarify packages, such that the market was left thinking that technically “if its a required swap, even as part of a package trade, it has to be on SEF”.

- TeraExchange announced a partnership with European IDBs, which in hindsight has confirmed what we all were thinking – European banks don’t want to trade on a SEF.

- We at Clarus announced that SEFView, our tool to track and drill into SEF data, was in beta.

February 2014

- A week before the Feb 17 MAT deadline, the CFTC gave 3 months of no-action relief for packaged trades, giving until May 15.

- SEF activity slowed down dramatically in that same penultimate week.

- UBS Neo announced they had executed the first IB trade, which happened to be a bunched order done on TrueEX’s SEF and used UBS’s standby clearing to facilitate post-execution allocations.

- Clarus SEFView went live with our first subscribers!

March 2014

- Credit Index’s became MAT on the first day of March, and credit volumes on SEFView begin their climb up.

- Industry headlines shouted about volumes being off by 30-50%. Our data showed however, that while there was indeed a dropoff through the MAT weeks, it came back into line quickly thereafter.

- After 23 weeks of weekly SEF Blogs, I apparently determined there was nothing newsworthy, so skipped the blog for week 24.

- For the first time since launch, D2C activity, when looking at vanilla USD and EUR rates and credit, was 50% of the total SEF activity. D2C had accounted for as low as 15%.

- TeraExchange announces the first Bitcoin derivative. We are still waiting for the BTC MAT filing 🙂

April 2014

- Nothing happened in April. Maybe Easter, but that’s about it. We were all too busy contemplating what the CFTC might do about the packages coming due in May.

- (EDIT: It has been pointed out by a journalist that banks were busy de-guarantee’ing affiliates in April)

May 2014

- CFTC announces the phased compliance of package transactions. Starting with All-MAT packages on May 16. Followed by MAT with OTC non-MAT combos June 2, and Spread over US Treasuries June 16. The CFTC punted packages of Futures and other tricky items into November. Plenty of time to sort that out, right?

- ICAP launches IGDL which would start handling all USD, EUR and GBP rate swaps. Idea being that IGDL is dual-registered as both a SEF and an MTF, such that the marketplace has both US and European liquidity. I’m still not sure if the T’s were crossed and I’s were dotted on that, but it is what it is.

- Bloomberg turns on their SDR aptly named BSDR. All of their SEF trades (less some non-cleared outliers) start being reported there instead of DTCC.

- Given all of the package exemptions, I estimated a slow grind up in activity, yet still calculate that no more than 75% of the market would be SEF-able. (I am proven right!)

June 2014

- Next two package exemptions roll off (Mat/non-MAT and Spread-over treasuries)

- D2C SEF’s continue to show growth. This time Tradeweb comes in with some big numbers.

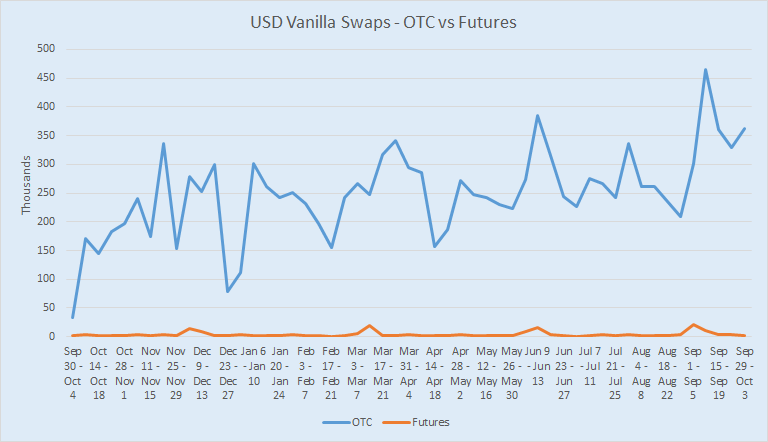

- Clarus adds Eris and CME swap futures to SEFView. Data reinforces that the market has not moved to futures, yet.

- TeraExchange does its first SEF trade (in USD, not Bitcoin).

July & August 2014

- I managed to dispel the notion that the markets go on vacation in the summer months (we continue to see typical volumes go through on SDRView and SEFView).

September 2014

- Each of the 4 weeks of September are record highs for SEF activity.

- BBG introduced CLOB pricing alongside its RFQ mechanism, and we hear stories about some of the IDB’s doing 40-some percent of their activity electronically. Did it just take a year to get some of this done “e”?

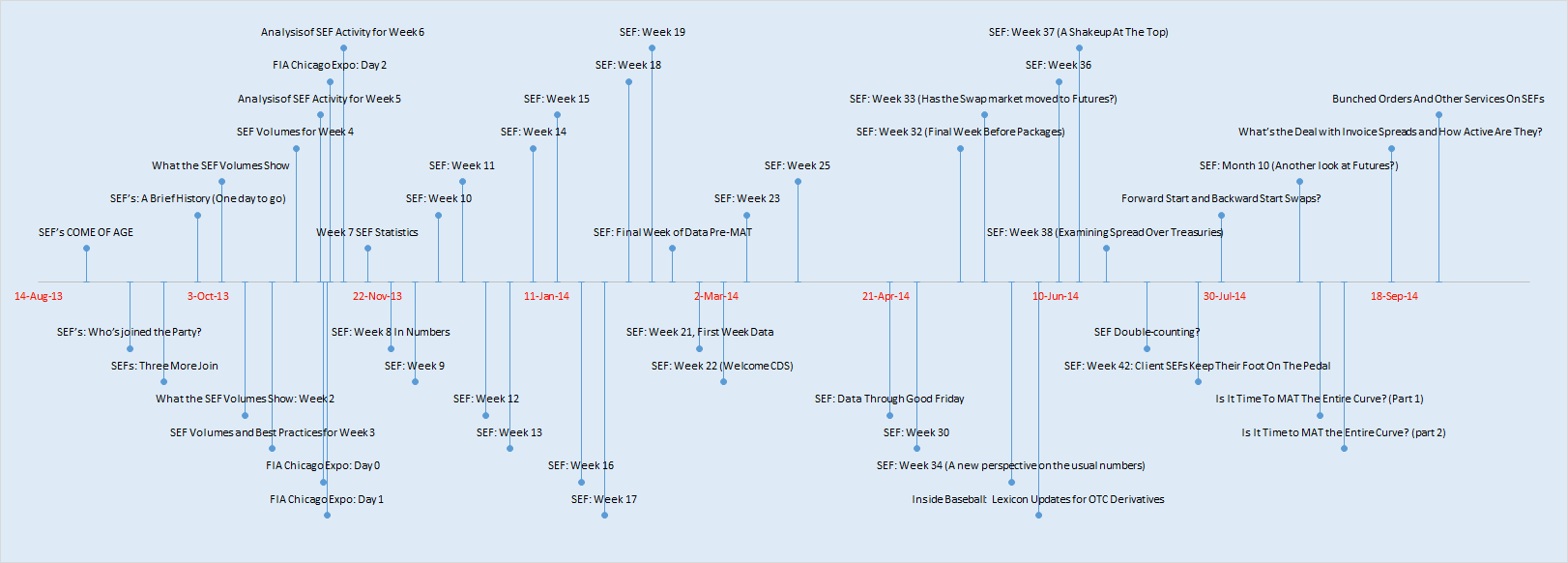

A BLOG ABOUT A BLOG

For any detailed commentary on any of the above topics, look no further than my blog. Given the 1st birthday of SEF’s, I have taken the opportunity to play with excel a bit and come up with the following timeline showing all of my blogs to date. We at Clarus have pushed out a couple hundred blogs over the past 18 months, myself accounting for 48 of them, mostly on the topic of SEF’s. What is interesting to me is how clearly you can see the weekly blogs I did up until Week 23, at which point the amount of topical information in SEF-land began to taper.

SHOW ME THE TRENDS OVER THE YEAR

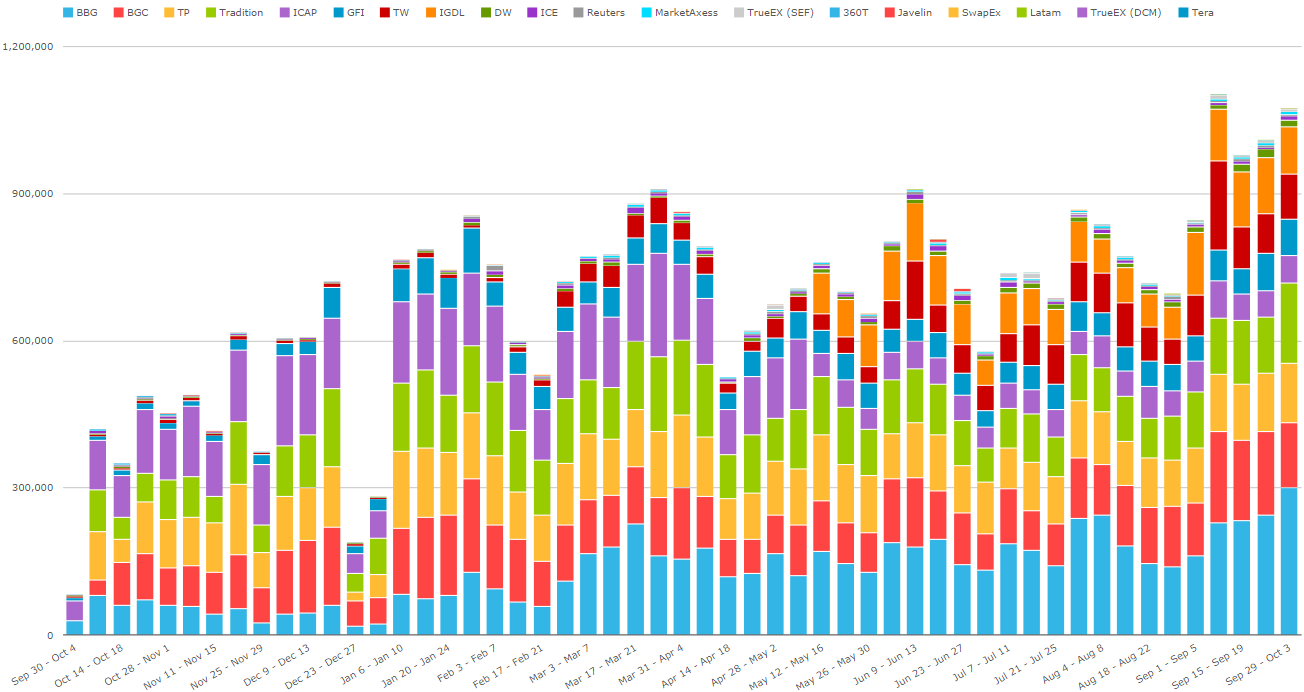

The best way to spot some of the trends that emerged over the past year is with charts generated in SEFView. Lets have a look.

Overall SEF Activity

We can make out some of these events described above. Eyeballing the chart below showing all activity spanning IRD, FX and Credit, you can make out the Feb 17 MAT weeks and the highlights in the month of September.

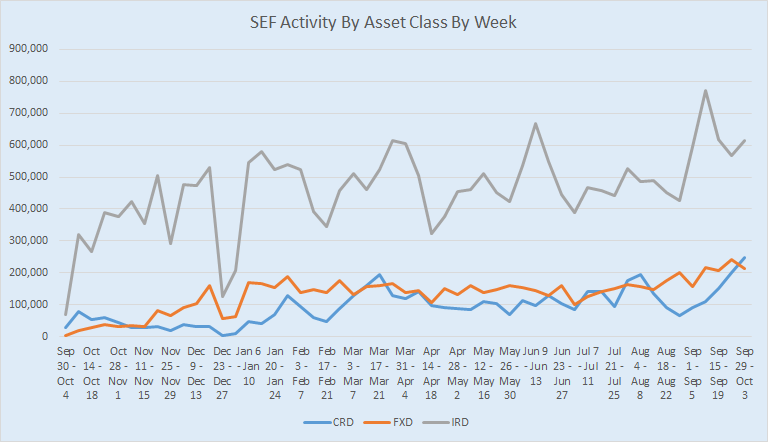

Look at Each Asset Class

Looking at the data by asset class, we can see the vast majority is in IRD, which has had some steady growth. FX and Credit, while paling in comparison, have also shown similar growth.

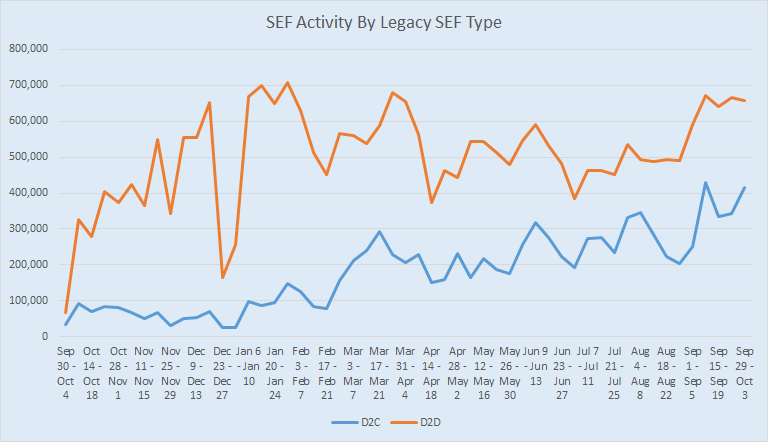

Look at D2C vs D2D

Here you can readily make out that the growth has been in the client SEFs. Interdealer activity has plateau’d.

Look at Futures

Whittling the data down to just USD Vanilla swaps and their USD Swap Future cousins, we can also see that swap futures have not presented a real threat. Any blips would seem to be the quarterly contract rolls.

WHAT LIES AHEAD

I will wrap up with some predictions for the next 12 months.

Order Book

There have been a few press releases over the previous months speaking about the growth in some of the IDB order books. I am a believer that electronic order books will ultimately be the sources of liquidity for the liquid products that comprise 60-70% of the market. There is just no fundamental reason this wouldn’t be the case. In other asset classes, it took a while, but when it happened, the shift occurred and was permanent. The same will surely happen. Within the next 12 months? I would say yes.

More MAT products

So you have come to learn that trading your spot starting swap has to be done on SEF. This required lots of pain, be it legal, operational, technical, but the investments have been made. Now that we have arrived, you have to ask yourself – does a 4-day forward start swap really mean you have to pick up a phone? Another MAT submission will happen, and it will be justifiable.

MAC & Futures

There will always be the bespoke nature of the swaps market. However I see growth in the standardized MAC contracts as good approximations that yield cost benefits that outweigh the small basis risk. Further, liquidity providers will prefer these products as cheaper to margin and process. The CDS market had a big bang, but I project a slow bang in rates in these standardized contracts. I think that shift will be visible within the next year. The next logical progression is into trading these products as futures. I’m not as bullish on this happening within the next 12 months, but I do see growth in futures within this coming year, however I do not believe it will constitute more than a handful of percent. Yet.

Focus on Margin

Over the past year there has been lots of expenditure by firms on compliance. I see compliance costs taking a turn back towards earth. What’s next is capital. I’ve been shocked to find that firms, both buyside and sellside, have been generally oblivious to the costs associated with collateralizing their OTC derivatives with a central counterparty. For some, its because they haven’t historically had to pay margin. For others, its because their cost of capital has been low in the current low-rate environment. All we need is for rates to inch up, and that suddenly constitutes a doubling or trebling of funding costs for many firms. Desks will quickly be forced to behave smarter about their funding costs, and margin will be of primary importance.

SUMMARY

Crazy year. No other year quite like it in the past 20 years of OTC derivatives. I have a hard time seeing how the next 12 months could trump this one.