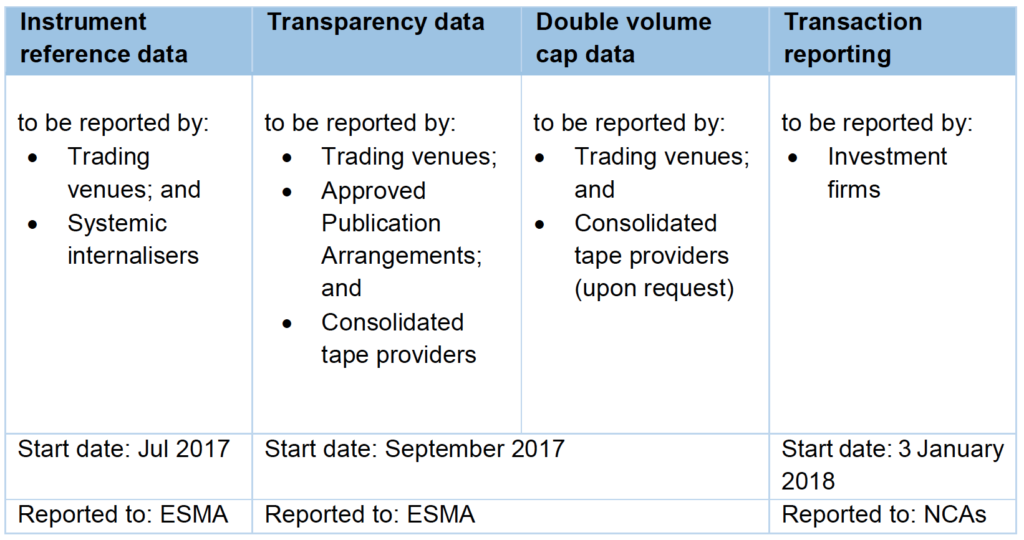

Following on from my article on the MiFID II: Instrument Reference Data, I wanted to look at the “Transparency Data” mentioned in the briefing note released by ESMA on 12 Jan 2017, titled “MiFID II technical data reporting requirements“. This starts with the following table:

Showing that from September 2017 ESMA will start collecting Transparency data.

Transparency Data Requirements

The requirements of Article 22 of MiFIR, RTS 1,2,3 mean that trading venues (TVs), approved publication arrangements (APAs), and consolidated tape providers (CTPs) will have to report data required for the purposes of transparency and double volume cap calculations.

ESMA will then publish on its website the transparency calculation results on predefined dates depending on the financial instrument’s type.

For a refresher on ESMA’s transparency concepts of Liquid Market, Large in Scale (LIS) and Size Specific to Instrument (SSTI), please refer to one of the blogs Transparency for Swaps or Transparency for Bonds.

Now to review the accompanying 80 page document titled, “Reporting Instructions FIRDS Transparency System”, which is available here for those of you who like to go direct to the source, for others please read on.

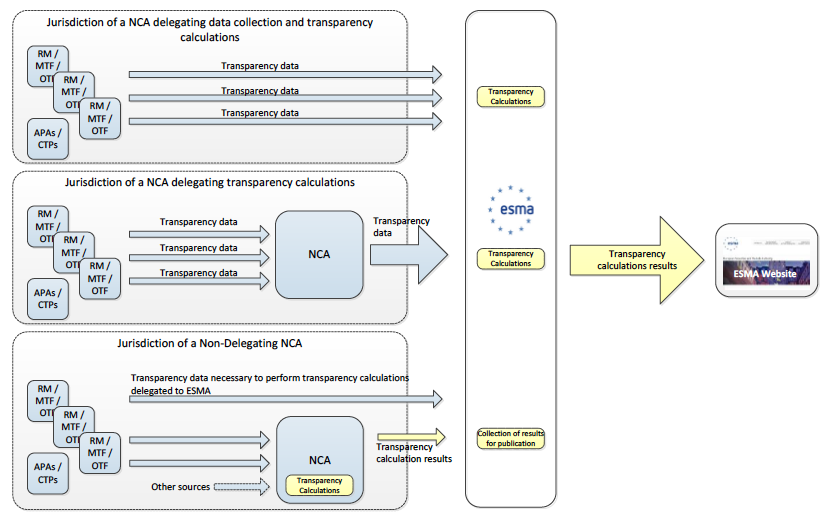

Transparency Data Flow

Lets start with a diagram from this document.

Showing that ESMA collects transparency data from:

- TVs, APs, CTPs for National Competent Authorities (NCAs) delegating calculations to ESMA, and

- NCA’s delegating transparency calculations but not data collection in their jurisdiction

And ESMA collects Transparency Calculation results from non-delegating NCAs.

Data is submitted daily in agreed XML file formats and ESMA performs validation checks, provides a feedback file , calculates and publishes results as required:

- quarterly for bond liquidity calculations

- yearly calculations for financial instruments

- first 4 weeks of trading of a new financial instrument

- date of admission to trading of a new financial instrument

In the remainder of this article I will focus on Derivatives or what ESMA term Non-Equity data in their document.

Non-equity transparency reference data

On a given day T, the file should contain:

- All non-equity financial instruments newly admitted to trading or traded on day T

- All instruments for which the transparency reference data has changed compared to previous files

Transparency reference data for an instrument has to be initially submitted no later than on the day defined in RTS 23 / Field 11 with a “Reporting day” equal to RTS 23 / Field 11. These values are effective for this instrument until RTS 23 / Field 12 (if applicable) or until the “Reporting day” of the next received record with the same ISIN.

There is a long table in the document which specifies the fields required and when I saw long it spans 13 pages! So I won’t bore you with the details as mostly just reference data to identify the instrument.

It is not obvious to me why this data is needed when there is a separate Instrument Reference data collection process covered in my recent blog.

The fields do differ between the two, so I can only assume that the data here is required specifically for the transparency calculation. However one would have thought that with more analysis and design effort, the regulations could have combined these two feeds and so saved significant costs for TVs, APAs, CTPs, NCAs and ESMA itself.

Moving swiftly on to the interesting data.

Non-equity transparency quantitative data

This data is required on a give day T, but for all transactions executed on day T-7 calendar days.

It consists of the number of transactions and notional traded for an instrument in “size of transaction” bins.

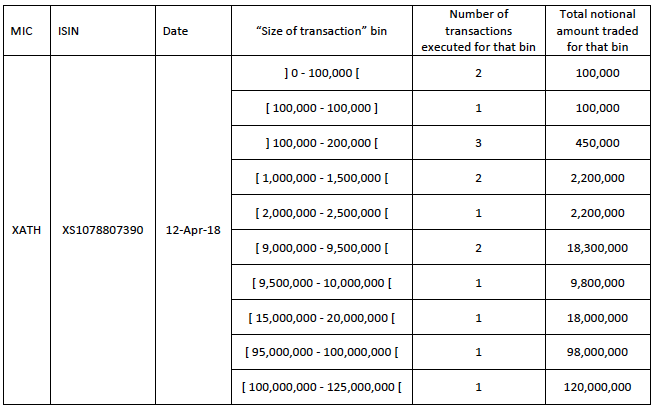

A nice example table is given in the ESMA document.

Showing for a specific TV with MIC = XATH and ISIN = XS1078807390, an execution date and the volume by number of transactions and total notional in specified bins of notional size ranges.

Very interesting data to collect for all bonds and derivatives instruments for each trading venue.

Non-equity transparency calculation results

While there isn’t a section in the ESMA documentation for the format of transparency calculation results that will be published on the ESMA website, there is a specification of the same results expected by ESMA for those NCAs that calculate these themselves (rather than delegating to ESMA). We can assume that data in a similar format will be published by ESMA.

This is the key data and contains the following fields:

- Instrument identification code

- Instrument full name

- Reporting period (start and end dates e.g. quarterly or annual)

- Liquid or not

- Pre-trade Large in Scale threshold (LIS) in Euro

- Post-trade Large in Scale threshold (LIS) in Euro

- Pre-trade Instrument Size Specific threshold (SSTI) in Euro

- Post-trade Instrument Size Specific threshold (SSTI) in Euro

- Total number of transactions

- Total volume of transactions

It is key, because these thresholds determine the rules for pre-trade and post-trade transparency, so whether pre-trade public disclosure is required for a trade or not and whether post trade disclosure can be deferred for two business days or not.

Important not only to Trading Venues themselves but also to market participants to understand the transparency implications of their activity and the market at large.

It is surprising that LIS and SSI amounts will be in Euro and not the currency of the financial instrument. This means having to convert a trade to Euro each time and for a significant change in value of the Euro over the year, the trade size changing. After all USD, GBP, CHF, JPY and other non-Euro linked currencies will also trade actively (one hopes) on TVs under ESMA’s jurisdiction.

Summary

In September 2017, ESMA will start collecting transparency data.

This will be provided each day by Trading Venues, APAs and CTPs.

Either direct to ESMA or via their National Competent Authority (NCA).

ESMA will publish transparency calculation results on its website.

For each instrument, whether it is liquid and its LIS and SSTI thresholds.

These are necessary to determine pre-trade and post-trade transparency.

Which starts in 2018?

I tend to lose track of dates that get pushed back. 🙂