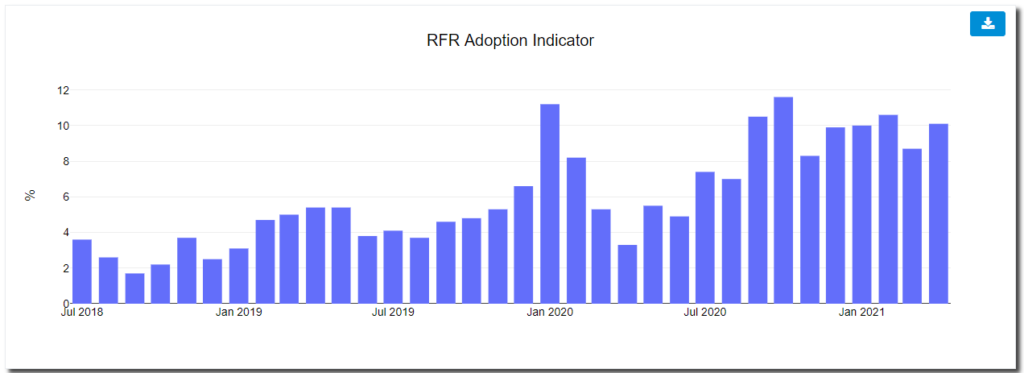

The latest ISDA-Clarus RFR Adoption Indicator has just been published for April 2021. It saw an increase to 10.1% and it is now back to the levels it has been at for most of 2021. Was March maybe just a blip in the RFR story?

Showing;

- The RFR Adoption Indicator was at 10.1%, higher than last month and very similar to the 10.0-10.6% readings since the turn of the year.

- USD SOFR increased to 7.5%, the second highest reading we’ve ever seen.

- $7.04Trn of SOFR-linked notional traded in USD, a new record. In notional terms, SOFR was the largest RFR market last month.

- CHF increased to 16.7% with a record amount of SARON traded.

- 51% of GBP risk was traded versus SONIA, a new all-time high.

Behind the Data

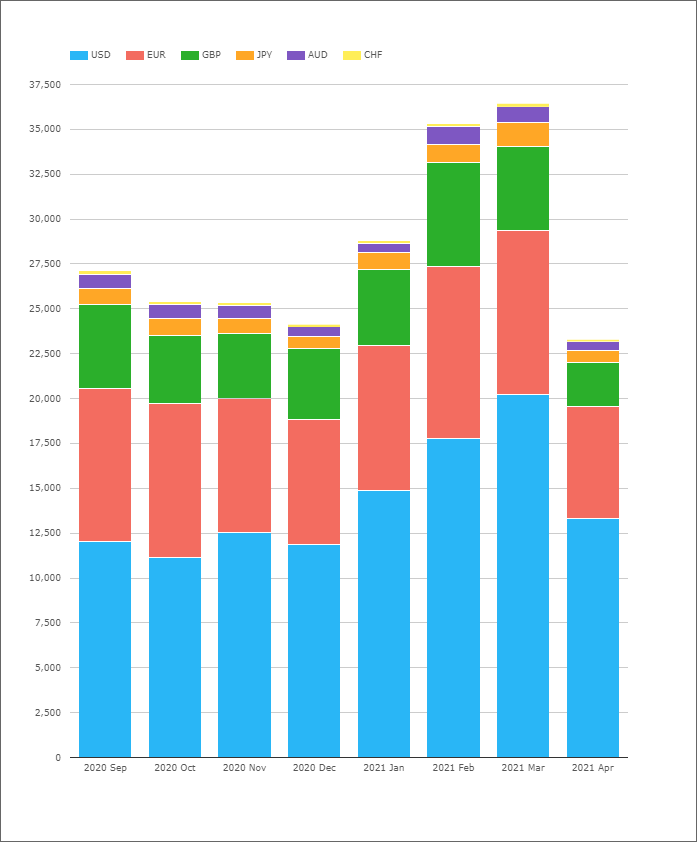

Digging into CCPView for the actual DV01 data, we see a significant reduction in overall trading activity during April 2021:

Showing;

- Total DV01 traded across IBORs and RFRs in six major currencies. This covers both OTC Swaps and exchange traded futures.

- April saw the lowest amount of risk traded in the past six months.

- In fact, the amount of risk traded last month (~$23bn DV01) is far more in line with the lull in activity we see associated with summer trading or end of year dips. Weird.

- The decrease in activity was pretty consistent across both OTC and ETD markets.

- March 2021 did see a decent amount of trading activity – the most since Q1 2020. However, activity in April 2021 was nearly 20% lower than a “typical” April (compared to 2020 and 2019).

- The chart shows that trading activity reduced in each of the six currencies.

Which Currencies Reduced the Most?

Compared to March 2021, April saw the following reductions in risk traded per currency:

- 51% reduction in JPY.

- 48% reduction in GBP.

- 46% in CHF.

- 40% in AUD.

- 34% in USD.

- 31% in EUR.

Due to the size of the USD market these days, that results in an overall reduction in trading activity of 36%.

Which is Bigger – SONIA or SOFR?

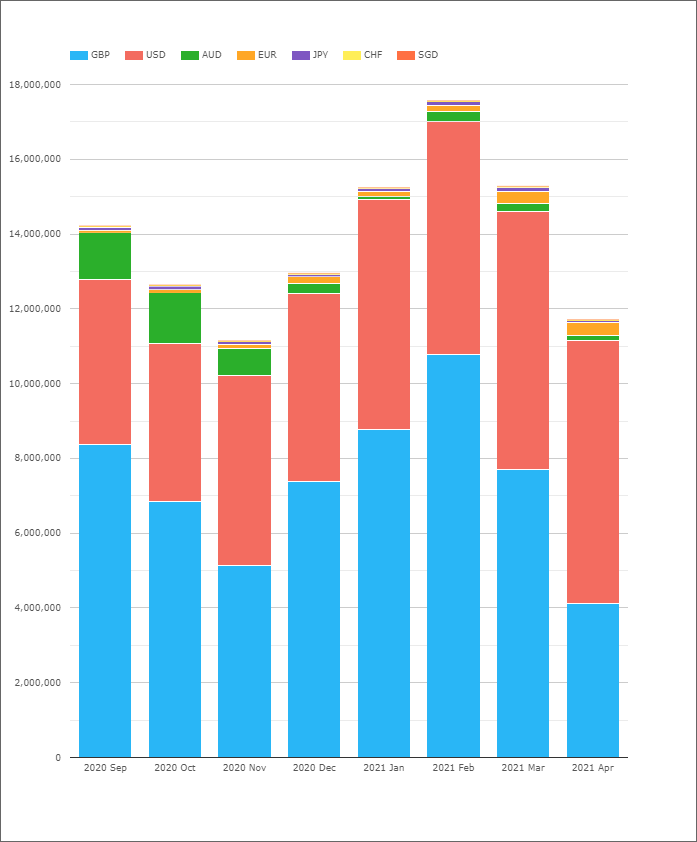

Due to the large decrease in volumes across GBP markets last month, the amount of SONIA traded also fell sharply. This has a big impact on the overall amount of RFR risk traded in the month because SONIA is the largest RFR market.

Interestingly, if we look at the notional of RFR-linked derivatives traded in April 2021, we see that more SOFR-linked notional traded than SONIA! SOFR was the largest RFR market, as measured by notional, in April 2021.

Showing;

- $7.04Trn notional equivalent traded in SOFR-linked products in April 2021. That’s a new record!

- $4.1Trn notional equivalent traded in SONIA-linked products in April 2021.

SOFR-linked products did pip SONIA-linked products once before, in June 2020. However, the difference was nowhere near as large back then (“just” $0.2Trn).

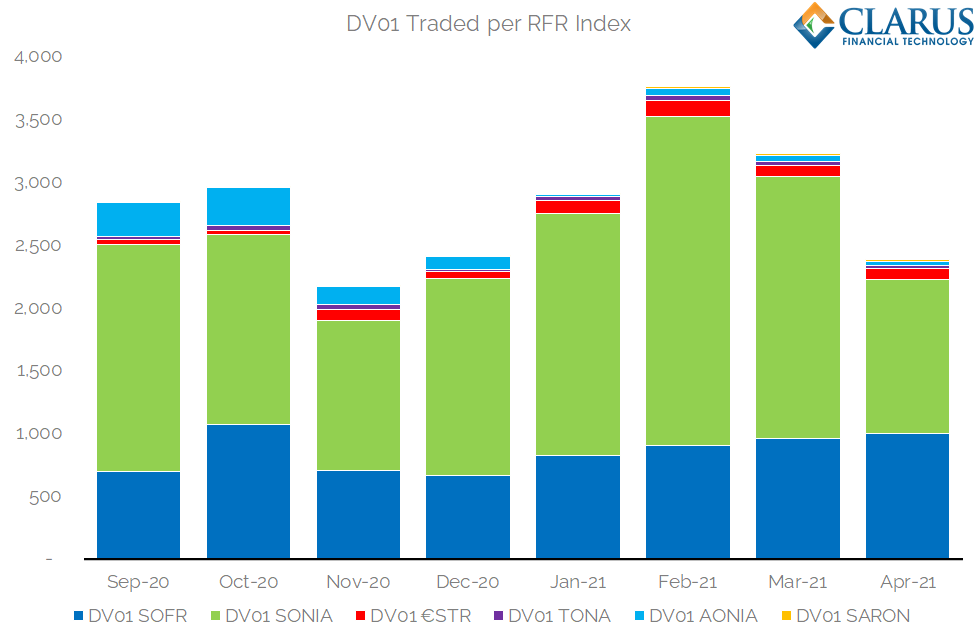

Remember however that the RFR Adoption Indicator is based on DV01 calculations and not notional. Translating these figures to DV01 reverses the pecking order – SONIA is still larger than SOFR. The chart below shows the DV01 traded in each of the RFRs for the past six months:

Showing;

- SONIA is the largest RFR market each month. The ~40% decrease in SONIA risk traded last month likely had a big impact on the overall indicator value.

- However, the amount of SOFR risk traded last month actually increased, even in absolute terms.

- It was only a small increase in SOFR, but it climbed to the second highest value on record. A good sign!

- In terms of risk traded, the SONIA market was still some ~25% larger than the SOFR market.

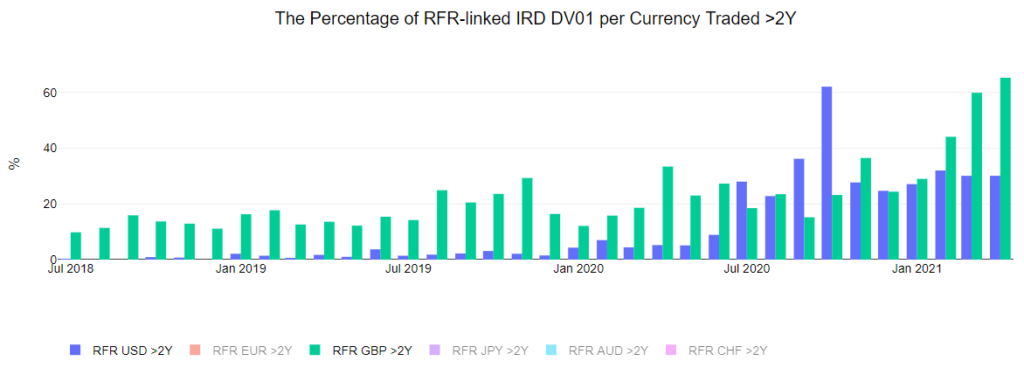

The difference in measures of the two markets between notional and DV01 likely speaks to the longer-dated nature of the SONIA market. Over 60% of risk traded is longer than 2Y in GBP SONIA, whilst only 30% of risk is longer than 2Y in USD SOFR:

In Summary

- The RFR Adoption Indicator increased to 10.1% in April 2021.

- This would have likely been higher if overall trading activity had not dipped so much in GBP markets.

- SOFR was the largest RFR market in April 2021 (when measured by notional).

- SOFR accounted for 7.5% of the overall USD market, 2.8% higher than last month.

- SOFR adoption is therefore looking positive.

- Record amounts of CHF SARON risk also traded, reaching 16.7% of the overall CHF market.

Will SOFR continue to grow in May 2021? Subscribe to find out. It’s free!