What’s New in CCP Disclosures – 3Q22?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, CCPs publish over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing and more. CCPView has 7 years of these quarterly disclosures for 44 Clearing Houses, each with multiple Clearing Services, covering the period from 30 Sep 2015 […]

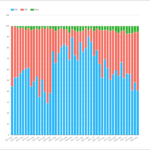

CORRA First in CAD Markets

I first wrote about benchmark reform in Canada in 2019: Since then, we have had the announcement that CDOR will cease in 2024: As with all good benchmark stories, the announcement of cessation sets the ball-rolling on a number of fronts: CORRA First Luckily, we have a well-thumbed playbook to refer to now, and the […]

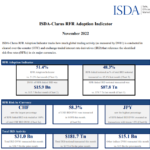

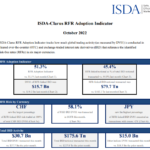

RFR Adoption – Is This Groundhog Day?

The ISDA-Clarus RFR Adoption Indicator for November 2022 has now been published. Showing; Is History Repeating? Groundhog Day appears to be a traditional film that isn’t actually set at Christmas but is associated with this time of year. RFR Adoption is somewhat similar – in the run up to the end of 2021, it was all […]

The Latest in Aussie and Kiwi Swap Markets

The end of the year is a traditional time to reminisce. In that spirit, I remember writing my first blog on AUD swap markets from the back of a camper van on the West coast of Oz, after surfing in Yallingup. That experience now feels like a lifetime ago for me personally. Having recently returned […]

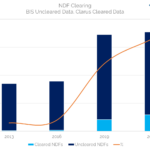

NDF Clearing – What’s New in 2022?

There is now over a $1Trn of cleared NDFs traded every month in 2022. March and September 2022 were particularly notable volume months. This is against a backdrop whereby the uncleared NDF market has not really grown. BIS data suggests that over 16% of total NDFs are now cleared across the whole market. This is […]

What’s New in Term SOFR?

In April, Amir gave a timely update on Term SOFR. In case you missed it: And the calls from the industry to make Term SOFR a more widely traded derivative have only become louder since, with the latest Risk.net article particularly worth a read: It’s a great article, but it does not update readers on […]

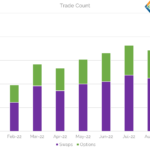

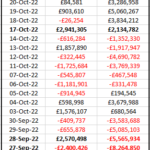

GBP Swaps variation margin in a financial crisis

We covered the significant increase in initial margin for cleared GBP Swaps in two recent blogs; How Kwasi Kwarteng has increased your IM and Rishi Sunak and the impact on GBP Swaps IM. In the first of those blogs, Chris added a brief section towards the end on variation margin and I wanted to take […]

A New Plateau in RFR Adoption?

The ISDA-Clarus RFR Adoption Indicator was 51.3% last month. This is the third consecutive month that it has remained around 51%. SOFR adoption hit a new all-time of 58.1%. €STR adoption remains volatile. Trading activity across all markets was lower than last month. The ISDA-Clarus RFR Adoption Indicator for October 2022 has now been published. Showing; […]

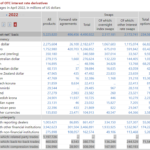

Have you seen the BIS Triennial Survey 2022?

Trading shrank by about 20% to $5.2Trn per day in Interest Rate Derivatives from April 2019 to 2022. Transition to RFRs has resulted in a $1.4Trn reduction in daily activity in FRAs alone, explaining much of the decline. The BIS survey occurred when markets were likely experiencing a degree of heightened activity, although Clarus data […]

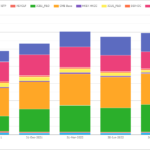

Rishi Sunak and the impact on GBP Swaps Initial Margin

In early October we wrote about How Kwasi Kwarteng has increased your Inital Margin, given that so much has happened in the past month, I wanted to update the GBP Swaps initial margin figures in that article. Before we start, two general points, very nicely illustrated by two The Economist covers. On the left, “Reasons […]