Have You Listened to our new Podcast yet?

The first Clarus podcast is out – please take a listen! Podcasting You may have noticed that we’ve had reason to celebrate a few milestones on the blog over the past year: 1,000 blogs on Clarus 400 blogs for both Chris and Amir With the blog continuing to be well received and well read (even […]

Most Active Names in Credit and Equity Derivatives – Oct22

Earlier this summer we looked at the SEC Securities Based SDRs (SBSDRs) for the Most Active Equity Total Return Swaps and Most Active CDS Single-names. Today I will use SBSDRView to look at which names have been most active in October 2022. CDS on Sovereigns Let’s start with the twenty most active sovereigns by trade […]

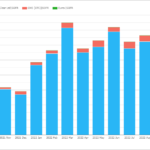

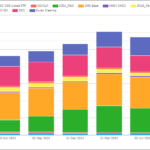

3Q22 CCP Volumes and Share in IRD

Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons of volumes. Today we look at 3Q22 Volume and market share in IRD for: USD Swaps (LIBOR, OIS, SOFR) EUR Swaps (EURIBOR, OIS, €STR) GBP Swaps (LIBOR, SONIA) JPY Swaps (IBOR, TONA) AUD Swaps (BBSW, […]

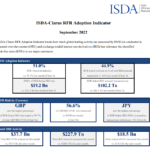

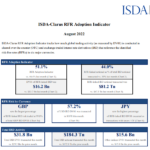

New RFR Trading Records Everywhere we Look

The ISDA-Clarus RFR Adoption Indicator has stayed above 50% for the second month. In September 2022 it remained at 51%. SOFR adoption was at 56.6%, the second highest on record. €STR trading increased to 23.5%. Trading activity in RFRs hit all-time records across DV01 and notional amounts traded. The ISDA-Clarus RFR Adoption Indicator for September […]

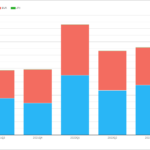

3Q22 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 3Q 2022. Index, Single-name and Swaptions Volumes in 3Q slightly up on 2Q and significantly up on a year earlier USD CRD volumes up 36% in 3Q 2022 compared to 3Q 2021 EUR CRD volumes up 58% in 3Q 2022 […]

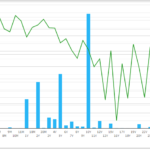

How Kwasi Kwarteng Has Increased Your Initial Margin

Initial Margin for GBP swaps has increased by up to 65% due to the mini-budget. 5 of the 6 largest ever moves in GBP rates have occurred during September 2022, since the mini-budget. We look at Initial Margin models and how IM has changed over time. It is fair to say that GBP Swap markets […]

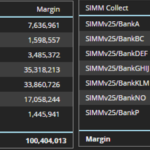

ISDA SIMM – What changes in v2.5?

ISDA SIMM v2.5 is effective December 3, 2022 Updated with a full re-calibration and industry backtesting Meaning Initial Margin will change for most portfolios In particular, material increases for Commodity and Credit risks To quantify the actual impact of SIMM v2.5 Clarus CHARM can run both SIMM v2.5 and v2.4 on your portfolios And do so before go-live, to […]

The GBP Financial Meltdown – what is still trading?

GBP markets are exceptionally volatile at the moment. We look at transparency data and find that derivatives markets are continuing to function. September 2022 will likely see the largest notional volumes traded this year. We cannot say for sure that will be the case for the amount of DV01 transacted. We consider what this means […]

What’s New in CCP Quant Disclosures – 2Q22?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures: Initial margin for ETD at $528 billion is down 7% QoQ and up 19% YoY Initial margin for IRS at $280 billion is up 4% QoQ and 8% YoY, to hit a record high Initial margin for CDS at $76 billion is up 15% QoQ and 31% YoY LME Disclosures that increase in the latest quarter are […]

RFRs are now half of the market

The ISDA-Clarus RFR Adoption Indicator has now climbed above 50% for the first time. In August 2022 it hit a new all-time high at 51.1%. SOFR adoption increased to a new all-time high, at 57.2%. GBP and CHF continue to see nearly 100% of risk traded as RFRs. €STR trading slipped (again) to 19.3%, the […]