As we note today in What did January teach us about RFR trading, SOFR Swap and Futures volume hit an all time high of 28.4% of all USD risk traded, which is up 3% from the prior month. CME also put out a press release, noting SOFR Futures and Options record volumes on February 10, 2022. All postive signs in the continued adoption of SOFR Futures and OIS Swaps.

Two of the criticisms of SOFR compared to Libor, are that it is not a forward looking term rate and does not include a bank credit spread (being a secured risk free rate). So lets’ look at how two alternatives that seek to overcome these objections are doing in the Swap market; firstly Term SOFR and secondly BSBY.

Term SOFR

CME Term SOFR Rates are a forward looking term rate, available here, which are derived from prices of CME SOFR Futures. A methodology document is available on the same page and also provides for the future inclusion of SOFR OIS Swaps, when their monthly volume exceeds 25% of SOFR Futures volumes for a consecutive 6-month rolling period. (One to watch out for in the months ahead).

The NY Fed also publishes SOFR Averages, available here, with 30-day, 90-day and 180-day averages and while these are backward looking, they are also a term rate.

Given these sources of daily Reference Rates, we can look at Swap trades in US SDRs.

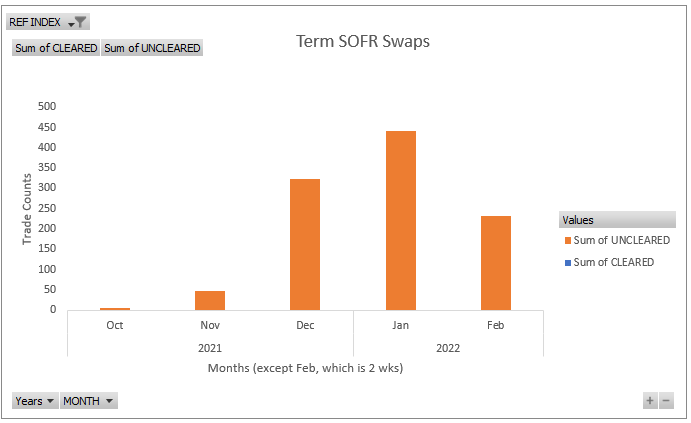

Using SDRView, I export USD FixedFloat Swaps (so not OIS), filter on Term SOFR Reference Indices (more on this later) and create the chart below.

The number of trades in a month increasing from:

- <10 in Oct 2021,

- 320 in Dec 2021,

- 440 in Jan 2022,

- 230 in the first 9 days of Feb 2022.

- All are Uncleared (and Off SEF).

So low numbers compared to the 25,000 USD Libor Swaps reported in Jan 2022, but an upward trend nevertheless.

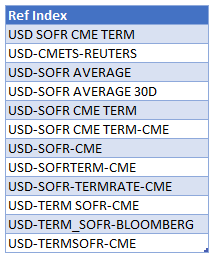

Unfortunately, as a new reference rate, the naming conventions on trades have a lot of variation, so I ended up making an educated guess and selecting the following:

Each of which has Average or Term as well as SOFR in the name.

And not selecting values with USD-SOFR, USD-SOFR-COMPUND, USD-SOFR-H15, USD-SOFR-NYFED, USD-SOFR-OIS-COMPOUND, on the basis that these reference the daily SOFR rate and for some reason are reported as FixedFloat and a 1-day Reset Frequency (mostly) and not as OIS Swaps.

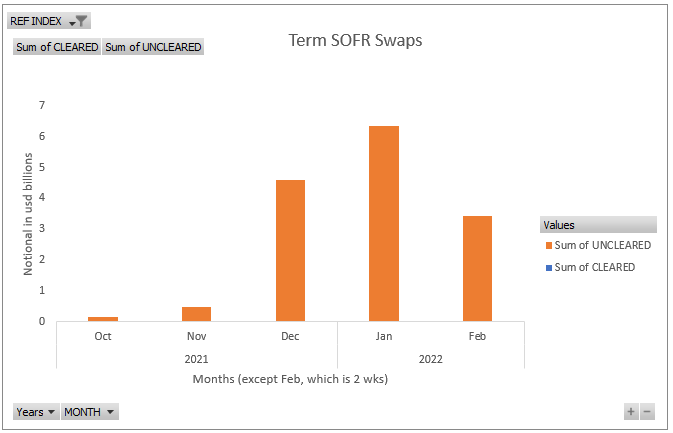

And the same chart but with gross notional by month.

A high of $6.4 billion in Jan 2022 with $3.4 billion in the first 9 days of Feb 2022.

I note that CapsFloors are also using these reference rates and in Jan 2022 we see:

- 195 trades with USD Libor

- 95 trades with SOFR Average 30-day

- 281 trades with a SOFR Term rate

- 58 trades with SOFR (daily)

Interesting to say the least and comparable volumes to Term SOFR Swaps.

I don’t know the reason behind this activity, please reach out to us if you have an explanation.

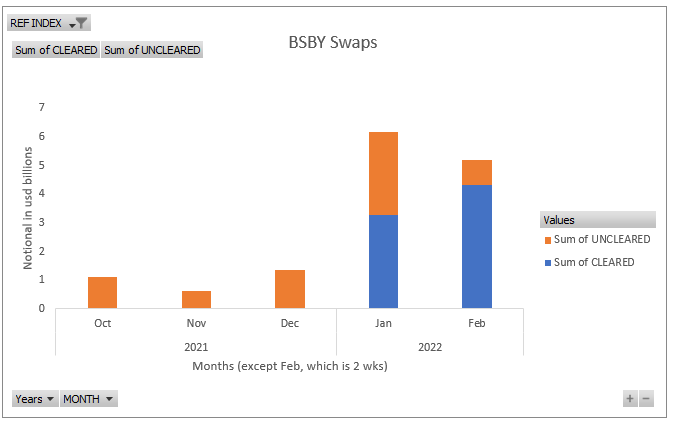

BSBY Swaps

The Bloomberg Short-term Bank Yield Index (BSBY), available here, is a series of credit sensitive reference rates that incorporate bank credit spreads and a forward term structure. The methodology is based on transactions and executable quotes from Bloombergs electronic trading solutions and short-term senior unsecured bank corporate bonds reported by FINRA.

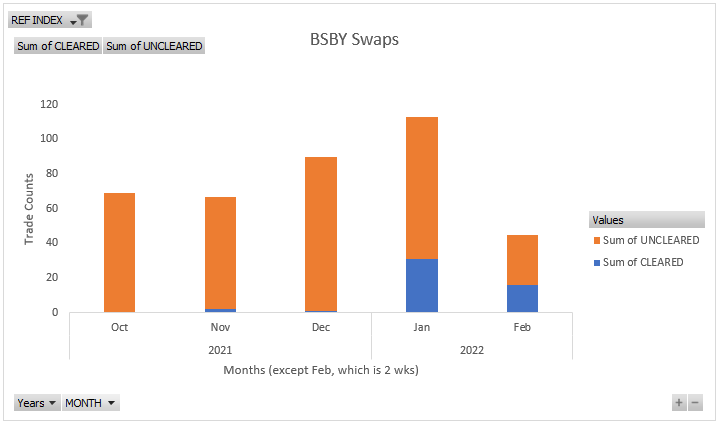

Let’s repeat our above exercise using SDRView, but this time filter on Reference Indices with BSBY in the name.

- Oct 2021 with 70 Swaps, all Uncleared

- Nov 2021 with 65 Swaps, the first Cleared trades

- Dec 2021 with 90 Swaps

- Jan 2022 with 31 Cleared and 82 Uncleared

- Feb 2022, first 9 days with 16 and 29 respectively

So signs of a pick up in volume, but again very low numbers compared to the 25,000 USD Libor Swaps in Jan 2022. As BSBY Swaps are clearable at CME and LCH and CME lists a BSBY Future, it is possible these Swaps will become attractive to more particpants and volumes increase. But the jury is out and only time will tell.

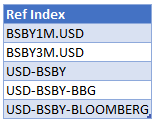

This time I filtered on five variations of BSBY, as in the table below.

Next let’s chart gross notional volumes.

Jan 2022 with $3.2 billion in Cleared and $2.9 billion in Uncleared, while Feb 2022 shows a signifciant jump in Cleared volumes, over and above the trade count chart, which augurs well for clearing leadning to more particpants and volumes. Even though USD Libor volume of $1.2 trillion in Jan 2022, shows the relative scale to climb.

And just for comparison to SOFR, we do see 2 CapsFloors in Jan 2022 that reference BSBY.

Summary

Similar volumes of Term SOFR and BSBY Swaps are now being reported.

440 Term SOFR and 113 BSBY Swaps in Jan 2022.

$6 billion gross notional in Jan 2022 for each.

Term SOFR is also significant in CapsFloors with 400 trades in Jan 2022.

BSBY Swaps are clearable and Feb 2022 shows a jump in volume.

It will be interesting to see volumes in BSBY and Term SOFR develops.

From one of our readers:

The uncleared swaps that are traded with corporates (not required to clear) will likely have a floor included as a structure to ensure aligned hedging with an associated floating rate loan. These would be reported separately to the SDR as a swap and floor but traded concurrently. The corporate client will not purchase a swap and cap concurrently as these tend to achieve similar hedging objectives. The cap mitigates economic risk, rather than matching the terms of a loan (it is unlikely to be capped). Caps are understandably popular at the moment, so the CAPFLOOR flag is most likely a CAP and not a floored swap.

SOFR term swap is not supposed to be traded unless for hedging purpose. Is there anyone cross checking the validity of the trade? Otherwise, it goes against the ARRC proposations.

SOFR “OIS” Swap exchanges fixed coupons on one leg against “backward looking” compounded daily SOFR: but at trade inception, the “backward looking” compounded daily SOFR legs are (of course) unknown; these will be only realized throughout the life of the swap. Therefore, the fixed coupons on these “OIS” SOFR swaps represent the implied forward-looking compounded daily SOFR rates; therefore the fixed coupons on the SOFR OIS swaps can be seen as “implied forward-looking term rates”. The difference between a “term SOFR” swap and an OIS SOFR swap is that on the “term SOFR” swap, the SOFR coupons will be based on a SOFR term rate observed at some specific future date, whilst on the “SOFR OIS” swap, the SOFR coupons will be based on backward-compounded daily SOFR realizations, but these will be also observed only on some future date. Therefore both, SOFR OIS and SOFR “term” swaps are forward-looking at trade inception by their definitions; both contain information about future state of interest rates. Why then the need for “term” SOFR swaps: it’s basically a derivative on a derivative (because the SOFR coupons on these swaps are based on “term SOFR” which itself is a derivative). Why not just use the fixed coupons on SOFR OIS swaps as a forward-looking “term” rate?