- CDS index products are seeing unusually high trading activity.

- Inflation swaps have also seen significant volumes.

- These are two hot topics for market participants to monitor.

- Europe has also extended equivalence for non-European CCPs for another 3 years.

- There is now a consultation to understand which regulatory actions can most effectively move clearing activity to European CCPs.

There are three Clarus-worthy stories I wanted to highlight before I take a brief break next week. I will publish Part Two of the SACCR series after the break – I’m still not sure how many 800 word pieces SACCR will take up this year, but I’m betting on more than two!

Now for the data and what has piqued our interest this week.

Credit

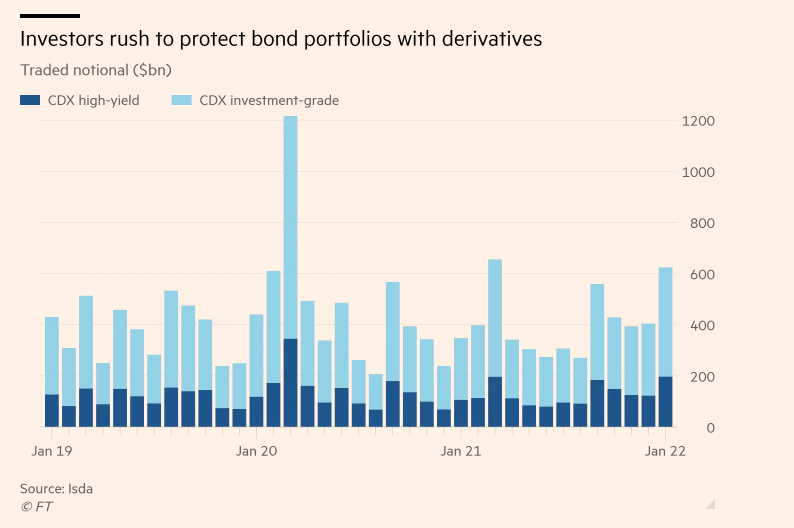

First up, I noticed the FT team wrote about a spike in CDS volumes this week:

https://www.ft.com/content/cf1d717a-f3c1-489e-b3ac-c4db2124536d

Whilst the FT cites ISDA as the data source, I’m certain this is the same DTCC SDR data that we use in our SDRView data products. CDX volumes such as these have unfortunate biannual spikes associated with the index rolls each March and September. So any truly unusual volumes are hard to pull out.

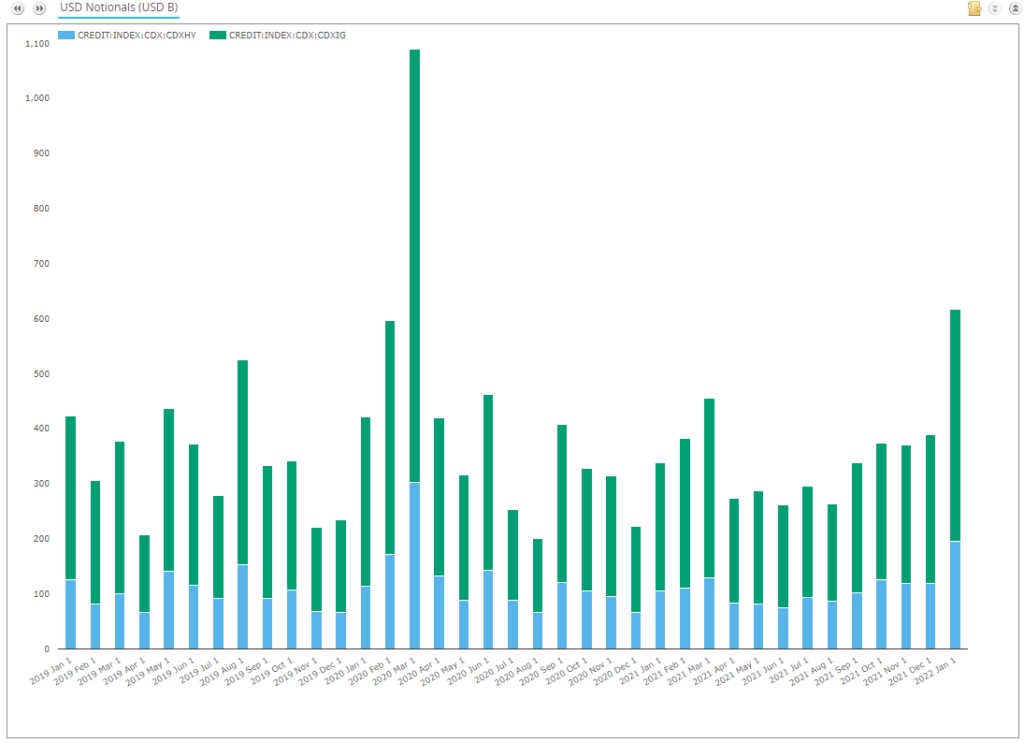

Here is the same data but with the roll volumes removed from March and September activity:

Showing;

- January 2022 volumes were unusually high in CDX markets.

- January 2022 was the highest month on record, excluding the crazy volumes in March 2020 (due to the pandemic).

- At $600bn of notional volume, it is the only month, other than March 2020, that CDX volumes reported to SDRs have been so high (and remember the true volume is higher due to block trades being reported with a notional cap threshold).

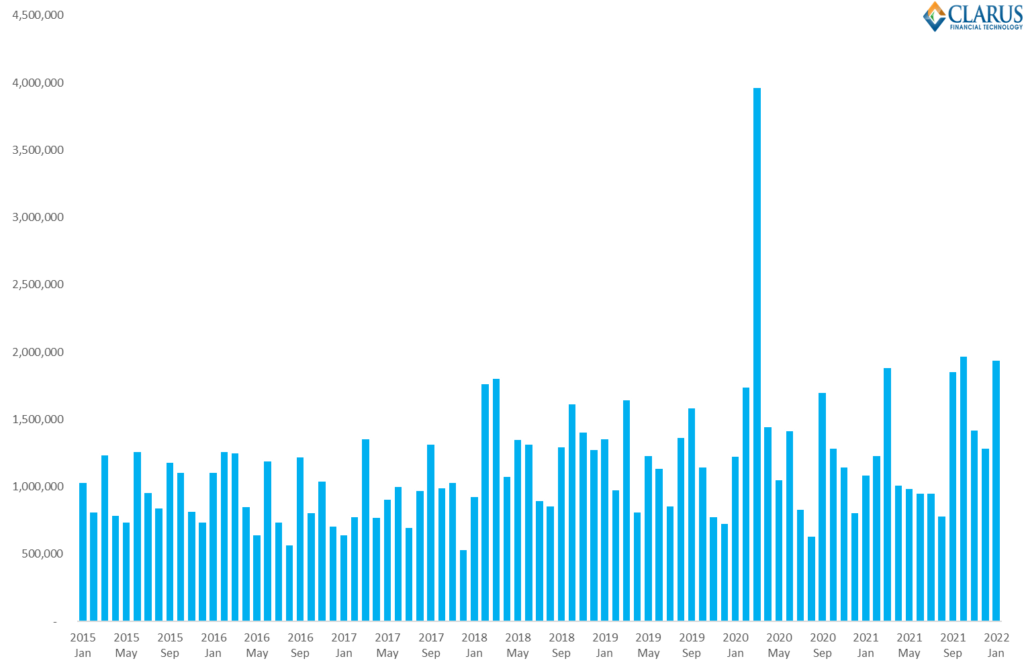

Elsewhere in our Clarus data, we can look at global activity in cleared CDS using CCPView. This looks at all cleared activity and we can expand it to look at all CDS indices as well. We use the same ratios as SDRView for March and September roll months to adjust for the volume inflation in these months:

Showing;

- Total Cleared volumes across all CDS indices since 2015.

- This covers activity in EUR, JPY and USD. The original SDRView chart looked at only the USD market.

- As you can see, the overall market is much larger – nearly $2trn in notional across all cleared CDS markets traded in January 2022.

- The crazy volumes of March 2020 still stand head and shoulders above everything else on this chart.

- Overall CDS activity (adjusted for the roll activity remember!) has been very elevated since September last year.

- January 2022 was the 3rd highest month on record. October 2021 was the 2nd highest. Okay, these are well short of the ~$4Trn record in March 2020, but let’s hope we don’t have another month like that any time soon!

When the FT are writing about it AND the data is showing sustained high activities, it seems like something everyone should be looking at….

Inflation

Talking of topics EVERYONE is looking at right now, inflation is at the front and centre of everyone’s mind. Particularly central banks! As a result, we’ve had plenty of incoming asking about inflation volumes. My previous blog on Inflation volumes from last year is proving particularly popular right now:

We’ll need to do a quarterly “Inflation Swap Summary” at this rate. Let us know down below if you’d like to see such a blog added to our quarterly roster of regular blogs.

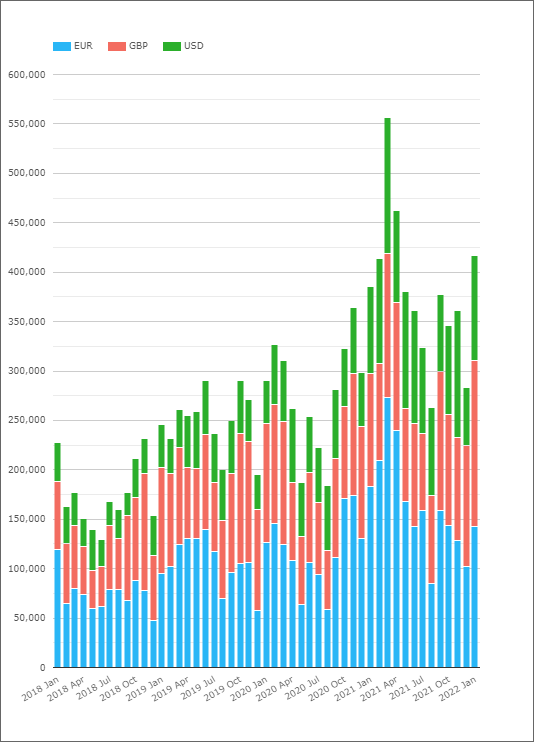

For now, here is what G3 Inflation Volumes have been up to recently:

Would you look at that!

- January 2022 also shows unusually high levels of activity in Inflation Swaps across EUR, GBP and USD.

- (Okay, this was probably a bit of a lay-up given the backdrop. Even central banks have noticed!).

- It is useful to be able to quantify by how much volumes have jumped.

- And the answer might be less than you think looking at that chart.

- January 2022 volumes were ~25% higher than the average from the second half of 2021.

- However, they are still not reaching the heady heights of Q1 2021 that caused us to write the previous blog.

- We are about 10% below the elevated levels of activity seen from January 2021 to April 2021.

A notable aspect of inflation-linked activity is that there were four consecutive months of elevated activity last year. Will the same happen again? Is January 2022 just the Inflation Swap market warming up for higher volumes? Another one to monitor.

Europe

Finally today, the European Commission has both:

- Extended UK CCP equivalence ruling by three years to June 2025.

- Launched a consultation on what they can do to make clearing at European CCPs more attractive.

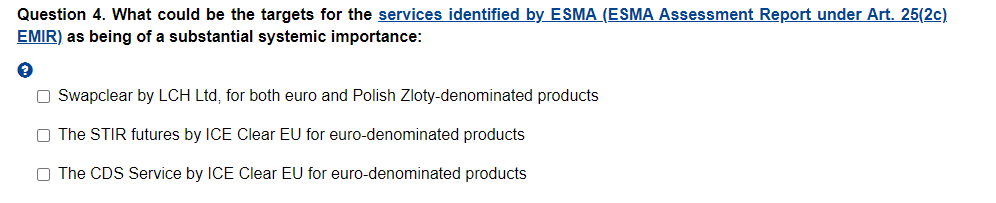

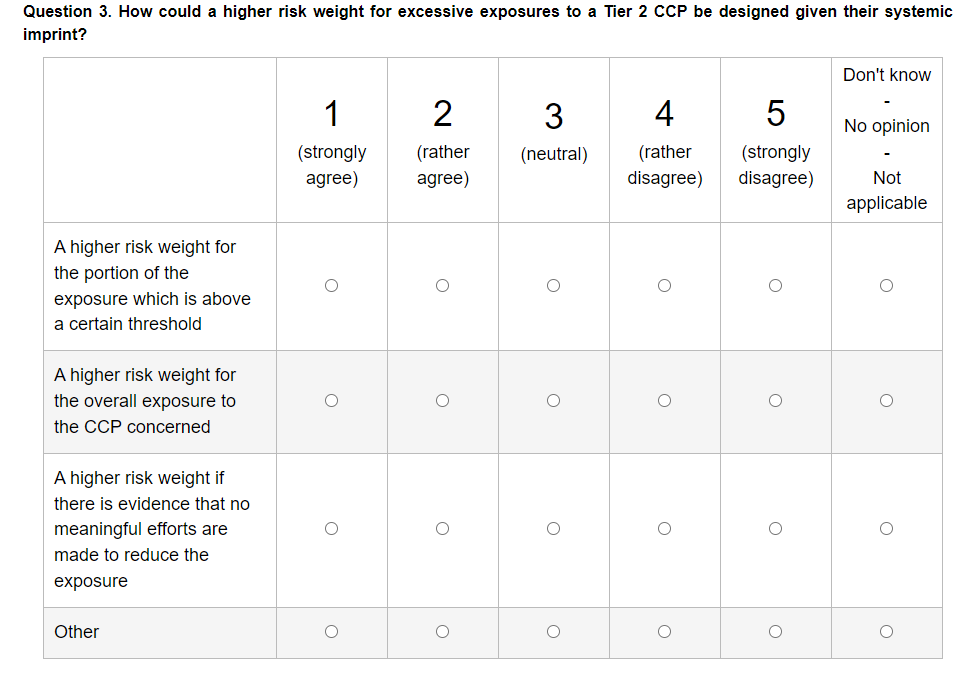

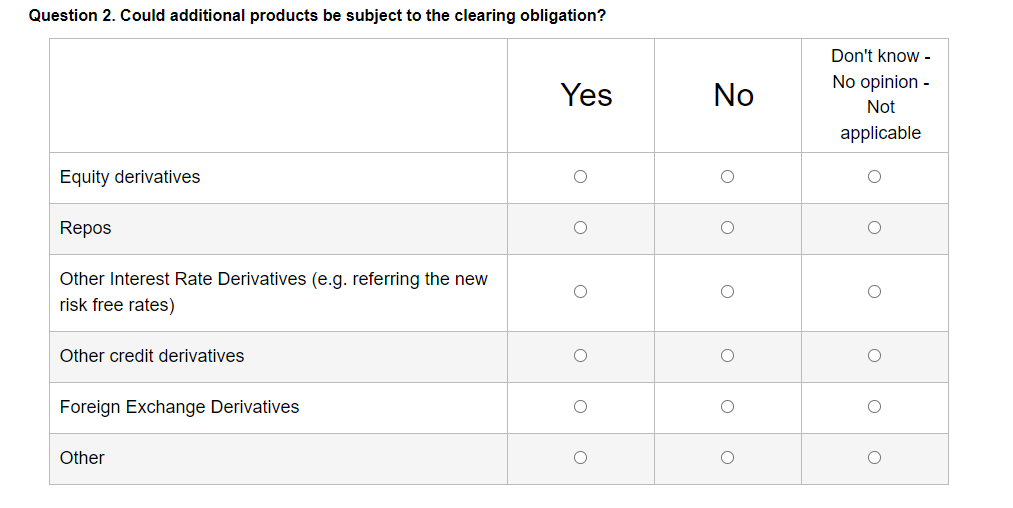

The consultation is going to be a bit of a beast to respond to. And the questions are not mincing any words here. Have a look at some of the content below:

And in case people don’t even get past the first page of questions, the very first question is a humdinger (in my humble opinion!):

A range of possible options are presented which could support enhancing the attractiveness of clearing at EU CCPs. Please indicate which ones are the most effective in your view in contributing to the objectives:

European Commission

Consultation to expand central clearing activities in the EU

https://ec.europa.eu/eusurvey/runner/central-clearing-review-2022?surveylanguage=en#page2

- Broadening the scope of clearing participants

- Broadening the scope of products cleared

- Higher capital requirements in CRR for exposures to Tier 2 CCPs

- Exposure reduction targets toward specific Tier 2 CCPs

- Macroprudential tools

- Obligation to clear in the EU

- Active account with an EU CCP

- Hedge accounting rules

- Use of post-trade risk reduction services

- Fair, reasonable, non-discriminatory and transparent (FRANDT) commercial terms for clearing services

- Measures to expand the services by EU CCPs

- Payment and settlement arrangements for central clearing

- Segregated default funds

- Enhancing funding and liquidity management conditions

- Interoperability

The whole consultation will likely attract a Clarus blog, but these questions seem to say that the “market led” approach of the past few years has not resulted in enough volume moving into European clearing services. Therefore, one of these 15 options is going to be used instead. I wonder if there will even be more than one?

In Summary

- Trading volumes in CDS index products are unusually high right now.

- Inflation swaps have also seen a significant increase in volumes since H2 last year.

- These are two hot topics that market participants are expected to keep a close eye on over the coming months.

- Elsewhere, Europe has extended equivalence for non-European CCPs for another 3 years.

- And Europe has also launched a consultation to see what measures could be most effective to move more clearing activity to European CCPs.

It would be great to have the inflation swaps volumes summarized quarterly. thank you.