Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalised and aggregated to allow meaningful comparisons of volumes.

Today we look at 2Q24 volume and market share in IRD for:

- USD Swaps (SOFR, FF)

- EUR Swaps (EURIBOR, €STR)

- GBP Swaps (SONIA)

- JPY Swaps (TONA)

- AUD Swaps (BBSW, AONIA)

- CAD Swaps (CDOR, CORRA)

- EMEA Swaps

- AsiaPac Swaps

- LatAm Swaps

Which show record high quarterly volumes for GBP, JPY, EMEA, AsiaPac and LatAm Swaps.

Onto the charts, data and details.

Volumes and Market Share

For major currencies and regions, vanilla swaps referencing IBORs and OIS Swaps referencing RFRs, using single-sided gross notional volume over a period; either a month, quarter or year.

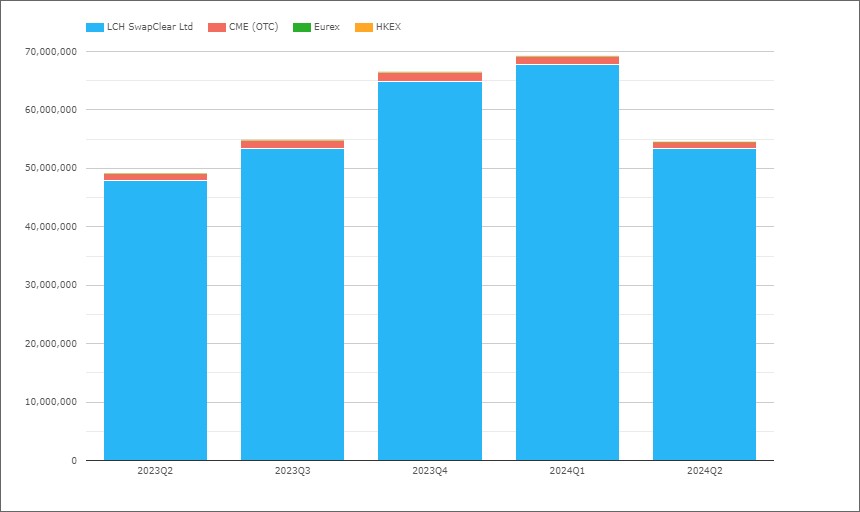

USD OIS

Swaps referencing either Fed Funds or SOFR indices.

- 2024Q2 with $54.5 trillion is up 11%, compared to $49.1 trillion in 2023Q2

- LCH SwapClear with $53.3 trillion in 2024Q2 and $47.9 trillion in 2023Q2

- CME OTC with $1.18 trillion in 2024Q2 and $1.20 trillion in 2023Q2

- 2024Q2 Share is LCH 97.8% and CME 2.2%, compared to 97.5% v 2.5% in 2023Q2

While 2024Q2 is down from the record high in 2024Q1 of $69.2 trillion, this drop is similar in magnitude to that between 2023Q1 and 2023Q2. The 11% increase from the 2023Q1, augurs well for forecast volumes in 2024Q3 in turn being higher than the equivalent 2023 quarter.

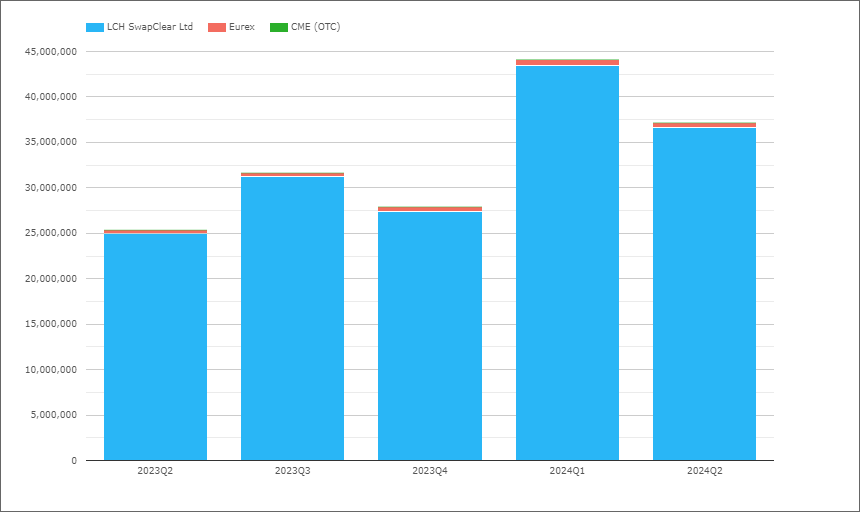

EUR Swaps (Euribor)

- 2024Q2 with €16.5 trillion is up 36% compared to €12.1 trillion in 2023Q2

- LCH SwapClear with €15.6 trillion in 2024Q2 and €11.5 trillion in 2023Q2

- Eurex with €0.92 trillion in 2024Q2 and €0.62 trillion in 2023Q2

- 2024Q2 market share is LCH 94.4%, Eurex 5.6%

- While 2023Q2 share was 94.9% and 5.1% respectively

2024Q2 is only 3% down from the record high volume of €17 trillion in 2024Q1.

EUR OIS

Referencing either EONIA or €STR, though in recent quarters all volume will be €STR.

- 2024Q2 with €37.2 trillion is up 46%, compared to €25.4 trillion in 2023Q2

- LCH SwapClear with €36.6 trillion in 2024Q2 and €25 trillion in 2023Q2

- Eurex with €0.58 trillion in 2024Q2 and €0.42 trillion in 2022Q2

- 2024Q2 market share is LCH 98.4%, Eurex 1.6%, the same as a year earlier

The combined EUR IRS and OIS volume of €53.7 trillion in 2024Q2 at an fx rate of 1.07 is eqivalent to $57.5 trillion, so higher than USD OIS volume of $54.5 trillion in the quarter.

GBP OIS (SONIA)

- 2024Q2 with £21.6 trillion is up 170% compared to £12.5 trillion in 2023Q2

- LCH SwapClear with 99.9% share

2024Q2 volume is the highest on record, far above the prior high of £18.4 trillion in 2020Q1.

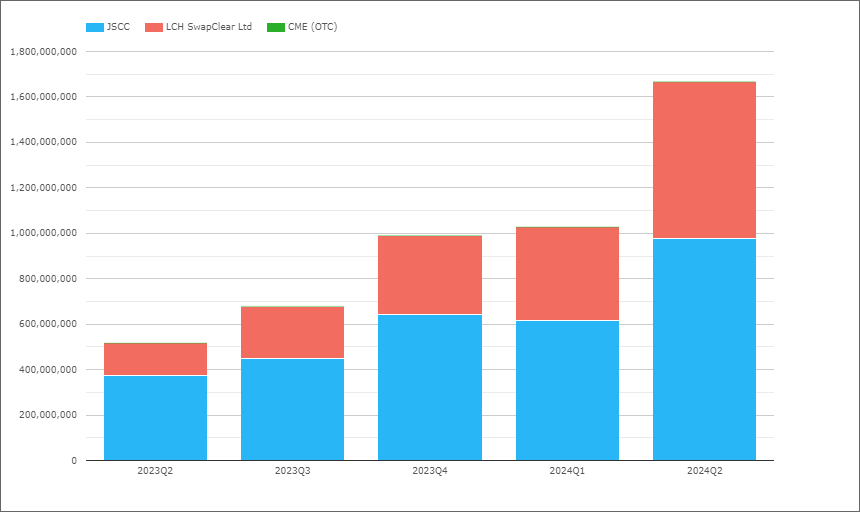

JPY OIS (TONA)

- 2024Q2 with Y1,558 trillion is up 300% compared to Y517 trillion in 2023Q2

- JSCC with Y976 trillion in 2024Q2, compared to Y373 trillion in 2023Q2

- LCH SwapClear with Y692 trillion in 2024Q2, compared to Y144 trillion in 2023Q2

- 2024Q2 Share is JSCC 59.5%, LCH 41.5%, compared to 72.1% and 27.9% in 2023Q2

2024Q2 volumes are a new record high, far exceeding the prior high of of Y1,028 trillion in 2024Q1.

At an FX rate of 160, the Y1,558 trillion in 2024Q2 is equivalent to USD 9.7 trillion.

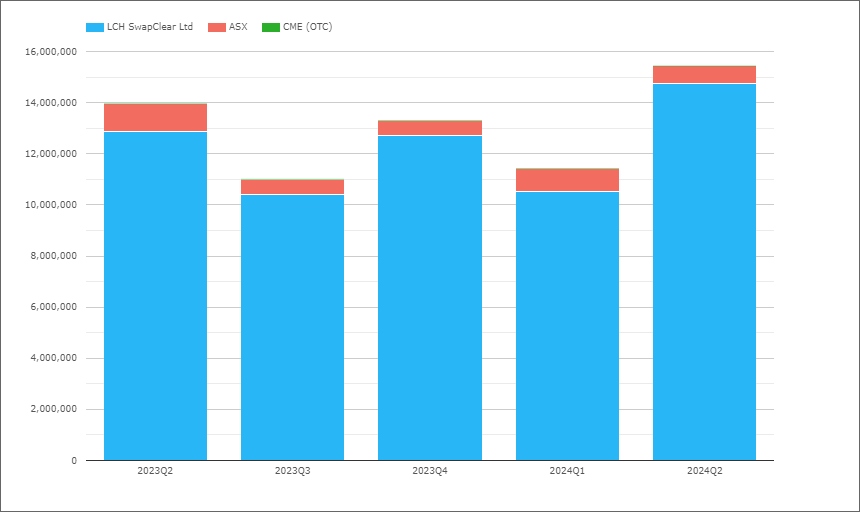

AUD Swaps

Referencing either AONIA or BBSW, so both OIS and IRS.

- 2024Q2 with A$15.4 trillion is up 10% compared to A$14.0 trillion in 2023Q2

- LCH SwapClear with A$14.7 trillion in 2024Q2 and A$12.9 trillion in 2023Q2

- ASX with A$0.7 trillion in 2024Q2 and A$1.1 trillion in 2023Q2

- 2024Q2 Share is LCH 95.4% and ASX 4.6%, compared to 92.3% vs 7.7% in 2023Q2

AUD up YoY and QoQ but still far-off its record high in 2020Q1 of A$22.8 trillion.

CAD Swaps

Referencing either CORRA or CDOR, so both OIS and IRS.

- 2024Q2 with C$5.65 trillion, compared to C$5.17 trillion in 2023Q2

- IRS down to C$180 billion from C$1.4 trillion, as the move to CORRA nears completion

- LCH SwapClear with 99.8% of the volume

2024Q2 is the third highest volume quarter, after 2020Q1 and 2023Q1.

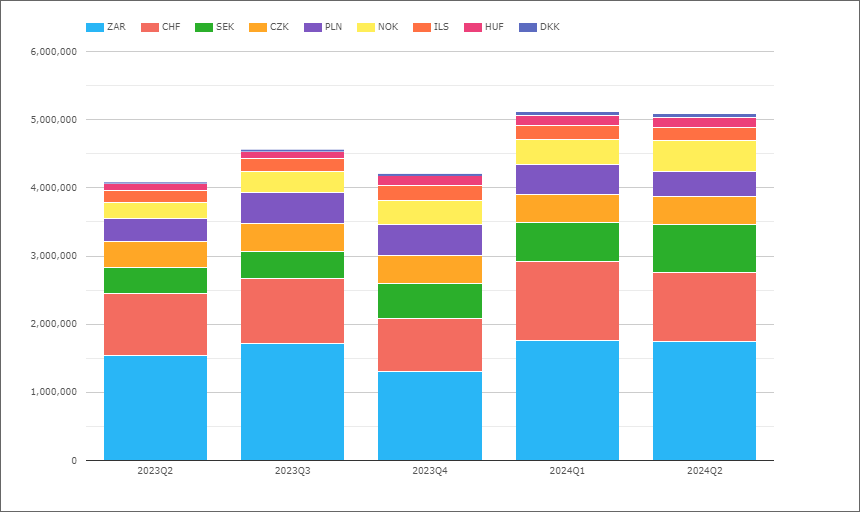

EMEA Swaps

Now let’s switch to EMEA Swaps (all types) and volumes by currency.

- 2024Q2 with $5.1 trillion is up 24% from $4.1 trillion in 2023Q2

- ZAR the largest in 2024Q2 with $1.75 trillion, similar to $1.55 trillion in 2023Q2

- CHF next with $1.0 trillion, up from $0.9 trillion in 2023Q2

- SEK with $693 billion, up from $369 billion

- NOK with $458 billion, up from $238 billion

- CZK with $422 billion, up from $387 billion

- PLN with $362 billion, up from $334 billion

- ILS with $194 billion, up from $177 billion

- HUF with $141 billion, up from $101 billion

- DKK with $52 billion, up from $22 billion

Volumes in all currencies are upfrom a year earlier, except for ZAR which is flat.

The overall volume at $5.1 trillion in 2024Q2 is similar to 2024Q1, which was a record high quarter.

Not shown in the chart is market share by CCP, where LCH has >99% share for 2024Q2 except for:

- CZK, LCH 95.8%, CME 4.2%

- HUF, LCH with 91.5%, CME with 8.5%

- PLN, LCH with 94.5%, CME 3.6%, KDPW 1.9%

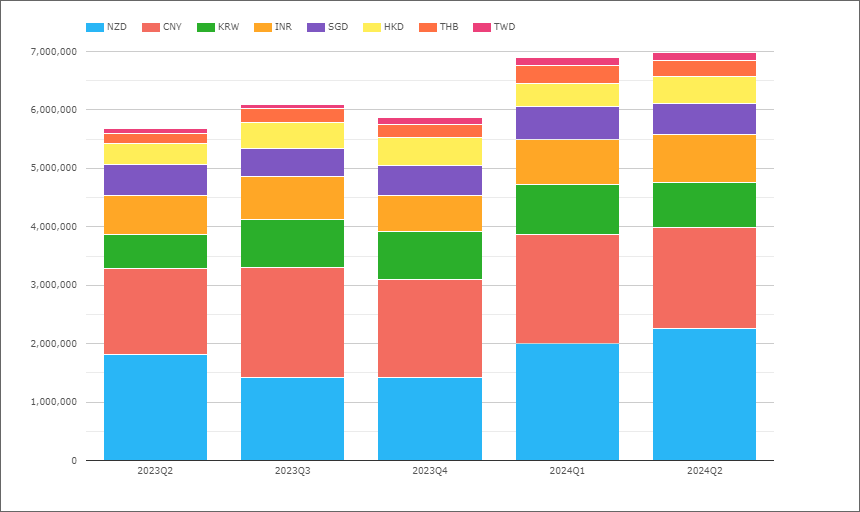

AsiaPac Swaps

Now let’s switch to AsiaPac Swaps (all types) and volumes by currency.

- 2024Q2 with $7 trillion is up 23% from the $5.7 trillon level in 2023Q2

- So materially larger than the $5.1 trillion for EMEA

- NZD the largest with $2.25 trillion in 2024Q2, up from $1.8 trillion in 2023Q2

- CNY next with with $1.7 trillion, up from $1.5 trillion

- INR with $827 billion, up from $666 billion

- KRW with $770 billion, up from $584 billion

- SGD with $527 billion, up from $519 billion

- HKD with $457 billion, up from $362 billion

- THB with $282 billion, up from $179 billion

- TWD with $133 billion, up from $84 billion

Every currency is higher in 2024Q2 than a year earlier and 2024Q2 volume of $7 trillion is a record high.

Not shown in the chart is market share by CCP, where LCH has >99.8% share for 2024Q2 except for:

- CNY, Shanghai with 57.4%, LCH with 42.5%

- HKD, LCH with 99.5%, HKEX 0.5%

- INR, LCH with 75.5%, CCIL with 24.4%

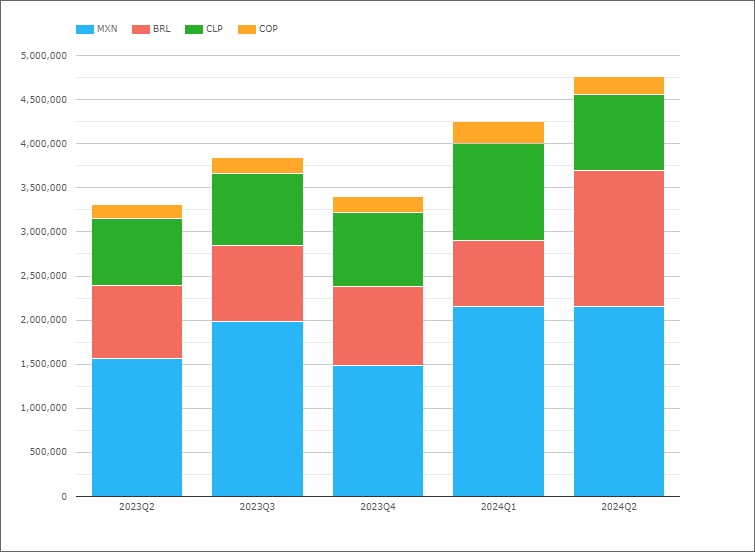

LatAm Swaps

Finally lets look at LatAm Swaps.

- 2024Q2 with $4.77 trillion is up 44% from $3.31 trillion in 2023Q2

- MXN the largest in 2024Q2 with $2.15 trillion, up from $1.56 trillion in 2023Q2

- BRL next with $1.54 trillion, up from $0.83 trillion in 2023Q2

- CLP with $870 billion, up from $764 billion

- COP with $204 billion, up from $156 billion

MXN and BRL with very significant increases and the volume of $4.77 trillion in 2024Q2 is a new recod high from the prior high in 2024Q1.

Not shown in the chart is market share by CCP, where for 2024Q2 the shares are:

- MXN, CME with 94.9%, Asigna/Mexder 12.1%, LCH 3%

- BRL, CME 92.5%, LCH 7.5%

- CLP, CME 98.9%, LCH 1.1%

- COP, CME 97%, LCH 3%

That’s It

10 Charts for an overview.

Still a lot more data to look at

Volume in DV01 terms and Open Interest by currency.

IR Futures in all the major currencies and US Treasury volumes.

For more details, please contact us for a CCPView demonstration.