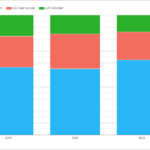

2021 CCP Volumes and Share in CRD

A review of Credit Derivatives (CRD) volumes and market share at Clearing Houses (CCPs) in 2021. Index, Single-name and Swaptions Volumes in USD of $10 trillion, down 9% Volumes in EUR of €6.7 trillion or $8.5 trillion, flat on the year Index is 90% in USD and 94% in EUR Single-name is 9% in USD […]

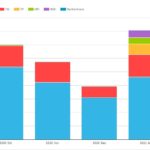

US SEFs now have 50% share of EUR iTraxx

We covered EUR iTraxx very briefly in last weeks blog New Brexit Rules Move $4trn of Derivatives to the US, so today I will take a deeper look into these Credit Index Derivatives volumes. SEF Volumes Using SEFView we can isolate gross notional volumes in EUR Credit Index Derivatives, meaning the iTraxxEurope family. Showing a […]

Credit Index Options – Dec 2020

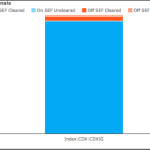

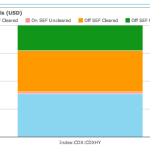

Clearing of Credit Index Options is a product to watch in 2021 with recent announcements from both ICE Clear Credit and LCH CDSClear. In early November, ICE launched clearing for Options on CDX NA.IG and CDX.NA.HY In early December LCH CDSClear went live with Options on CDX.NA.IG and CDX.NA.HY To add to those on iTraxx […]

CME Halts CDS – Where’s The CDS Business?

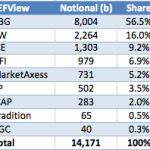

Last week, CME announced it would end it’s clearing offering for Credit Default Swaps, and instead focus it’s effort on other innovations in clearing services for Interest Rate and FX, including: FX Options launched by 2017 year end Interest Rate swaps for 3 more currencies – CNY, CLP, and COP by early 2018 Further capital […]

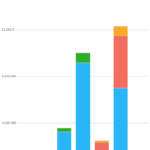

Swaps Data Review: Credit Derivative volumes

My Monthly Swaps Data Review for Risk Magazine was published on Friday. This looks at volumes of Credit Derivatives in the 4-month period to July 2017, showing: Global Cleared Volumes CDS Index represents 86% and CDS 14% of volume ICE Clear Credit is the largest CCP with 75% of the volume iTraxx Europe is the […]

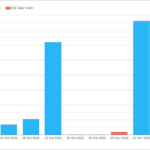

CDS – Record Volumes, Expiring Swaptions and Bloomberg

We look at the SDR data for CDS Index and Swaption trading. In Options, we see a lot of Swaption expiries coming up next week. For the underlying Indices, there have been record volumes traded during 2016… …with Bloomberg’s SEF the number one venue. Automated Trading in Credit anyone? I recently saw a nice click-bait title on Bloomberg […]

Stop Losses Evident in CDX Price Action

CDS indices trade in an almost continuous market This gives us a lot more price and volume data to analyse than for a tenor-specific Interest Rate Swap We briefly look at tick sizes and volume at price for the CDX:IG Index, but don’t find anything too compelling But we find an interesting representation in 3 dimensions when […]

Post-Trade Transparency in CDS Index

The recent IOSCO report on Post-Trade Transparency in the Credit Default Swap Market, certainly makes interesting reading and in this blog I will provide a short summary of the report as well as looking in more depth at the data now available for CDS Index. IOSCO Report The report focus is on regulatory systems that mandate disclosure of […]

CDSIndex Volumes: A Year to Date Review

Reading a Bloomberg article today, Swaps Boom is Unintended Consequence of New Curbs on Wall Street, it seems that instead of trading investment-grade bonds themselves investors are increasingly turning to derivatives. The reason given that they cannot get quickly in and out of cash bonds as dealers are pulling back from debt trading. While the figures quoted in […]

CDSIndex On SEF Volumes after MAT

February 27, 2014 was the Made Available Trade (MAT) determination date for CDSIndex contracts based on the TradeWeb submission. Similar to my recent article on Interest Rate Swaps, I will look at what the volumes show. Which products are MAT? Two North American Indices: CDX.NA.IG.5Y and CDX.NA.HY.5Y Two European Indices: iTraxx Europe 5Y and […]