Average and Term SOFR Volumes in 2022

Recently I looked at Term SOFR and BSBY Volumes in 2022 and in that article I used a pretty loose definition of Term SOFR; basically anything where the index was not the standard overnight SOFR index. My goal being to isolate the trades not using overnight SOFR. Today I want to seperate out the use […]

Why Did SOFR Trading Decrease in January?

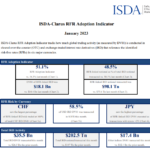

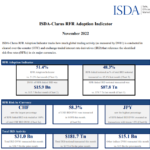

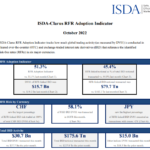

The ISDA-Clarus RFR Adoption Indicator for January 2023 has now been published. Showing; Why The Stasis? Am I becoming a broken record? In the past few weeks, I have written: All of those blogs are very much about the slower than required adoption of RFRs, particularly SOFR, as June 2023 fast approaches. What does this tell […]

Term SOFR and BSBY Volumes in 2022

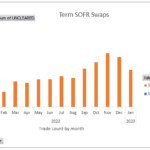

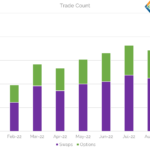

We looked into Term SOFR and BSBY Swap Volumes in April 2022 and What’s New in Term SOFR in November 2022, so today I will update that blog to see how trade volumes in these reference indices developed in 2022. Term SOFR Swaps In SDRView, I can group USD FixedFloat Swaps by the Reference Index […]

CORRA First – Clients don’t get it

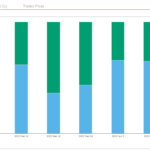

CORRA First was put in place on January 9th 2023 to help CAD interest rate derivatives transition from CDOR to CORRA. For all of the juicy details, please see my blog from last year: Transparency is Better Than Ever RFR transition in Canadian markets may seem a little niche for some of our readers. However, […]

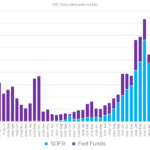

Are Fed Funds the latest winner from benchmark reform?

This is a follow-up to an RFR Adoption blog that I wrote in November: In that blog, I noted that Fed Funds seemed to be settling at around 10% of the USD market (excluding LIBOR, which continued to print in relatively large size every month in 2022). However, last week I noticed the following Linkedin […]

Can $62Trn really be about to simply disappear?

As January slips by, we will shortly be staring at June 30th 2023 when USD LIBOR will finally cease publication. Whilst all signs suggest that LIBOR transition in USD markets will be just as smooth as in GBP, JPY and CHF last year, it is worth just pausing and noting how large the USD LIBOR […]

CORRA First in CAD Markets

I first wrote about benchmark reform in Canada in 2019: Since then, we have had the announcement that CDOR will cease in 2024: As with all good benchmark stories, the announcement of cessation sets the ball-rolling on a number of fronts: CORRA First Luckily, we have a well-thumbed playbook to refer to now, and the […]

RFR Adoption – Is This Groundhog Day?

The ISDA-Clarus RFR Adoption Indicator for November 2022 has now been published. Showing; Is History Repeating? Groundhog Day appears to be a traditional film that isn’t actually set at Christmas but is associated with this time of year. RFR Adoption is somewhat similar – in the run up to the end of 2021, it was all […]

What’s New in Term SOFR?

In April, Amir gave a timely update on Term SOFR. In case you missed it: And the calls from the industry to make Term SOFR a more widely traded derivative have only become louder since, with the latest Risk.net article particularly worth a read: It’s a great article, but it does not update readers on […]

A New Plateau in RFR Adoption?

The ISDA-Clarus RFR Adoption Indicator was 51.3% last month. This is the third consecutive month that it has remained around 51%. SOFR adoption hit a new all-time of 58.1%. €STR adoption remains volatile. Trading activity across all markets was lower than last month. The ISDA-Clarus RFR Adoption Indicator for October 2022 has now been published. Showing; […]