- Cross Currency Swaps trading fundamentally changes during a funding crisis.

- I run through the impacts to the risks that are being managed and the daily flow of news that drives trading activity.

- There are various drivers ranging from FX markets, LIBOR fixings, futures convergence trades, central bank operations and client demand.

- Most traders will only have time to “Trade. Eat. Sleep. Repeat.”

A lot changes in the space of a week these days. I thought it would be interesting to set out what has happened in the space of 24 hours for a Cross Currency swaps trader during this evolving crisis.

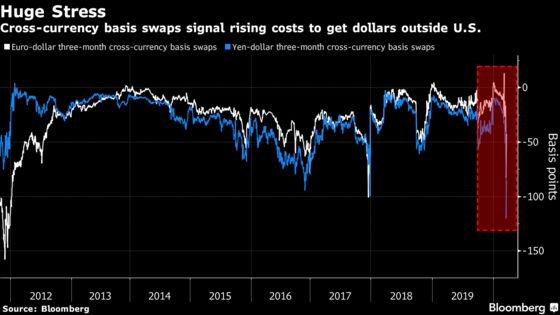

The current crisis is beginning to show signs of stresses in funding markets, including a rush to secure USD funding, no matter the cost.

Remember that when XCCY basis moves lower (more negative/wider) it means that USD funding is becoming more expensive. This is because a XCCY swap has an initial and final exchange of notional. When the basis becomes more negative, market counterparties are willing to lend the non-USD currency (e.g. EUR) at huge discounts to the floating index (3m EURIBOR), in order to secure USD funds.

17th March 2020

Tuesday saw three important bits of market information that suggested there was a significant shortage of USD in funding markets:

- A group of US banks announced that they had tapped the “discount window” to borrow USD from the lender of last resort, the Fed. It is worth reading the press release, as this coordinated effort was designed to remove the stigma attached with accessing this facility. Nonetheless, a nervous market interpreted this news as proof that banks will be accessing the discount window facility going forward – rather than raising these USD in the open market.

- The Bank of Japan’s USD repo facility attracted USD30.2bn of bids, which were fully allocated. Judging from the market reaction, this was a much larger amount than expected.

- 3 month USD LIBOR jumped much higher. It fixed 16 basis points higher, which came on top of a ten basis point jump on Friday and a 4 basis point jump on Monday. The total rise has now been 31 basis points since the low on Thursday last week.

All of these events conspired to send EURUSD basis into somewhat of a tailspin. For the purposes of this blog, it is disappointing that we only see transparency for US markets, particularly for such a global product as Cross Currency. And particularly in light of the fact we are most interested in European data to see how they are raising USD!

Nonetheless, yesterday we saw 54 EURUSD XCCY basis trades hit the SDR, albeit only totaling $3.84bn. Unsurprisingly, the short-end was very active, with 1Y having a range from -43 to -21 basis points!

You will notice that the lows were hit first thing in the London session on the 17th March, and the basis recovered throughout the day.

What Does This Mean for XCCY Traders?

This extreme volatility changes the trading day for Cross Currency Traders. It feels like there is “event risk” every 30-90 minutes throughout the day.

A typical daily run-down of events now looks something like:

- 7:00am: Check 3 month FX Fwds to see where the implied “front-roll” is. This is the implied basis (derived from Covered Interest Rate Parity) from making a 3 month EURIBOR loan and converting it into USD via a 3 month FX swap.

- 7:30am: Update above calculation as STIR futures markets settle down and estimates of the day’s LIBOR and EURIBOR fixings come in. This is particularly difficult in the third week of March because the first IMM STIR futures do not settle until June. That means that any movement in LIBOR between now and June is very difficult to estimate. Cross Currency traders will now typically start trading the first “serial” contract – in this case EDJ0 – to start hedging fixing risk and first roll exposures.

- Remember that Cross Currency swaps have much larger notional amounts than vanilla Fixed-Float IRS. This means that the fixing risk (a.k.a FRA risk) on a cross currency book tends to be much larger than on an IRS book. Hedging these daily fixings becomes close to a full-time job, and yet is only a second-order risk that is not an intentional “profit driver”.

- 9:00am: Start hedging today’s EURIBOR fixings in the futures market to mitigate any potential spikes across all funding markets.

- 9:30am: Decide best course of action to hedge the day’s USD fixings – using OTC FRA to bring forward the risk of another fixing later in the week/month, using the front serial Eurodollar contract, or the (pretty useless at this point) June contract that does not move in tandem with the daily USD LIBORs.

- 10:00am: Monitor the weekly central bank auctions for USD allocations (see future blog).

- 11:55am: Check USD LIBOR fixing. Re-calibrate front-roll.

- Midday: This can often be the peak activity time for short-dated Cross Currency. All of the fixings are now known (rather than estimated), and front futures contracts will give a knee-jerk reaction as to where 0x3s FRA fixing tomorrow will be (the current market consensus where USD LIBOR will fix next). Cross Currency traded today will still include the 0x3s fixing TODAY, so there will be an adjustment necessary if LIBORs are expected to continue rising tomorrow. This makes monitoring the 3 month front roll throughout the day pretty onerous as STIR futures markets continue to fluctuate, implying volatility in tomorrow’s fixing.

- 13:00pm: This is really the time when Cross Currency traders can start to turn to their “day job” which is actually pricing customer trades, moving longer dated risk and keeping clients informed of the moves/volatility/trading activity. It also has the benefit of seeing peak liquidity between European and US centres.

- 14:00pm – 17:00pm: The chance to now hedge those client trades and find the offsetting risk.

- 17:00pm – 19:00pm: Time to assess how the spot LIBOR fixings have moved relative to the futures hedges that were put on earlier in the day. Despite the volatility in the XCCY basis itself, this “stub risk” between cash and futures will still often be the largest component of PnL at the end of the day. Particularly when the implied convergence between cash and futures rates is extreme.

- 19:00pm – 20:00pm: – catch-up on all of the risks/idiosyncrasies/trading action outside of EUR and USD that a typical “G8” cross currency book will have.

This is a pretty brutal day by most standards. You won’t find (m)any Cross Currency Traders “blowing off steam” at the end of such a day. Especially in these markets.

Trade. Eat. Sleep. Repeat.

18th March 2020

And so far today, we’ve seen the following:

- Central bank auctions of USD from ECB, BoE and SNB. The ECB alone allotted nearly $100bn across 7- and 84-day tenders. I’ll put a blog up later today with some analysis.

- EURIBOR virtually unchanged.

- USD LIBOR again moving higher by 6 basis points.

- The front roll has therefore been exceptionally volatile today, now settling into single negative figures at pixel time.

- And of course front Eurodollar STIR contracts continue to be volatile:

In terms of trading activity in EURUSD XCCY today (so far ~13:00pm CET), we’ve had 23 trades totaling $2.32bn. The 1Y trades below are all forward-starting, so take their printed levels with a pinch of salt.

Importantly 5y has traded 6 times in a tight range of -20.5 to -19.5 basis points. That is a good sign that the market is finding an equilibrium level (for now).

I still believe that this level of transparency is highly beneficial to the market. When the observed, implied rates via FX are so volatile, it is crucial to be able to analyse exactly what is actually trading.

Key metrics from here for the cross currency community will be where EDJ0 goes. Fixing in about one month from now, it is still implying a USD LIBOR fixing of ~70 basis points. That is already about 2 basis points of convergence every single day versus the spot USD LIBOR fixing. If that continues to diverge, expect cross currency to stay volatile and see some more swings negative.

Secondly, the big question is what will happen to those USD raised at the central bank repo operations? Whilst they promise OIS + 25 bp, there is a minium of a 6.5% haircut on non-USD collateral posted against it. I’ll examine this more in a blog post specifically about these operations.

In Summary

- Trading these markets is exceptionally difficult.

- Even for a linear product like Cross Currency swaps, there are a multitude of moving parts to constantly monitor and hedge.

- Stresses in funding markets fundamentally change how often and to what tolerance these risks must be managed.

- As the crisis continues to evolve, this volatility is likely to remain.

- The best way to understand the volatility is to have post-trade transparency so that market participants can continue to analyse what has actually traded.