The final cessation of GBP, JPY and CHF LIBOR will have some impacts on transparency data across our Clarus data. Here are some of the more obvious ones to highlight. We are sure that more will become apparent over the coming weeks:

IRS Have Disappeared

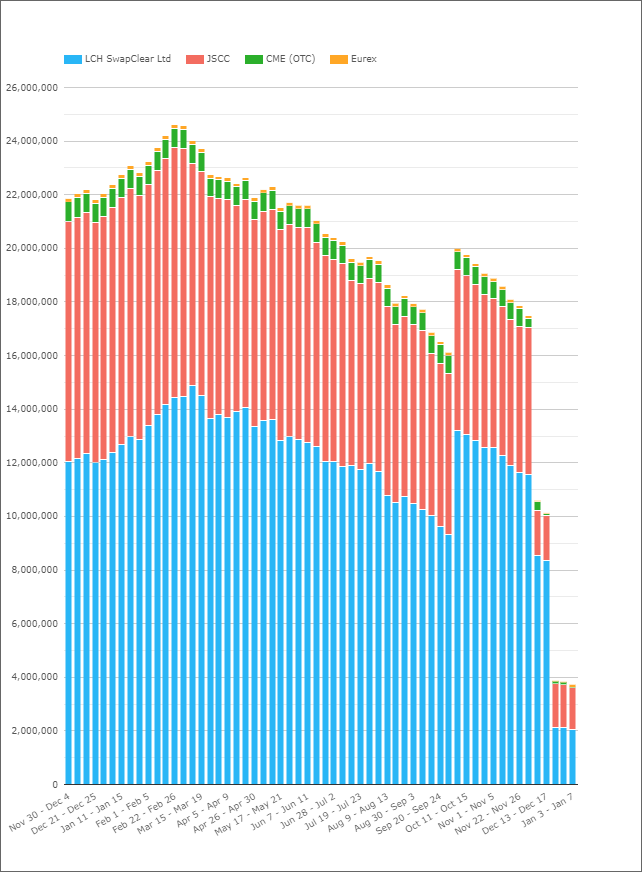

The most stark representation of the cessation of LIBOR comes from CCPView, looking at the drop in Open Interest in GBP, JPY and CHF Interest Rate Swaps:

Showing;

- Open Interest, in USD equivalents, for vanilla Fixed-Float Interest Rate Swaps in GBP, JPY and CHF.

- Following the conversion exercises at each of the CCPs, these IRS have been converted into OIS equivalents (plus the fallback spreads).

- I make that an 83% reduction in the Open Interest of outstanding LIBOR-linked IRS in these currencies.

- Why isn’t it a 100% reduction? My guess is that everything still outstanding is in the final period of the swap, and has therefore already fixed (vs LIBOR). Coincidentally, all of these markets traded versus 6M LIBORs, so there is likely to be residual Open Interest until the middle of 2022.

- Somewhat more strangely is that we still see new volumes being reported in these currencies this year!

As the chart shows, GBP swaps still traded in the week of Dec 20th-24th, and we have seen over $10bn-equivalent of JPY IRS also traded this year (see reader comments below as to why this is. Hint: TIBOR).

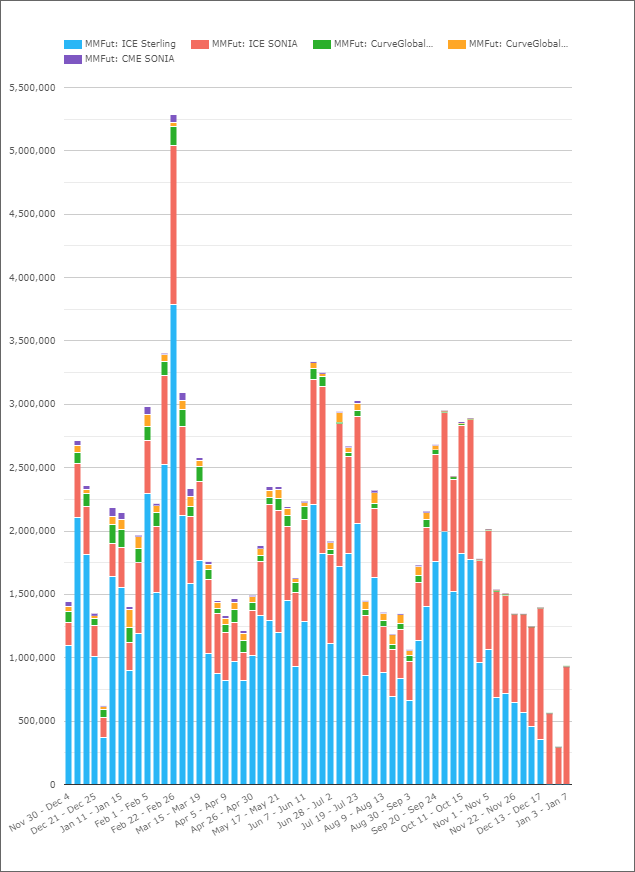

FRA Matching Services

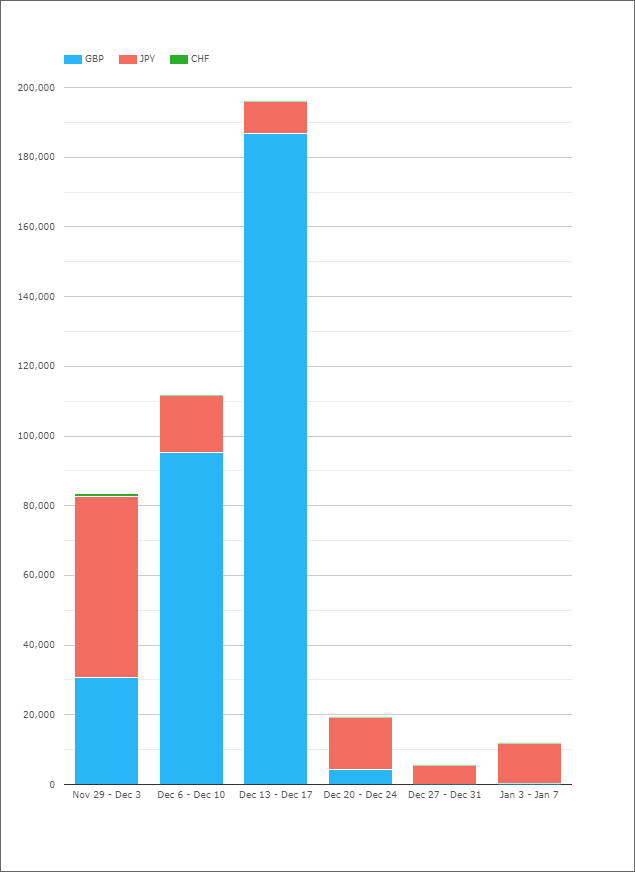

Turning to SEFView, we can see the risk management impacts of the wind-down of LIBOR. It is no longer necessary to manage fixing risk on term IRS using FRAs tied to LIBOR. This appears to have had the biggest impact on the NEX SEF, which has seen a large reduction in volumes in GBP, JPY and CHF products:

Showing;

- Volumes at the NEX SEF in GBP, JPY and CHF Interest Rate products. Note: this covers ALL products, not only FRAs.

- This is not “new news”. We wrote about “toxic FRAs” last year in GBP markets, with the available universe of hedging instruments gradually shrinking to zero as the end of LIBOR approached.

- It is nonetheless interesting that hedging activity in FRAs has not been replaced with any other instrument – yet. There will still be a desire from dealers to reduce their OIS fixing risk across certain dates. Watch this space to find out how dealers start to manage these risks.

- It is worth noting that this impact will not only be felt by NEX – it just so happens the effect is more transparent in the data for their business. Similar reductions in volumes will be seen across tpMatch and any FRA matching offered by other IDBs/SEFs.

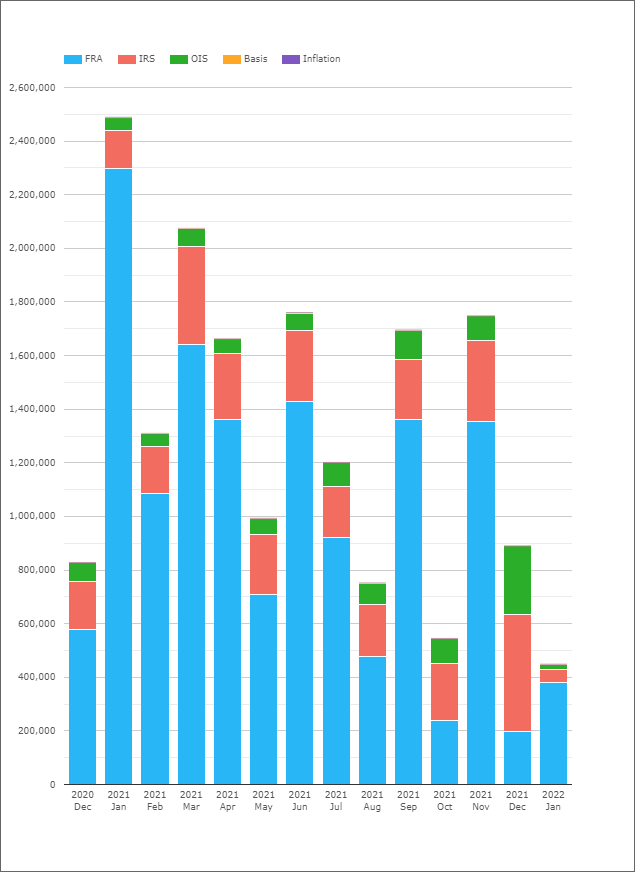

FRAs in the SDRs

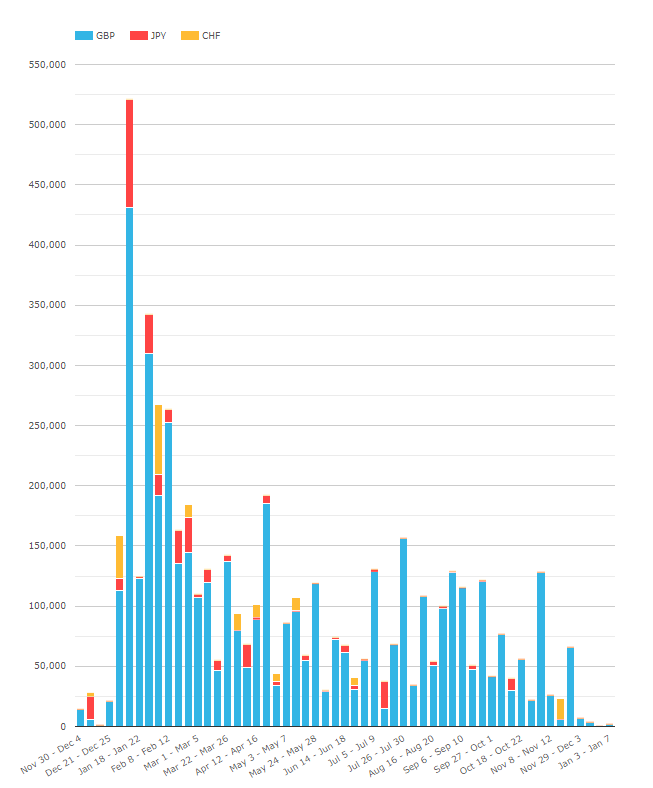

Linked to the above, and tied to the concept of toxic FRAs as well, we no longer see any meaningful volumes reported in FRAs to the SDRs:

What impact does this have? Well, we intentionally remove FRAs from our volumes stats and monitoring because they tend to be only portfolio management exercises – they are not true price-forming trades (on the whole). They are also short-dated but large notional, therefore not particularly “sticky” risk. Depending on how the short-end of the curve becomes managed, we may begin to see inflated volumes in IRS now (such as single period swaps). This is why we already allow users to filter those from our IRS data:

However, for GBP, JPY and CHF it is likely that a lot more short-end activity finds its way into OIS volumes. It might be an idea to start filtering out any tenors less than 1Y in the volume monitoring of these products to avoid distortions tied to short-end activity.

The alternative is to use DV01, a maturity-agnostic measure of risk, rather than notional volumes.

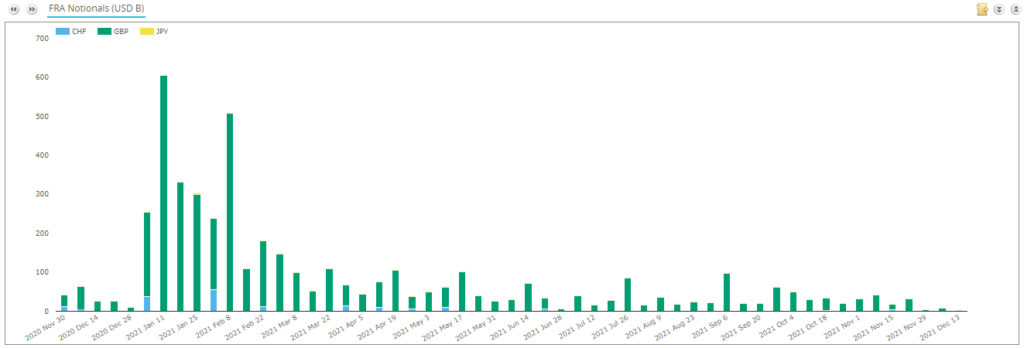

EUR FRAs and Eurex

Anywhere up to 90% of Eurex EUR volumes are in FRAs. Are market participants going to continue trading such large volumes in EUR FRAs if they stop trading them in GBP, JPY and CHF? Obviously the USD market has some way to run, but EUR will stand out as an outlier soon enough:

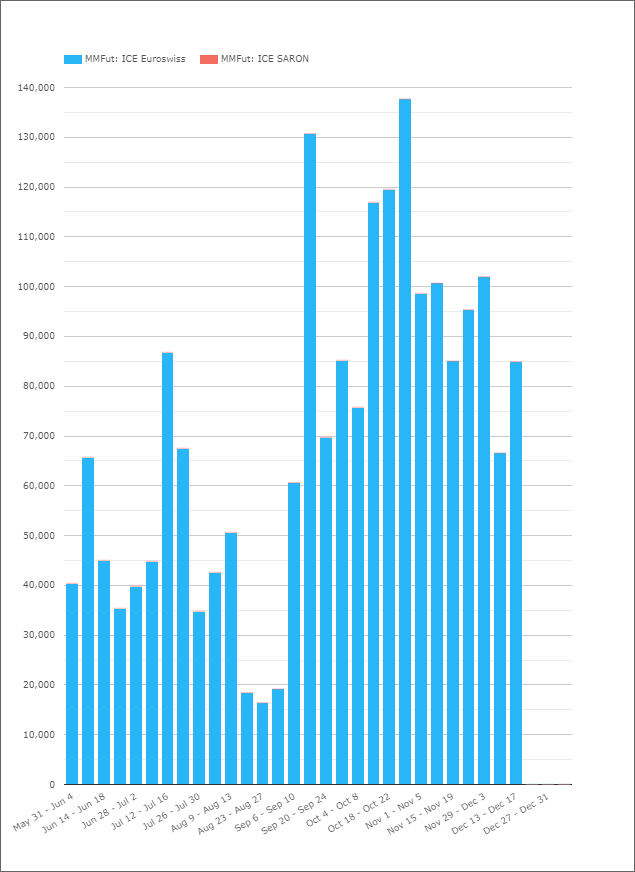

STIR volumes

Will volumes in RFR-linked STIRs ever reach the heights of their LIBOR brethren? It is too early to say from the data – we will need a whole quarter I think.

The data in GBP looks promising:

However, the data for Swiss SARON looks far less convincing! Yes, the SARON contract is included on this chart, it is just too small to see:

In Summary

The demise of LIBOR has impacted the following data. Remember this when comparing volumes over a time-series:

- Open Interest of IRS

- FRA volumes

- SEF specific franchises, such as FRA volume matching

- Short Term Interest Rate futures

Hi Chris, your colleague Amir put out a blog post about 2021 CCP volumes. In it he highlights that for JPY, TiBOR is continuing, unlike JPY Libor. My expectation is that the JPY IRS you are seeing in January 2022 are all TIBOR trades?

Brilliant, many thanks Rob for pointing this out! I believe the volumes are indeed at JSCC (LCH do not clear TIBOR swaps), so this makes a lot of sense. Good spot!