After a 3-year hiatus it was great to attend FIA Boca again, not only to meet up with customers, contacts and colleagues but also to get a sense of the topics d’jour in Cleared Derivatives.

The two that stood out for me were the high profile of Crypto firms and Cloud technology.

Cloud, as our technology stack of choice in starting Clarus in 2012, has always been strategic for us and it was great to see the major cloud providers (AWS, Azure, Google) and hear about plans by Exchanges (CME, Nasdaq, OCC, TMX, …) to move their technology stack onto Cloud. We think this is overdue and offers signifciant benefits in scale, reliability, cost and innovation to our industry.

The focus of my article today is Crypto and in particular FTX’s submission of a direct clearing model under the Commodity Exchange Act and CFTC regulations, which was the subject of much talk and discussion at the conference.

CFTC Seeks Public Comment

The best place to start is the CFTC webpage annoucing that it is seeking public comment on the FTX request and noting that it has received enquiries from DCOs (Derivative Clearing Organizations) or potential DCOs seeking to offer clearing of margined products direct to participants, so not via FCMs (Futures Clearing Merchants) or Clearing Brokers; a non-intermediated model.

This page has a link to the questions/request for comment document that CFTC is seeking comment on by April 11, 2022, as well as links to review the FTX documents. The intro to the document starts with the following:

Current DCO clearing models

There is then a page on current DCO clearing models, which highlights three characteristics: margined products, intermediated clearing and mutualized losses.

The prevalent model in derivatives clearing is one where clients are risk managed by FCMs/Clearing Brokers, who are members of a DCO/Clearing House and these members guarantee a clients obligations as well as contributing to the Default/Guarantee Fund of the DCO.

This section also states that, “Currently four DCOs, including FTX, clear only non-margined, fully collateralized trades. In a fully collateralized trade, the DCO holds as collateral 100 percent of the potential losses a counterparty could incur and the DCO is thus not exposed to the risk of a counterparty default.”

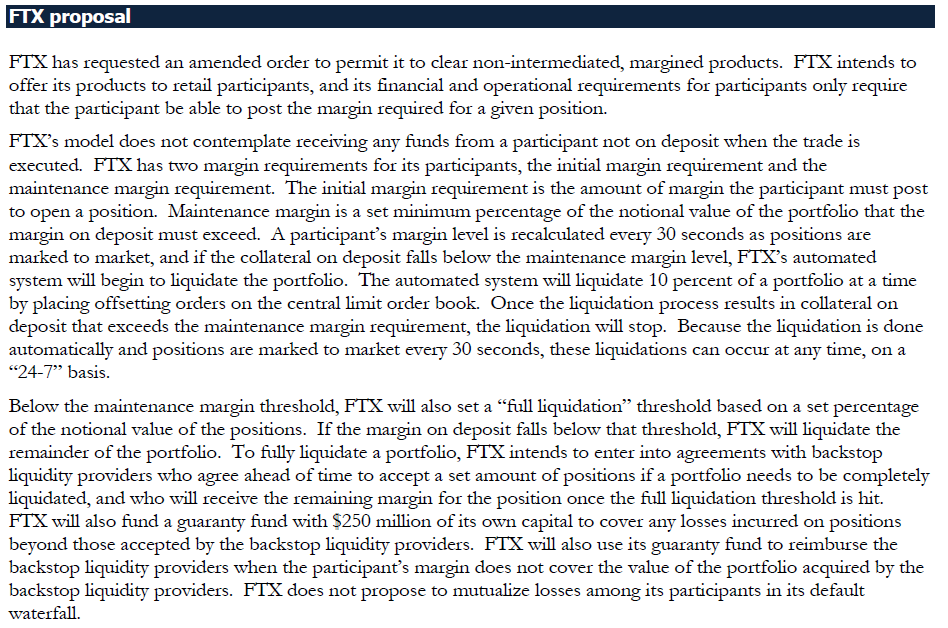

FTX Proposal

There then follows a section on the FTX Proposal, which I was going to summarise, but on reflection it is short enough to copy and paste in full.

Wow and there you have it, a significant and disruptive change indeed.

Questions seeking Comment

There then follow four pages with detailed questions that CFTC is seeking comment on and I am not going to directly cover each of these in my blog, but would encourage you to read these, consider and respond to the consultation, if an area of interest for your firm.

In addition the two letters from FTX, available here, are well worth a scan or careful read.

So, thoughts?

My Thoughts

Any innovative and disruptive proposal, invariably raises questions from the incumbent orthodoxy and while ultimately we (all) believe in market choice and customers deciding for themselves in a competitive environment, we need appropriate rules and regulations within which such choice and competition operates.

A list of concerns, questions and thoughts for me:

- The FTX letters make no specific mention of bitcoin or digital currencies, so not obvious to me if the request pertains to a derivative in any asset class regulated by CFTC (FX, Rates, Commodity) or a specific digital curency such as Bitcoin.

- LedgerX, now part of FTX, currently offers Bitcoin Futures, Options and Swaps, so I expect this should be taken as the scope.

- Will customers accept a model where their derivative positons were real-time mark to market and automatically liquidated in 10 percent increments and ultimately completely?

- In a fast moving market, would I not continually be closed out?

- It’s like stop loss orders on steriods, but those are orders I as a customer have a choice to put on and are not imposed on me.

- Could ‘bad actors’ take advantage of the backstop liquidity provider rules to end up owning liquidated retail client positions at below fa-r value?

- FTX’s own guaranty fund contribution of $250 million is indeed chunky and more than mosts DCO’s own contributions, however it pales in comparison to the amount of prefunded member contributions at the majority of large DCOs.

- FTX’s proposed methodology for sizing its guarentee fund is described in its letter and proposes a Cover 1, Cover 2 or Cover-3 type model using a 10% of IM threshold.

- In a non-intermediated model, I would question the appropriateness of a Cover 1 or 2 type model as commonly used by DCOs. While FTX envisages large institutional firms, that sort of act like clearing members, for most incumbent DCOs, client IM is far larger than member IM and I would expect this ratio to be even higher than for a non-intermediated model. In this case a large market shock could result in droves of clients defaulting (correlation in a stressed markets goes to 1, as we have repeatedly learnt to our cost) and simply using 1 or 2 or 3 members is not a sound approach.

- Most existing DCOs and certainly those in existence for a few decades, started as member owned organizations (mutual ownership) designed to keep costs low for themselves. As the profits, costs and risk increased, the majority were acquired by for profit entities. However in all or the majority of cases the capital contributed to the guarentee fund has ended up being provided not by the DCO owner but by member contributions, persumbly due to the large amount and cost of this capital. As such it seems unlikely that this could be profitably be provided just by a DCO itself?

- Unless an innovative business model and better technology allows a provider like FTX to do so.

- And what motivation is driving a non-intermediary model?

- Is it the usual strategy to capture profits extracted by intermediaries by replacing their use?

- Or is it the fact that intermediaries are standing in the way of clients, who are not passing their risk management checks or are doing so too slowly and only for criteria that results in a smaller market?

- Or a combination of both of these?

- ….

With less than 10 minutes to my publishing deadline, that is all I have time for today.

The above list is in no particular order, not exhaustive and not meant to criticize the submission.

Just thoughts to inform the debate.

Innvovative and disruptive approaches are always welcome.

And subject to consideration, debate and scrutiny.

They serve to move our industry forward.

Many of our readers work in DCOs and FCMs and we would of-course appreciate your views on this topic.

Please do reach out to us and we will publish a follow-up blog.

Most likely just before or after the April 11 consultation deadline.

Components of this model were tried 30 years ago. No mutualization of risk among users. No intermediation (i.e. users had direct access). It was also privately owned. The initial asset class was options on US Treasury Securities. It was called Delta Clearing Corp. It was a registered clearing corporation with the SEC under Sec 17A of the ’34 Act. Its risk management protocols were substantially different in that it managed its risk at both the user level and the systemic level. Approximately 40 institutions eventually signed its User Agreement. Unfortunately, it never achieved critical mass as the dealer community viewed it as an agent of disintermediation. What’s old is new.

Thanks Steve, very interesting.