Well this is something!

Babel Finance have not only completed what is maybe the first ever cross currency swap in cryptocurrencies, but they even chose to make it a mark-to-market swap! Let’s look into what this transaction is.

Disclaimers

I think this is my first blog on crypto/defi, so there may be some errors on the crypto side of things. However, I will (try to) apply my experience trading traditional cross currency swaps to explain how a transaction such as a BTC vs ETH cross currency swap can be priced, understood and possibly standardised in the future.

Mechanics of a Cross Currency Swap

In traditional finance, a cross currency swap is essentially:

- A loan in one currency versus

- A deposit in another currency

A cross currency swap is therefore a funding product that allows counterparties to translate funding exposures (either loans or deposits) from one currency to another.

Alternatively, we can also think of a cross currency swap as a loan in one currency that is collateralised by a loan in another currency. If the counterparty on our trade goes bust, we do not get our original currency back, but we still have the “foreign” currency amount that was paid to us on inception. Cross Currency Swaps therefore carry a natural credit mitigant, much as repo trades do.

There is plenty more on traditional cross currency swaps in my original Cross Currency Swap blog:

The Transaction?

So what has Babel Finance done in this trade? We don’t know the directionality of the swap (or the other counterparty/counterparties involved), but we can probably assume:

- The mark to market currency is most likely BTC.

- Let’s assume that Babel Finance are long BTC before the trade starts. This would be consistent with the Mark to Market currency being BTC. The goal of this transaction is to lend BTC to another counterparty. This will earn a rate of interest. Babel Finance are therefore able to create a yield generating BTC asset.

- They also borrow ETH off the same counterparty. Why would they do this? A couple of reasons are possible:

- This may be because they believe they can earn a greater rate of return on ETH than the interest rate that the counterparty is charging to borrow ETH.

- Babel Finance may be concerned about the credit worthiness of the counterparty. They therefore take ETH as collateral against the BTC loan. Whilst they pay interest on this collateral held, they now have an element of protection in the event that they cannot get the BTC back at maturity date.

- Or it is a simple “carry trade”. Babel Finance believe that the rate of interest paid on the BTC side more than offsets the rate of interest they pay on the ETH, and that the differential is more than enough to offset the risk of possible changes in the BTC vs ETH outright price. This is highly unlikely, so I’m not going to dwell on this here.

So the trade probably looks a lot like this:

- Babel Finance lend to Counterparty X 1,053 Bitcoins (using current BTC vs USD exchange rates, equivalent to ~$50m).

- Babel Finance agree to receive an interest rate of A% on these BTC.

- This interest rate will be reset periodically, typically every three months.

- For the first period, let’s say this interest rate is 2.6% (more on that later).

- This interest is received in BTC, it will be calculated daily, compounded and paid once a quarter.

- If we have 92 days in the first quarter, the first interest payment will be 6.92317005 BTC.

- Babel Finance also receive the equivalent amount of ETH. Let’s say they receive ETH14,672 at the current BTC vs ETH exchange rate.

- On the ETH 14,672, they agree to pay a daily compounded quarterly interest rate of 5% plus a “basis“. The basis is likely to be negative (let’s assume BTC retains a “liquidity premium” in Crypto) so let’s guess that this basis is negative 1%. All in, Babel pay 4% in the first quarter to borrow ETH.

- The interest on the ETH leg is receivable in ETH, it will be calculated daily, compounded and paid once a quarter (and reset each quarter).

- With the same 92 days in the quarter, the first interest payment will be 148.665951935920000000 ETH (apparently ETH trades to 18 decimal places, and BTC to 8 decimal places. Every day is a school day here folks!).

- The mark to market feature means that every 3 months, when these crypto interest amounts are exchanged, there will also be an exchange of BTC related to the move in the BTC vs ETH exchange rate.

- We used an exchange rate of 13.93352 at inception to set 1053 BTC equal to 14,672 ETH.

- From the chart above, we can see that over the past 3 months, the BTC vs ETH exchange rate has varied from 12 to 15.5, and we are settling somewhere in the middle of that range.

- If, in 3 months time, BTC vs ETH has moved to 14.5, Babel Finance will receive 41.13793103 BTC back from Counterparty X. The size of the BTC loan is effectively reduced, as the 14,672 ETH that they agreed to at the beginning of the trade is now worth fewer BTC.

- All future BTC flows will now be based on a new notional amount of BTC 1,011.86206897, including the final exchange of notional at maturity date.

- However if, in 3 months time, BTC vs ETH has moved to 13.5, Babel Finance will lend an additional 33.81481481 BTC to Counterparty X. The size of the BTC loan is increased to 1,086.81481481 because the 14,672 ETH that they agreed to at the beginning of the trade is now worth more BTC. Another way to state that is that the ETH can now collateralise a greater amount of BTC borrowing for Counterparty X.

- We normally talk about these mark to market resets as “cash settling” the move in FX between the two currencies during the life of the trade. Of course, in this case we are settling in cryptocurrency, but the concept is the same. The change in exchange rate between BTC and ETH is periodically settled in BTC as the trade evolves.

Why A Mark to Market Swap?

The final bullet above raises an interesting question. Why does the swap involve a mark to market mechanism? Typically, this is used to reduce counterparty credit exposures, at the expense of funding-certainty. The trade that traditional finance makes is that it is more valuable to cash settle counterparty credit exposures related to the FX component of the swap, which avoids filling up risk limits, versus the certainty of knowing exactly how much USD has been funded.

In traditional finance, the mark to market mechanism therefore implies that:

- Banks are only ever hedging their non-USD exposures.

- Banks can raise USD at the floating rate of the swap. If the cross currency swap is written at SOFR flat, a mark to market event makes an explicit assumption that the bank can raise USD for 3 months at SOFR flat.

- We obviously know that this is not true, so banks will tend to value the mark to market leg at their own internal funding curve (SOFR + (or minus!) a few basis points).

- Each mark to market event therefore carries event risk around the exact FX fixing used.

How does this relate the BTC vs ETH swap?

- Assuming BTC is the mark to market currency, each side of the trade are basically saying they have unlimited access to BTC funding at “market rates”.

- An interesting assumption, but maybe no more interesting than banks claiming the same in USD.

- If you are a crypto lender/deposit institution, this may well be a fair reflection of your underlying business model.

Fixings

Something that is not detailed in the press release is where the BTC and ETH interest rate fixings are coming from. I do not think we have the equivalent of RFRs, LIBORs or any overnight/term rates for cryptocurrencies. So what will they do? I arrived at the interest rates payable in the example in this blog by taking the daily paid rates from the latest nexo blog post:

Brilliantly, we can see already that these carry a yield-curve structure, offering an extra 1% of yield in both BTC and “Rest of Crypto” for deposits lasting more than 1 month. And 4% for currency in USDx, which I thought was a stablecoin but is apparently different? One for me to investigate there….

IF Babel and Counterparty X had agreed to just look at the nexo.io website and take these fixings for a traditional cross currency swap, that could put nexo into some hot water. Are these benchmarks? Can they be referred to in contracts? Are they benchmark compliant etc? I’m not saying this is what they did, and they may well have agreed to transact at zero interest rates, given the “basis price” of the swap could be much larger than any coupon component. Who knows at this point?

Synthetic Swap

Embarrassingly, it has now taken me 1,500 words to describe a very simple transaction! However, I am still left with questions – why MTM the swap in BTC and what fixings are being used for the interest rates?

I therefore revisited the press release and noticed the following:

The synthetic swap is an upgrade from a pure deposit/loan transaction, and will contribute toward a more efficient marketplace and reduced arbitrage space, as well as providing more liquidity for market participants, said Babel Finance’s Head of Treasury Yang Song.

https://babel.finance/notice-detail.html?id=8

I think the fact this is described as a “synthetic swap” might explain a couple of things. Like maybe this is a 2 year ETH deposit with Babel Finance, that they are collateralising/funding in shorter term BTC markets? That would remove the need for fixings.

Pricing

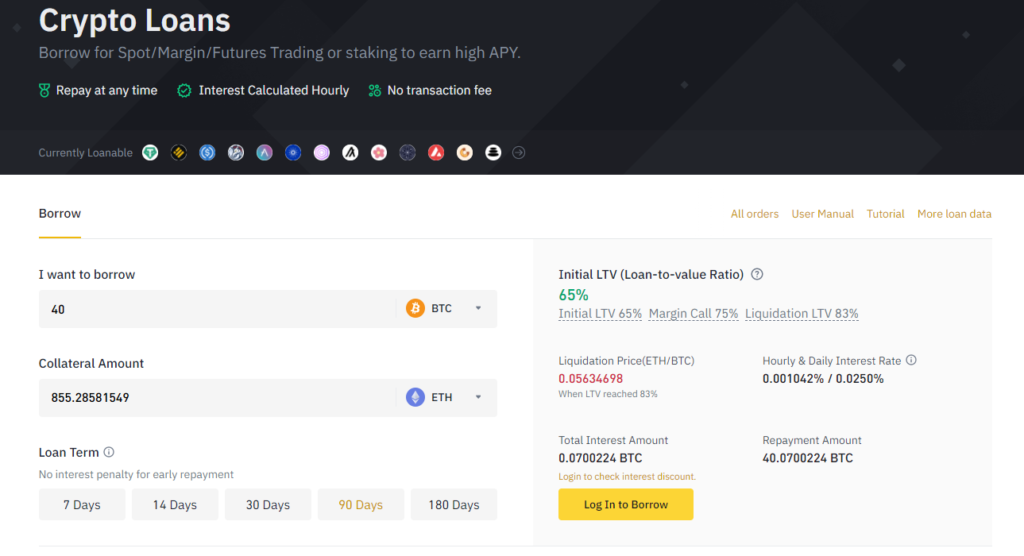

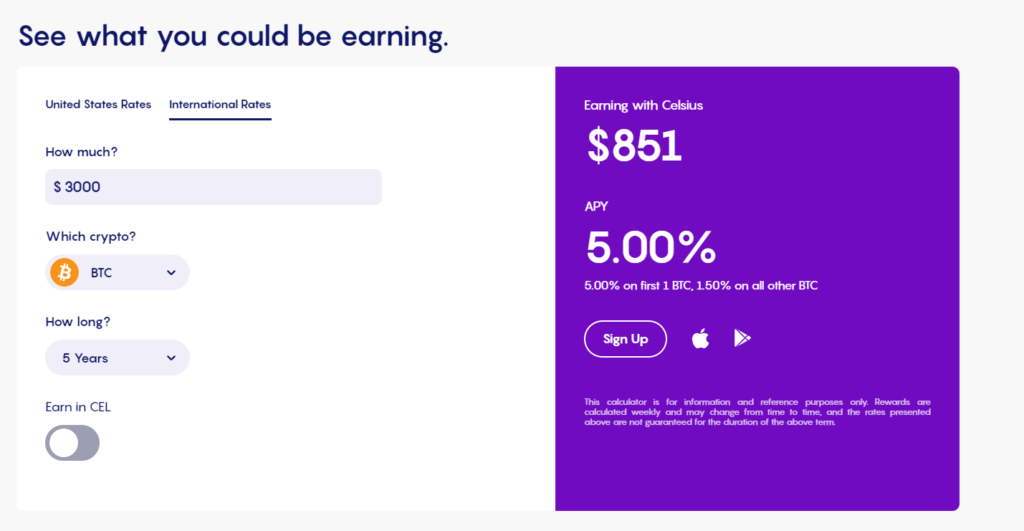

Finally, I’ve found that both Binance for crypto vs crypto and Celsius for rates versus fiat are good resources to get an idea on pricing here. Both will apply haircut amounts to the crypto, so it is not a 100% replication of the swap, but it would be my starting point to re-engineer the possible pricing on the swap.

Binance:

Celsius:

Finally

I guess crypto has come a long way from where I first started thinking about it! My central assumption was that cryptocurrencies would have an inbuilt interest rate/inflation return linked to the cost of mining new currencies. It appears that we are long past that, with market-led yields on crypto borrowing and lending a real thing. Whether they are achieved via “DeFi” (decentralised finance) or with an intermediary (“CeFi”), it brings into possibility all sorts of transactions – including cross currency swaps.

We could go on to talk about what an ideal Cross Cryptocurrency Swap looks like. Things like calculating compounded interest amounts to the second, payment vs payment of each crypto to reduce settlement risk, and alternative mark to market mechanisms (daily with a threshold or automated for each 1 % move) which would bring Cross Currency Swaps kicking and screaming into the 21st Century. But those are topics for another day…..