- For the first time, basis trading reported to the SDRs has topped $1trn in a single month.

- Similarly, global basis trading has now topped $2trn cleared at LCH SwapClear in a single month.

- We see that average maturity of basis trades varies according to the indices being traded.

- Activity in 30y and 50y basis trading has recently increased at LCH.

Libor Fallbacks and Basis Trading

Today, we are looking at single currency basis swaps. These tend to be Libor 1m vs Libor 3m (or 3m vs 6m) or Libor vs OIS. Whilst in the past I’ve looked a lot at Cross Currency Basis trading, they are certainly a different beast – please don’t get confused between the two!

Why my current interest in single currency basis trading? This interest stems from two recent articles on RFRs – Libor fallbacks and OIS maturities. I mainly wanted to see if the announcement of a Libor fallback had impacted basis trading. In theory, what is going to happen as a result of the ISDA methodology is:

- A methodology will be announced/consulted on, defining how the historic spread between LIBOR and the RFR will be calibrated.

- My understanding is that this will be tenor-specific.

- Most likely, we will look at the history of LIBOR for e.g. five years and look at the spread versus the realised, compounded RFRs for the corresponding date.

- At the moment we do not know how long the historic look back period will be, or how an average will be calibrated -e.g. mean, median, trimmed mean.

This means that after LIBOR ceases publication, the spread between e.g. LIBOR 1m and LIBOR 3m fixings will be constant. What will this do to basis trading?

There’s an App for That

Our CHARM app, called Effective Rates, will be very useful here. I ask the app for an index, a value date and a tenor and the app returns the RFR compounded rate for the appropriate period. This will make our calibration of these spreads very easy to do. Let us know if you’d like to see more:

Basis Trading Data

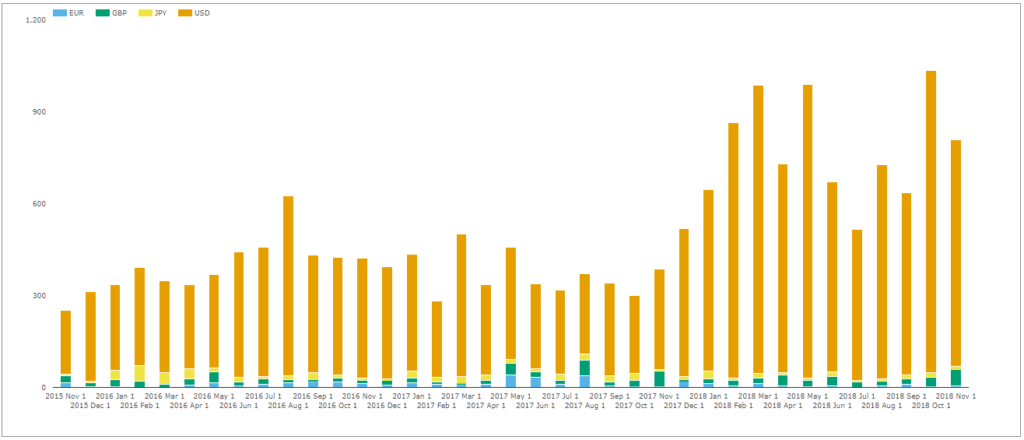

SDR data shows that volumes in basis swaps have been increasing steadily over the past two years. October 2018 saw over $1trn reported for the first time:

- Single currency basis swap trading across EUR, GBP, JPY and USD.

- This being SDR data, it is clearly dominated by USD trading.

- October 2018 saw over $1,000bn trade for the first time.

- All of the peaks in volume have occurred during 2018 – March 2018 and May 2018 also nearly breached the $1,000bn threshold.

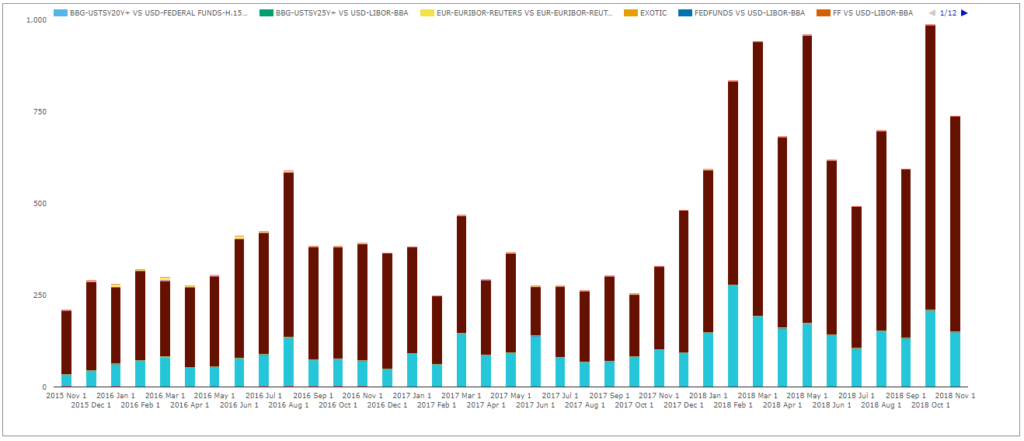

What has been driving the volumes higher? We can look at the data for USD by Index traded:

- Volumes are dominated by LIBOR vs LIBOR trading (purple).

- A close second is Libor vs Fed Funds.

- The nascent SOFR vs Fed Funds market is present, but volumes are dwarfed by the legacy products.

- Volumes have increased in both Libor vs Fed Funds and Libor vs Libor trading.

- But the huge uptick in volumes have predominantly been driven by Libor vs Libor trading.

This wasn’t quite the story I was expecting to see – with trading shifting to RFRs, I thought we would be seeing a much bigger uptick in Libor vs OIS trading than we have so far witnessed.

However, in light of the announcement of the Libor fallback methodology, it does make sense that we see continued trading in Libor vs Libor.

Basis Trading Analysis

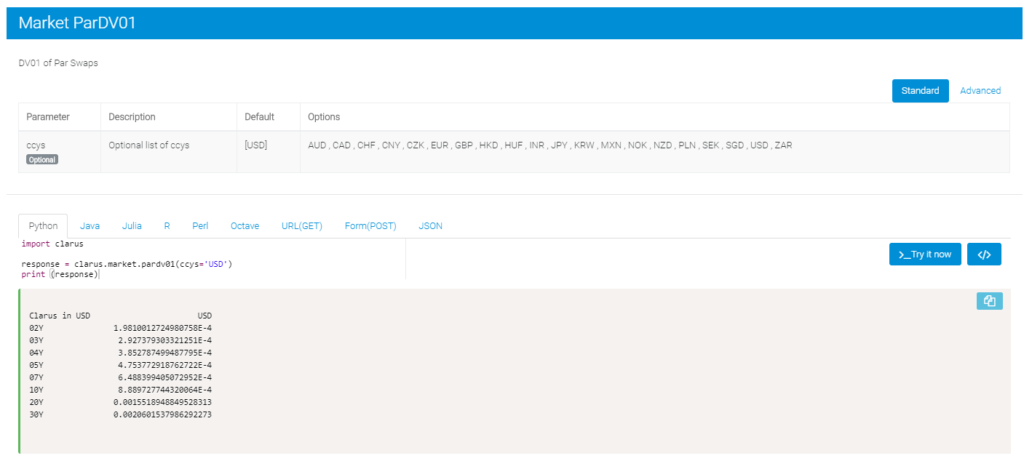

I had a look at the month of October 2018, using our microservices DV01 tool to convert to risk measures:

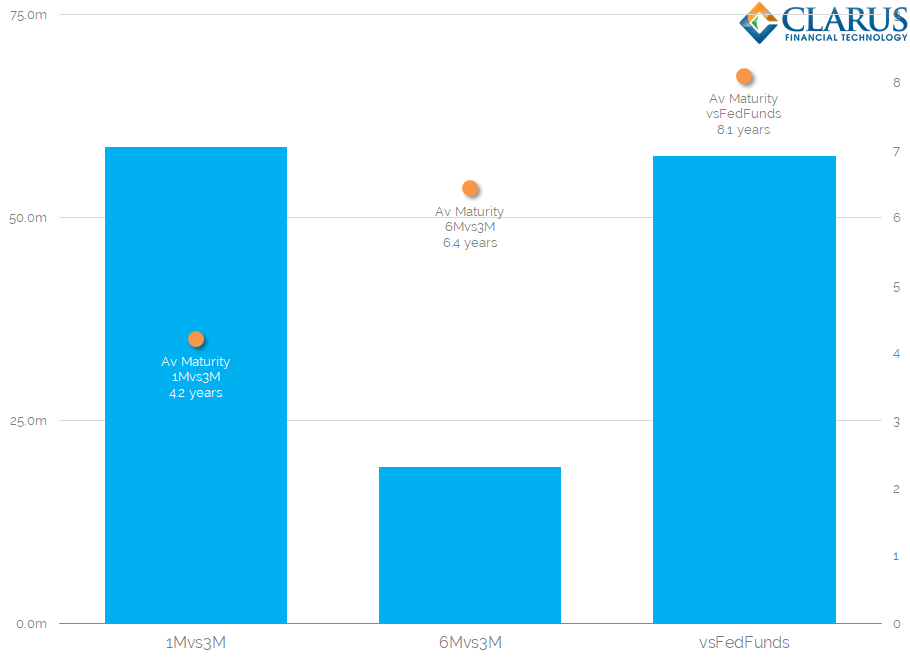

Exporting the data allowed me to look at the most commonly traded basis, and take a look at the average maturities:

Exporting the data allowed me to look at the most commonly traded basis, and take a look at the average maturities:

- In DV01 terms, the balance of trading activity in 3m vs 1m LIBOR and Fed Funds vs Libor was almost perfectly balanced in October 2018.

- $58m DV01 traded in each basis.

- 3m vs 6m is nowhere near as active, but still registered nearly $20m DV01 in activity.

- Why are notionals traded in LIBOR basis so much higher than in Fed Funds? Because 3m vs 1m Libor activity tends to be much shorter dated than any other activity.

- The average maturity of 3m vs 1m was just 4.2 years (weighted by DV01 of trades).

- For 3m vs 6m this extended out to 6.4 years.

- Whilst the average Fed Funds vs Libor trade was twice as long, at 8.1 years.

If we think that Libor will still be around in 2021 (Andrew Bailey’s speech referred to “end 2021” to end the industry reliance on LIBOR), then most of this 3m vs 1m basis activity has nothing to do with RFRs and transition trades. And 58% of 3s1s trades transacted during October 2018 will indeed expire before the start of 2022.

There is much more analysis to be done here – such as will the curve show a dislocation in the forwards between 2021 and 2022? Or will the whole curve revert to long-run averages in anticipation of the LIBOR fallback? We’ll leave a more in-depth analysis on the price side to our users. Meanwhile, we will continue to monitor volumes in this important product.

Global Basis Volumes

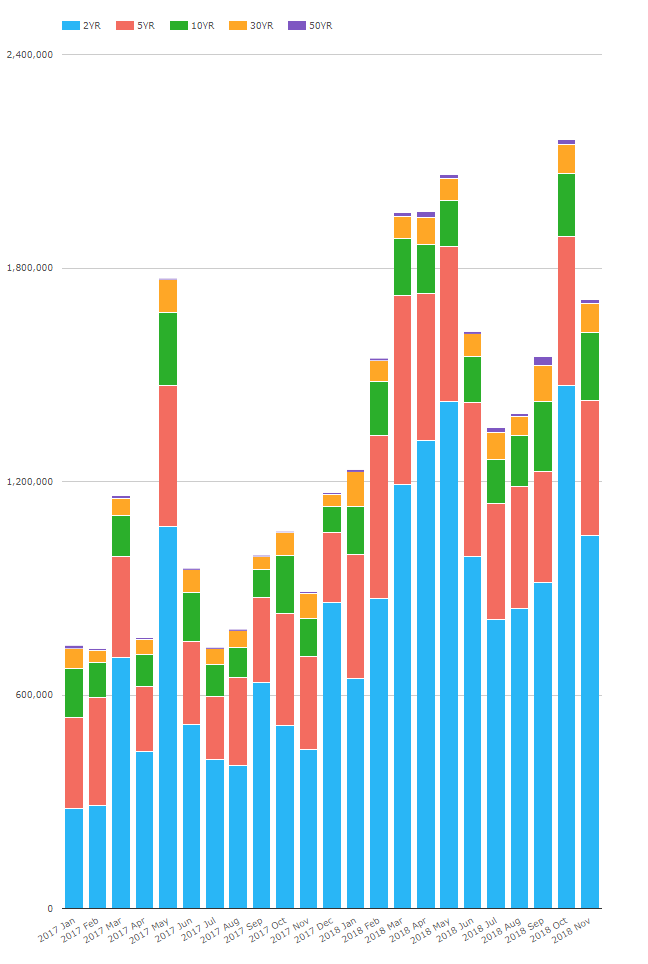

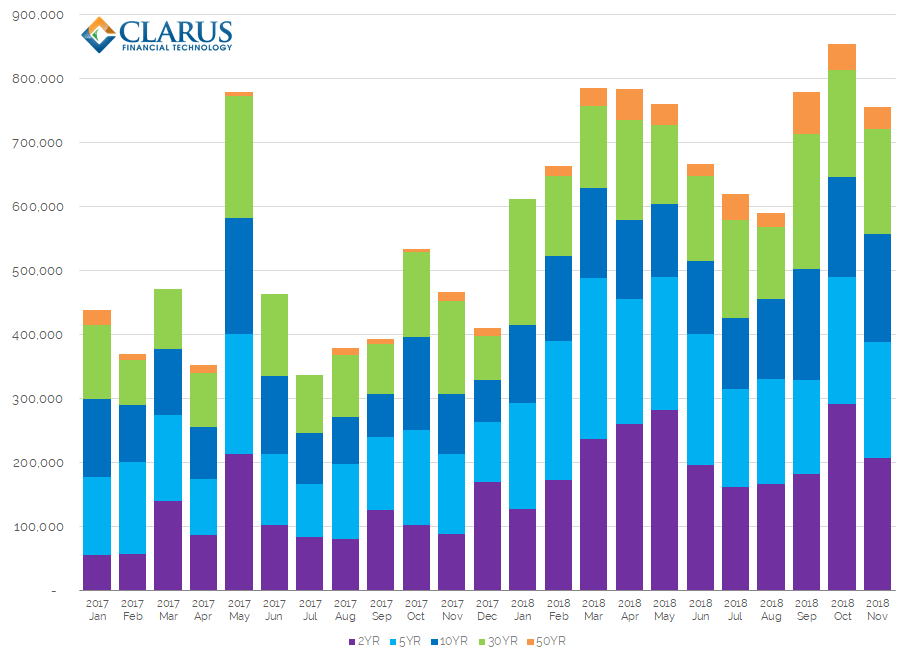

Finally, I remind readers that we also have global cleared volumes of basis trading via CCPView. We also have these volumes split by tenor for LCH cleared data, although not be index. Unsurprisingly, volumes have been growing at LCH as well:

- Basis trading at LCH across the four major currencies topped $2.16trn in October 2018!

- We can see in the chart above that much of this increase was driven by basis trading in tenors of 2 years or less.

- If we remove the 2 year tenor from our analysis, overall volumes drop below $750bn per month.

- I will therefore leave you with one final chart – LCH basis trading expressed in DV01 terms:

This LCH data is consistent with the SDR story. One key aspect that I note is the growth of trading activity in the 30Y and 50Y tenors. September 2018 saw record levels of activity in both of these tenors. Will this trend persist?

This LCH data is consistent with the SDR story. One key aspect that I note is the growth of trading activity in the 30Y and 50Y tenors. September 2018 saw record levels of activity in both of these tenors. Will this trend persist?

In Summary

- Single currency basis trading is much more active now than ever before.

- Over $1trn can be reported to the SDRs in a single month, with the global market topping $2trn.

- In USD, there is a lot of activity in shorter dated 3s1s LIBOR basis trading, which is not associated with the market transition to RFRs.

- At LCH, there has been a pick-up in long-dated basis trading, with 30y and 50y tenors both seeing recent record volumes.