- ISDA have announced a preliminary methodology for Libor fallbacks.

- This will be the RFR plus a historical spread.

- This announcement could have a pronounced impact on basis trading.

- Elsewhere, we have seen continued SOFR trading and the results of the BoE Term Sonia consultation.

- CLARUS01 already replicates this LIBOR fallback methodology.

Risk Free Rates

Everywhere we look, it seems that the “Libor issue” is front and centre. In a quiet week post Thanksgiving, I thought it might be useful to highlight some of the progress being made.

ISDA Libor Consultation

Hot off the press today is the preliminary response from ISDA with regards to Libor fallbacks. With 164 responses received, ISDA state that the front-runners are:

- Compounded setting in-arrears for the adjusted risk-free rate.

- Historical mean/median approach for the spread adjustment.

This is big news! For any background to the ISDA consultation, please check out our previous blogs here and here. Please bear in mind that this statement from ISDA is still “subject to the ongoing work and ultimate decision of the ISDA Board Benchmark Committee” – but I guess it is fairly unlikely to change.

From our point of view:

- Hurrah for number 1! This is clearly sensible, and we have launched CLARUS01 to cater for this.

- In terms of the Historical mean/median approach, I wrote at the time of the original consultation:

[W]e should see Libor-OIS spreads converge to their e.g. 5 year averages from now until 2021. It will make trading short-end basis extremely complex into 2021 and beyond as the pricing of any monetary policy changes must be balanced against the chance that an IBOR rate ceases to publish. It’s difficult to say where the most concentrated positions in pure Libor-OIS basis are – short end or long-end? This approach would see the least amount of value transfer from long-end positions but could mean that short-end trading becomes extremely complex.

I still think this will complicate short-end trading. On the plus side, it might have the added benefit of motivating market participants to neutralise their FRA positions ahead of 2021.

CLARUS01

I was pleased to hear that William Porter, now at Credit Suisse, said the following in a Bloomberg interview:

Its complexity is a regret. We regretted this early on. The daily compounding is, in my view, a mistake. I don’t think it’s going to be changed now. It’s analytically pure.

The logical thing to do is just to set up a site where you can put in two dates and get the compounding between them, and then click on the number and socialize the calculation rather than everyone doing it in-house, unverified. To have an external, verifiable source would be a good idea.

(Emphasis mine). Mr Porter – I have some good news for you Sir. That is exactly what CLARUS01 does. Check it out for yourself at rfr.clarusft.com. And to learn more about our solution to take the complexity out of RFRs, please see our earlier blog. We also have an app that allows you to enter specific dates – see more in our SONIA Term Rates blog.

SOFR Trading is picking up

Last month, we had reason to highlight SOFR trading because a large block trade had gone through, probably linked to the Fannie Mae SOFR issuance. This month, we are highlighting a lot of outright trading. Whilst we have been previously used to basis trades dominating proceedings, this month we have seen 11 outright trades, as well as 3 basis trades. Key points below:

- Trading has now extended out the curve to 10 years.

- We saw some uncleared SOFR reported. This is the first uncleared trade that I recall seeing.

- 5y outright trades were active, trading 4 times. This easily made them the most active maturity on a DV01 adjusted basis.

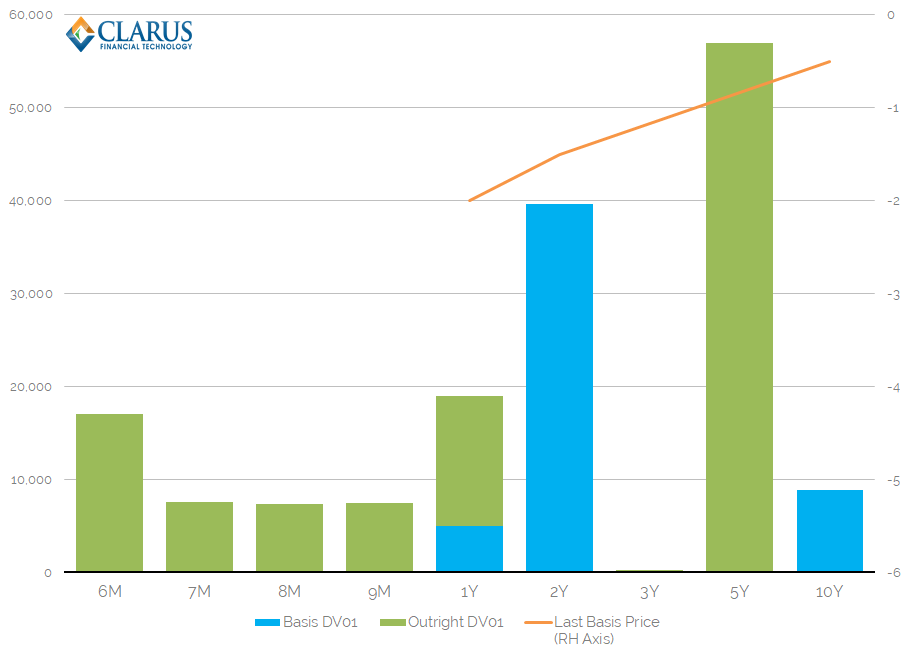

Chart of the month below:

- All SOFR trades reported to the US SDRs since November 1st 2018.

- Activity is reported in DV01 – a maturity agnostic measure of risk traded.

- 5 years was by far the most active maturity, with $57k DV01 traded.

- By way of reference to notionals traded, $340m of 6 month traded (the largest). $10m of 10y traded (the smallest).

BoE SONIA Consultation

The Bank of England has published a summary of the responses received to the Term Sonia Reference Rate (“TSRR) consultation. This is looking at whether a portion of the market would benefit from a Term rate, instead of compounding up the daily SONIA rates and fixing in-arrears. Our own response wanted to highlight three points:

- Any element of complexity in a compounded daily fixing is removed by a fixing service such as CLARUS01.

- Any components of a term fixing should be cleared at a single CCP. Whilst SONIA is a short-term product, and hence intrinsic margin funding costs are small, we should be cognizant of the fact that CCP basis is supply/demand driven and so the design of the term rate should cater for the possibility of a CCP basis.

- It is unlikely that a term rate will be hedged with vanilla SONIA swaps due to convexity.

The key take-aways that the BoE saw were:

- A step change is required before current SONIA-referencing derivative markets could provide the basis for a TSRR.

- Both OIS and Futures markets could be used but both markets need continued development.

- Compliance with IOSCO principles is necessary, as is avoiding systematic usage of TSRRs in derivatives markets.

- International consistency across currencies is desirable.

You can find the summary from the Bank here, along with my favourite paragraph:

Libor basis hedging

Ahead of 2021 and the possibility that Libor disappears, I wrote about how to manage FRA risks on a dealer swaps book. This is an intricate and complicated area of the market. Now that we have a possible fallback methodology from ISDA, FRA hedging could well increase to avoid any shocks at the short-end of the curve.

What will happen with long-term basis trading as a result of this (tentative) fallback methodology announcement? This could go three ways:

- The market, as of today, converges to the 5 year historic average of Libor-OIS basis. The only reason post-2021 FRAs move is due to expected changes in the RFR. Therefore, LIBOR swaps become effectively fungible with OIS swaps, and Libor 3m swaps become fungible with Libor 6m swaps. Basis hedging basically stops.

- We await the exact details of the calibration of the historic median/mean. If it’s one year only, we await 1st Jan 2020 for a huge wave of hedging.

- The market decides on some kind of “delta” that Libor will exist post 2021. Will ICE continue to publish it into 2021? If so, the clock would restart again for the calibration of the historic mean. And any hedges done for 2021 will suddenly not look so great if you expected them to be settling at the historic levels.

It seems like we are due for a volatile 2019 for basis trading. We’ll keep our eye on the volumes….

In Summary

- The announcement of a potential LIBOR fallback methodology from ISDA is the big news this week.

- The fallback will be the compounded RFR plus a historic spread. We await details on how the spread will be calibrated as the consultations move forwards.

- This will likely have a big impact on basis trading in both Libor-OIS and 3m vs 6m Libor.