Last week saw the launch of a new futures exchange – LSE’s CurveGlobal. We have pulled the data for the first week, and I thought it appropriate to explore this market.

The general overview of CurveGlobal:

- 30% owned by LSE Group. Remaining 70% owned by CBOE, BofA, Barclays, Citi, Goldmans, JPM, SocGen, BNP

- STIR (3-month “MMK”) and LTIR (bond) futures in EUR and GBP

- STIR futures products eligible for Portfolio Margining alongside LCH IR swaps (aka LCH “Spider”). LTIR futures are planned for a later time.

If you need a refresher on the mechanics of STIR and LTIR futures, Chris has some good blogs here and here, respectively.

PRODUCTS

CurveGlobal launched with 6 products:

- 3-month Euribor

- 3-month Sterling

- EUR Schatz (~2Yr Bond)

- EUR BOBL (~5Yr Bond)

- EUR Bund (~10Yr Bond)

- GBP Gilt (~10Yr Bond)

Interestingly, this is the exact set of STIR and LTIR products available at Nasdaq’s NLX.

The other competing exchanges for these products are:

- Eurex, with:

- EUR STIR

- EUR and CHF LTIR

- ICE (the old LIFFE), with:

- EUR, CHF and GBP STIR

- EUR, CHF and GBP LTIR

And of course when it comes to USD, we have the CME with their USD STIR and LTIR futures. Unless I am mistaken, this is the only (?) active USD futures market.

DATA

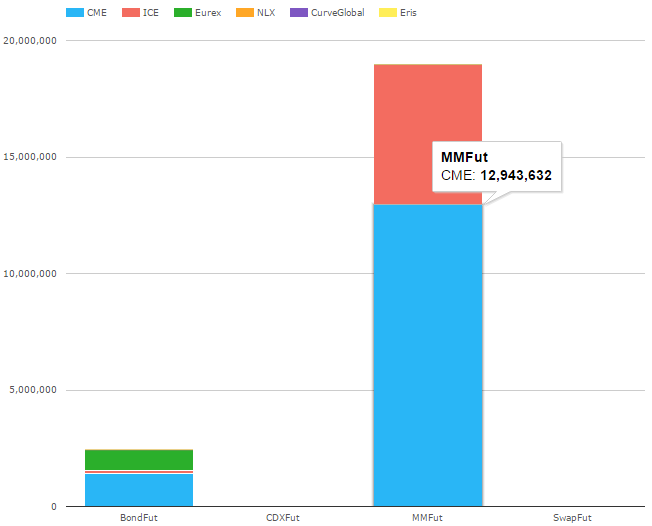

Let’s now examine some data on these products. CCPView reports now on 6 Exchanges, spanning 4 product types:

- BondFut (LTIR)

- MMFut (STIR)

- SwapFut (IR Swap)

- CDXFut (CDS Index)

The data is normalized around a USD notional equivalent. I’ll begin with notional activity for the last week of September 2016:

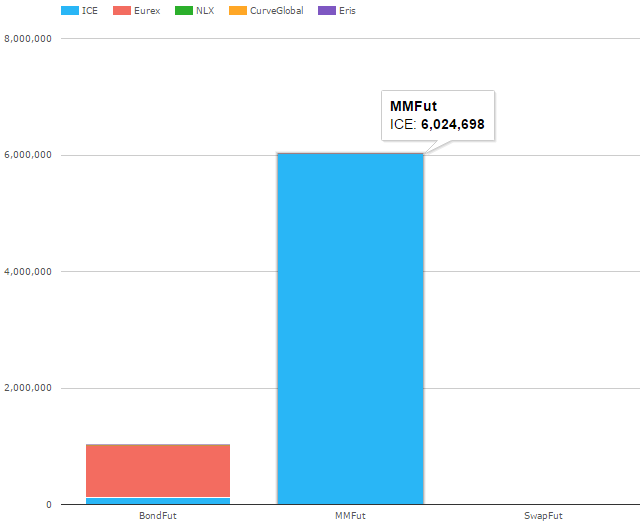

To get a fairer picture of the market that CurveGlobal is competing in, lets remove USD from the picture:

Which paints the competitive picture nicely:

- ICE (LIFFE) owns the STIR futures market

- Eurex owns the LTIR futures market

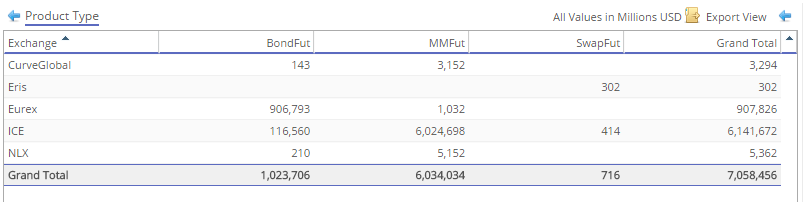

In tabular format, we can make out the significance (or lack of significance) of the 2nd place venues:

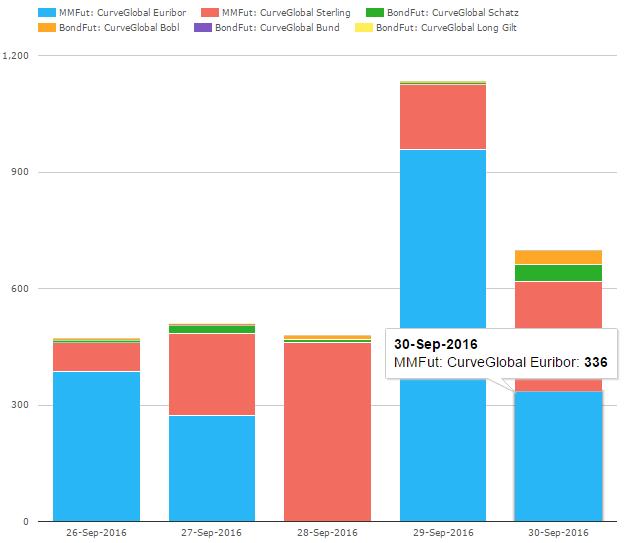

Finally, let’s drill in on CurveGlobal and their daily activity, and break it out by product & ccy:

This tells us there was activity across the full complex of products in their first week, so a good first week.

SUMMARY

- CurveGlobal launched

- The STIR and LTIR markets in Europe are currently dominated by ICE and Eurex, respectively

- The CurveGlobal futures are portfolio marginable with LCH swaps (as are NLX futures)

I should point out that the launch of CurveGlobal comes at a time when LSE is (likely) merging with Deutsche Börse. Should that merger go through, the combined company would have both the Eurex and CurveGlobal exchanges. So we could quickly consolidate again!

Hi Tod

Portfolio margining vs LCH IRS is a key part of this but what’s Curve’s USP over NLX?

Perhaps there is something unappealing about NLX membership to the banks in the group of Curve owners?