Continuing with our monthly review series, let’s take a look at US Interest Rate Swap volumes in Sep 2015.

First the highlights:

- On SEF USD IRS Sep 2015 volume was >$1.2 trillion,

- Up from August and similar to July

- SEF Market Share remains the same as YTD

- Bloomberg in front with 30%, Tradeweb 23%, IDBs in mid-teens

- Tradeweb compression volume was approx. $184 billion

- TrueEx compression volume also strong at $43 billion

- CME–LCH Basis Swap Volumes were higher than July and August

- In this Tradition had 42% share, ICAP 38% and Tullets 17% in Sep

- Global Cleared Volumes in G4 Ccys were significantly higher than August

- LCH SwapClear Client Clearing USD IRS share was 66% vs 34% at CME, a YTD high

And there is more. So onto the charts, data and details.

USD IRS ON SEF

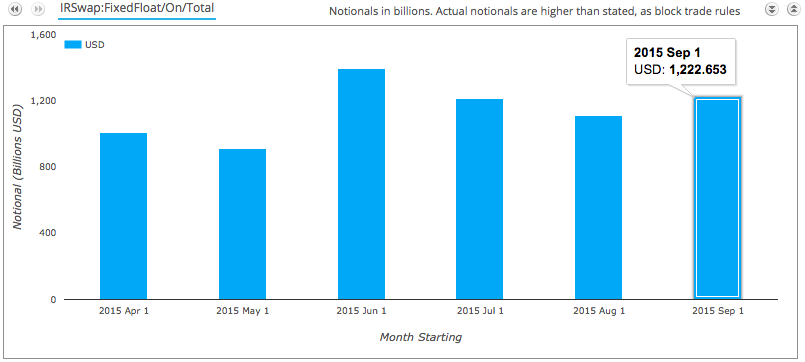

Using SDRView lets start by looking at gross-notional volume of On SEF USD IRS Fixed vs Float and only trades that are price forming, so Outrights, SpreadOvers, Curve and Butterflys.

Showing that:

- September gross notional was >$1.2 trillion

- Up from the August and similar to July

- Compared to Sep 2014, gross notional was down 7%

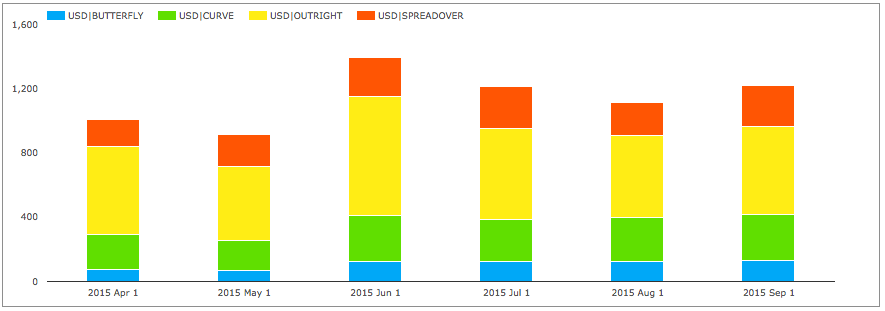

And splitting this by package type.

We see SpreadOver and Butterfly volume in September was the higher than in any of the preceding 6 months.

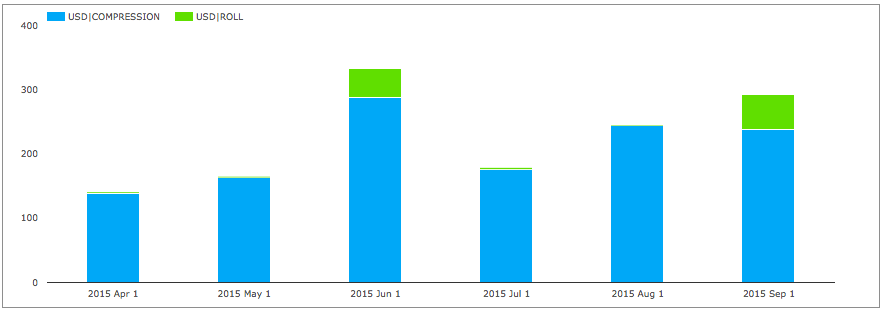

And non-price forming trades; Compression and Rolls.

Showing that:

- As Sep is an IMM month, Roll volume was significant (>$54b)

- Compression volume was similar to August

- Only June compression volume was higher than these months

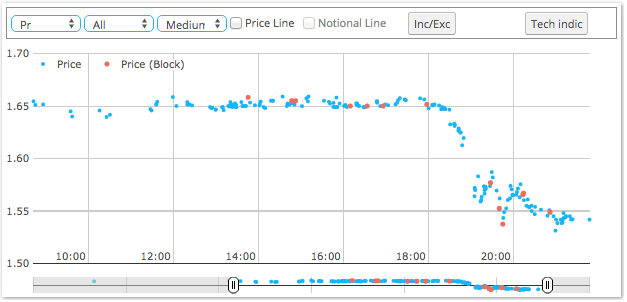

USD IRS Prices

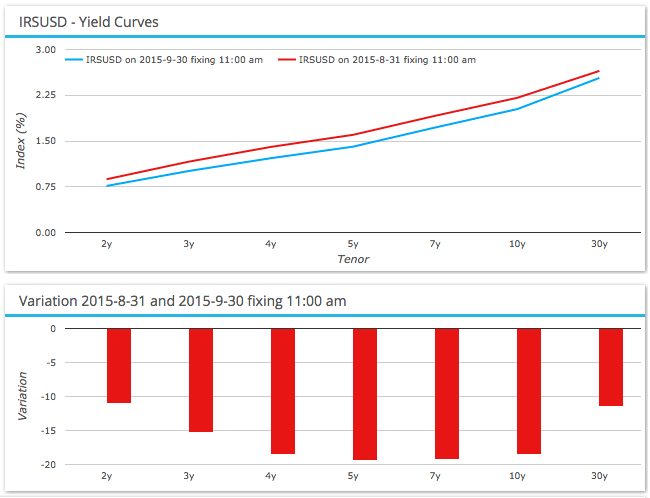

Using SDRFix lets take a look at what happened to USD Swap prices in the month.

Showing that the Swap Curve:

- Moved lower by 11-19 bps

- Continuing the trend seen in July and August

- 5Y and 7Y saw the largest drop of -19bps

- 2Y and 30Y, the smallest drops of -11bps

In-fact Swap fixed rates are now very unusually below Treasury yields in some tenors e.g. 7Y, 10Y. Not something we see very often given that Treasury’s are the risk-free rate and Swap spreads should have a risk premium. (See FT article) But this is a larger topic and one for another day

Most of the fall in Swap Rates occurred on Sep 17 at the time of the FOMC meeting.

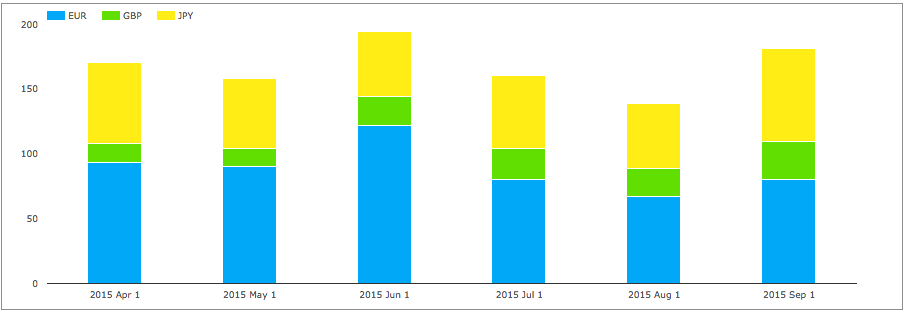

EUR, GBP, JPY Swaps

Lets also take a look at On SEF volumes of IRS in the other three major currencies.

Showing that for price-forming trades aggregate volumes at > $182b, were much higher than July and August, with GBP and JPY both highs for the 6-month period.

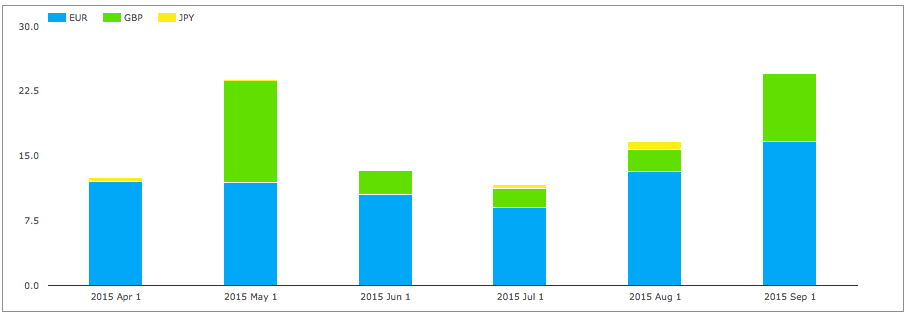

And then looking just at compression activity.

We see that EUR compression was the highest in the period and GBP the second highest.

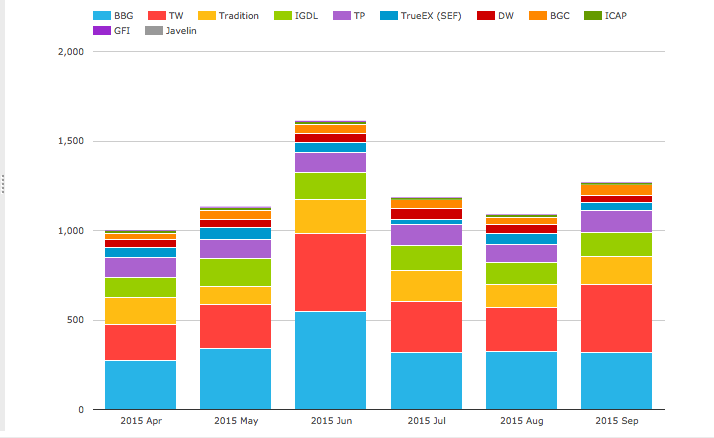

SEF Market Share

Lets now turn to SEFView and SEF Market Share in IRS including Vanilla, Basis and OIS Swaps.

We will start by looking at DV01 (in USD millions) by month for USD, EUR, GBP and by each SEF.

Showing that:

- Overall September volume is higher than any month except June

- TW seems significantly higher than Aug

- Tradition, Tullets and BGC are also up

- D2C share in Sep is 58% of overall (including Compression)

- D2D share in Sep is 42% of overall (including Compression)

- Both close to the 6 month average share

Next DV01 volumes with Compression volumes stripped out as per our previous assumptions.

Showing that:

- Tradeweb had an exceptional month in Compression with around $184b

- Equal to its record high in June (is there are IMM effect?)

- TrueEx again with strong Compression volumes

- (We are assuming all TrueEx volumes are compression, though some may be price-forming)

- September % share for each SEF was consistent with YTD %

- September volumes were higher for every SEF than July or August

- Bloomberg remains out in front with 30%

- DW+TW second with 23%

- Tradition, ICAP and Tullets, each in mid-teens

- BGC+GFI at 6%

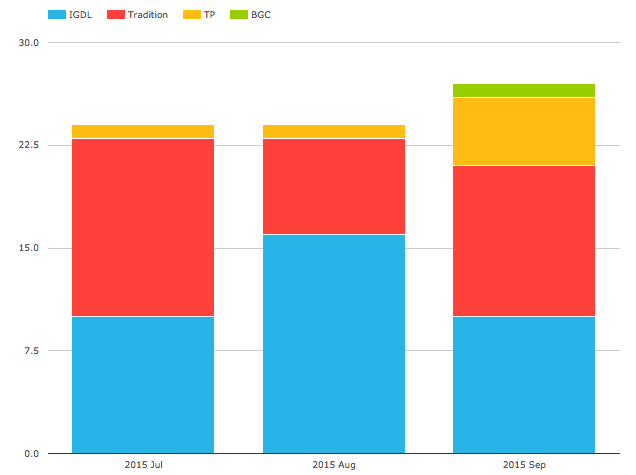

CME-LCH Basis Volumes

Using the DCO filter in SEFView we can also get an insight into CME-LCH Basis volumes.

Showing that in DV01 terms:

- Volume is slightly higher than the previous two months

- Tradition’s share is significantly up (42%)

- ICAP share is down (38%)

- Tullets also show good volume (17%)

- BGC makes a showing (2%)

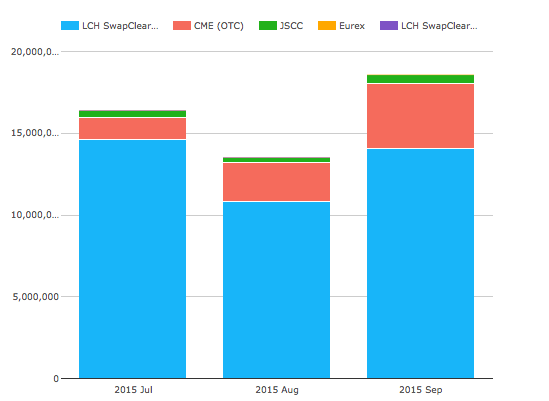

Global Cleared Volumes

Finally lets use CCPView to look at Global Cleared Swap Volumes for EUR, GBP, JPY & USD Swaps.

Showing that:

- LCH SwapClear volume is up ($14.1 trillion)

- CME also looks up at $4 trillion

- However we know that $2.2 trillion of TriOptima compression on 2-Sep is included in these figures

- Adjusting for this puts CME at $1.8 trillion (down from $2.4 trillion in August)

- JSCC volume is at the higher end of its $410-$550 billion range with $525 billion in Sep

- Eurex just about showing on the chart with $10 billion

And focusing just on USD Vanilla IRS and Client Clearing, shows that LCH had 66% share vs 34% at CME; a further gain in share for LCH from its YTD high of 63% in July.

Thats it for today.

A lot of charts.

Thanks for staying to the end.

Our Swaps review series is published monthly.