- 70% of GBP risk transacted last week was in SONIA.

- Just 7.6% of GBP notional cleared at LCH SwapClear was in LIBOR last week.

- In these extremely volatile markets, much of this activity is due to large amounts of short-dated risk trading.

- 91% of SONIA risk was in short-dated tenors (2 years and shorter).

- There are signs that the market standard is moving toward SONIA, but 5y and 10y maturities remain dominated by LIBOR.

Following on from our live blog last week (and ignoring the volatility coursing through markets for a moment!), we can report relative success in the shift toward SONIA trading last week. Recall that last Monday was the day when we asked “Will GBP LIBOR stop trading?”.

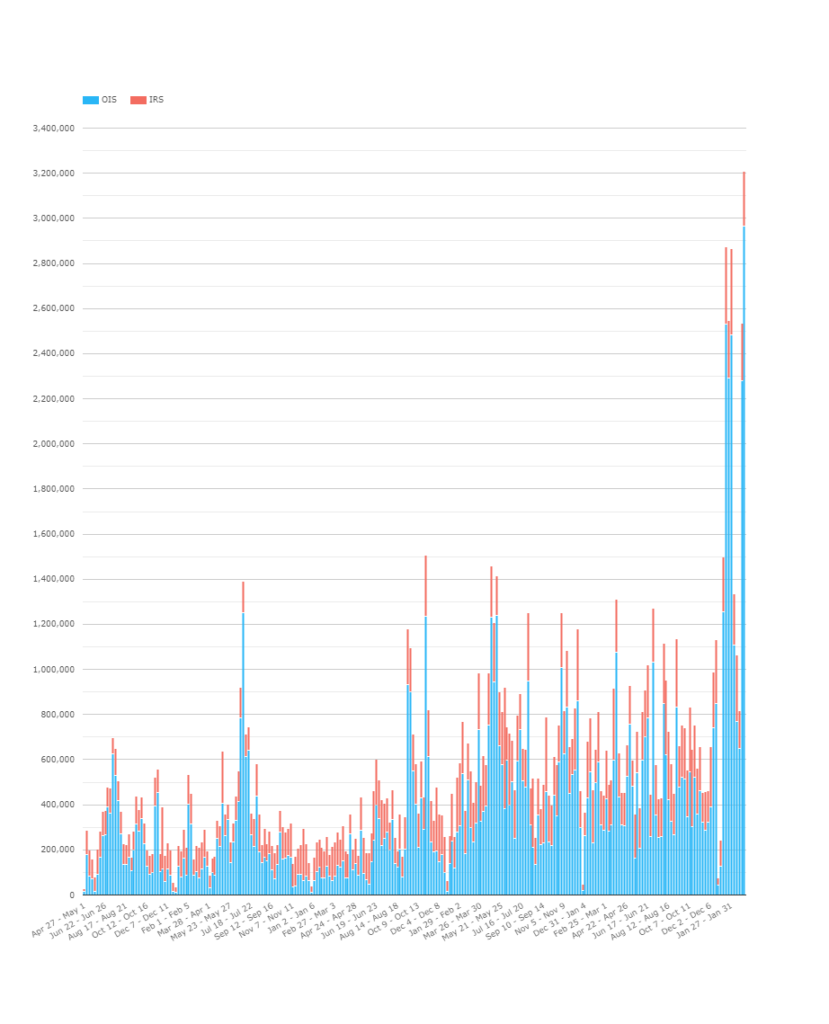

In Notional terms, just 7.6% of GBP notional cleared at LCH was a LIBOR IRS (ignoring FRAs). This is the lowest weekly percentage that we have on record.

Last week was also the record weekly GBP notional ever recorded, most of it in SONIA:

Whilst I was somewhat relieved last week that I wasn’t live blogging during the Fed’s emergency 50 basis point cut, it turns out that today I will be publishing a SONIA blog when:

- The MPC cuts by fifty basis points.

- There is a budget.

- The MPC has introduced a new term funding scheme.

- The countercyclical capital buffer has been reduced to 0%.

- Supervisory guidance has been issued not to increase bank dividends nor bonus pools.

I’m not sure I can do justice to any of those measures in the space of a short blog, so let’s just concentrate on what has traded during these extremely volatile times.

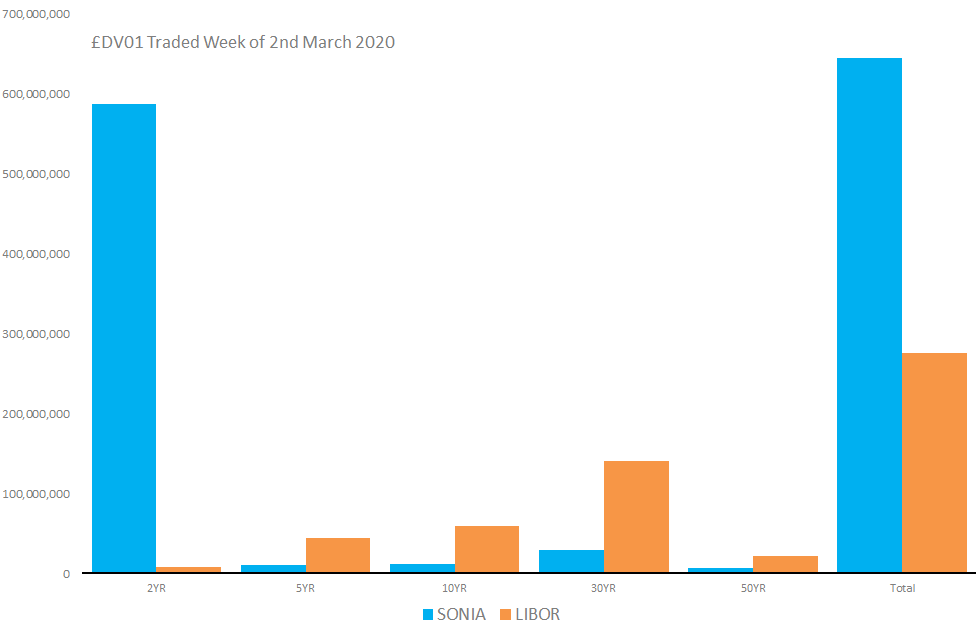

DV01 of SONIA Traded

Just as we did in the live blog, let’s analyse the amount of risk that has traded in SONIA relative to LIBOR. Again, this excludes Basis trades (float vs float) which are a surprisingly small part of the GBP market.

Showing;

- DV01 in GBP cleared at LCH SwapClear for the week March 2nd-6th 2020 in GBP IRS (LIBOR) and GBP OIS (SONIA).

- The data we have is separated into 5 tenor buckets (2YR, 5YR, 10YR, 30YR and 50YR) as shown above.

- Across all tenors, 2.3 times more risk traded in SONIA than in LIBOR.

- This is undoubtedly a good thing!

- It shows a much greater degree of success than we saw in the live blog, when LIBOR risk outstripped SONIA £7m DV01 vs £4m DV01.

There is more to this chart as well;

- There was a huge amount of activity at the short-end of the curve. It’s safe to say that was due to the Fed cut, and hence expectations that the BoE would follow suit – just as they have done today.

- The live blog was based on a partial view of the market (US Persons only). This data shows the benefits that we could have enjoyed if we had accessible transparency in European markets.

Looking at some maturity splits;

- 91% of SONIA risk was transacted in the 2 year tenor.

- In 5y+ maturities, LIBOR risk accounted for £267.5m DV01.

- In 5y+ maturities, SONIA risk accounted for just £58m DV01.

- Our live blog showed clearly that long-dated trades continue to be dominated by LIBOR-based risk.

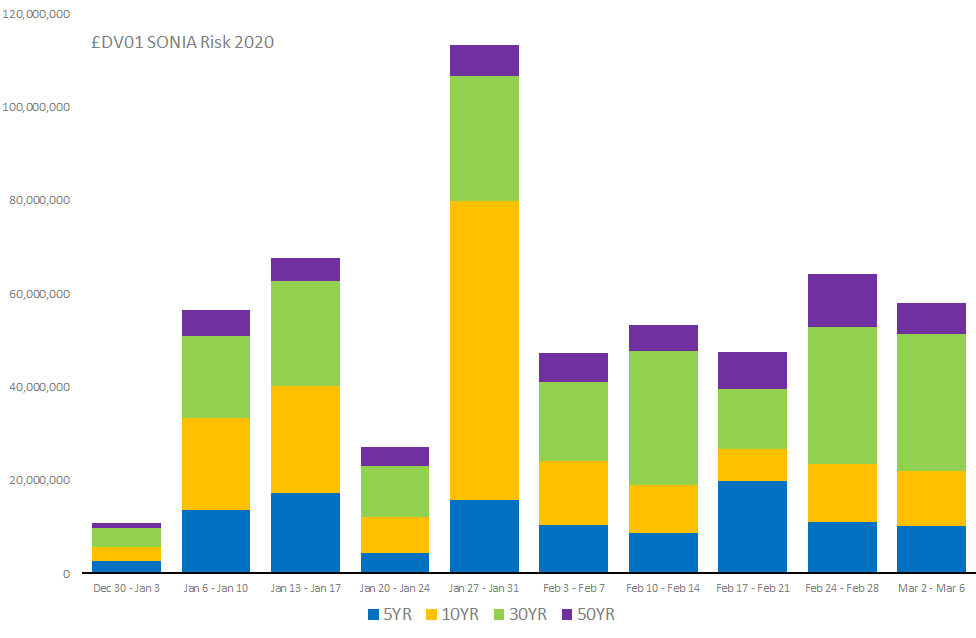

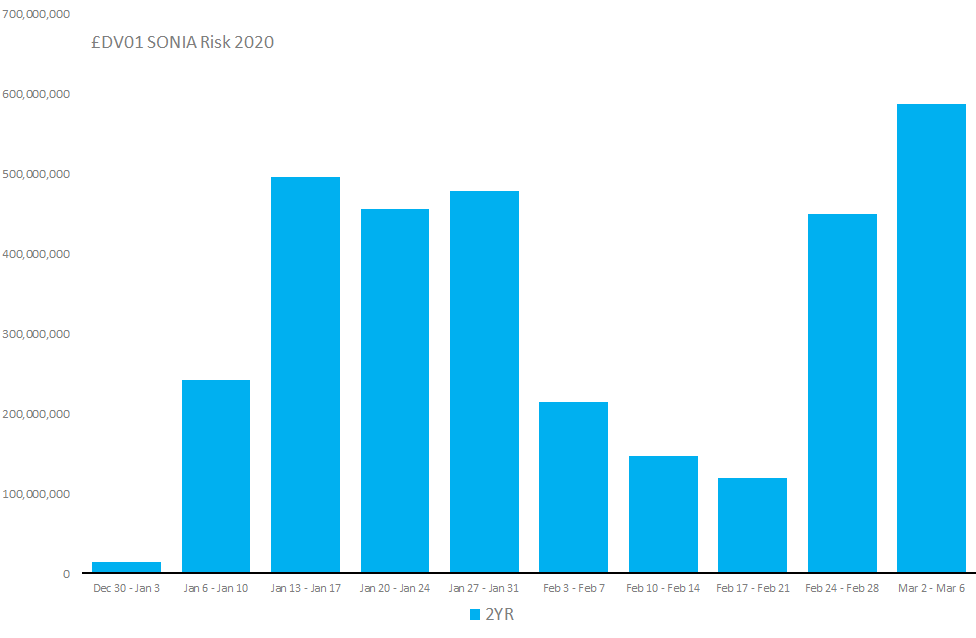

2020 SONIA Risk

It is worth looking at SONIA risk transacted during 2020 in two different ways. Longer than 2yrs and the 2yr risk itself:

For the long-dated risk we find;

- The beginning of March was far from a record month for long-dated SONIA risk. Remember this is against a back-drop of extreme volatility, with USD rates at the long-end plummeting. It is somewhat surprising that it didn’t break records.

- There is consistently more risk executed in 30Y SONIA in most weeks than in 10Y. This is surprising given that liquidity should be pretty straight-forward to transform from the Gilt (10Y) future into SONIA equivalents.

And then at the short-end:

Showing;

- The amount of SONIA risk transacted is highly sensitive to what the market expects the MPC to be doing. No great surprises/changes there.

- It is therefore difficult to disassociate this activity with any actual market structure changes.

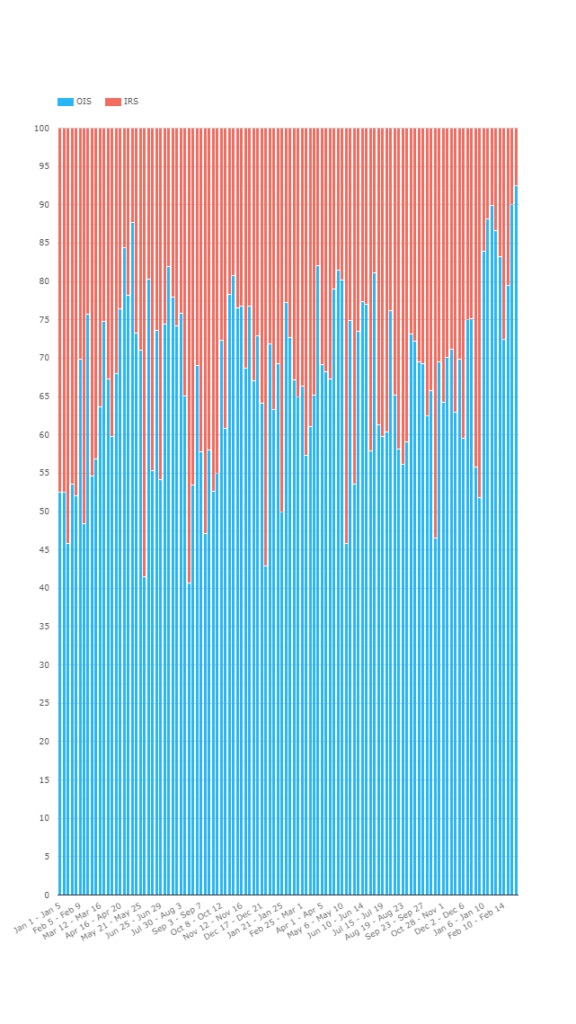

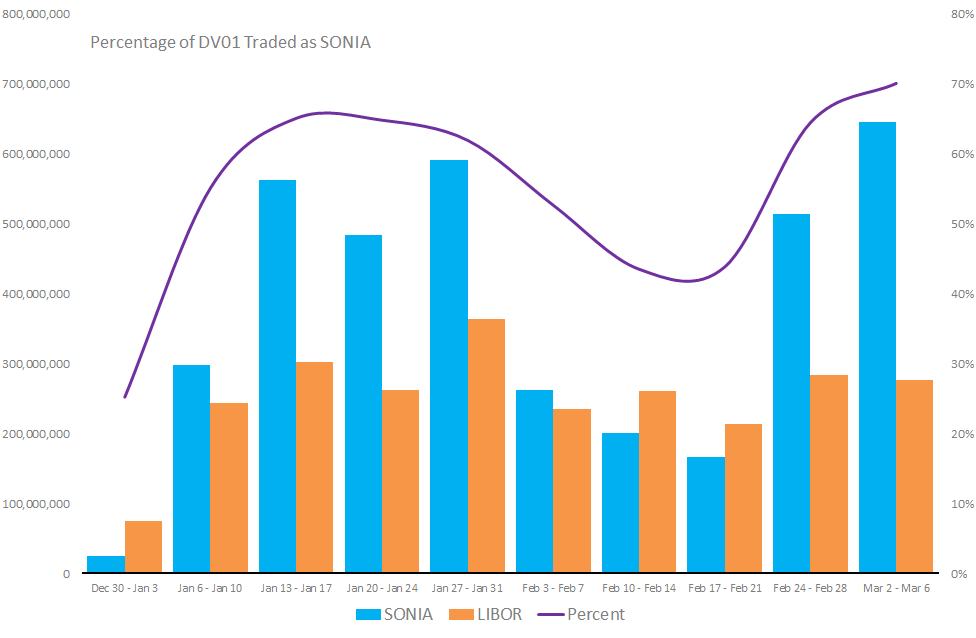

2020 SONIA Risk vs LIBOR Risk

However, we are left with an overall increase in SONIA risk trading relative to LIBOR – even if much of it is short-dated. On a weekly time-series this year we see the following;

Showing;

- In our transition week of March 2nd, 70% of GBP risk cleared at LCH SwapClear was in SONIA.

- Let’s see over the coming weeks/months whether this transitions into more long-dated SONIA risk also trading.

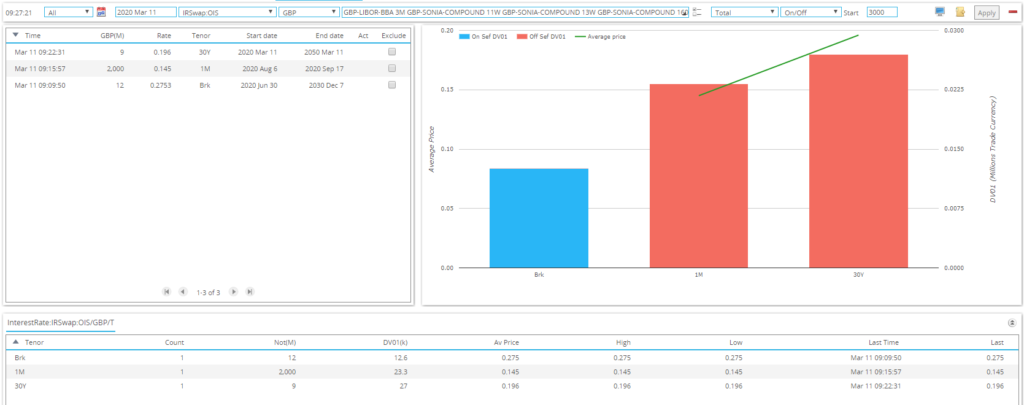

A Big Positive for SONIA

There are tentative signs that the transition is taking hold. For example, just one hour after the BoE measures were announced today, we already saw 3 SONIA trades, including 30Y trading:

However, it continues to be the case that:

- 5y and 10y liquidity is much greater in LIBOR than in SONIA.

- SONIA futures are still playing catch-up to Short Sterling. That needs to also change for the swap market to change.

In Summary

- With such volatility in markets, and with central banks “in play” it is very difficult to draw firm conclusions from last week’s (or this week’s!) trading activity.

- However, due to large amounts of short-end activity, SONIA activity accounted for 70% of total GBP swaps trading. That is a good thing in the transition story.

- It remains clear that 5y and 10y liquidity is still concentrated in LIBOR-based products. This needs to change over the coming months.

- We will take a look at GBP futures again at some point to see if they are taking a lead from Swaps markets.