- SEF trading accounted for 77% of USD swap trading in 2022.

- This was despite there being no “MAT” trading in USD swaps during 2022.

- The portion of the USD market traded on-SEF has dropped to 65% in 2023, despite D2C SEFs seeing all-time record volumes.

- Against this backdrop, a new MAT filing has been submitted, which would create a new execution mandate for SOFR swaps aligned with the old LIBOR execution mandate.

- October 2023 will see the tenth anniversary of SEF trading!

Made Available to Trade

Let’s do a poll to kick things off.

Before you clicked on this blog, did you know that there had been a new MAT filing?

I’m betting that most of our readers were well aware. The MAT filing, from Tradeweb, received decent press coverage, including from Risk:

What Is It?

A MAT filing, or “Made Available to Trade” determination, is when a trading venue (SEF) submits a proposal to the CFTC stating that they deem certain swaps to be liquid enough to have an execution mandate applied to them.

Basically, a SEF says “I think these swaps should only be traded on SEFs in the future”. If you are captured by Dodd Frank, you then require an exemption to trade a “MAT’d” swap off-SEF.

MAT History

In most cases, MAT swaps are applicable to the interdealer market. They are the highly commoditised, standardised swaps that trade all day, every day between banks. The original MAT filing (October 2013), however, tried to cover everything! Anyone remember the particular kerfuffle over the original Javelin MAT filing? Tod provided a great insight into the teething problems in the early days of SEF trading:

For USD swaps, the final, accepted MAT filing covered the following:

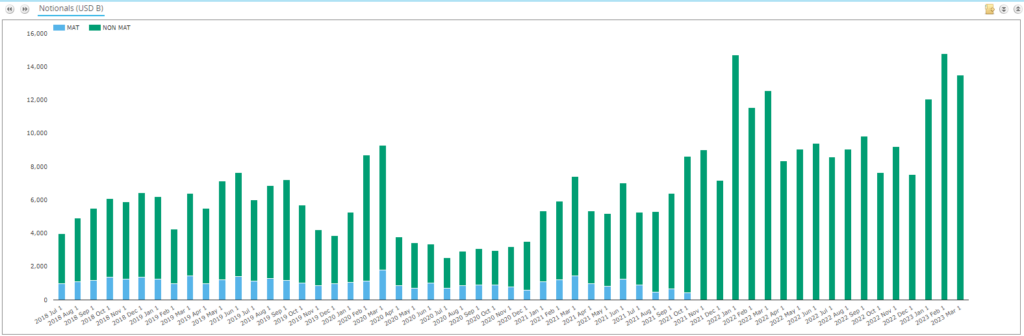

Note these are all spot starting (or IMM) in major tenors. That means when we look at the history of MAT trading, these swaps don’t cover that much of total volume traded in USD swaps. The blue bars are MAT trades in the past five years:

As a sidenote, I think that means October 2023 will be the tenth anniversary of SEF trading. Wow!

Why Is It Required?

As we noted when looking at Clearing Mandates two years ago, there were no Clearing or Trading mandates active for SOFR swaps last year. You can see from the chart above that MAT swaps stopped trading in December 2021.

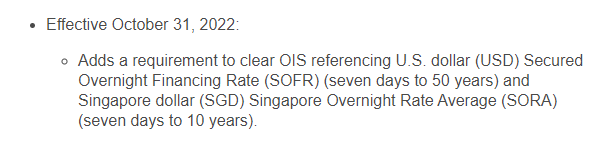

In October 2022, the CFTC finally introduced a clearing mandate for SOFR (and SONIA) swaps:

A MAT filing cannot be made until there is a Clearing Mandate in place, so this was a necessary “first step” to mandating (some) SOFR swaps to trade on SEFs.

What Has Happened to MAT Trading?

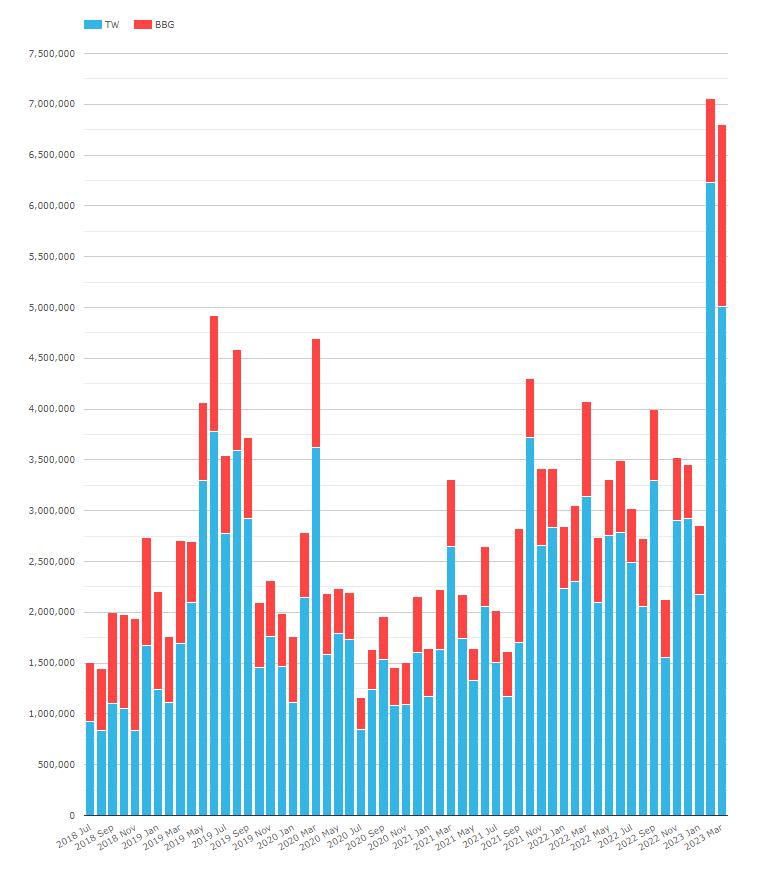

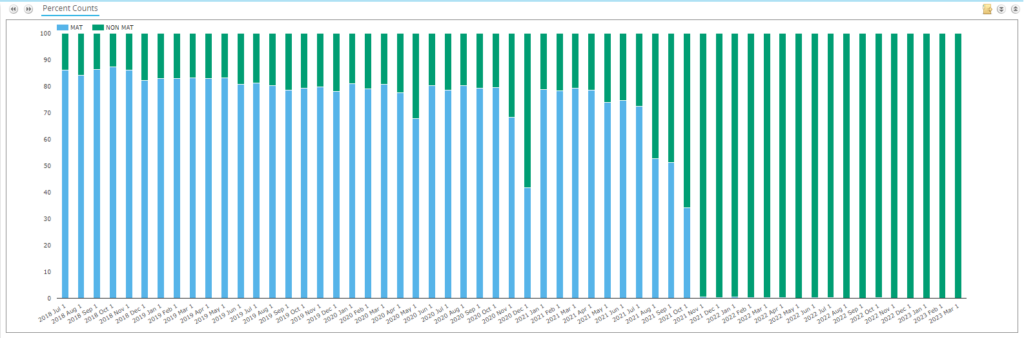

We obviously have a filter on our data to look only at MAT trades (because that’s what we do). Before LIBOR transition, MAT swaps accounted for 85-90% of all spot starting trades in USD swaps:

Showing;

- Split of spot starting USD swaps only (covering both Fixed-Float IRS and OIS).

- Split by MAT and non-MAT.

- This is presented by trade count, to avoid any distortion from non-MAT swaps potentially being above notional reporting thresholds.

What Currently Trades in SOFR

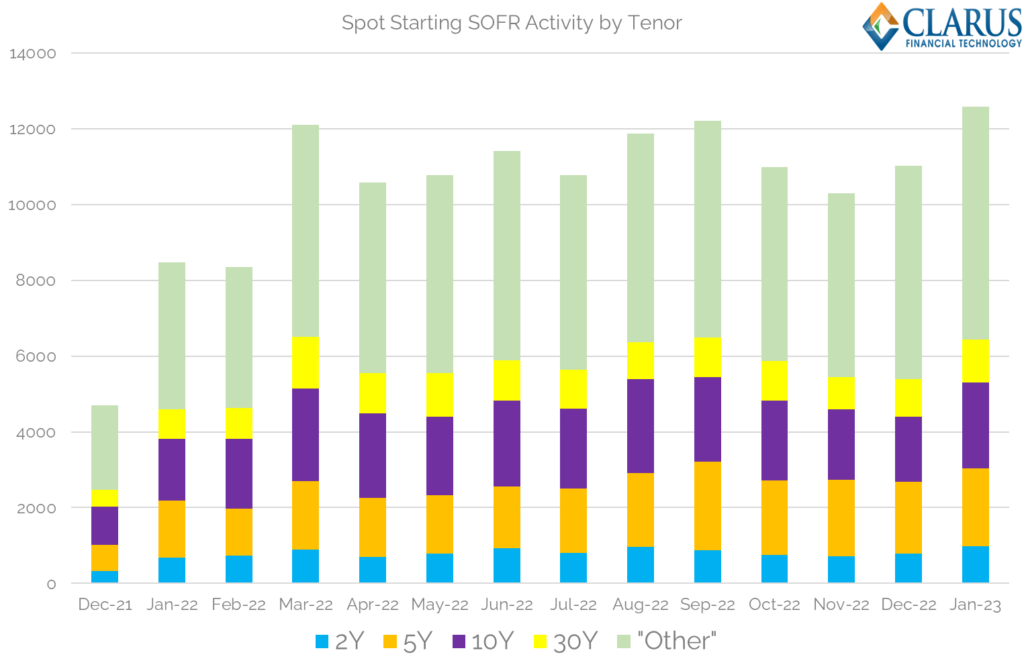

With no current MAT trading to analyse, we are essentially starting with a blank piece of paper. So what currently trades in SOFR? I covered this in detail back in March:

Stealing the most appropriate chart from that blog, we see the following for spot-starting SOFR swaps:

As I said at the time, the chart shows;

- Number of transactions per month per tenor in spot starting SOFR swaps.

- Over 50% of activity each month is concentrated in just 4 tenors.

- We have used trade count to avoid complications over notionals, capped amounts etc.

- 7% of total trades are in 2 years.

- 16% of trades in 5Y.

- 19% in 10Y (!).

- 9% in 30Y.

Astounding that nearly 20% of trades are in a single tenor.

And the new MAT filing is….

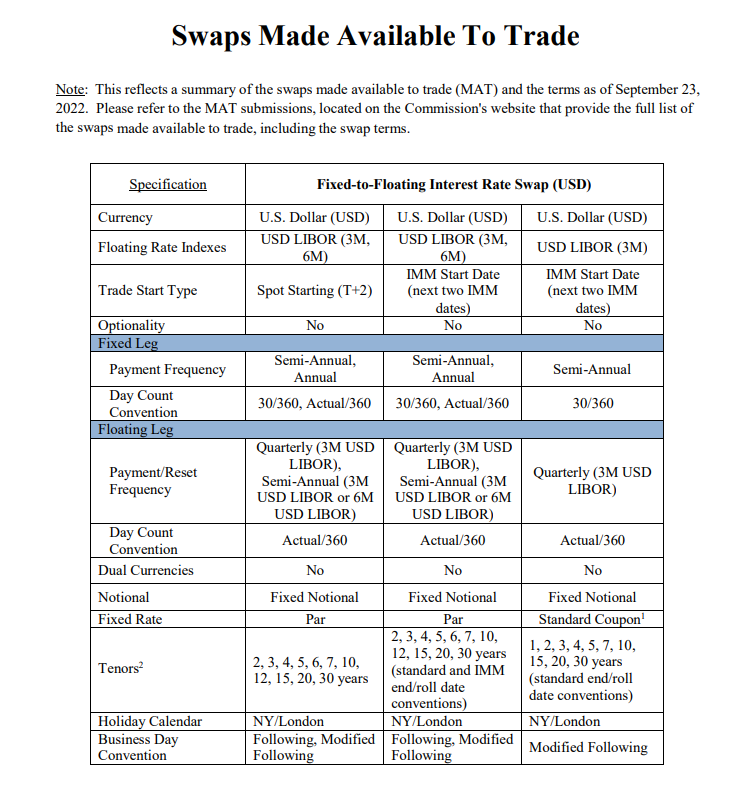

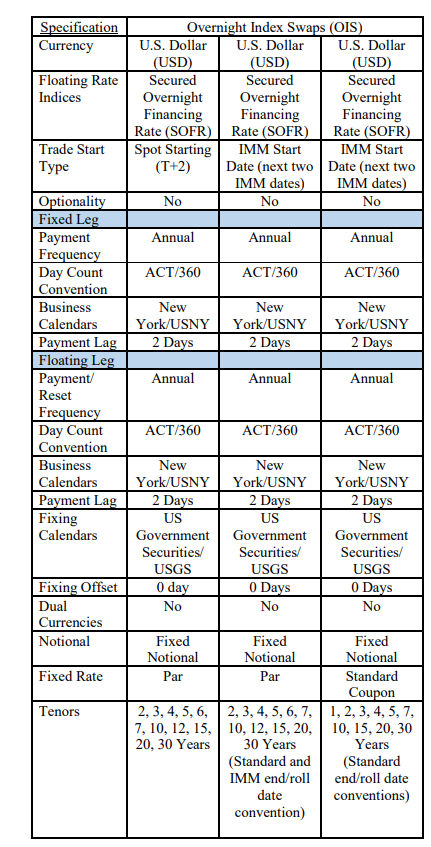

Likely surprising absolutely no one (particularly if you ticked “yes” to the poll question), the new MAT filing looks just like the old one!

Showing;

- The MAT filing from Tradeweb, Page 4, available here.

- Replace LIBOR with SOFR and it is pretty much identical to the old, LIBOR-based MAT filing.

- It covers only Spot starting swaps, plus the first two IMM dates.

- It covers the same tenors – annually from 2-7 years, 10, 12, 15, 20 & 30 years.

- Nothing too controversial I would suggest?

Good for Transparency

We find that the best quality data is still related to those swaps executed on-SEF. In addition, SEFs disclose the full size of their trades (albeit aggregated at a tenor level) within 24 hours of execution. Therefore, our gold standard for transparency, is a SEF-executed trade.

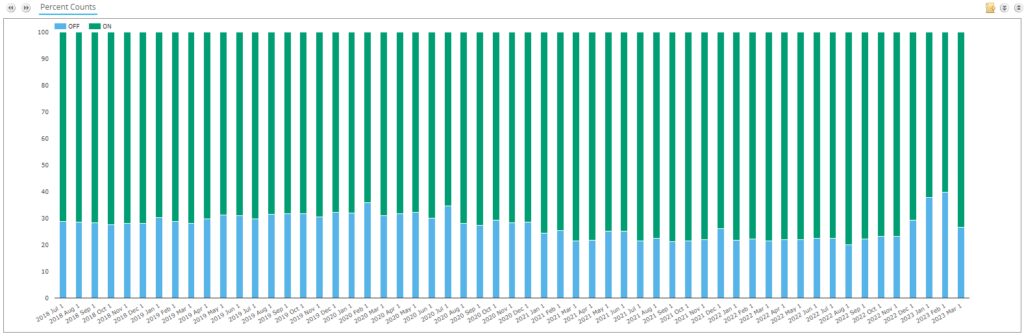

It is therefore very interesting to note what has happened to the overall share of USD swaps executed on-SEF in 2023. First, the percentage of trades executed on-SEF in the past 5 years:

Showing;

- The share of SEF trading was extremely consistent for about five years at 70-75% of trades (measured by trade count).

- But at the beginning of 2023, the number of swaps executed off-SEF began to increase.

- 23% of USD swaps (across all types) were executed off-SEF in November 2022.

- By February 2023, this had grown to nearly 40%!

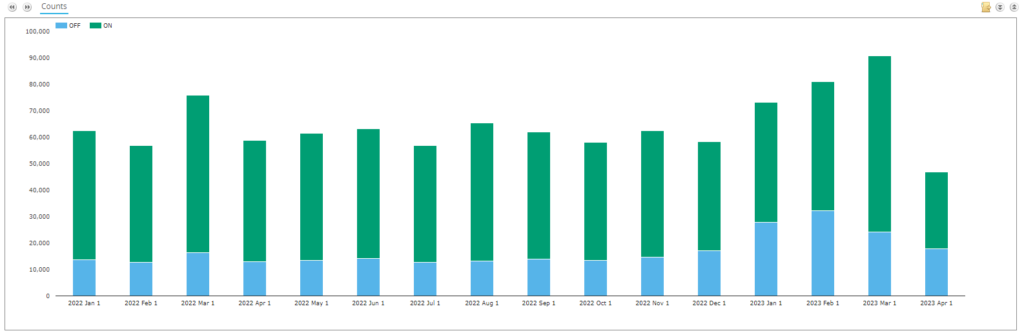

Drilling down to the past year:

Showing;

- SEFs have seen an increase in volumes this year. The above is shown in terms of trade count.

- However, off-SEF trading has seen a larger relative increase, which we haven’t seen for a long time.

- It is not clear what has driven this, particularly when we look at the largest SEFs – Tradeweb and Bloomberg – which have seen record volumes (see below):

- The volumes on D2C SEFs in Rates are on an inexorable march higher. The volumes in 2023 look so large that it is maybe worthy of a blog of its own….

Which makes it seem even crazier to highlight that the proportion of the market traded on-SEF has decreased overall this year. It is an interesting one for sure…..

Finally…

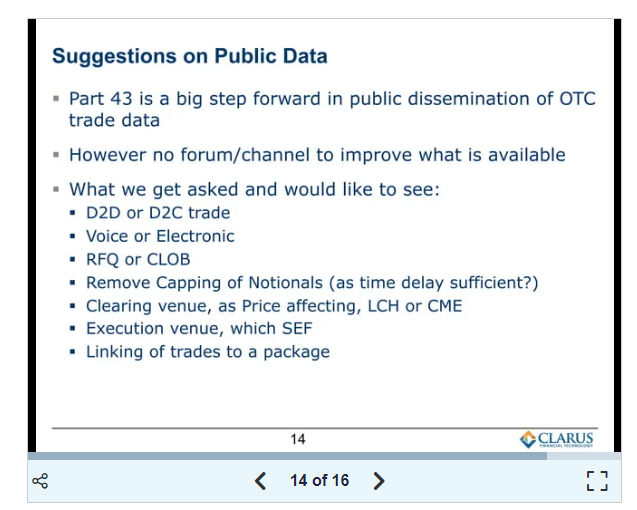

The MAT process was reviewed in July 2015, with our very own Amir Khwaja asked to present a “Data-based Assessment of MAT” to the CFTC. It is well-worth revisiting, particularly as Clarus suggested some improvements to the public data:

It took nearly 8 years, but the changes to the public data were made in December 2022 and:

- Now identify the SEF on which a swap is traded, thus allowing identification of D2C or D2D venue; by extension whether voice or electronic; and whether RFQ or CLOB.

- Identify packages.

- All of these changes are available in SDRView.

It is great that regulators listen and react to market participants feedback. It is crucial to help markets evolve.

In Summary

- There is a new MAT filing for USD SOFR swaps made by Tradeweb SEF.

- There was no MAT-trading of USD swaps in 2022, and yet the portion of the market traded on-SEF continued at 70-75% of trades.

- This shows how much of the market voluntarily chooses to execute on-SEF.

- The MAT filing applies to all of the same tenors as the previous LIBOR-based MAT filing.

- This new MAT filing comes just as off-SEF trading has seen an increase. It is unclear what has caused the 2023 increase in off-SEF trading.