Following on from his Cross Border Swaps Regulation 2.0 whitepaper from last October, CFTC Chairman Giancarlo gave some updates in his speech at the recent FIA IDX in London . He is leaving the SEF cross-border proposals to be turned into proposed rules and voted on by his successor as Chairman – Heath Tarbert. On CCP cross-border rules however, he’s hit the gas pedal, bringing three proposals to a CFTC commissioner vote before his July departure.

I focus here on two of these proposals related to non-US CCPs in terms of who they are regulated by, whether they need to register with CFTC and whether and how they can clear for US person clients. Some commented this is merely codification into regulation of the status quo inherent in current exemptive reliefs these CCPs have from the CFTC. Maybe true – but I think there’s also an interesting contrast with EU regulators’ approach.

Background

From my first skim read of a draft of Dodd-Frank in early 2010, it seemed clear that cross-border regulatory overreach by CFTC would become a problem. At the time I remember humming the Morrisey song: “America is not the world”. And so it turned out. In the white paper linked above, Giancarlo conceded there are specific elements of over-reach and laid the ground work for fixing them. As he approaches stepping down next month, it’s the clearing aspects he’s now focused on pushing to a Commision vote.

It’s also worth summarizing three principles Giancarlo has espoused which guide his proposals:

- Direct and significant impact on US commerce. Dodd-Frank says “The CFTC’s swaps authority “shall not apply” to activities outside the United States unless those activities “have a direct and significant connection with activities in, or effect on, commerce of the United States….”[iii]. Determining what is “direct and significant” to the U.S. financial system is critical (and in Giancarlo’s view has been overdone).

> The result of the two CCP proposals seems to be a view that no non-US CCPs themselves (other than LCH SwapClear) are direct and significant to the US financial system.

- Differentiate regulatory approach – firmer on systemic risk vs. lighter on trading market practice. Regulations designed to mitigate systemic risk include – CCP regulations, clearing mandate, uncleared margin mandate, dealer capital, recordkeeping, trade reporting. Regulations that address market and trading practices include SEF and trading protocols.

> The two CCP proposals are in the systemic risk category which may explain the urgency from the Chairman.

- Defer to non-US G20 regulators. CFTC should defer non-US activities to other G20 regulators where they have adopted comparable (not identical) reforms. Combining principle 2 above, the intent is to defer broadly on market and trading practices regulation but seek targeted comparability on systemic risk regulation but even then defer to home regulators once comparability is established.

> The aim is to minimize cases of regulatory duplication for a given trade.

The two proposals

Chairman Giancarlo proposes to put the following two proposals to a vote before stepping down in July. We will show how they in effect codify the status quo of LCH, Eurex, JSCC, ASX and other Asian IRS CCPs.

Proposal 1: “DCO Registration with Alternative Compliance”. Non-US CCPs can register with the CFTC but remain regulated by home regulator. Client clearing for US persons can be offered only by US FCMs, as is currently the case. A non-US CCP must register in this fashion if it exceeds the 20/20 test thresholds (see later section for details).

Proposal 2: “Exempt DCO”. Non-US CCPs not caught by the 20/20 test can opt not to register with CFTC and be regulated solely by G20 regulators if those regulators have adopted comparable regulation. Client clearing can for the first time be offered to US persons by unregistered CCPs but only by non-US clearing brokers (not US FCMs).

(For avoidance of doubt, there is a third swap entity cross border proposal mentioned in the speech which I don’t cover here.)

The effect on client clearing possibilities

Relaxation of rules can have some benefits:

- CCP registration obligations are relaxed. Other than those already registered (LCH SwapClear, Eurex, LCH ForexClear (I think), few if any non-US CCPs will be forced to register, because none will be caught by the 20/20 tests. They can now operate as “exempt DCOs” and clear for US clients which are prepared to clear via a non-US non-FCM clearing broker.

- US clients can clear at all G20 non-US CCPs. Previously this was only possible at those which had registered with the CFTC as foreign DCOs. Nothing changes for CFTC-registered DCOs so US clients still have to clear via a US FCM. To clear at exempt DCOs, they will have to clear via a clearing broker which is not a US FCM. This may entail setting up trade flow infrastructure with new entities as well as getting comfortable with non-US bankruptcy regime as well as.

Clearing market impacts

Not much given the following:

- Will this have much effect on IRS clearing CCP market share? Probably not. LCH SwapClear, Eurex and LCH ForexClear are already CFTC registered. JSCC, ASX, Shanghai Clearing and a couple other Asian CCPs are not client clearing much yet.

- Will US clients clear at exempt non-US IRS CCPs? Probably not. Asian IRS CCPs given yen / RMB / HKD IRS can be cleared at CME or LCH SwapClear and will be more IM efficient there if the firm already clears other currency IRS given cross-currency correlation-driven risk offsets in CME and LCH SwapClear margin methodologies which are not available in single Asian currency CCPs.

- Will US clients clear at exempt non-US CDS, FXD CCPs? Perhaps to Comder, HKEx, JSCC CDS especially where products are unique (e.g. HKEx cross-currency swaps, Japanese CDS).

In sum, around the edges there can be some new opportunities for US clients and non-US CCPs to interact.

The 20/20 test

Remember this is a test of whether a CCP is obliged to register. Any CCP can still register if they want to. First, let’s note the term “US origin” is used meaning “ultimately owned by a US person holding company”. Two tests are applied to a CCP’s US origin business:

- US origin swaps cleared at the CCP are more than 20% of US cleared swaps; and

- US origin IM posted to the CCP is more than 20% of the DCO’s total IM.

I’m assuming the numbers are pan-asset class i.e. the 20% is of all five OTC asset classes rather than separately applied to each of Rates, Credit, FX, Equity, Commodities.

Please advise if I’ve missed something.

This is crude, since the risk in different asset class is, well, different. Different qualitatively and different in quantitative terms, say in average IM per unit notional. The crudeness has a silver lining, namely, simplicity in application. Quarterly IOSCO IM disclosures (in Clarus’ CCPView) and US cleared swaps volumes from the SDRs (in Clarus’ SDRView) can be gathered together with simple submissions from CCPs of their US origin figures and the percentages would drop from a simple spreadsheet.

Impacts of rule 1

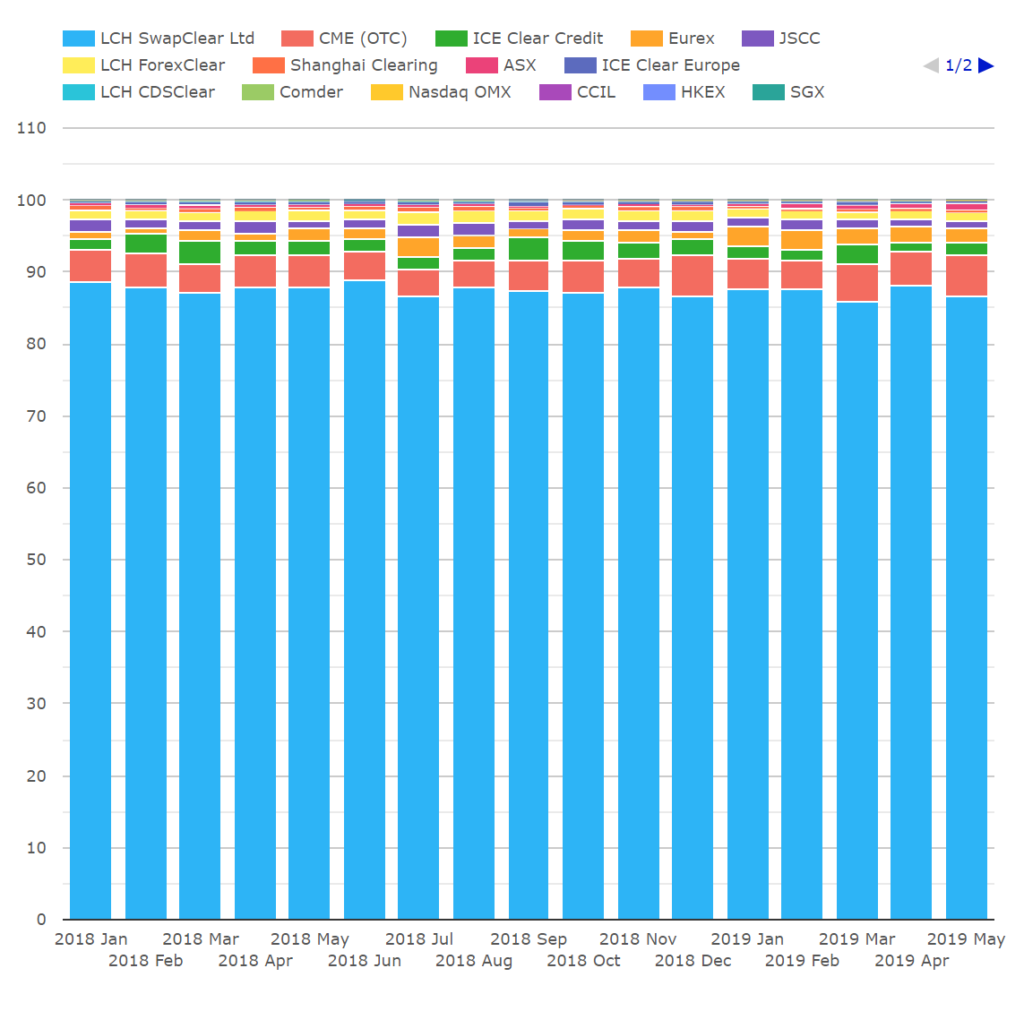

On rule 1, whether the metric is notional cleared on notional outstanding, LCH SwapClear is the only one currently above 20% of the US swaps market. While we don’t have global public volumes, we would expect US swap clearing notional shares by CCP to closely correlate with their global equivalents given large global swap market share of US banks and US buy side firms. CCPView gives us the global CCP notional shares on both Notional Cleared and Notional Outstanding bases.

We see:

- LCH SwapClear with 85+% of notional cleared and 77+% of notional outstanding with a slight downward trend in share of each metric. A long way above 20%.

- CME / ICE are US CCPs so not relevant.

- Other non-US CCPs are below 2% – the more material of which are JSCC, Shanghai Clearing, Eurex, ASX, LCH ForexClear, ICEClearCredit. A long way below 20%.

This situation looks unlikely to change except if:

- A major market IRS clearing share shifts away from SwapClear e.g. a Brexit driven shift to Eurex caused by Brexit. As Eurex is already DCO-registered we can park that one. (That’s enough Brexit, Ed.)

- A major FX clearing uptick which would need to include a big slice of FX forwards and swaps not just options / NDFs and hedge FX forwards. FXD at $~5tn a day is bigger traded notional than IRD at $~2.7tn a day (BIS Triennial Survey figures). Notional Outstanding is the other way around with IRD $436tn vs FXD $91tn. Even here, LCH ForexClear is already DCO-registered with CFTC. This may affect their non-US competition from Comder and HKEx or others.

Impacts of rule 2

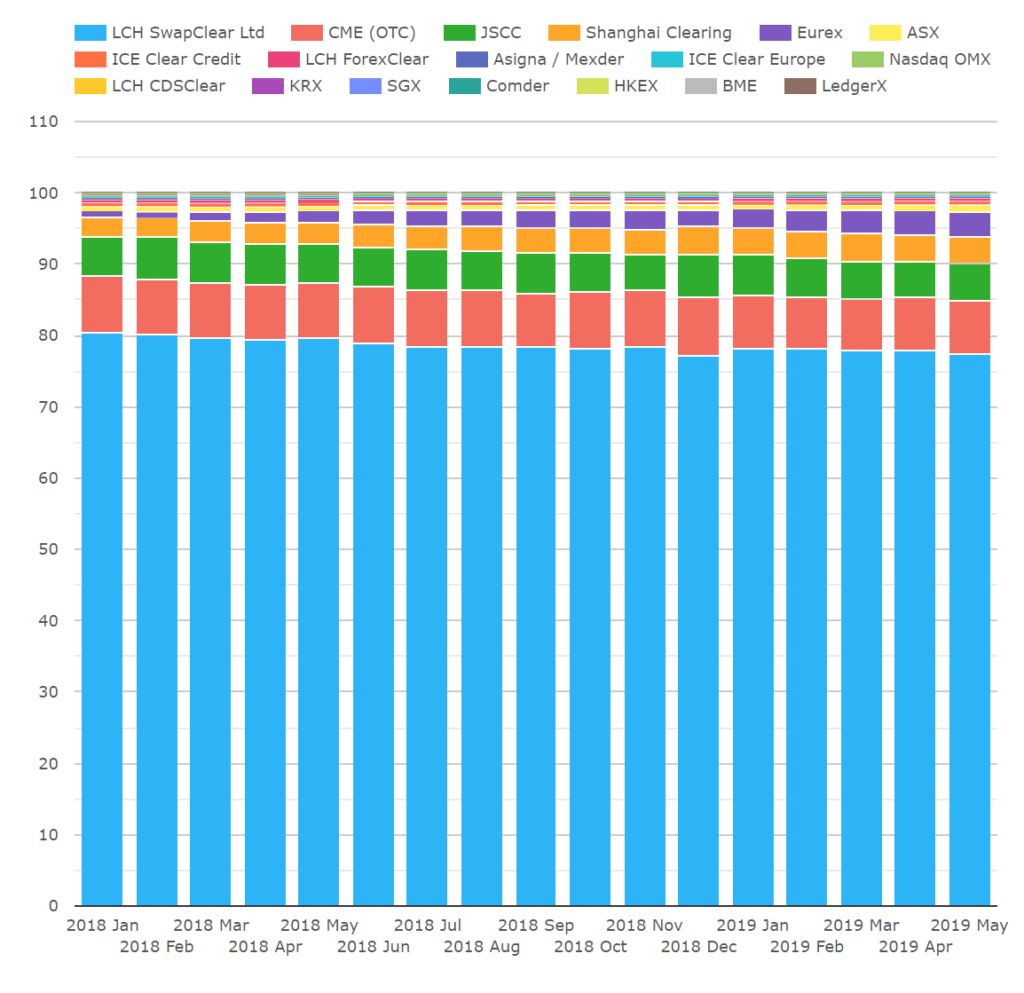

On cleared IM, the disclosures part of CCPView (second tab at the top) gives us the total IM by asset class and CCP (among a lot more pieces of data) as described in Amir’s recent blog. Only CCPs themselves know the US origin share figures. US banks and buy side firms have a material share of the global swap market in general (including their European and Asian affiliate entities). Therefore, it’s likely US origin IM is above 20% for several of the foreign CCPs above.

The combined effect

On specific CCPs, Eurex, ForexClear and ICEClearCredit are CFTC registered already so we’re down to JSCC, ASX, Shanghai Clearing, HKEx and some smaller Asian CCPs which would ever be impacted by this test.

It depends though on whether both rules have to hit together or being caught by one is enough. If both are needed, absent a CCP market share earthquake, no CCP that is not already registered will to be obliged to register any time soon. If one is enough, US origin IM share questions may become important for some non-registered Asian IRS CCPs (as well as some smaller non-IRS CCPs around the globe). e.g. JSCC has the big 5 US banks all owning clearing members. I’ve no idea whether these are more than 20% of their IM.

CFTC registration may be used electively to enable US FCM membership and client clearing. Since Asian CCPs have resisted this steadfastly when it was supposedly CFTC mandated, they seem unlikely to change this view given they now have another path to clearing US clients via non-FCMs.

More interesting – the contrast with EU cross-border regulation

I’ll just come out and say it – on the cross-border reach of OTC clearing regulations, US and EU regulations now seem to be heading in opposite directions. My observations are:

- On currency: CFTC has never used the US currency – USD – as a determining factor in OTC cross-border regulation. A benchmark currency is inherently internationally used and its use beyond the US is not part of the US commerce. EU regulators seemed to focus on EUR trade clearing for a while but now seem to have conceded this point.

- On CCP, clearing member and participant location: CFTC always allowed equivalent G20 non-US CCPs to have US clearing members without regulating the CCP and to have US clients clear via US FCMs to those CCPs. Now the limitation to US FCMs and the limitation to clear on registered non-US CCPs are both being rescinded. EU regulators want E27 firms to clear at on shore CCPs, or offshore CCPs regulated by them as well as home regulators or something.

- On LCH SwapClear Ltd specifically: the elephant in the room has always cleared a majority of the US or EU swaps markets and of USD or EUR swaps or of any other measure. CFTC is ok with this. EU regulators are not.

Hypothetically, If EU regulators adopted a similar stance to that of the CFTC I’m not sure there’d be a Brexit CCP issue. Of course, nothing containing the word Brexit is that simple. I offer this only as a point of fact comparison not a recipe for resolution of what are of course deeply entrenched and political issues about which I have very little knowledge or expertise.

If anyone can provide a rational explanation of both approaches being logical as opposed to politically expedient, I would welcome that. Answers on a post card please…