- GBP markets are exceptionally volatile at the moment.

- We look at transparency data and find that derivatives markets are continuing to function.

- September 2022 will likely see the largest notional volumes traded this year.

- We cannot say for sure that will be the case for the amount of DV01 transacted.

- We consider what this means for GBP liquidity.

Was This Really a “Mini” Announcement?!

Watching the horror show that is the financial market reaction to a “mini-budget” (imagine what the reaction would have been like to a full budget!), I cannot help thinking about the potential impacts on derivative markets.

Gilts and hence GBP Yields have seen the biggest daily moves I can ever recall, and the fact that the huge sell-off continued on Monday suggests some type of contagion going on.

An Aside on GBP Swap Spreads

I’ve spent much of this week trying to work out why GBP Swap Spreads aren’t negative across the whole curve now? Someone with better market colour can tell me, but as a brief outline of what we are dealing with when we talk about GBP Swap Spreads:

- Recall that GBP Swap Spreads are an OTC cleared SONIA OIS versus a Gilt.

- The Swap Spread is the yield on the swap minus the yield on the Gilt. A positive swap spread means that swaps have a higher fixed rate (“yield”) than Gilts.

- There is a “credit component” to SONIA (it is unsecured overnight cash) but it has no term-credit risk associated with it.

- The OIS swap (i.e. a Fixed leg versus compounded SONIA) is subject to a Clearing Mandate. Daily cash collateralisation (and even over-collateralisation of the risk via Initial Margin) is mandatory. OIS Swaps are the closest thing we can imagine to a truly risk-free product.

- Gilts, on the other hand, do carry risk. They are not daily collateralised. People can do this crazy thing and just buy gilts and hold them on their balance-sheet without cash-settling the move in their price. (How crazy does that now sound compared to the nice, safe and secure collateralised derivatives markets?!).

- Buying a Gilt also involves actually lending money to the Government of the United Kingdom. ‘Nuff said.

- I believe that Quantitative Tightening has started this week, meaning that the BoE is now selling Gilts into the market as well. More supply into a market showing signs of zero demand for Gilts cannot be good?

Whilst I continue to scratch my head over why the short-end of the GBP Swap Spread curve is so positive, let’s look at what has traded this week.

And in case you missed the coverage, please check-out the FT Alphaville coverage, which has been spot on:

Puppies: https://www.ft.com/content/bd408a16-ed9f-480a-ba99-b19933e4ef45

James Bond: https://www.ft.com/content/47692de0-99e2-4d02-be9a-fef66a5b30b4

Volumes Traded

First up, the most important thing to state is that transparency in markets is a really good thing in times like these. With such ridiculous moves in price/yield, many commentators will say things like “it is gapping, nothing is trading, liquidity is terrible”. We never know whether they are correct or justifying wider bid-offer spreads in a market-making business. With transaction data, we can see both the prices and volumes that have traded.

Even for the UK market, even after Brexit, we do not have good access to post-trade derivatives data. We have to rely on US data for that (we look at GBP products from data that covers “US Persons”). So we only have a portion of the market to examine, but we assume that the transparent portion of the market reacts in a similar way to the overall market.

Swaps

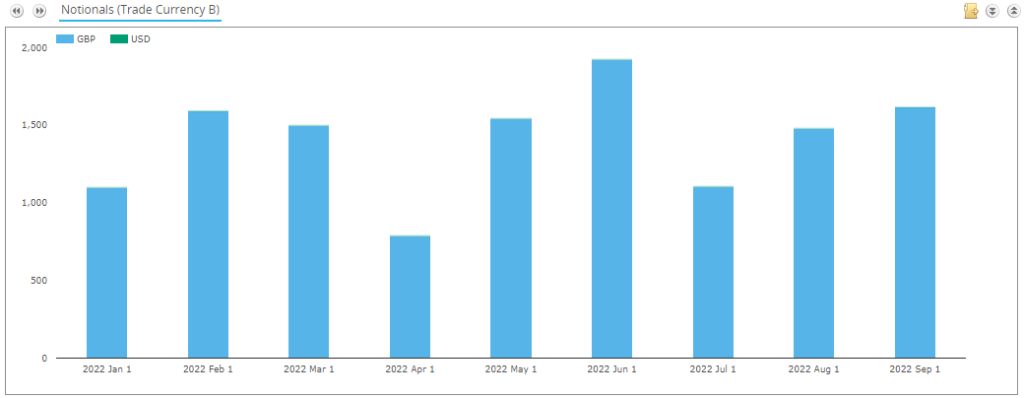

As I write this on Tuesday morning (27th Sep 2022), we can see that September volumes have been healthy in GBP SONIA OIS (GBP IRS do not trade any more due to LIBOR cessation). The chart below shows notional volumes in GBP OIS. Volumes are shown in native currency (GBP – the chart looks pretty different in USD terms!).

Showing;

- With 4 trading days still to go, notional volume in September is already the second highest volume month this year.

- June was the record month this year.

- In GBP terms, September volumes are within GBP300bn of the June total.

- Could we imagine the GBP market trading GBP90-100bn per day into month-end to hit new monthly records this year?

- The Average Daily Volume traded in September so far has been ~GBP85bn per day.

- Of course, one GBP is not worth the same number of USD as it was at the beginning of the month (or in June!). So we are taking the FX effect out with these charts and looking at the numbers in native currency.

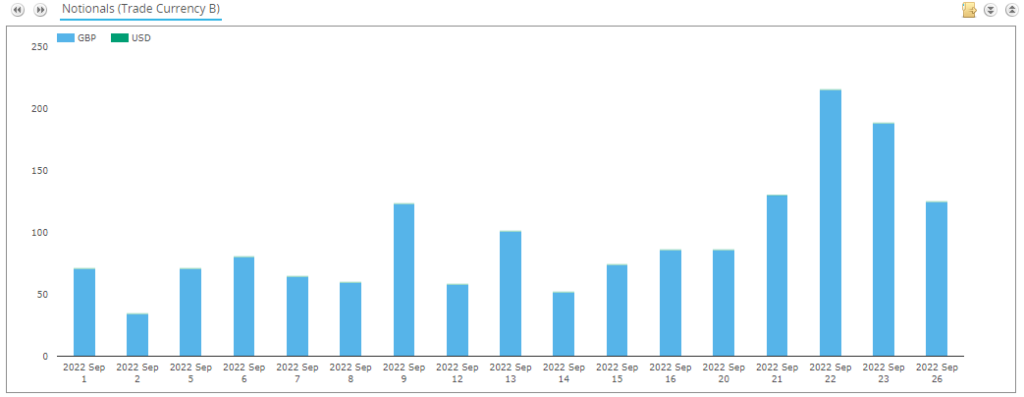

Looking at daily volumes in September so far:

Showing;

- The lowest volume day was Friday 2nd September. Surprisingly, this was even lower than Monday 5th, which was Labour Day and we are talking about US data here.

- Since that low point, volumes have been ramping up pretty much day by day.

- Wednesday 21st Sep saw GBP130bn trade.

- We then increased to GBP215bn on 22nd Sep!

- Okay, volumes have tailed off since – not a great sign – but yesterday still saw GBP125bn in notional trade.

- At GBP125bn per day, that would take us to a monthly record for notional traded in 2022.

SONIA DV01

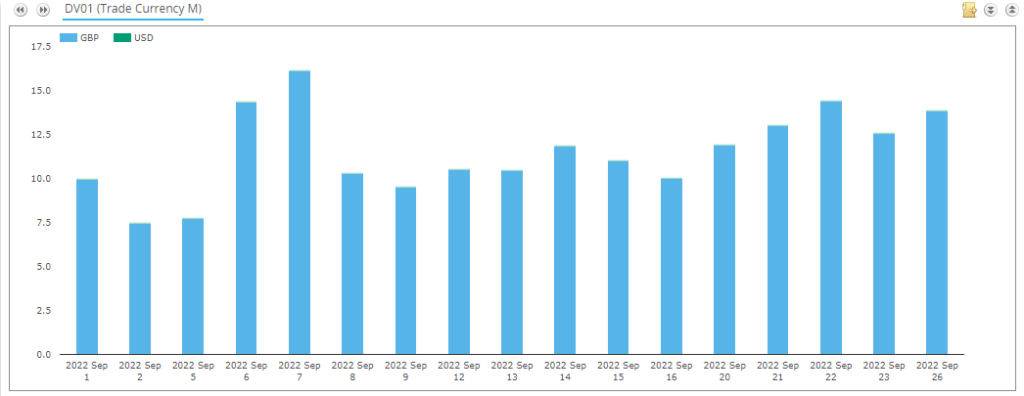

Let’s sanity check this with a look at DV01 traded. Maybe this is all large notional, short-dated MPC SONIA that is trading?

Aha!

- Maybe the DV01 chart doesn’t paint such a rosy picture of liquidity/volumes?

- The most amount of DV01 traded in September was way back on September 7th.

- Given the huge repricing in the 5Y and 10Y areas of the curve (as well as the short-end), we would have expected lots of activity in DV01 terms to show up in a well functioning market.

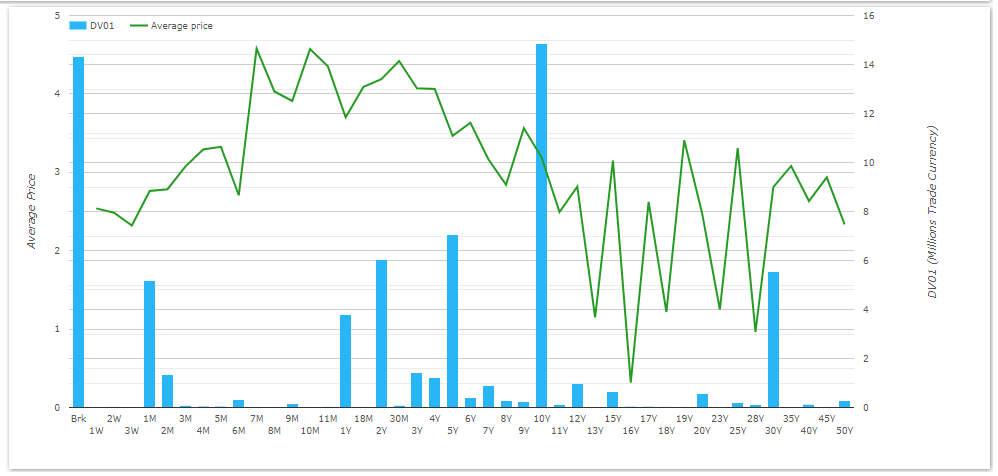

More analysis is possible via SDRView Pro, showing us the precise split by maturity of the DV01 traded for the past week:

Showing;

- 10Y is the most traded part of the curve in DV01 terms, closely followed by “Broken Tenors”.

- The amount of DV01 traded in short dated products, mainly 1 month, is less than half compared to the 10Y point.

- (On the chart, the “BRK” for “broken dates” are all longer-dated products, 2Y+).

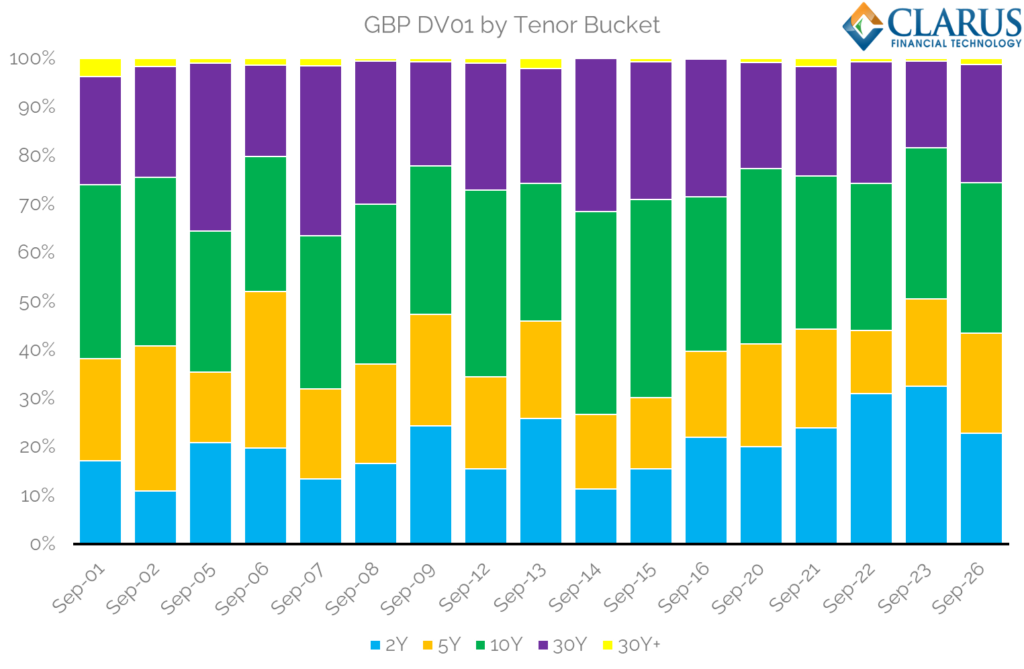

We can also split the overall trading in September by maturity from SDRView:

- There have been days where trades falling in the 2Y and 5Y buckets have made up over 50% of GBP trading.

- There has been a clear increase in the relative amount of short-end trading that has occurred since the 14th Sep.

- 10Y accounted for 34% of all DV01 traded up until September 21st.

- In the past 3 trading days, 10Y trading has accounted for a slightly lower 31% of the total.

In Summary

- Transparency data (from the US….) reveals that GBP derivatives are continuing to trade despite huge volatility.

- September 2022 is likely to be the record month for the notional amount of GBP derivatives traded this year – at least for SONIA swaps traded by US persons.

- In terms of the amount of risk traded, we cannot say for sure that records will be broken.

- Despite the large moves in price/yield we have seen in the long-end, more trading activity in DV01 terms has taken place at the short-end.

- Whether this is a reflection of market demand or constrained long-end liquidity is worth examining in the data as the market continues to digest events.