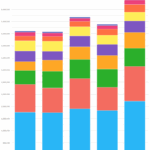

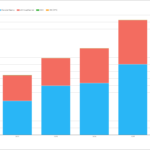

2025Q1 CCP volumes and share in IRD

Clarus CCPView has daily volume and open interest data published by each CCP, which is filtered, normalized, and aggregated to allow meaningful volume comparisons. Today, we look at 2025Q1 CCP volumes and market share in IRD for: Onto the charts, data, and details. Volumes and market share For major currencies and regions, vanilla swaps referencing IBORs and OIS Swaps referencing RFRs, using […]

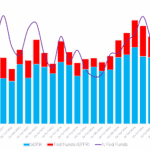

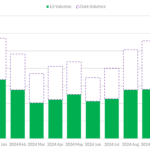

Recreating the RFR Adoption Indicator

This blog is unashamedly targeted at our data subscribers. Specifically, those of you interested to replicate our RFR Adoption Indicator. Read on for your “cut out and keep” guide to RFR data. A Bit of History Clarus and ISDA teamed up way back in 2020 to “help derivatives market participants keep tabs on progress to […]

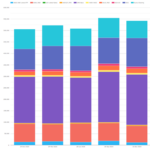

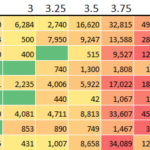

What’s new in CCP Disclosures – 4Q24

Clearinghouses have published their latest CPMI-IOSCO Quantitative Disclosures: Background Under the CPMI-IOSCO Public Quantitative Disclosures, central counterparties (CCPs) publish over 200 quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk, back-testing, and more. CCPView has more than 8 years of these quarterly disclosures for 44 clearinghouses, each with multiple Clearing Services, covering the period from 30 September […]

Swapalypse Now

(FT Alphaville came up with the “apocolypse/swapscalypse” first. I am not that clever). Hello Swap Spreads As the link to Alphaville shows, the market narrative is adding USD swap spreads to the “people are worried about the basis trade” theme. Whilst there is potentially more notional tied to the basis between cash USTs and CME-traded […]

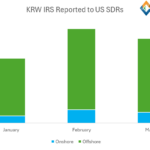

What You Need to Know About KRW Swaps

Where do KRW Swaps Rank on the Global Picture? CCPView allows us to compare the relative size of KRW swap markets to other currencies. Taking out the “G6” – USD, EUR, GBP, AUD, CAD and JPY – we see the below: Showing; Are All Volumes Cleared at LCH SwapClear? Our CCPView data shows that almost all […]

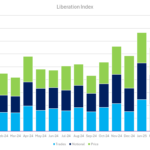

What Would a Liberation Index Look Like?

Today is meant to be Trump’s so-called “Liberation Day” with tariffs potentially being activated with some of the largest trading partners of the US. It is surely no coincidence that it is happening on April Fool’s Day. Just for the sake of it, I wondered what a “Liberation Index” might look like. What are the […]

Transparency – Where do we go from here?

USD OIS Trading The chart below shows the entire global USD OIS cleared swaps market in 2024: The chart shows the amount of DV01 traded in benchmark maturity buckets – ranging from 2Y to 50Y – in USD OIS versus both SOFR and Fed Funds. The data is from CCPView. This data is reported directly […]

CNY Swaps – What’s New?

When I last wrote about CNY Swaps back in 2020, I found that CNY swaps were the 9th most traded currency in cleared Interest Rate Derivatives. They have since increased in size significantly, and are now the 7th largest swaps market. Updating the data from CCPView; Showing; CCP Market Share CNY is one of the seven […]

Swaption Volumes by Strike Q4 2024

Continuing the work on Swaptions, I delve into the options market activity in Q4. The quarter was characterised by trading activity related to the US election, and from a data perspective we cannot avoid giving a notable hat tip to the change in block sizes. Q4 2024 saw the following daily moves in ten year SOFR […]

€STR Volumes and Market Share February 2025

€STR Futures Our €STR Dashboard summarises key liquidity attributes in this growing market: Showing; Open Interest CCPView provides all the data we need on Open Interest for €STR futures: EURIBOR No change that I can see in EURIBOR trading. It continues to dominate EUR STIR future volumes: January volumes in EURIBOR were close to the October […]