CLARUS01 Risk Free Rates

CLARUS01 Are you currently using LIBOR01? What will you do if (when?) Libor is no longer published? We have a simple solution – use CLARUS01 instead. Find it at rfr.clarusft.com. What is CLARUS01? Libor. Risk Free Rates. Benchmark reform. We believe that Interest Rate trading is about to fundamentally change. Clarus want to help during […]

CCP Disclosures 2Q 2018 – What the Data Shows

Clearing Houses 2Q 2018 CPMI-IOSCO Quantitative Disclosures are now available, so lets look at what the data shows, similar to my 3Q 2017 trends article. Background Under the voluntary CPMI-IOSCO Public Quantitative Disclosures by CCPs, over two hundred quantitative data fields covering margin, default resources, credit risk, collateral, liquidity risk and more are published each quarter with a quarterly lag. CCPView has […]

Scandie Swaps

We take a look at Scandie swaps through the lens of our data products. SEK are the most traded currency, seeing an average daily volume of $19bn, and a monthly total of $290bn. SEK is the 7th largest cleared currency in IRS trading. The US persons market accounts for around 20% of volumes. There is […]

Swaps Data: Sonia growth spreads down the curve

My monthly Swaps Review in Risk Magazine looks at how: volumes of GBP SONIA Swaps are growing compared to LIBOR Swaps, the maturity profiles that trade for these two products, EONIA and EURIBOR volumes and maturity profiles. Please click here for free access to the full article on Risk.net.

Derivatives, the Cloud and the source of truth

As a cloud service provider, we are frequently evaluated by a customer’s IT Security who conduct risk assessments on our Software-as-a-Service’s architecture, security and processes. These assessments are detailed and thorough. Clarus is not the only innovative cloud vendor doing this, we are one of many. The cloud is happening, and it is happening now. […]

Global Swaps Volume and Market Share in Q3 2018

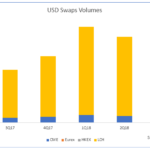

I last looked at the market share of cleared swaps in major currencies in my July article in Risk, which covered the period up to 2Q 2018. In today’s article I will bring that analysis up to date and follow the structure of my start of the year article, 2017 CCP Market Share Statistics. In CCPView we […]

Should the $8 billion UMR threshold for IM increase to $100 billion?

ISDA, SIFMA and other trade associations recently published a letter addressed to BCBS and IOSCO, which makes very interesting and important recommendations for the remaining phases of the IM implementation required under Uncleared Margin Rules. (full letter here). Background Uncleared margin rules (UMR) required Phase 1, 2 and 3 firms, with >$3 trillion, >$2.25 trillion […]

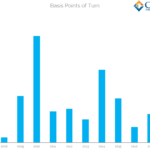

Cross Currency Basis and Turn of the Year

There was a huge move lower of 30 basis points in short-dated cross currency swaps on Thursday September 28th. This is because the “front roll” went over the turn of the year date. There is a huge disconnect for turn of the year pricing between USD Libor and Cross Currency basis. USD overnight interest rates […]

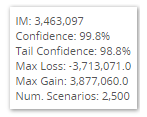

Could the Nasdaq default happen in Rates markets?

What could cause a Rates CCP to lose €100m from the Default Fund? We look at 10y IRS in NOK vs SEK. We find that liquidity add-ons prevent very large positions from being under-margined. Nevertheless, we present a scenario that causes a €74m loss. And then we explain why we really shouldn’t worry about it! […]

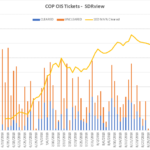

Non-Deliverable Swaps Clearing Volumes

This year both CME and LCH launched clearing in new Non-Deliverable Swap (NDS) currencies and in today’s article I will look at how volumes in these products have performed. CME – NDS in CLP and COP In May 2018, CME launched Chilean Peso and Columbian Peso NDS as new currencies and both of these have […]