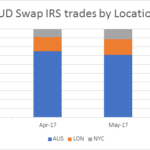

AUD Swaps: What Does the Data Show?

Over the last few years we have published many blogs on the AUD Swap market. Amir also includes an AUD summary in his monthly swaps review. The DTCC does publish some market info from the Australian SDR, but the aggregated nature of this data does not allow for a meaningful analysis of what is actually […]

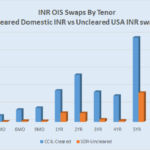

KRW and INR Swap Clearing

The CME have announced they are planning to clear Korean Won (KRW) and Indian Rupee (INR) interest rate swaps in the near future. I wanted to have a look at what these markets look like. So first things first, I grabbed all trades for non-G4 swaps on the US SDRs, year-to-date. Did this for both […]

LCH-JSCC Basis: An Update

My blog last week on LCH-JSCC Basis in JPY Swaps has been massively popular and now that we have another week’s data under our belt, it is worth an update. Indicative CCP Basis Quotes Let start with Tradition’s page as of Friday April 22, 2016. Showing, Yen IRS quotes at JSCC, Yen IRS quotes at LCH, LCH/JSCC Basis and 6v3 […]

LCH-JSCC Basis in JPY Swaps

Last week a number of our readers alerted us to the sudden formation of a Basis in Yen Swaps between LCH and JSCC, which is interesting to say the least. So lets look at what the data shows. Indicative CCP Basis Quotes Tradition kindly sent us a screenshot of their new page. Showing, Yen IRS dealer quotes at JSCC, […]

What did the Australian Regulators say about OTC Derivatives Trading Mandates?

I read last month with interest the report on the Australian OTC Derivatives Market issued by the Council of Financial Regulators (which includes Australian regulators APRA, ASIC, RBA and The Treasury). The full report of which can be found here. Given we already know a lot about the Trade Reporting and Central Clearing developments, I […]

Australian Rates Clearing Mandate

Australian Rates Clearing Mandate now only 6 months away. LCH is the current king of AUD$ Rates Clearing ASX goes strong on the Cleared AUD$ OIS product Regulators may delay mandate start on FRAs and OIS? Will a market share split see a CCP basis spread like for USD on LCH-CME? I thought might be […]

Why trade level reporting is the only reporting that makes sense

We look at the data sources available for AUD IRS markets…. …and try to reconcile some of the numbers We quickly find this is not as easy as it first appears…. …and conclude that publicly disseminated, trade-level reporting is the only way to add true transparency to OTC derivative markets. The great data reconciliation game […]

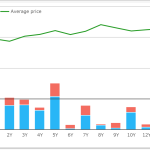

SEFS in Japan: First Month of ETP Volumes

Following on from our blog, SEFs in Japan: ETP Data, I wanted to look at the first month of trade activity. Background Japanese Electronic Trading Platforms (ETPs) commenced operation on 1 Sep 2015, with trading in Vanilla JPY Fixed vs Libor Swaps, Cleared at JSCC with 5Y, 7Y, 10Y tenors and trades executed between large […]

AUD Cross Currency Swaps

Clarus explores the AUD/USD Cross Currency Swaps market. We find that our SDR data covers over 20% of the market – both for dealer-to-dealer and dealer-to-client flows. SEF-trading has seen an impressive uptake, with an average daily volume over $500m. The off-SEF market remains important – not surprising, given a lack of clearing or execution […]

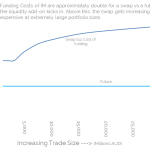

AUD swap market: Concentration risks from the Clearing Mandate

We present a uniquely Clarus view of the AUD IRS markets Our analysis of the regulatory landscape, bond issuance data and swap market flows suggests that many Swap Dealers will end-up in Add-On territory for OTC swaps clearing at CCPs This means that swaps become incrementally ever more expensive to trade relative to futures From a liquidity point of view, […]