My blog last week on LCH-JSCC Basis in JPY Swaps has been massively popular and now that we have another week’s data under our belt, it is worth an update.

Indicative CCP Basis Quotes

Let start with Tradition’s page as of Friday April 22, 2016.

Showing, Yen IRS quotes at JSCC, Yen IRS quotes at LCH, LCH/JSCC Basis and 6v3 Tenor Basis.

- 10Y IRS Basis is 0.875 bps, down from 1.75 bps on 15 April

- 20Y IRS Basis is 1.50 bps, down from 3.25 bps on 15 April

- 10Y Receive fixed at JSCC is 0.13625% up from 0.12% and Pay fixed is 0.09625% up from 0.08%

- 10Y Receive fixed at LCH is 0.1455% up from 0.1375% and Pay fixed is 0.105% up from 0.0975%

So while the Basis has come in, it remains significant and it’s volatility remains higher or equal to that in Outright JPY Swap rates.

JSCC Initial Margin

One of the triggers for the sudden formation of the LCH-JSCC Basis, may be the change by JSCC on April 11 of its Initial Margin model. Lets look at the details of this.

The main change is from relative return scenarios to absolute return scenarios. The effect of which is to increase the size of scenarios applied in low rate environments like today.

An example: if rates were 3% 5 years ago and a 5-day change resulted in rates dropping 50bps, using relative scenarios this would be stored as a -0.1667%, while using absolute scenarios it would be -50bps. So if today rates are 1%, then using relative scenarios we get a resulting shocked interest rate of 0.83%, while with absolute we get 0.50%. Clearly the latter is a bigger move and means our current portfolio will exhibit greater PL variance and a consequent higher IM with the absolute scenarios.

Now while we do not have data on how much JSCC IM increased for members, we can assume it will have increased.

LCH SwapClear also changed its margin model from relative to absolute returns in May 2013 and I covered that here. At that time we crudely estimated a 30% increase in IM for some portfolios, while the JSCC impact is likely to be less, it should make the JSCC margin higher and more similar to the LCH SwapClear one.

Such as increase may have caused firms to think again about the size of their positions at each CCP.

A firm receiving fixed at one CCP and entering into a hedge to pay fixed at the other CCP, ends up paying two lots of margin and not the net zero margin if it was receiving and paying at the same CCP.

Further changes to the JSCC IM model is the revision of stress event scenarios for IM to three and a modification to the volatility adjustment formula used in scenario generation. These sound less significant.

The other trigger may have been the news that JFSA granted LCH SwapClear approval to clear non-JPY IRS on behalf of local banks.

Two triggers, both together may have been significant enough to reach the tipping point.

Lets look at what has happened to volumes.

Clearing Volumes

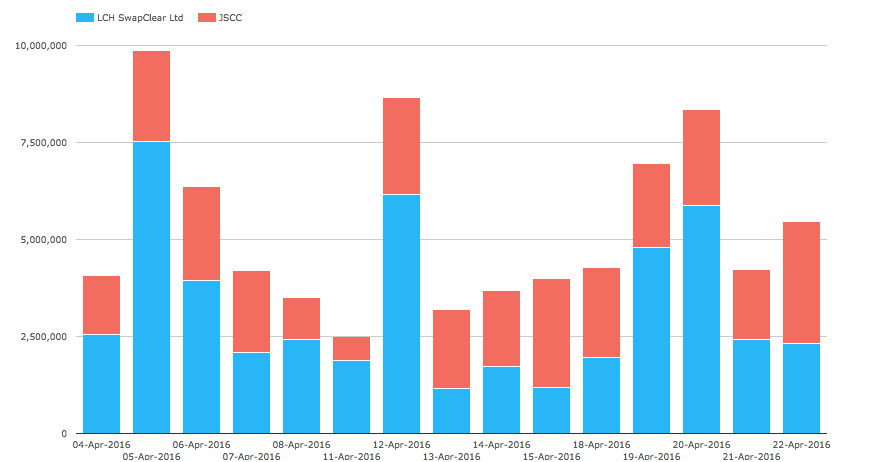

In CCPView we can look at the JPY IRS Volumes published by LCH and JSCC.

Showing:

- Daily volumes in millions of JPY for the past three weeks

- And we see that JSCC volume was higher than LCH between 13 to 18 April

- While from 19 April on, LCH is again higher as it was on days prior to 13 April.

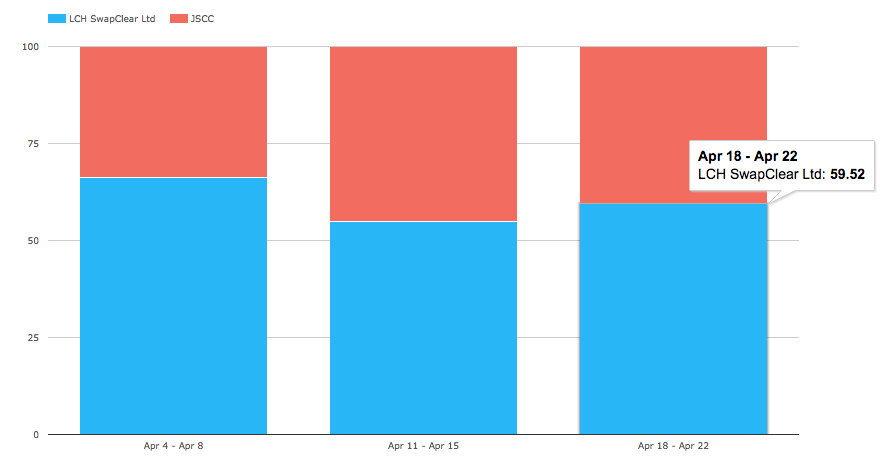

Showing the same data but as percent of total and by week.

We can see LCH SwapClear was at 66% of total, then 55% and for last week it is 59.5%.

So while both JSCC and LCH are up, LCH is up much more and close to is volume in the week of 4-8 April.

Swap Data Repository

In SDRView we can look at Cleared JPY IRS reported by US Persons to US SDRs (DTCC and BBG) and it is a reasonable assumption that these trades are all cleared at LCH.

Showing that from 20 April, volumes are back up to levels seen in the week starting 4 April (before the sudden increase in the Basis on 13 April), corroborating what we saw in CCPView data.

Japan ETPs

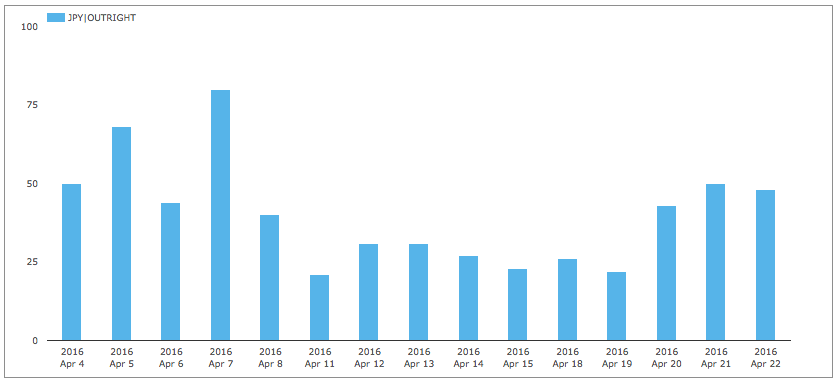

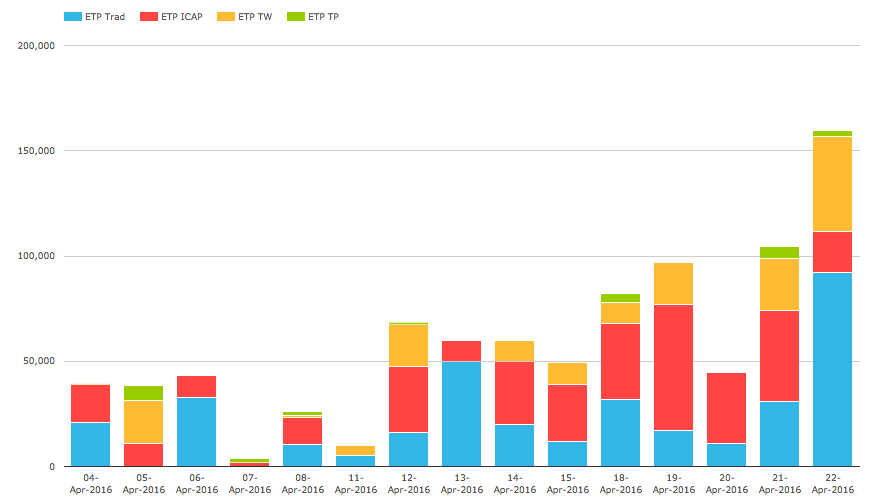

In SEFView we can look at the trades reported by ETPs in Japan, which are JSCC Cleared Swaps (5Y, 7Y, 10Y).

Showing JPY Notional in millions with last weeks volumes higher than the week of 11-15 April. The highest day being 22 April, with Tradition and Tradeweb both showing higher volume than usual and ICAP with good volumes from 18 to 21 April.

The week of 18-22 April is equal to the highest weekly ETP volume we have seen in 2016.

Final Thoughts

Thats it.

Another week of data.

And the Basis is down from the highs of last week.

The moves in the Basis are as large as moves in Outright levels.

Volumes are up at both JSCC and LCH.

With LCH volumes back up to their higher levels.

Could we be returning to the status quo prevailing prior to April 11?

Only time will tell.