Have you seen the BIS Triennial Survey 2022?

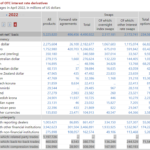

Trading shrank by about 20% to $5.2Trn per day in Interest Rate Derivatives from April 2019 to 2022. Transition to RFRs has resulted in a $1.4Trn reduction in daily activity in FRAs alone, explaining much of the decline. The BIS survey occurred when markets were likely experiencing a degree of heightened activity, although Clarus data […]

The GBP Financial Meltdown – what is still trading?

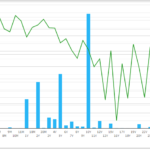

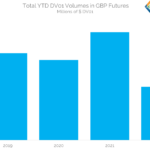

GBP markets are exceptionally volatile at the moment. We look at transparency data and find that derivatives markets are continuing to function. September 2022 will likely see the largest notional volumes traded this year. We cannot say for sure that will be the case for the amount of DV01 transacted. We consider what this means […]

What is new in GBP Swap Markets?

We look at vanilla swaps, inflation swaps and futures. Some markets have seen volumes reduce by over 50%. Whilst others recorded all-time record volumes in August 2022. What is driving such different outcomes across a single derivatives market? With Liz Truss the newly anointed Prime Minister, the FT had an interesting take on UK markets […]

Microservices to monitor new Inflation data

Here on the Clarus blog, we anticipated that LIBOR cessation in GBP, JPY and CHF would usher in simpler markets and “easier” trading this year. Less indices, less basis, fewer restructuring requests. Heaven forbid, fewer blogs even! However, 2022 has seen two big market themes step up that have provided plenty to write about – […]

The Endgame for Basis Swaps?

Interest Rate Basis Swaps can be categorised into two distinct types, with floating sides/legs which reference either: Distinct reference indices e.g. USD Libor 3M vs Fedfunds, or Tenor Basis e.g. USD Libor 3M vs 6M Basis Swaps are used to hedge or trade the basis spread between the reference indices or Libor tenors and are […]

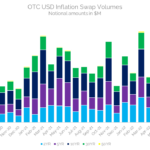

Are Inflation Expectations Becoming Entrenched? The Data.

With inflation front and centre of everyone’s mind, let’s test a simple hypothesis. If inflation expectations are becoming entrenched – i.e. people expect inflation to be elevated for a longer period – is there evidence of this in trading activity? What evidence might we see? There are two potential signals: More trading activity in Inflation […]

Interest Rate Swaps made easy – What You Should Know

An Interest Rate Swap (IRS) is a financial derivative that is widely traded. This blog defines an interest rate swap and its practical uses. Why the parties involved would choose to carry out an IRS. What the possible risks of an interest rate swap are. About the Author Jake is 17 years old and studying […]

Have You Seen This 60% Decrease In RUB Derivatives?

We run through activity in RUB Rates, CDS and FX markets. Data shows that CDS markets are continuing to trade, with 25-30 cleared trades every day. Risk is reducing, with Notional Outstanding in CDS reducing most days. RUB NDFs have seen Notional Outstanding reduce by 60% recently. RUB IRS Markets To start with, I will […]

FTX’s Direct Clearing Model application to the CFTC

After a 3-year hiatus it was great to attend FIA Boca again, not only to meet up with customers, contacts and colleagues but also to get a sense of the topics d’jour in Cleared Derivatives. The two that stood out for me were the high profile of Crypto firms and Cloud technology. Cloud, as our […]

RUB Derivatives Are Still Trading

Derivatives transparency allows us to monitor the continuing activity in RUB markets. Interest Rate Swap activity in RUB spiked in response to the central bank action this week. And Russia is a component of the CDX.EM CDS index, where trading continues despite huge event risks. FX markets are a little more opaque, but we see […]