Four Trends in Swaps Data 2019

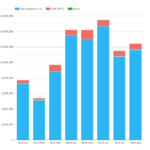

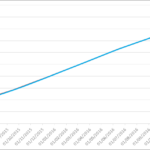

Welcome to a review of Clarus data for 2019. Cleared Rates markets are a $2.7trn-per-day market in 2019. On top of this, Compression accounts for a further $2trn of activity every day. Continued growth in clearing, electronification and compression coupled with a shortening of maturities have been identified by the BIS as key drivers for […]

BIS Triennial Survey 2019

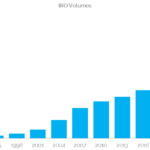

Trading reached $6.5trn per day in Interest Rate Derivatives during April 2019. Our markets have grown at unprecedented levels in the past three years. The BIS used our own CCPView data to cross-check the survey results. BIS IRD Volumes in April 2019 The latest BIS survey data is now available. Performed once every three years, […]

Swap Volumes: SOFR v FedFunds

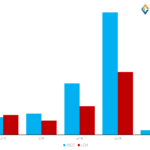

Back in February 2019, I wrote a blog on the state of the GBP and USD OIS markets. At that time, I held great hope for the USD SOFR markets to develop during 2019 to support a growing market in SOFR-based cash products and the derivatives used to hedge them. This blog looks at the […]

JPY Swaps – A Market Overview

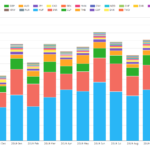

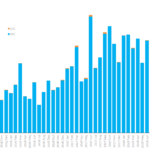

JSCC has enjoyed a 63% market share in vanilla JPY IRS versus LCH over the past year. The market shares vary by tenor and month-by-month. JPY OIS trading is a very small market. LCH is the leading CCP in this market with a 67% market share. JPY single currency basis trading remains a large market […]

Mechanics and Definitions of Carry in Swap Markets

We take a look at the cost of carry in Interest Rate Swap trading. We analyse both 2y vs 10y curve trades and a simple spot starting 10y trade. We also take a brief look at exchange traded derivatives to estimate the carry on short-term interest rate futures. Positive carry trades can provide a strong […]

Scandie Swaps

We take a look at Scandie swaps through the lens of our data products. SEK are the most traded currency, seeing an average daily volume of $19bn, and a monthly total of $290bn. SEK is the 7th largest cleared currency in IRS trading. The US persons market accounts for around 20% of volumes. There is […]

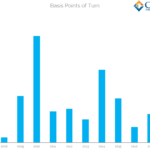

Cross Currency Basis and Turn of the Year

There was a huge move lower of 30 basis points in short-dated cross currency swaps on Thursday September 28th. This is because the “front roll” went over the turn of the year date. There is a huge disconnect for turn of the year pricing between USD Libor and Cross Currency basis. USD overnight interest rates […]

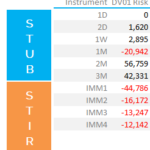

Mechanics of FRA Risks

Managing FRAs and Libor fixings on Swaps is complex. Short-end traders must balance their exposure between the Stub and STIR futures. Stub risk decays with time and changes with LIBOR fixings each day. It must therefore be carefully managed around event risks such as Central Bank meetings. IMM roll dates also result in PnL volatility […]

What is going on in Uncleared Derivative Markets?

We look at data from the BIS on Uncleared IRS. Notional Outstanding of Uncleared derivatives has been constant for the past year. The Gross Market Value of these derivatives has decreased by around 40%. The reduction in market value seems to be related to rates moving higher. Both Cleared and Uncleared markets have seen large […]

Bitcoin Meets OTC Derivatives

I attended the FIA event last week in Chicago. Much of the same stuff. Bank capital, swaps regulation, clearing, MIFID. And the obligatory panel on bitcoin. Over the past couple years, Bitcoin panels in our industry have tended to start out with the moderator making clear “we’re not going to talk about bitcoin the currency, […]