BIS 2016 FX Data – how much of the NDF market is Cleared?

We look at the FX data within the BIS triennial survey And show the evolution of NDF clearing since the UMRs came into force in September 10% of the market is currently being cleared, up from just 2% in April A background to NDF Data This blog will tie together a couple of themes from my recent blogs covering BIS […]

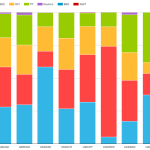

NDF Clearing – what is trading?

We look at the volumes being cleared in NDFs The growth is impressive, with nearly $200bn cleared in September This growth accelerated in the final weeks of September USDINR saw the highest volumes and USDBRL saw the largest growth Tod took a look at NDF clearing as of the 20th September, noting that volumes were really beginning to take-off. […]

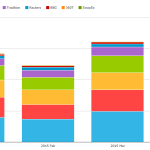

Brexit: FX Option and FRA Analysis

With the referendum just around the corner, it would be amiss if we did not update our analysis of EUR/GBP and GBP/USD FX Options ahead of the vote. We also take a look at GBP FRA activity, particularly the FRA switch over the 24th June. EUR/GBP and GBP/USD activity From SDRView Res, we can compare activity since […]

What is Multilateral Netting – FX NDF Clearing

Only a small portion of the NDF market is cleared We present theoretical exposures within bilateral and multilateral dealer networks to illustrate the reduction in Initial Margin that multilateral netting offers We can see that the motivation to clear varies with a dealer’s position And as positions change over time, more clearing leads to greater reductions in IM After my post last week […]

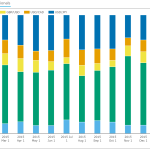

What’s going on – FX NDF Trading 2016

We update our periodic look at NDF markets for 2016. Over $1.1 trn in NDFs are regularly reported each month to SDRs. With up to 50% of the market traded on-SEF. March 2016 saw record volumes transacted on-SEF with over $500bn trading for the first time. Global cleared volumes have increased to nearly $75bn per […]

BREXIT: What do the FX Option volumes tell us?

Regular readers may recall that we looked at the break of the SNB’s EUR/CHF cap back in January 2015 in this blog. “Francaggedon” was a unique event without any pre-warning, and yet we were still able to see evidence in the data of fortuitous/lucky/profitable trading strategies in fairly decent size. Now that the “Brexit” referendum […]

FX Options Data on the SDR

Chairman Massad has been vocal recently in his intent to clean up the quality of the data in the SDR. I recall him a few months ago speaking about the progress the CFTC has made policing the industry on data quality for vanilla interest rate swaps, so I thought I’d go have a look at […]

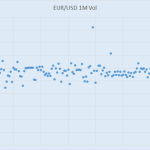

FX Options Trading On SEFs

In this article I will look at FX Options trade volumes as reported to US Swap Data Repositories and volumes published by US Swap Execution Facilities. This analysis highlights the following: Vanilla FX Option volume averages 24,000 trades a month in the largest 10 currency pairs EUR/USD is the most active pair with up to […]

FX NDF Trading On SEFs: April 2015 Update

It is more than a year since I last looked at FX NDF Trading On SEFs (Jan 2014) and as that was one of our Top 10 Blogs of 2014, it is long overdue for me to see What the Data Shows. April 2015 Lets start with SDRView and the latest volumes in the four largest currency […]

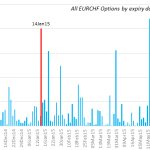

FX Options and the Swiss National Bank

What can we say about the SNB move that hasn’t already been covered? Simple – we can indulge everyone’s latent voyeuristic tendencies and look at what positioning may have been like in EURCHF OTC FX Options at the time of the SNB announcement. FX Options in SDRView This is an area we haven’t highlighted in […]