Microservices: ISDA SIMM™ in R

The Clarus API has a function to compute ISDA SIMM™ from a CRIF file contain portfolio sensitivities. What-if analysis can be performed in addition to the portfolio margin calculation. The function is very easy to call from many popular languages, including R, Python, C++, Java and Julia. What is R? R is a language and […]

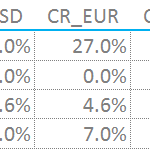

ISDA SIMM™ in Excel – Cross Currency Swaps

The ISDA SIMM™ methodology has been expanded to include Cross Currency Swaps. We explain in detail how to create the required input sensitivities. These sensitivities are not the typical cross currency basis risk that a risk management system would calculate. Once the input sensitivities are calculated, the calculation of Initial Margin follows the typical SIMM equations. We show how […]

Microservices: A SIMM Sensitivities Calculator

The Clarus API has a function to compute SIMM sensitivities from many trade description formats, including FpML and CSV trade lists. Results are in ISDA SIMM™ CRIF file format. The function is easily called from popular languages, e.g. Python, R, Julia, C++, and Java. Many related functions are available, see our API documentation. Calling directly […]

ISDA SIMM™ in Excel – Equity Options

We build an IM calculator in Excel for Equity Options under ISDA SIMM™. The methodology builds on the margin methodology for Swaptions, and uses very similar formulae. We cover all forms of IM. This blog is for the Vega and Curvature Margin. There are subtle differences to the implementation for Rates. UPDATE: We now offer free […]

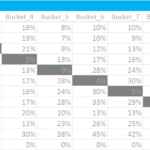

ISDA SIMM™ in Excel – Equity Derivatives

We build an IM calculator in Excel for Equity Derivatives under ISDA SIMM™. The methodology builds on the margin methodology for Rates products, and uses very similar formulae. We cover all forms of IM. This blog is for the Delta Margin. There are subtle differences to the implementation for Rates, mainly around the concept of “buckets” […]

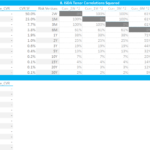

ISDA SIMM™: Concentration Thresholds

Concentration Thresholds are introduced as part of Version 1.2 of ISDA SIMM™ as of 4th February 2017. We must derive our own co-variance matrix between currency pairs in order to implement the new concentration thresholds into our ISDA SIMM Excel calculator. We provide a step-by-step guide that builds on our previous explanations of the model. UPDATE: […]

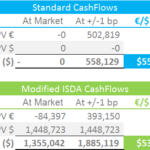

VM Big Bang – Analysing CSA Amendments

The VM Big Bang deadline is on March 1st 2017. We explain how a CSA governs Variation Margin for OTC Derivatives. ISDA are providing a Variation Margin protocol, allowing industry participants to efficiently amend their bilateral margin agreements (CSAs). We analyse what some of the changes could mean from a pricing perspective. Using a simple example, we highlight why the […]

ISDA SIMM™ – Swaptions IM in Excel

We build an IM calculator in Excel for Swaptions under ISDA SIMM™. The methodology builds on the margin methodology for linear products, and uses very similar formulae. There are some subtleties around multiple currency portfolios that we expand upon. We also introduce the concept of Curvature Margin which is calculated via theta and lambda multipliers. UPDATE: We […]

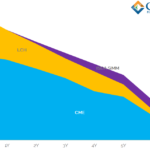

ISDA SIMM™ IM Comparisons

Clarus tools calculate margin under LCH, CME and ISDA SIMM™. It is a natural question to compare the three models. There are interesting differences across currencies and tenors. We find that SIMM is up to 37% higher than at a CCP. At last….! This blog has been sitting in my “to-do” box for long enough. It […]

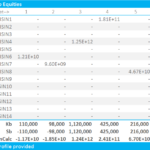

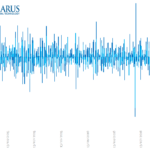

Calculating MVA under ISDA SIMM™

We describe how to calculate Margin Valuation Adjustments under ISDA SIMM™. This is a simple four step process starting with Risk Projection and IM calculation. And concluding with present valuing the margin costs. We then compare the MVA adjustments for both cleared and uncleared swaps. What is a Margin Valuation Adjustment (MVA)? As Amir stated back […]