What is the Impact of the ICAP and Tullet Deal?

The recent announcement of the ICAP and Tullet deal (see ICAP’s statement) has resulted in a lot of press coverage, see Financial Times (subs required) or The Guardian or Bloomberg for details. The transaction will result in Tullet taking over ICAP’s brokerage business (with ICAP retaining a minority stake in the Tullet Prebon Group) and ICAP focusing on its […]

Performance of Block Trades on RFQ Platforms

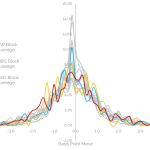

The nature of swaps trading (RFQ to 1 participant for example) means that there can be a motivation to trade large-sized tickets in an old-school fashion – bilaterally. Therefore, unlike more mature electronic markets, these orders are not sliced’n’diced. This means that not only the performance of these large trades can be monitored in public data…. […]

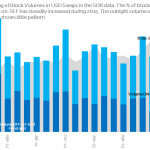

Identifying Customer Block Trades in the SDR Data

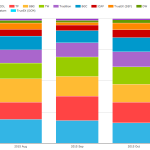

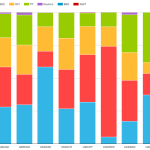

Following up on our previous blog, What’s the story behind Tradeweb block trading? Regulations mean that different market participants will transact trades of block size in different ways This allows us to identify whether a block trade is transacted across a D2D venue, Tradeweb or Bloomberg We therefore have increased transparency as to whether these […]

What’s the story behind Tradeweb block trading?

Tradeweb appear to have a 75% market share for Dealer-to-Customer Block trading which has increased substantially since the early days of SEF trading This is against a backdrop of fairly stable overall block activity… …but more and more block trades are being done on-SEF rather than off-SEF. Sadly, this may raise a question over good ol’ voice broking… […]

FX Options Trading On SEFs

In this article I will look at FX Options trade volumes as reported to US Swap Data Repositories and volumes published by US Swap Execution Facilities. This analysis highlights the following: Vanilla FX Option volume averages 24,000 trades a month in the largest 10 currency pairs EUR/USD is the most active pair with up to […]

SEFs in Japan: ETP Data

Japan has joined the SEF party with their own flavor of trading venues known as Electronic Trading Platforms (ETP’s). ETP’s launched last week on Tuesday, September 1st. Amir had written about them back in April. Some rules have since been tweaked, and of course we now have some data. Lets have a look at everything. […]

Is an All-to-All SEF Market about to arrive?

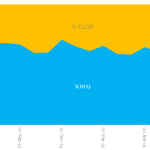

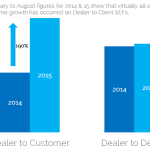

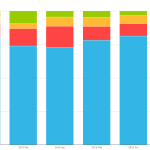

We combine SEFView and SDRView to strip out Compression flows from D2C SEFs. This allows us to make interesting comparisons between the Dealer to Client (D2C) and Dealer to Dealer (D2D) markets. D2D USD volumes have stagnated year-on-year. D2C volumes have exploded higher by 190%. This is before we even start talking about EUR swaps…. […]

What is the deal with Agency Execution of Swaps

I’ve been wondering about the success of agency execution firms such as UBS Neo. The headline sales pitch for such a service seems to be: One technical integration/onboarding exercise to just one “SEF”, gaining a firm access to the liquidity of all 20+ SEF’s combined. A firm does not need to sign up and review/stay in […]

CFTC’s Roundtable on the Made Available to Trade Process – July 15, 2015

Amir presented ‘Data-based assessment of MAT’ at the CFTC’s division of market oversight roundtable on MAT meeting last week. The meeting has been recorded and is available on youtube (section starts at 0.53.04), (watch out for Tod in the audience at the top-left of the shot). The presentation slides are available for download here, […]