- We detail the FX Swap lines offered by several central banks to supply their local markets with USD.

- For the mechanics of how the USD trades work, please see our previous blog.

- In this blog, we look at the usage of the FX Swap Lines per central bank.

Volatility

Markets remain in crisis mode. This can be somewhat tricky to judge if you are not day-to-day involved in trading. There remain two good indicators of how unusual these times are from a trading point of view.

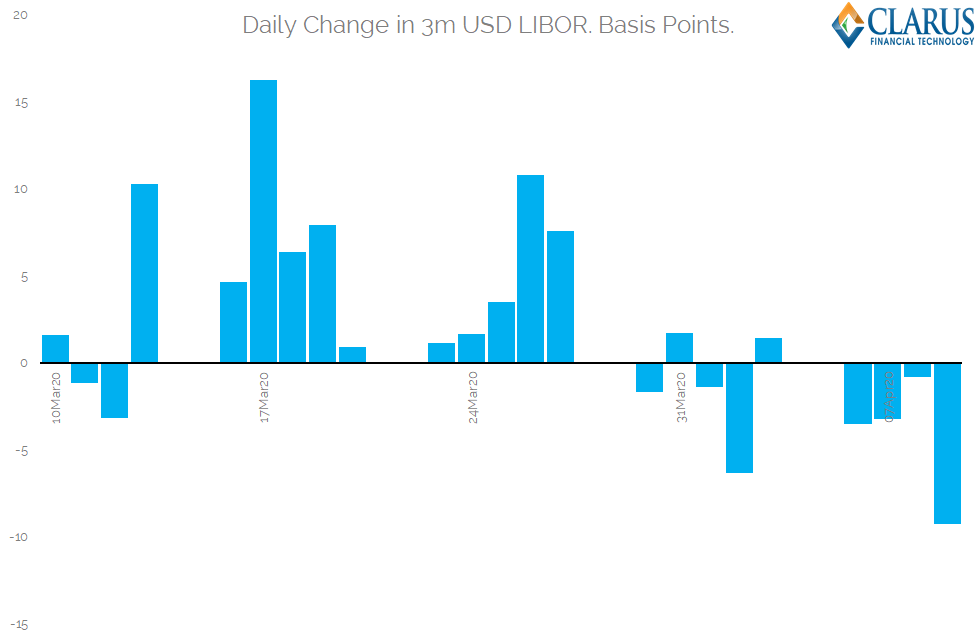

One is USD LIBOR:

Showing;

- The daily change, in basis points, of the 3 month USD LIBOR fixing for the past month.

- It is highly unusual for such a fixing to exhibit this roller-coaster behaviour.

- On Friday alone, we saw the biggest drop in USD LIBOR for a looooong time. It fell by 9 basis points.

- At the turn of the month, it increased by 11 and 7 basis points on consecutive days. These are crazy moves, only seen during crisis times.

These moves in the fixing of course impact derivatives markets as well. Cross Currency swaps still trade versus ‘IBOR indices, although the level of the basis is more typically tracked in “FX OIS” space at the moment, due to the volatility of ‘IBOR vs OIS spreads in the two currencies. This is acutely evident in the EURUSD market right now, where FRA-OIS spreads have tightened in USD as a result of the lower LIBOR fixing on Friday, and yet are widening in EUR.

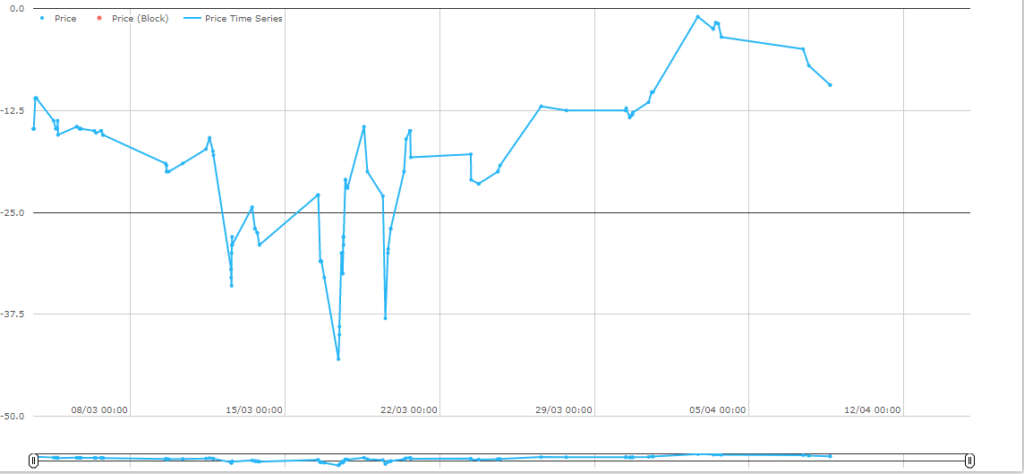

This is shown in the volatility of EURUSD basis at the moment. Outright chart of 1 year EURUSD XCCY Basis:

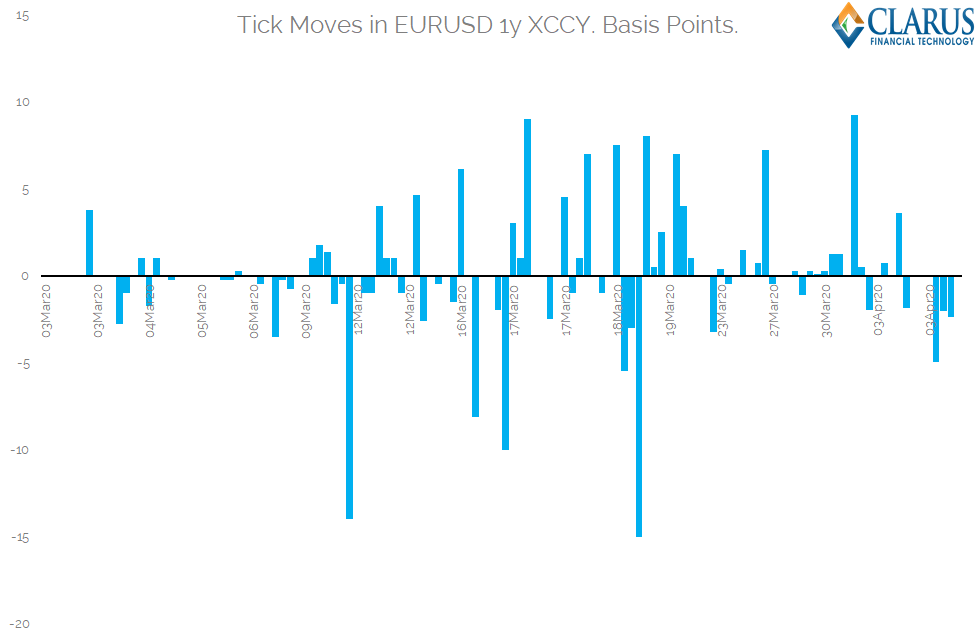

And then looking at the jumps in price between each trade – the so-called “Tick Size”:

- This shows the change in price between consecutive 1y EURUSD XCCY trades reported to the SDRs.

- This does not capture the whole market, but the extreme moves tend to show how much the basis “jumps” overnight as expectations for ‘IBOR fixings are re-evaluated each morning.

- This level of volatility is again extreme relative to typical market conditions.

Keeping Track

Markets remain volatile. This is not news. However, the number and variety of facilities that have been launched by central banks (particularly the Fed in the US) to quell the causes of this volatility are becoming difficult to keep track of.

I therefore wanted to document at least one of these facilities in detail so that I have a reference for how much of the facility is actually being used.

If this proves popular, we can look to repeat for the other crisis responses.

Central Bank Swap Arrangements

My fascination with the FX swap lines between central banks is because:

- USD Libor fixings are behaving like a lottery (“random number generator”) at the moment. This has knock-on effects across all Rates derivatives. Anything that can reduce this volatility is a good thing for trading conditions.

- There is transparent, timely data released for the usage of each facility.

- I used to trade cross currency swaps!

Whilst the data is good to have, it also needs context. So let’s look at the size of each facility offered.

Unlimited FX Swaps

There have been “standing” USD swap lines in place with the five central banks below since October 2013. The operations have been stepped-up recently to offer daily access to 1 week USD funds, and weekly access to 84-day USD funds;

- Bank of Canada

- Bank of England

- Banks of Japan

- European Central Bank

- Swiss National Bank

Usage of these lines has been almost zero since 2014, but has stepped up as a result of COVID-19. We covered this in our recent blog, and the FRED website includes a lovely interactive chart of the uptake. The amount of USD currently being offered is “unlimited” in these operations.

Limited FX Swaps

There are also swap arrangements in place with other central banks. The following have access to $60bn each (I guess aggregated across maturities, in any combination there-of);

- Reserve Bank of Australia

- Banco Central do Brasil

- Bank of Korea

- Banco de Mexico

- Monetary Authority of Singapore

- Sveriges Riksbank

And the following have access to $30bn each;

- Danmarks Nationalbank

- Norges Bank

- Reserve Bank of New Zealand

These limited lines will initially be made available for at least six months.

FIMA Repos

Finally, what to do if you are not on that list? As ISDA have just noted, Emerging Markets are heavily reliant on USD funding.

To help bridge this gap, it is now possible to repo any US Treasury securities held in a FIMA (“Foreign and International Monetary Authorities”) account directly with the Fed. This allows central banks to temporarily exchange their USTs for USD cash. I guess this could then be made available to local market participants.

Data

My main motivation for writing this week was the excellent data the Fed now make available on the allocations across these facilities.

The “Amounts Outstanding” are clearly split across the Central Banks in this file from the New York Fed website.

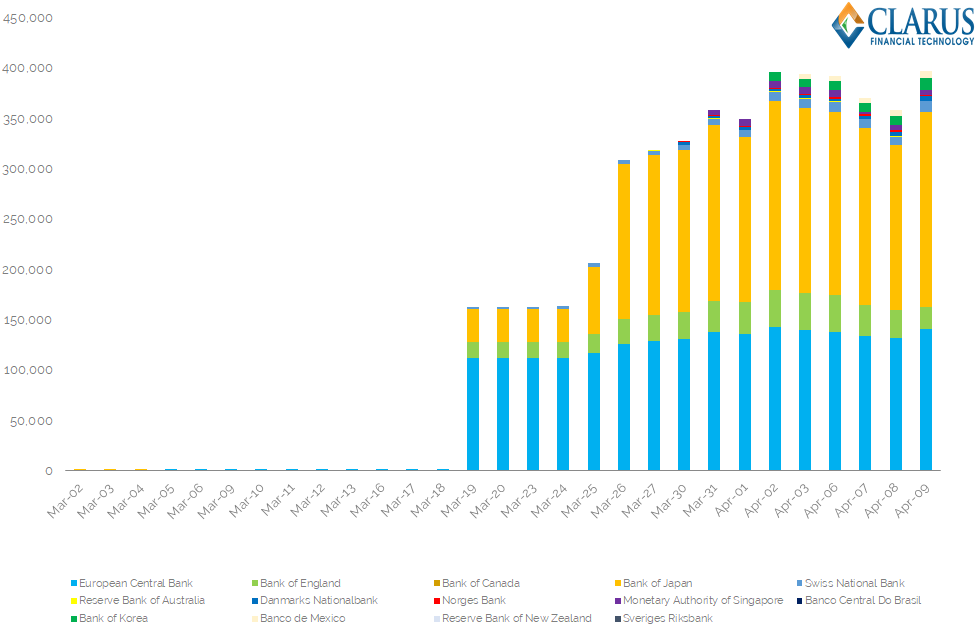

Showing;

- Japanese banks are the largest users of the USD funds. They have ~$193bn outstanding as at 9th April 2020.

- European market participants are in second place at ~$140bn outstanding.

- In fact, so far, the five central banks with unlimited, standing facilities, account for over 92% of the usage of “foreign” access to USD funding.

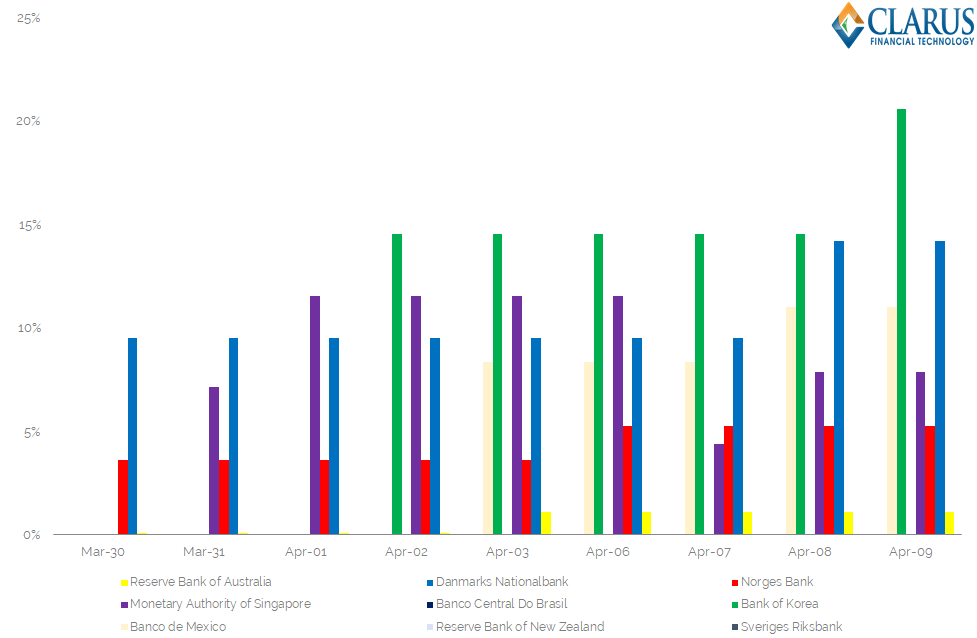

I wanted to perform a bit of further analysis on how much of the $30bn or $60bn lines each of the “smaller” central banks were using.

Showing;

- Bank of Korea is using the largest percentage of its total limit. It surpassed 21% last week. Still plenty of headroom there.

- Second is Denmark at 14%. Looking at the results, this has been spread across 4 market participants and is almost all in three month maturities.

- Mexico at 11% and Singapore (as high as 12% now down to 8%) are also notable.

Further Reading

In a brilliant exhibition of transparency, the hand-signed bilateral agreements between the central banks are also available on the New York Fed website:

Well worth a read for those of you still trying to understand the exact Mechanics of these swaps – as well as reading our blog too of course!