Clearing of Credit Index Options is a product to watch in 2021 with recent announcements from both ICE Clear Credit and LCH CDSClear.

- In early November, ICE launched clearing for Options on CDX NA.IG and CDX.NA.HY

- In early December LCH CDSClear went live with Options on CDX.NA.IG and CDX.NA.HY

- To add to those on iTraxx Main and iTraxx Crossover that LCH CDSClear announced in December 2017

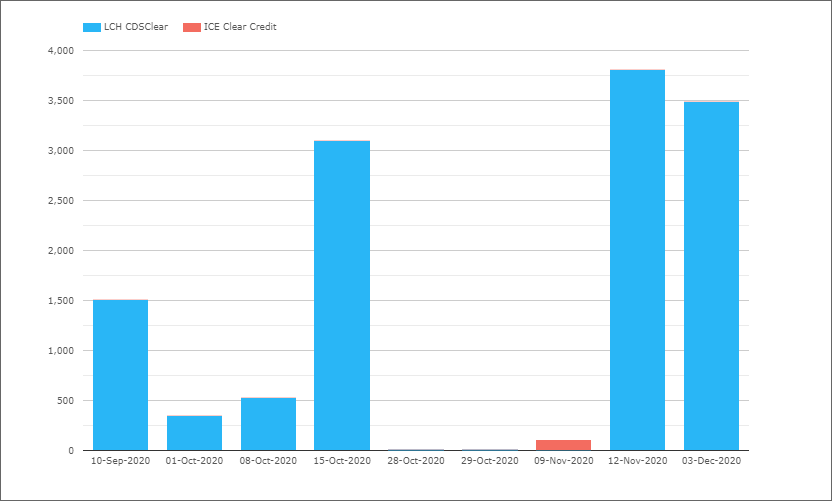

Daily Volumes

Let’s start by using CCPView to look at the cleared volume, which shows that only 9 days in the past 3 months had any volume.

- LCH CDSClear with a cumulative $12.8 billion or €10.9 billion of single-sided gross notional, all in either iTraxx Main or iTraxx Crossover and a singe day high of €3.3 billion on 12-Nov-2020

- ICE Clear Credit with $110 million of single-sided gross notional on 9-Nov-2020.

Showing that clearing of Credit Index Options is still in it’s infancy.

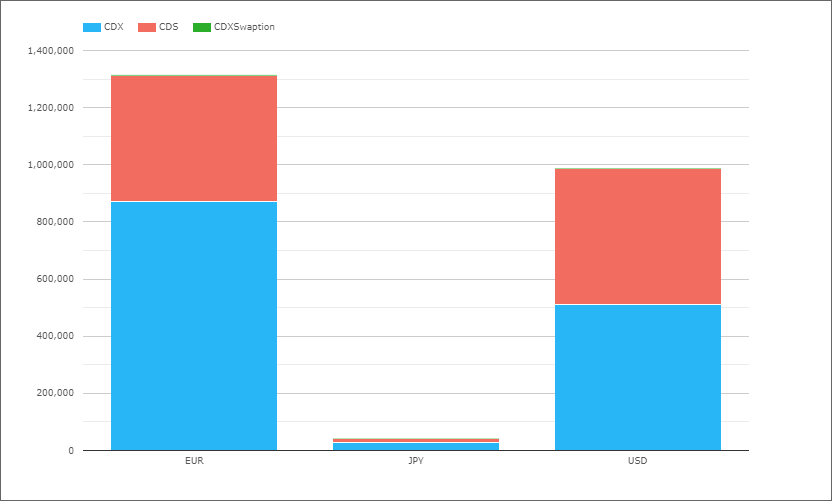

Open Interest in Credit Derivatives

Let’s take a look at cleared credit derivatives by currency and product type using open interest.

- Credit Indices in EUR the largest with $870 billion or €720 billion

- Credit Indices in USD next with $510 billion

- Single name CDS in USD with $475 billion

- Single name CDS in EUR with $440 billion or €365 billion

- Credit Indices in JPY with $28 billion

- Single name CDS in JPY with $12 billion

- Credit Index Options in EUR with $3.4 billion or €2.8 billion

- Credit Index Options in USD with $110 million

Meaning that for Credit Index Options in EUR (ITraxx) the open interest is only 0.4% of the Index itself, suggesting that there is a lot of room for growth.

Bi-lateral Credit Index Options are subject to Uncleared Margin and if these are delta-hedged with the Index as a cleared trade, then the delta component of SIMM will be significant and act as an incentive to clear the option trade.

It will be interesting to see if Credit Index Options volumes increase significantly in 2021.

The recent launches by ICE and LCH suggests their is interest from market participants.

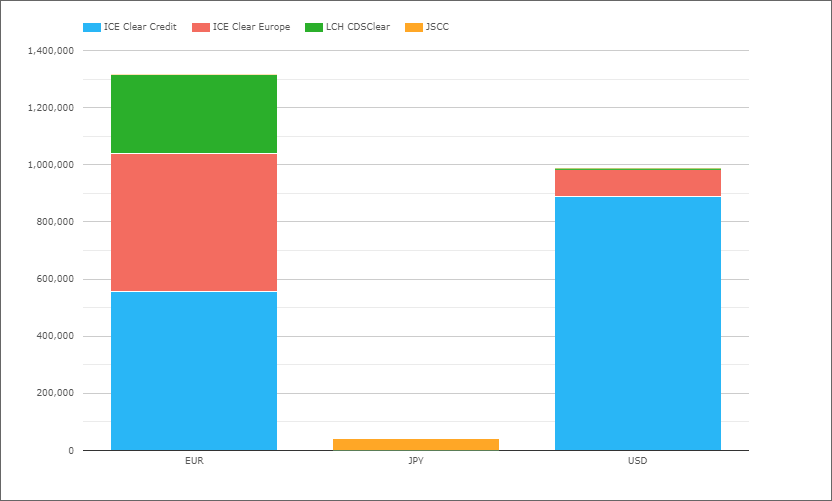

Open Interest by Clearing Service

Before we end, let’s look at the above chart by split by Clearing Service.

- ICE Clear Credit with $1.44 trillion

- ICE Clear Europe with $580 billion

- A combined $ 2 trillion at ICE

- LCH CDSClear with $277 billion

- JSCC with $41 billion

Market share by Clearing Service, Currency and Product is also one to watch in 2021.

That’s all for today.