What You Need To Know

Swaps Regulation 2.0 is a whitepaper that was presented by Chairman of the CFTC, Christopher Giancarlo, at the annual ISDA AGM. The paper sets out 6 broad areas of reform for Swaps markets. We looked at (1) Trade Execution and (2) Trade Reporting in Part One.

This week, we look at sections (3) through to (6). If the previous blog was about trading, this is about the post-trade life of a swaps contract. Read on to find out what Chairman Giancarlo had to say about potential reforms for CCPs, capital requirements for banks and uncleared margin models.

3. CCP Reform

The white paper is about more than just SEFs. There is a whole section focused on CCPs and how critical they now are to the functioning of swap markets. (Clarus data shows just how critical CCPs are – not just for IRS, but OIS, Inflation and NDFs since the advent of Uncleared Margin Rules).

The white paper is about more than just SEFs. There is a whole section focused on CCPs and how critical they now are to the functioning of swap markets. (Clarus data shows just how critical CCPs are – not just for IRS, but OIS, Inflation and NDFs since the advent of Uncleared Margin Rules).

As you would expect, the paper is very detailed, and the section on CCPs in particular provides background information that we don’t see covered elsewhere.

For example, just how does a CCP manage the risk of a defaulting member? In an auction process:

Footnote 15: More precisely, as soon as possible after a default, a CCP hedges the market risk of no longer having a matched book. Then, through an auction, the CCP transfers the defaulted positions and the hedges to one or more clearing members. In practice, most of the liquidation costs are incurred in the hedging rather than the auction phase of replacing defaulted positions.

This subtlety in the process isn’t obvious. i.e. after a default, a CCP first puts on “macro” hedges that broadly neutralise the risk of the portfolio (I guess it would be outright and curve risk?). These are transacted as new trades (“hedges”). These are then bundled together with the defaulted portfolio and auctioned off. According to the paper, most of the “costs” incurred in the default process are during step one – hedging the outright risk.

So how are these costs dealt with? The paper goes on to describe a so-called “default waterfall” (page 13), which is designed to cover the costs in different ways:

1. Margin of the defaulting customer or member;

2. Guaranty funds of the defaulting member;

3. Skin-in-the-game;

4. Guaranty funds of non-defaulting members; and

5. Assessments on non-defaulting members.

The first two are “defaulter pays” in that the costs are borne by the estate of the defaulting member. Remember that in this “waterfall” of resources, we only proceed to the next level in the case that the previous level is exhausted. This is pretty unlikely when Initial Margin is already calculated at a 99%+ percentile for 5 day moves. Most of the hedging will have been completed by lunchtime of the first day I imagine!

The third level of this waterfall is how much money the CCP operator itself may have to pony up (most CCPs are for-profit companies, so this seems fair enough to me). Numbers 4 and 5 seem to be more into the murky world of trying to make sure the CCP continues as a going concern after a huge default.

The purpose of the whitepaper is to look at this process and see if reform is possible or desirable. For example, where should the resources of a CCP be invested – repo, commercial bank cash, cash at the federal reserve? What size of CCP should be able to hold cash at the Fed? There are no explicit answers in the paper, but plenty of areas for discussion.

There is also a focus on the need for further research into CCPs, because they are so much more important now than before the crisis (for Swap markets). Areas of research that the Chairman would like to see covered are:

- Correlated defaults and the associated network effects (e.g. if one member goes down, does this automatically increase the chances of more members defaulting).

- Liquidation costs – under difficult market conditions how much would/could/should the hedging process cost, bearing in mind that markets will be in stressed conditions.

- Waterfall design – are levels 1-5 of suitable size? There are regulatory guidelines already in place for some of this, but nothing seems to explicitly dictate the relative size of number 3 to number 4 for example.

There is also a whole section on Recovery and how resources should be correctly apportioned to make sure that CCPs can be a going concern even after huge defaults. This is something I hope none of us ever have to actually witness!

4. Capital

The section on Capital is all to do with the Leverage Ratio (or Supplementary Leverage Ratio (SLR) as it is called in the US). The paper takes issue with how the Current Exposure Methodology (still embedded into Basel III capital requirements) is used to calculate Leverage.

The section on Capital is all to do with the Leverage Ratio (or Supplementary Leverage Ratio (SLR) as it is called in the US). The paper takes issue with how the Current Exposure Methodology (still embedded into Basel III capital requirements) is used to calculate Leverage.

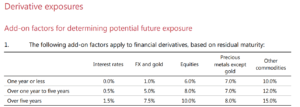

The paper highlights how crude this CEM methodology is, based as it is on gross notional and a maturity dependant add-on table. Furthermore, netting is not based upon trade direction, but on market value (and is capped at 40%).

The Chairman highlights a particular market shift in Clearing recently that aims to bring OTC derivatives onto a more even footing with futures contracts. Both from an accounting and reg cap perspective, OTC derivatives have been hampered by the concept that we should recognise a value on one side versus a collateral on the other. This both inflates balance sheets and makes the contracts a lot more cumbersome to manage than a futures contract. In reality, when margining occurs daily at a zero threshold, an OTC derivative is really just a cash-settled contract, the same as a future. This has recently been recognised in Clearing, as the Chairman points out:

The Chairman highlights a particular market shift in Clearing recently that aims to bring OTC derivatives onto a more even footing with futures contracts. Both from an accounting and reg cap perspective, OTC derivatives have been hampered by the concept that we should recognise a value on one side versus a collateral on the other. This both inflates balance sheets and makes the contracts a lot more cumbersome to manage than a futures contract. In reality, when margining occurs daily at a zero threshold, an OTC derivative is really just a cash-settled contract, the same as a future. This has recently been recognised in Clearing, as the Chairman points out:

The shift of variation margin to settlement for cleared swaps occurred, at least in part, because CEM was particularly punitive for swaps, as described.

Treating variation margin as settlement, however, reduced the capital requirement of swaps. Taking interest rate swaps as an example, CEM recognizes the higher risk of long-term swaps by setting the exposure of five-year or longer swaps as 1.5% times notional amount, of swaps between one and five years as 0.5% of notional, and swaps shorter than one year as 0%. By treating variation margin as settlement, so that the value of swaps is settled every day, all interest rate swaps were considered very short term and were calculated as having no exposure. The ten-year interest rate swap and the one-year interest rate swap were considered as having the same lowest category of exposure.

This helps with the add-on for CEM, but it still doesn’t help with the lack of netting. These are still large amounts of gross notional that are being capitalised. The Chairman acknowledges that SA-CCR (the proposed measure that will hopefully supersede CEM soon) goes a long way to adopting a more risk-based approach to exposure measurement for Leverage, but it still has limitations in its’ ability to recognise every last dollar of margin held. Instead, the preferred approach is to allow the approval of more internal models for capital requirements:

[F]or regulators to improve their capabilities with respect to approving and monitoring the use of internal models. The latter approach may be challenging with respect to both expertise and resources, but model supervision is an essential and indispensable part of an effective and efficient regulatory regime

5. End User Exception (Exemption?)

I always think this part should be called an End User Exemption, but the “Exception” terminology has been carried over in this paper as well. The following text is lifted straight from the paper:

1. The CFTC should continue to provide relief to small banks from clearing requirements by codifying existing no-action relief and considering incremental regulatory changes;

2. “Material swaps exposure” thresholds, below which entities are excepted from uncleared margin requirements, should be reworked, measured in units more meaningful than notional amounts, and should apply to variation margin as well as initial margin;

3. A material swaps exposure threshold should be applied against the clearing requirement, as well; and

4. Rules governing uncleared initial margin calculations should be much less prescriptive and should not be biased in favor of cleared products.

6. Uncleared Margin

I didn’t expect this bit at the end. I was under the impression that everyone loved ISDA SIMM? Our blogs are certainly very well read. However, there are concerns in this paper over why regulators chose a 10-day margin period of risk over which to calibrate the model. The paper also questions why there are no offsets in the ISDA SIMM model for the same risks, when they are classified within different product buckets.

I didn’t expect this bit at the end. I was under the impression that everyone loved ISDA SIMM? Our blogs are certainly very well read. However, there are concerns in this paper over why regulators chose a 10-day margin period of risk over which to calibrate the model. The paper also questions why there are no offsets in the ISDA SIMM model for the same risks, when they are classified within different product buckets.

There is a specific criticism of ISDA SIMM that I hadn’t been made aware of before. From the paper:

[H]aving a single, global model for swaps is not desirable. SIMM charges too much for small, relatively liquid positions and too little for large, relatively illiquid positions.

I thought the Concentration Thresholds in ISDA SIMM were calibrated (or could be) to avoid this, but I get the impression from the paper that a one-size fits all model is maybe not preferable. The paper therefore suggests adopting a number of different internal models:

Regulators will certainly find it a challenge, with respect to both expertise and resources, to examine, approve and exercise surveillance over uncleared margin models. But, once the assumption has been made that the financial industry cannot be relied on to police itself, the active scrutiny of models is an essential dimension of regulation.

That seems like a great note to finish upon.

In Summary

- Swap Execution will probably become simpler via more flexible execution methods in the future.

- CCPs may face different requirements in the design of their default waterfalls and the resources they have at hand.

- Banks may see changes in capital calculations (particularly for leverage ratio) by gaining regulatory approval for their internal models.

- End users will continue to be given relief from many of the regulations.

- ISDA SIMM may no longer be the sole Uncleared Margin model.

- The CFTC will rise to the challenge of increased model scrutiny for both capital and uncleared margin requirements.

Thanks for altering me to this paper. The tone from the CFTC is one of recognition that rule making is hard and needs to learn from hindsight. They have taken on board a new recognition that measuring risk in the OTC market needs considerable refinement, such that the behaviour of the market is not forced arbitrarily into unwanted directions. The paper is a good education on reporting, margin, clearing and capital and should be understood by everyone in the US, and most outside.