- KCCP defines the amount of capital that must be held versus default fund contributions at a CCP.

- The lower the value of KCCP, the lower the overall cost of clearing.

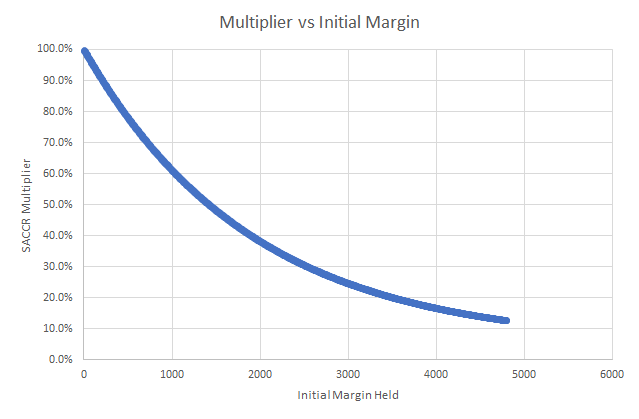

- The SACCR multiplier used to calculate KCCP suggests that KCCP reduces for every extra dollar of Initial Margin posted at a CCP.

- We look at the relationship between KCCP and Initial Margin for 6 large Clearing Services.

KCCP – What is It?

Central clearing is capital efficient, and for many asset classes it is more capital efficient than alternatives (e.g. bilateral trading). No surprises there.

However, not immediately obvious is that Clearing carries a capital cost for default fund contributions. This is because a member has to fund (potentially mutualised) losses.

The calculation for how much capital has to be held against these default fund contributions is defined in bcbs282, “Capital Requirements for Bank Exposures to Central Counterparties”. A key component of the capital cost is the “hypothetical capital requirement of the CCP due to its counterparty credit risk“.

ONLY a CCP can calculate the KCCP figure.

Fortunately, the value of KCCP is now published quarterly via CPMI-IOSCO disclosures. These are available as part of a CCPView subscription.

The formula a CCP must use to calculate KCCP is as follows:

\( \tag {1} K_{CCP}= {\sum\limits_{CMi}{ EAD_i . RW . capital ratio}}\)Where;

EAD is the exposure at default for member i.

RW is a risk weight of 20%.

Capital ratio means 8%.

The value of this KCCP variable is a key factor in determining how much capital must be held versus default fund contributions at any given CCP. Let’s look at the data.

KCCP – What Has Been Happening?

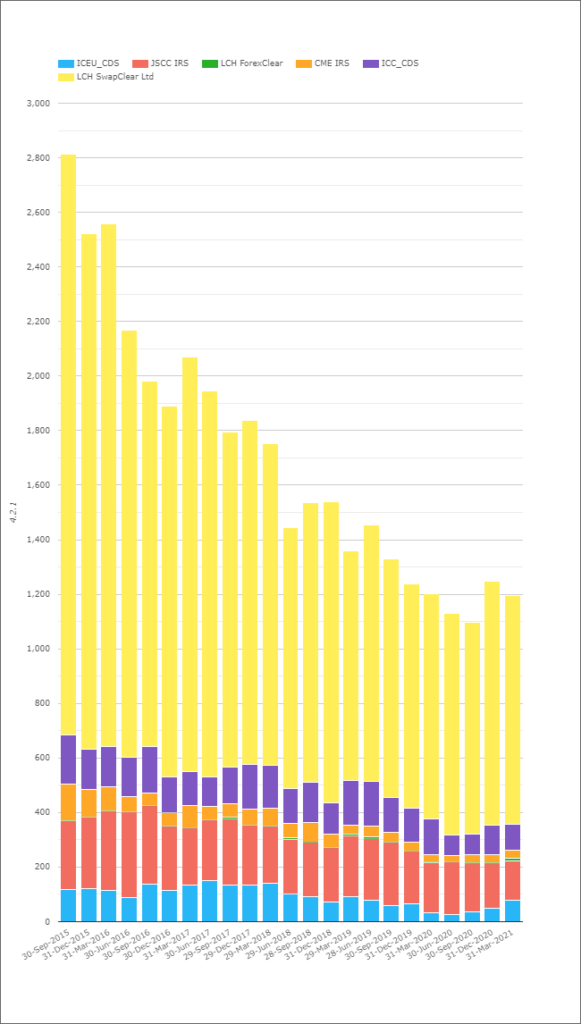

In CCPView, we now have an impressive history of CCP data for the past 6 years. Looking at KCCP for some of the major clearing services shows an almighty decline:

Showing;

- KCCP values as reported via CPMI IOSCO disclosures for LCH (SwapClear and ForexClear), JSCC, CME (IRS) and ICE.

- The overall value across these 6 Clearing Services has reduced markedly in the past six years.

- The combined KCCP was 2,812 in September 2015.

- This has reduced to 1,193 in March 2021.

- This reduction has been seen across all of the CCPs.

- SwapClear 61% reduction.

- CME IRS 78% reduction.

- ICE Clear 34-47% reduction.

- JSCC 43% reduction.

KCCP versus Initial Margin

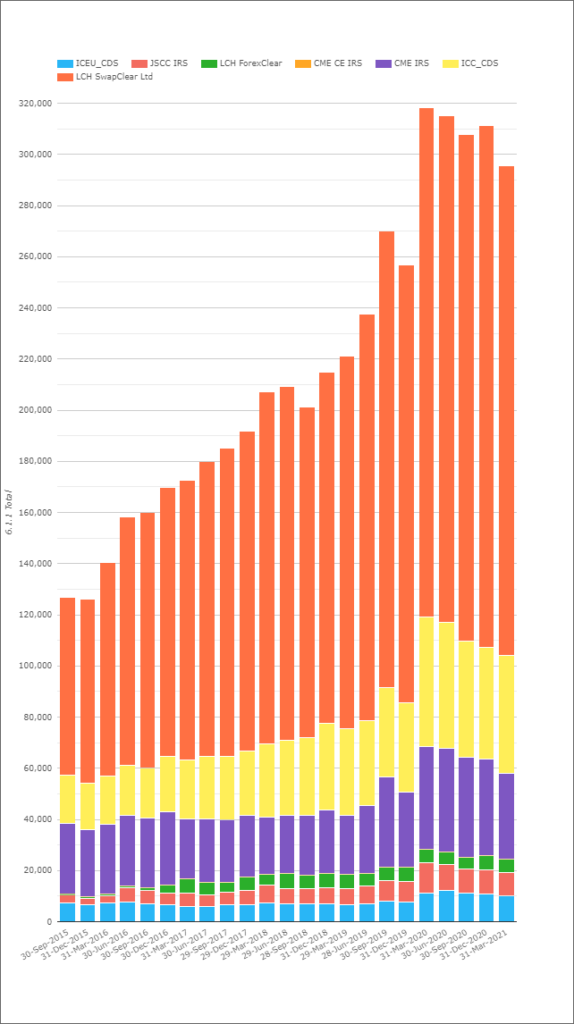

How can KCCP keep on declining year after year? How does KCCP decline even during the almighty market volatility we saw during March 2020? Maybe highlighting how counterintuitive this is, take a look at how Initial Margin has changed over the same period at the same Clearing Services:

This initial margin charts shows;

- Total Initial Margin Required as reported via CPMI IOSCO disclosures for LCH (SwapClear and ForexClear), JSCC, CME (IRS) and ICE.

- The overall IM across these 6 Clearing Services has increased markedly in the past six years.

- The combined IM was $126.8bn in September 2015.

- This has increased to $295.5bn in March 2021.

- This increase has been seen across all of the CCPs.

- SwapClear 276% increase.

- CME IRS 123% increase.

- ICE Clear 134-241% increase.

- JSCC 304% increase.

So if IM is increasing, suggesting more members and more risk in the Clearing Services, why is KCCP, which is meant to measure the hypothetical capital requirement of the CCP due to its counterparty credit risk decreasing?

We need to really geek out to work out why.

SACCR EADs and the Multiplier

As our clients well know, we offer a SACCR Calculator via CHARM, via Microservices and via Excel. We have detailed the calculations behind these tools in a previous blog, SA-CCR – EXPLAINING THE CALCULATIONS. The overall calculation for SACCR exposures is pretty straight-forward:

EAD = Alpha * (Replacement Cost + Multiplier * AddOn)

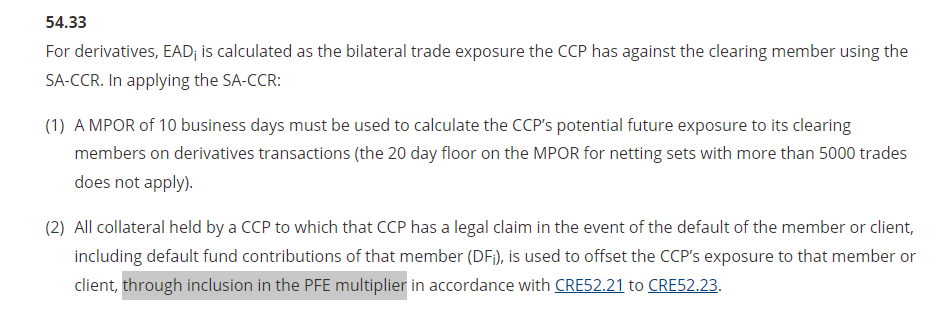

Looking at each term in this equation has lead us to investigate the impact that the SACCR “Multiplier” potentially has on KCCP. From BCBS CRE54, Capital Requirements for Bank Exposures to Central Counterparties:

This suggests to me that any IM held by a CCP can therefore impact the Multiplier in the calculation of KCCP. Let’s geek out further on the Multiplier then.

The SACCR Multiplier

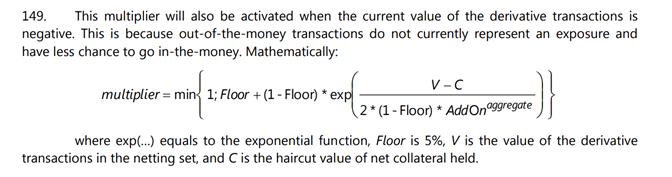

Those averse to a bit of maths, look away now! To anyone still reading (!):

Breaking this down leads to the following;

- “V-C” in the above is typically assumed to be zero from a CCP’s perspective because they call the amount of Variation Margin (C) they need to cover the current mark to market of the derivative.

- However, if you include Initial Margin (plus any other collateral held such as Default Fund contributions) in this equation as well, then the derivative portfolio will always be overcollateralised (by at least the value of IM) and therefore V-C will be negative.

- This means that as the Initial Margin held by a CCP for a given member increases, the multiplier will decrease and the EADs calculated under SACCR will decrease.

- This is shown graphically below:

It is not a one-to-one equation (it is exponential), but for each extra $1 of Initial Margin posted at a CCP the value of the SACCR exposure (“EAD”) will decrease. This in turn will decrease the overall value of KCCP that the CCP then calculates.

Equally, every extra dollar of default fund contribution will also lead to a reduction in the multiplier, a reduction in EAD and hence a reduction in KCCP.

2+2 = 4.1?

A word of warning – don’t believe everything you read on the internet! We haven’t had a chance to vet this with CCPs themselves yet, but the maths behind the calculations certainly looks compelling. It is the only explanation I can think of that explains why KCCP has been decreasing so aggressively over the past six years.

If anyone has any comments/corrections, the Comments are open below ↓ or reach out to us at [email protected].