A Final Check-In On RFRs For The Year

This is my final blog for the year, but the 2023 retrospectives will have to wait for January once all of the data is in. However, as the year draws to a close, I doubt 2023 will be remembered as the year that USD LIBOR finally ceased. That has to be considered a good thing. […]

What’s New in CCP Disclosures – 3Q23?

Clearing Houses have published their latest CPMI-IOSCO Quantitative Disclosures showing IM for ETD at $438 billion is down 2.5% QoQ and down 20% YoY, while IM for IRS at $283 billion is down 11% QoQ and up 1% YoY.

Read more to get all the detail.

What is the latest European plan to onshore rates trading?

Almost exactly a year ago, the EU proposed requiring market participants subject to a clearing obligation to clear a portion of the products that have been identified by ESMA as of substantial systemic importance through active accounts at EU CCPs.

The unknown in the past 12 months has been how the EU will define the “Active Account Requirement (AAR)”. In the past few days […]

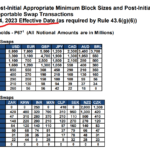

Dec 4th has been and gone. Where are our new block sizes please?

Back in June 2023, I covered the new block sizes that were due to come into effect on 4th December 2023. In case you missed them, please take a look before reading today’s blog: However – in what appears to be new news – the CFTC issued a No Action letter late in October to […]

What You Need to Know About INR Swaps

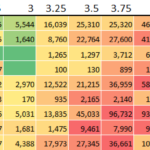

Where do INR Swaps Rank on the Global Picture? CCPView allows us to compare the relative size of INR swap markets to other currencies. Taking out the “G6” – USD, EUR, GBP, AUD, CAD and JPY – we see the below: Showing; Let’s look further into the INR Swaps market. Two Thirds of Cleared Volumes are […]

Time Series of Swap Prices and Volumes

Analysing existing datasets in new and novel ways, often throws up interesting insights and questions which help with our understanding of the real world and in turn help us to make better decisions. Today I wanted to showcase a new feature in SDRView, that demonstrates this, the Ticker Summary View. SDRView has transaction level data […]

Swaption Volumes by Strike Q3 2023

Sometimes this blog would benefit from another Chris Barnes or Amir Khwaja! It has taken me until the tail-end of 2023 to revisit one of the most popular topics on the Clarus blog – Swaptions: I do not know which of the ~85 blogs I should not have written since I last wrote about Swaptions, […]

New Musings on RFRs

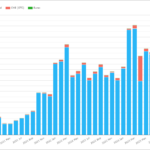

This week I will start with a chart – the DV01 traded in USD OIS per month over the past three years: Showing; For the second chart today, consider the same data, but split by OIS Index – SOFR or Fed Funds: Showing; Overall, 26% of OTC OIS risk was traded versus Fed Funds – […]

Default Simulation Exercises by CCPs

In June 2019, I wrote a blog titled, CCP Default Management Auctions, in which I covered the BIS CPMI-IOSCO “Discussion paper on central counterparty default management auctions” and explained how Clarus CHARM helps clearing members with their default management obligations, both actual and firedrill tests. One of the points in the discussion paper was on […]

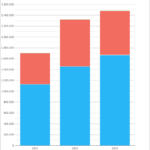

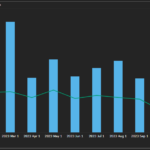

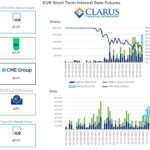

A new look at €STR Futures

In June this year I wrote that “We Need to Talk About €STR Futures“. RFR/€STR Adoption continues to be volatile in Europe, but €STR Futures have had a pretty good year so far, with monthly volumes increasing steadily: Showing; However, ESTR futures have only managed to grab a tiny percentage of the overall EUR STIR […]