- The MXN IRS market saw over MXN 6trn compressed in July 2016

- This compression activity was from the first TriOptima run in MXN at CME, resulting in a large notional reduction

- MXN markets also see significant volumes in Single Period Swaps – which are equivalent to FRAs in all but name

- For on-SEF Compression, all of the activity occurs on the TrueEx SEF.

Non G4 Compression Data

I spend most of my time looking at the G4 currencies in the SDR data. But we perform the same analyses on all currencies. This is valuable data, so let’s spend some time looking at the compression data in non G4 currencies this week.

As regular readers will know, we interrogate the incoming SDR data to identify particular patterns in the data. This process identifies whether a trade was transacted as part of a package – e.g. spreads and butterflies – and whether the trade was transacted via Compression (for cleared trades) or List traded (for uncleared trades).

However, due to a quirk of market infrastructure, this process also throws up trades in certain currencies that are traded as part of FRA matching sessions. These trades are not strictly speaking the same as Compression activity. A FRA typically hedges residual risks, whilst Compression is used to extinguish existing positions.

Why don’t we just filter out these FRAs I hear you ask? Well, in certain currencies, FRAs are booked as Single Period Swaps and hence reported as Fixed-Float IRS trades. Economically, these are near identical instruments, albeit with FRAs having settlement upfront and SPS settling at maturity. Some same-day currencies (such as AUD and CAD) have always tended to trade FRAs as SPSs. The JPY market has also always traded FRAs as an SPS, I believe due to regulations.

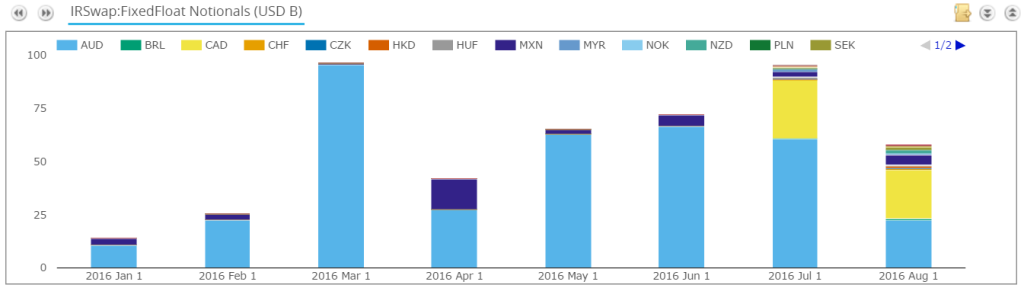

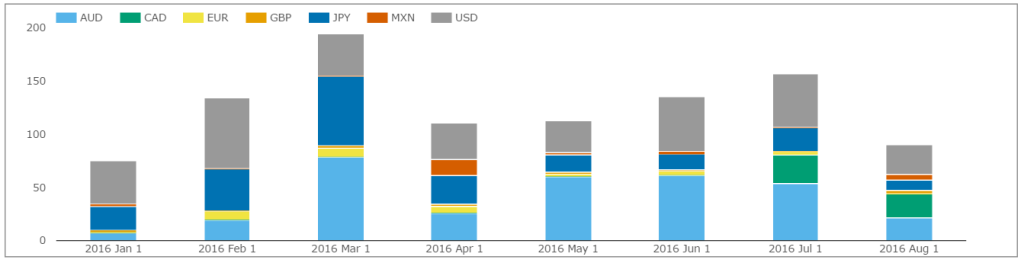

This has an important impact on the SDR data. Due to this market infrastructure quirk, it is the currencies that trade FRAs as SPSs that dominate volumes when we look at Compression and List data excluding the G4 currencies:

Showing;

- AUD and CAD volumes are significant due to the SPSs.

- Although it is somewhat surprising that CAD has only just recently seen substantial volumes in July and August.

- In third place is MXN. This surprised me as the MXN IRS market is much smaller in terms of volumes than the other currencies.

To extract true Compression volumes, we therefore currently mark all SPS, irrespective of whether they are Cleared or Uncleared, as the Package type “List” within the Clarus data products. Please feel free to contact us if you think we should look into adding an “SPS” product type instead.

Compression in MXN

Back to the data, and I decided to run the Compression query again and remove “List” trades. Et voila, MXN is still significant!

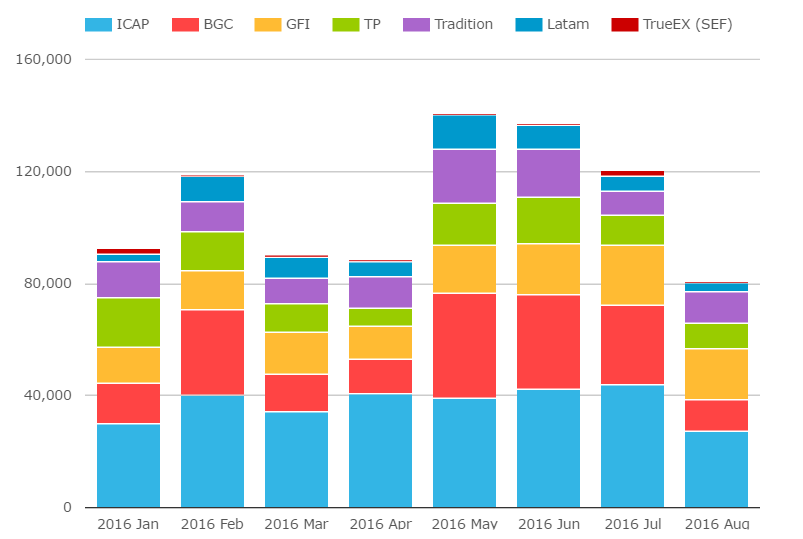

Below are Compression volumes from SDRView for all “other” currencies in 2016:

Showing;

- MXN volumes in grey. It is generally only second to AUD Compression each month.

- The largest volumes were over $2.5bn in February and July of this year.

- August has seen a much wider range of currencies marked as Compression than any month previously. That could be worth researching further.

SEFView

Of course, we can use SEFView to look in more detail at these Compression volumes. When we do, we see that all of the Compression activity is down to a single SEF – TrueEx.

For July 2016 we can successfully match the On SEF, Cleared swaps marked as Compression in SDRView with the volumes reported by TrueEx.

That is a nice “proof of concept” for how we identify the Compression volumes occurring across SEFs.

MXN and CCPView

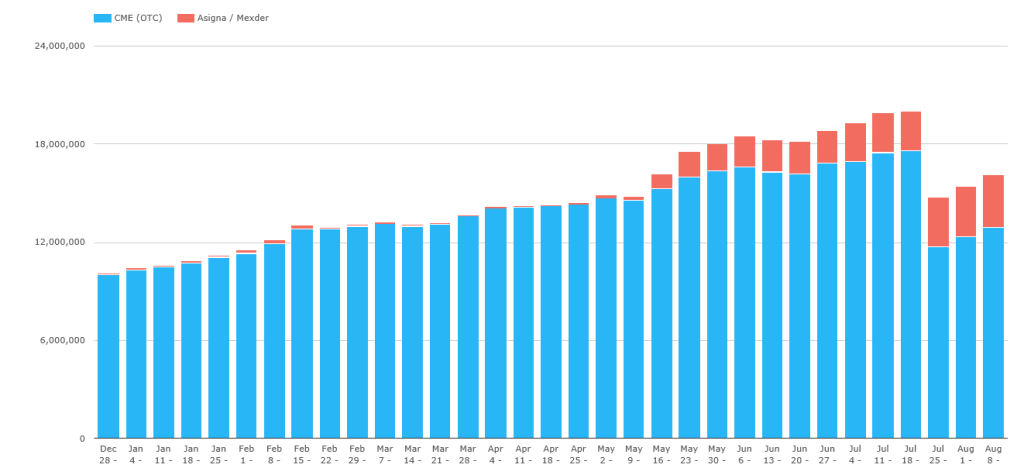

Whilst it’s nice to round the circle and spot the same trades occurring through our different data products, it is only a small portion of the amount of Compression going on in MXN. Here, we need to turn to CCPView. Have a look at the below chart, showing Notional Outstanding in MXN swaps across the global cleared IRS market:

Showing;

- CME Open Interest in blue, Asigna/Mexder in red.

- During the week of July 25th, Open Interest saw a huge reduction at CME, falling from a peak of MXN17.6 trillion down to MXN11.7 trillion the following week.

- To put that MXN6 trillion into perspective, that is double the open interest at Mexder. Impressive stuff!

- Clearly, something is going on in MXN Compression…..

A quick google search shows that the first TriOptima-CME Compression cycle in MXN took place on the 27th July. The CME announcement is here, confirming that $330bn equivalent was compressed (MXN 6.23 trillion). Due to the way CME report these Compression volumes, that helpfully explains the large spike in cleared MXN volumes that Amir noted in the monthly Swaps Review.

And what about those SPSs?

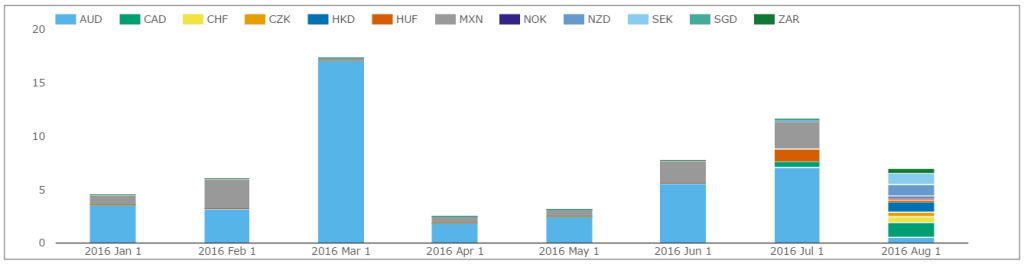

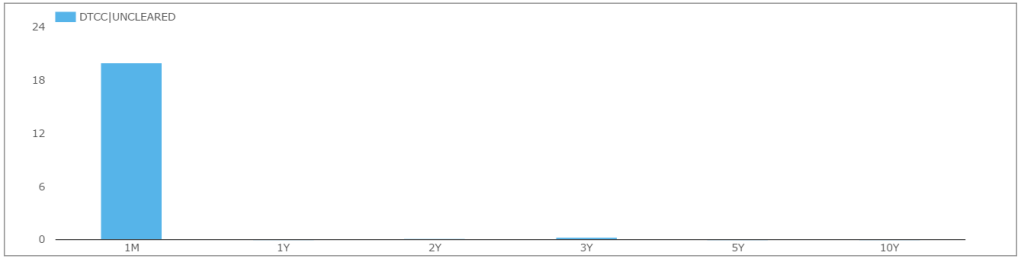

Having looked at cleared Compression in MXN, I then went on to look at List trading (aka uncleared Compression) in MXN. When I looked at it relative to other currencies, it was (again) surprisingly large in some months such as April:

Fortunately, I could quickly run the tenor profile of those MXN List packages in SDRView. Lo-and-behold, it is all short dated, high notional SPS activity:

So I’m happy to say I learnt something today. Looks like FRAs actually trade as SPSs in the MXN market. Who knew?

And what about Uncleared Compression list trading?

I’ll end with a couple of notes. As you’ll see in the chart above, there are volumes trading in uncleared list trading of currencies such as USD, JPY and CAD. Why?

The motivation is less obvious than for cleared swaps. Whilst we can analyse fee schedules of clearing houses and equate line item charges to futures trading in the cleared world, it is far less transparent for bilateral trades.

But it doesn’t mean that these charges don’t also occur in uncleared space.

Whether the fees are clearly stated in a Prime Brokerage agreement between a dealer and a hedge fund, or if it’s due to the amount of capital a dealer has to hold against gross notional positions, the same motivations for notional reduction largely exist in bilateral space as well.

And of course, the fewer trades you are carrying, the more efficient you can be in terms of operations. This may just be from processing fewer payments, but can also result in less collateral being posted and fewer valuation disputes. As with Compression in clearing, there are very few downsides. Assuming you can find a price that you agree with of course!

In Summary

- CCPView shows that there was a large TriOptima compression of MXN swaps at CME during July

- SEFView shows that TrueEx are the number one SEF in town when it comes to MXN Compression

- Single Period Swaps transacted as part of a FRA volume matching session share the same data properties as compression activity. But they represent a different trading motivation.

- We therefore include SPS activity within our List trading package type.