We covered the first day of SOFR First in our Live Blog on Monday, and today I wanted to take a look at the first two days of SOFR trading.

Increase in SOFR Swaps

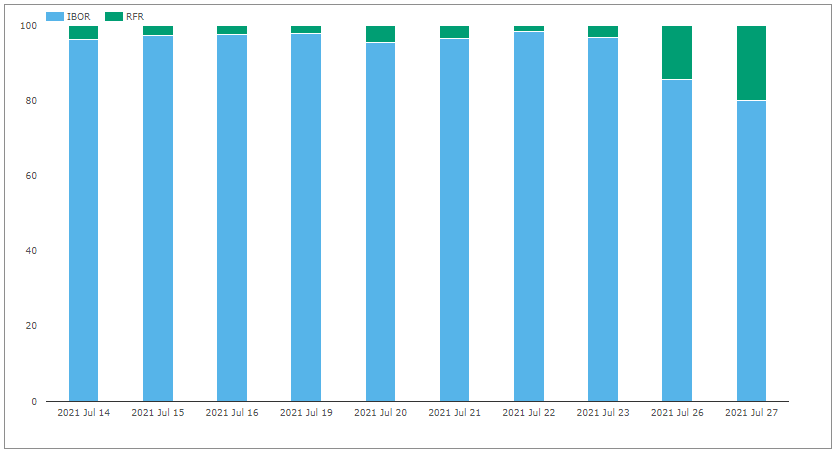

Using SDRView Researcher, we can easily see the increase in SOFR risk traded:

- From under 4%, we see a jump to 14.3% on Jul 26 and then 20% on Jul 27

- This is comparing USD FixedFloat Swaps and USD OIS SOFR Swaps, both ON and OFF SEF

- Recall these percentages are approximate given capped notional rules (i.e. a higher amount of Libor notional may be understated if more Libor swaps are subject to the capped amounts than SOFR)

- But the trend is clear and pronounced, a sharp increase in SOFR Swaps transacted

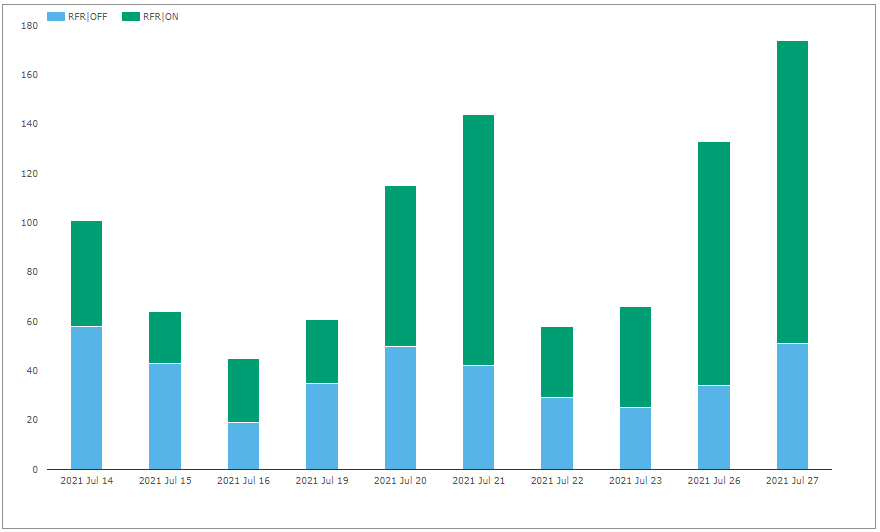

Looking at the number of transactions in SOFR for the last 10 days, split by OFF and ON SEF.

- Sharp jumps in ON SEF transactions to 99 and 123 on the most recent days

- The actual trades executed was a little lower on these days, due to a few gremlins causing duplicated to be publicly disseminated and a small number of curve switches executed (packages of two transactions)

- But the trend is unequivocal in On SEF with a sharp jump in trading

- While for Off SEF it is less clear cut that there has been any real shift

- Not surprising given the focus of July 26 was on inter-dealer trading which is primarily On SEF

SOFR SpreadOvers

In SDRView Professional, we can take a detailed look at the SOFR SpreadOver volume on July 27th:

- 5Y with 7 trades, $800m notional and a last price of -12.75 bps

- 10Y with 13 trades, $859m notional and a last price of -24.5 bps

- 30Y with 5 trades, $150m notional and a last price of -54.5 bps

- A total of 25 trades with $1.8b notional and $1.6m DV01

Comparing that to Libor Spreadovers on the same day, with 15 trades, $930 million notional and $700k DV01, we can see that this inter-dealer product is moving decisively to SOFR Spreadovers.

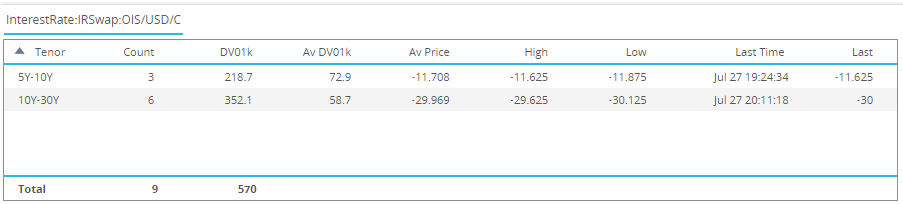

Next if we isolate SOFR Spreadover Curve (aka Switch) trades on July 27th:

- 5Y-10Y with 3 trades, $218k dv01 and a last price of -11.625 bps

- 10Y-30Y with 6 trades, $350 dv01 and a last price of -30 bps

- A total of 9 trades and $570k dv01

- Again more than Libor, were we only saw 5 trades and $120k dv01

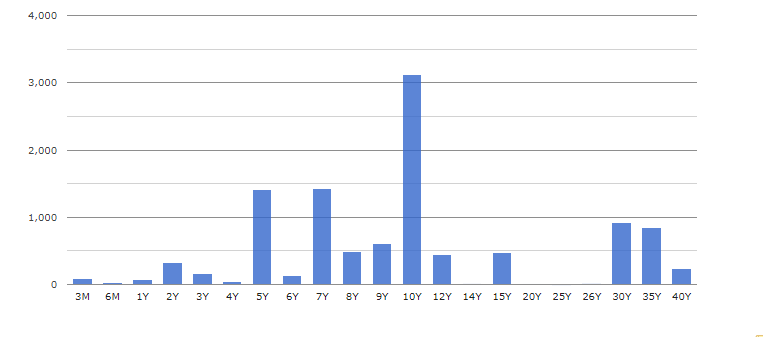

SOFR Swap Tenors Traded

Expanding our selection to SOFR Swaps that are either Outrights and Spreadovers: by tenor

- 10Y the largest with $3.1m dv01 (42 trades, or $1.8m dv01 on a package adjusted basis)

- 5Y and 7Y each with $1.4m dv01 (28 and 19 trades)

- 30Y and 35Y with $0.9m and 0.85m dv01 (13 and 4 trades)

- Multiple trades in many tenors from 3m to 40Y

- Not a lot of dv01 below 4Y e.g. 2Y with 8 trades, $1.7b notional and $300k dv01

- A total of 168 trades, $18 b notional and $10.8m dv01

- Which on a package adjusted basis is equivalent to $14b notional $6.7m dv01 (using a single notional and dv01 for the two transactions in a curve and three in a butterfly)

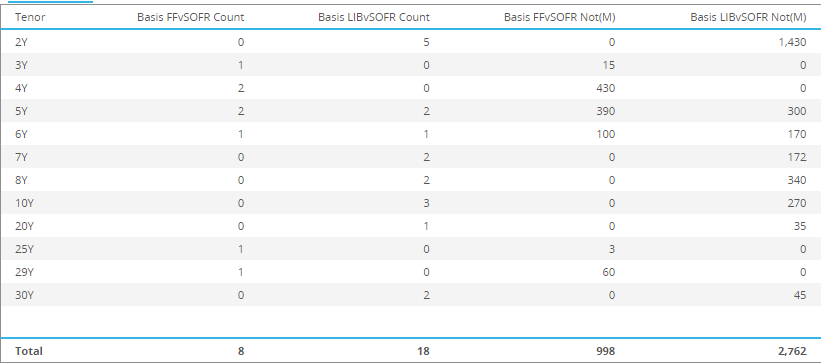

SOFR Basis Swaps

Before we end, lets take a look at SOFR Basis Swaps.

- FF vs SOFR with 8 trades and $1b gross notional

- Libor vs SOFR with 18 trades and $2.8 gross notional

- One or two trades in many tenors from 2Y to 30Y

That’s It for Today

We will continue to keep a close eye on SOFR volumes.

Over time we get more data and more time to analyse.

Clarus Data products provide the insight you need.

Please contact us if you are interested in these.

Great coverage by both, Chris and Amir, over the past two days. Please keep up the good work, pleasure reading the ClarusFT blogs and great help professionally.