Interest Rate Basis Swaps can be categorised into two distinct types, with floating sides/legs which reference either:

- Distinct reference indices e.g. USD Libor 3M vs Fedfunds, or

- Tenor Basis e.g. USD Libor 3M vs 6M

Basis Swaps are used to hedge or trade the basis spread between the reference indices or Libor tenors and are widely used, particularily in the dealer market to hedge client activity in the less liquid reference index or tenor.

With the demise of IBORs, there will naturally be less basis spreads in most currencies. Not great for brokers and dealers, as less products to trade and make markets in, but perhaps better for customers as a simplification of interest rate hedging.

Let’s look at what has happened so far in GBP, EUR and USD.

GBP Basis Swaps

GBP Libor came to an end on Dec 31, 2021, leaving only SONIA as the reference index for sterling, so let’s look at monthly volumes of Basis Swaps from Jan 1, 2021.

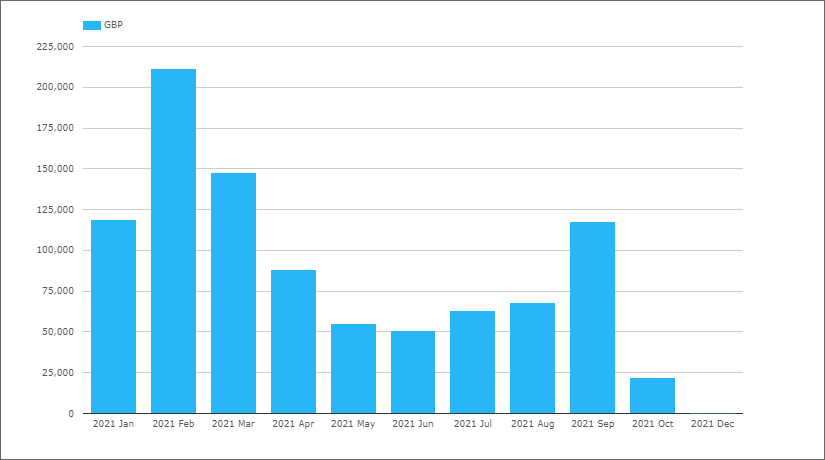

First global cleared volumes from CCPView.

- £120b, £210b, £150b in the first 3-months of 2021

- Then down to £50b in May and June 2021

- A spike in Sep2021 to £118b, as the LCH Libor conversions took place

- Then £22b in Oct2021 and £15m in Dec2021, with nothing after

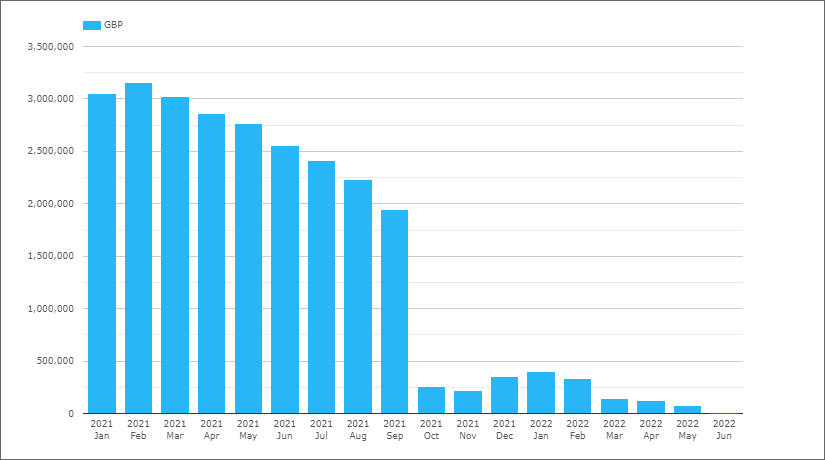

Next the outstanding cleared notional.

- £3 trillion at end Jan 2021

- Consistent and steady drops down to £2 trillion by end Sep 2021

- Then LCH and other CCP conversions of outstanding GBP Libor Swaps to Sonia

- Outstanding notional collapsing to £260 billion

- A small pick-up at end Jan 2022 to £400 billion(?)

- With only £2 billion left at end June 2022

- Which will run-off to zero soon.

In summary GBP Basis Swap volumes show:

- an orderly decrease starting a year prior to the Libor end date, then

- a collapse to a much lower level as CCP conversions happened, followed by

- a run-off to zero over the subsquent 6-months.

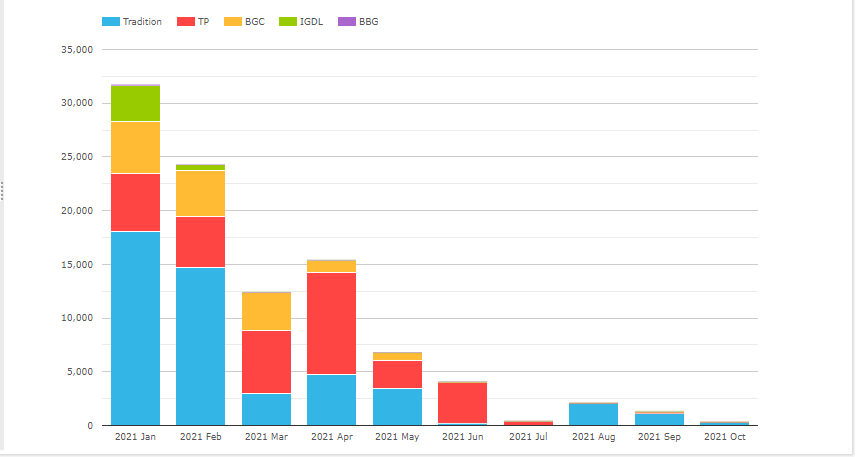

Before we look at EUR & USD, let’s look at two charts from SEFView and SDRView.

- On SEF volumes by month

- Jan 2021 with £32b, then £24b, £12b and £15b in subsquent months

- Representing 27%, 11%, 8% and 17% respectively of global cleared volumes

- Tradition the largest, followed by Tullet and then BGC

- No volume after Oct 2021.

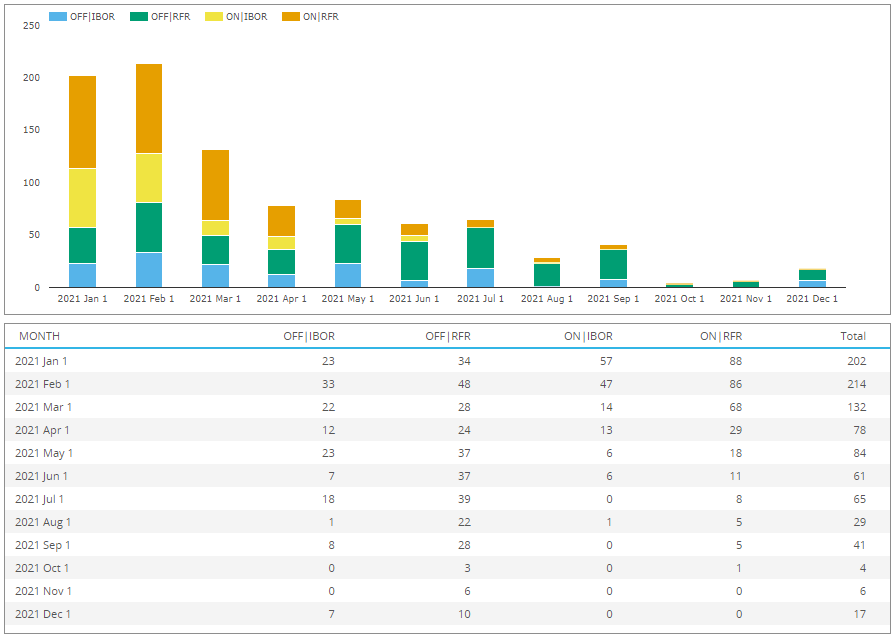

Next from SDRView, monthly trade counts by Off/On SEF and IBOR/RFR.

- 202 trades in Jan 2021

- 88 On SEF and RFR, so SONIA vs Libor

- 57 On SEF and IBOR, so Libor 6m vs 1m/3m/12m

- 34 Off SEF and RFR

- 23 Off SEF and IBOR

- Dropping to 61 trades in Jun 2021 and 41 trades in Sep

- And nothing after Jan 2022

That was the endgame for GBP Basis Swaps; all volume now in OIS Sonia Swaps.

EUR Basis Swaps

As Euribor has been reformed and expected to exist till end 2025, while €STR has replaced EONIA, we expect the data in EUR Basis Swaps to look very different to that in GBP.

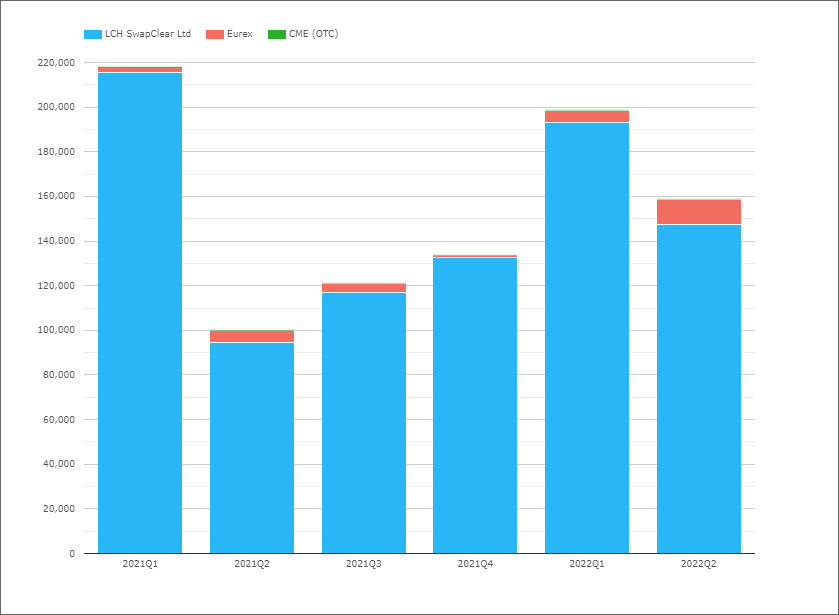

Starting with cleared volumes from CCPView.

- €220 billion in 2021Q1, the high for the period

- Much smaller than the £480 billion in 2021Q1 for GBP Basis Swaps

- Then €200 billion in 2022Q1 and €160 billion in 2022Q2

- Volumes looking like being higher in 2022 than 2021

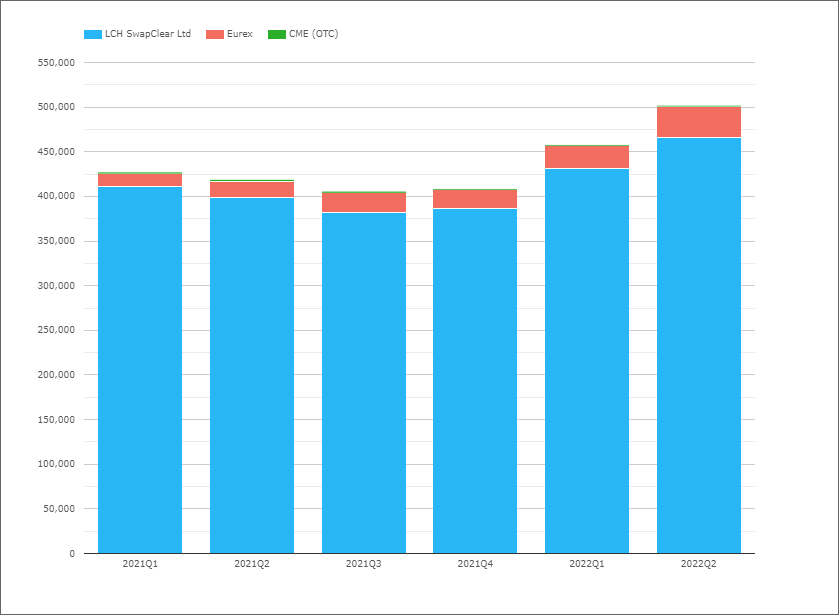

Next the outstanding cleared notional.

- End 2021Q1 outstanding cleared notional of €430 billion

- Again much smaller than the £3 trillion of GBP Basis on the same date

- End 2022Q2 outstanding notional of €500 billion

- Showing a continued increase in the stock of EUR Basis Swaps

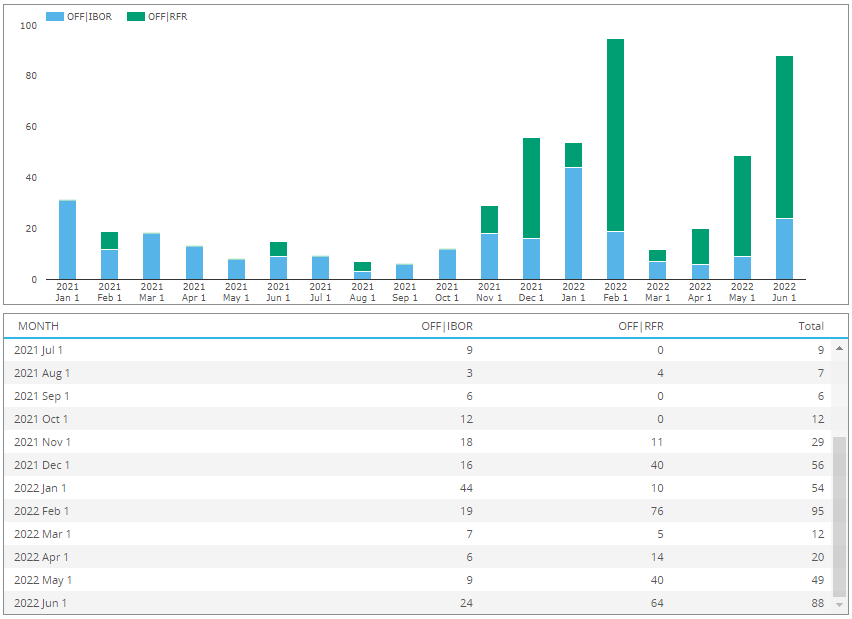

As there is no EUR Basis trading on SEFs, let’s look at what SDR trade data shows.

- An increasing trend in trade counts

- RFR trades, so €STR vs Euribor, the most common with 64 in June 2022

- IBOR trades, so Euribor 6m vs 3m or 1m vs 3m, with 24 trades in Jun 2022

- All trades are Off SEF

Not shown on the chart, is that Uncleared counts are similar to Cleared in each month, which is surprising for Swaps.

USD Basis Swaps

USD Basis Swaps, Libor Tenor and Reference Index (FF vs Libor, SOFR vs Libor, FF vs SOFR).

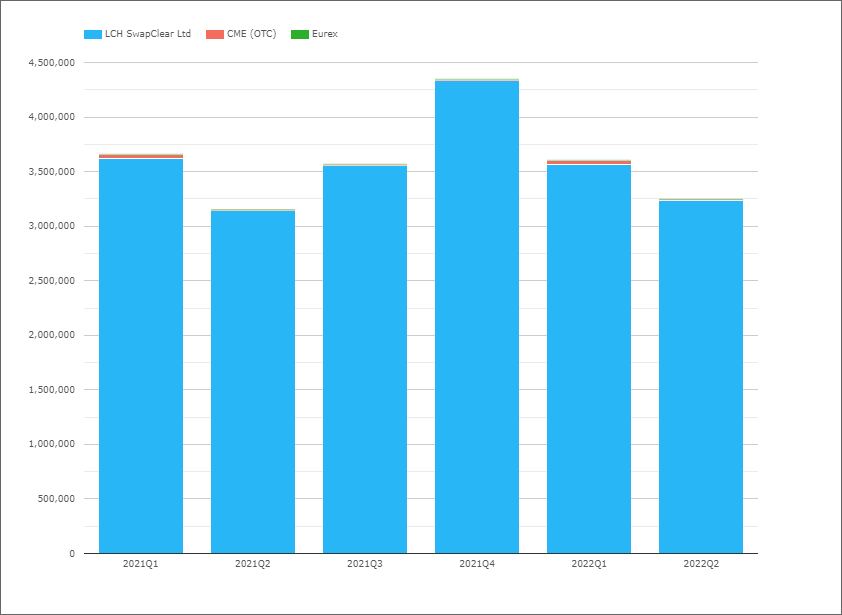

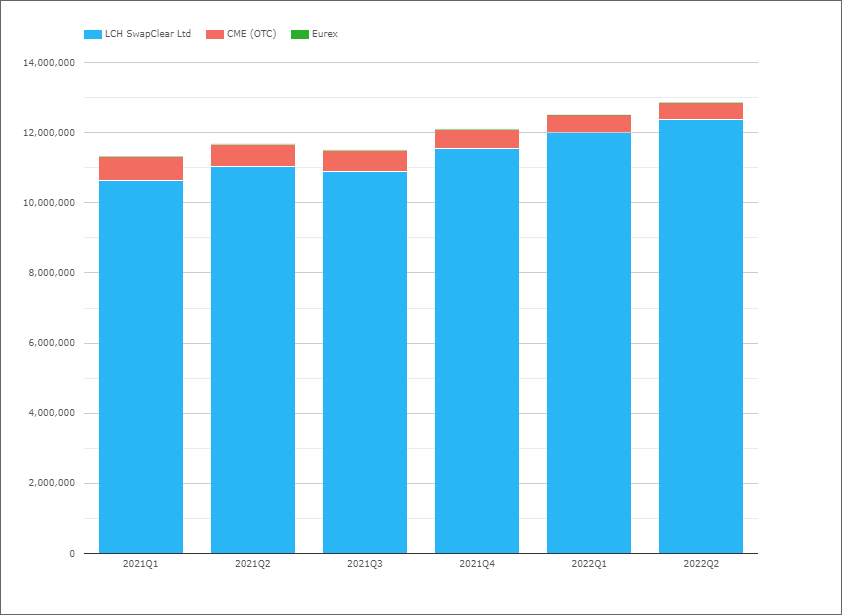

Starting with cleared volumes from CCPView.

- $3.7 trillion in 2021Q1, $4.3 trillion in 2021Q4 and $3.2 trillion in 2022Q2

- So much larger then GBP Basis Swap market was (£480 billion in 2021Q1)

Next the outstanding cleared notional.

- End 2021Q1 outstanding notional of $11.3 trillion

- End 2022Q2 outstanding notional of $12.8 trillion

- Showing a continued increase in the stock of USD Basis Swaps

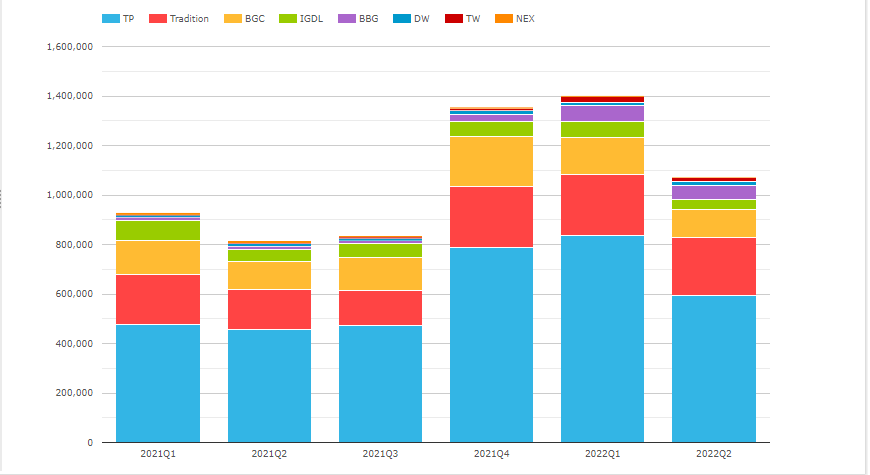

Next let’s turn to SEFView for On SEF volumes.

- Tullet by far the largest, followed by Tradition and BGC

- 2022Q1 with $1.4 trillion and 2021Q2 with $1.1 trillion

- On SEF volume around 30% of Global Cleared Volume

- The remainder must be Off SEF or non-US persons

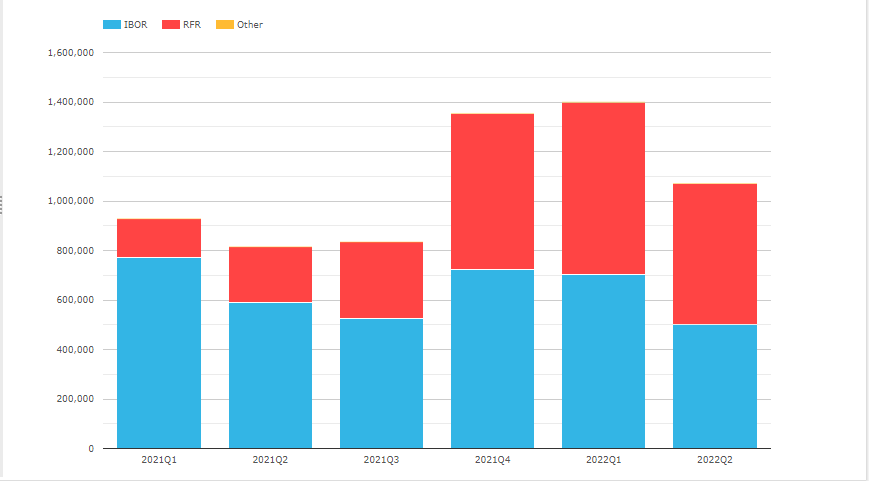

Let’s now slice this same SEF volume as follows:

- RFR, where one side is SOFR, the other Libor or FedFunds

- IBOR, where one side is Libor, the other Libor or FF or another index (but not SOFR)

- IBOR the largest each quarter, except for the most recent quarter

- IBOR with $500 billion in 2022Q2, compared to $590 billion in 2021Q1

- IBOR showing signs of decreasing QoQ

- RFR volumes in comparison have been increasing

- Up from $160 billion in 2021Q1 to $700 billion in 2022Q1

- However RFR here also includes SOFR vs LIBOR, which will end

In summary, all the IBOR volume of $500-$700 billion a quarter will go to zero.

If the pattern in GBP holds in USD (see GBP SEFView chart, 3rd from top), with 1-year left to the June 2023 end of USD Libor, we would expect the decline in volumes to accelerate in the coming months and go to zero before June 2023 (depending on when the CCP USD RFR conversions take place).

However not only will SEFs lose $500-$700 billion of Libor Basis volume, but a good chunk of the RFR Basis volume is SOFR vs Libor, which will also end, leaving SOFR vs FF volume.

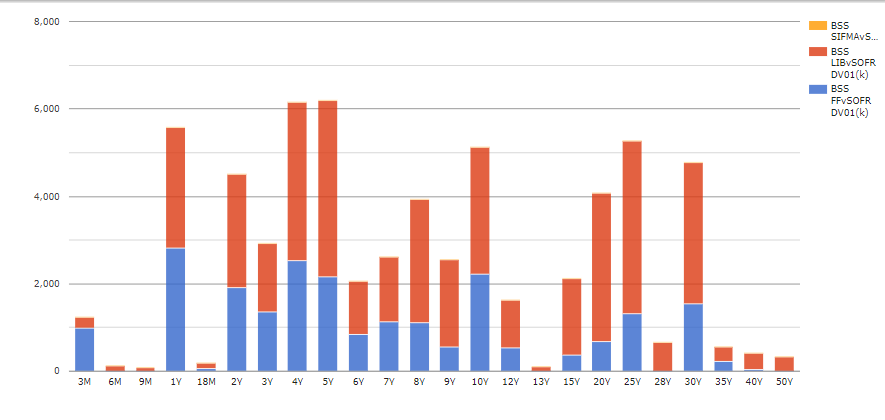

We don’t have a readily available seperation of the SEF RFR volume above into SOFR vs FF and SOFR vs LIBOR, but can turn to SDRView to get a good estimate.

- On SEF USD Basis Swap trades reported to SDRs

- Libor vs SOFR in red, the majority, with 585 trades, $104b notional, $40m dv01

- FF v SOFR in blue, with 419 trades, $106b notional, $22m dv01

Depending on the measure (counts/notional/dv01), 50%-65% of the volume is Libor vs SOFR.

Meaning the $700 billion SEF volume in 2022Q2 will become $350 billion by June 2023, let’s call it a round $100 billion a month.

There is of-course the possibility that SOFR v FF activity increases materially or new Basis Swaps against other reference indices (e.g. Term SOFR, BSBY, Ameribor, …), start to trade in material amounts. However it is too early to see that in the data.

For now we expect USD Basis Swaps to exhibit a similar(-ish) pattern of decline in volumes and outstanding notional to GBP, except for the fact that SOFR vs FF Basis volumes are material and likely to remain so or increase.

That’s all for today in the endgame.

One to observe in the months ahead.

I don’t think there is any official sector plan to deprecate EURIBOR, can you provide some context around “Euribor has been reformed and expected to exist till end 2025”?

Hi Ben, sure I took it from this, see https://www.lbbw.de/legal-information/legal-information/ibor-reform_abdhgytj6c_e.html

See the FAQ at the end with the title, “What is happening to Euribor”.

Next question would be where they got this information from (don’t expect you to answer this John!), since I can find no other official reference.

Sorry, I meant “Amir” not “John”!

EUR basis swaps are reported on SEF but as seperate trades , so for example a 5yr (ag 6m euribor) and a 5yr (ag 3m euribor). Of course there is no way to know when they are a basis or just outright.

Thanks for this Mark