- Swap Spreads, aka Spreadovers, have recently turned negative again in the US.

- They rebounded back into positive territory fairly quickly.

- This is against a background of all-time record volumes in USD swaps reported to US SDRs.

- Should Swap Spreads be at zero versus SOFR after LIBOR disappears?

Negative Again

In case you missed it, Swap Spreads (aka Spreadovers) in the US went negative again following the huge rally in Fixed Income that we have seen since the (unexpectedly) Dovish Fed messaging in March.

In case you missed it, Swap Spreads (aka Spreadovers) in the US went negative again following the huge rally in Fixed Income that we have seen since the (unexpectedly) Dovish Fed messaging in March.

The FT covered it pretty well, and included a handy chart (shown right), that shows the extent of the contraction.

However, before I could write it up for this blog, 10 year Swap Spreads then rebounded sharply on Friday and back into (marginally) positive territory.

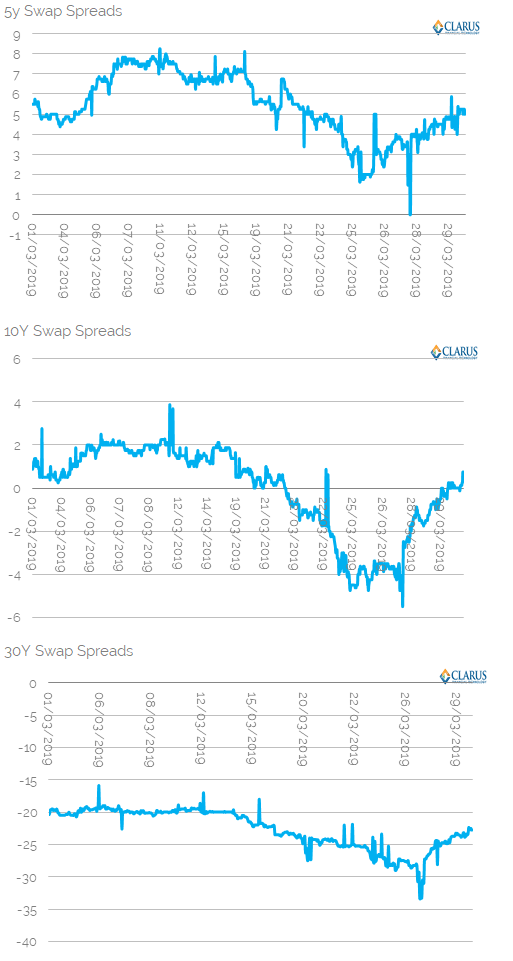

Fortunately, I can lean on SDRView Pro to create an updated chart, showing the evolution of 5y, 10y and 30y Swap Spreads over the past month:

Showing;

- The extent of the tightening and then bounce back in Swap Spreads across 5y, 10y and 30y maturities.

- 10y Swap Spreads caught all of the headlines, moving as high as +4 during the month, before trading all the way down to -5 (just as the FT chart stops).

- They rebounded quickly on Friday into the quarter end, closing at just over zero (+0.75 basis points to be exact).

- 5y Spreads also had a bumpy ride, with an 8 basis point range during the month. I’d love to know if they really traded as low as zero as implied in the data or whether that particular print was part of a package.

- On which note, we did see some apparently strange trades on 20th March in 5y Spreads with small negative prints. I’ve cleaned up the charts to exclude them for now, but please let us know in the comments below whether these are worth investigating in more detail.

- Wow 30y Spreads are volatile. These have moved from -16bp to -33bp in the month, before also rebounding on Friday.

Volumes

As always, these headlines about price action led me to look into the volumes that have traded. Have they been out of the ordinary? SDRView Researcher holds the answers.

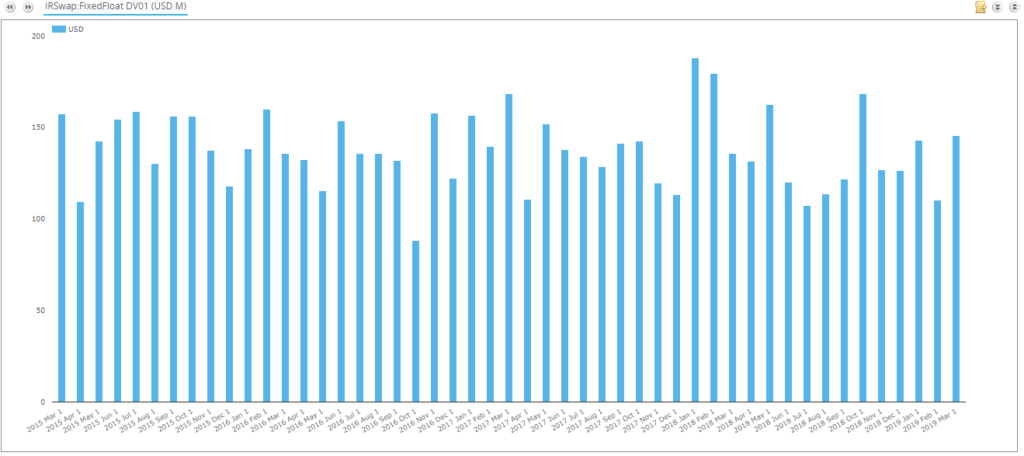

First, monthly volumes for the past 4 years in Swap Spreads (denoted as Spreadovers in SDRView), expressed in millions of DV01:

Showing that with $146m DV01 traded, March 2019 was a thoroughly unspectacular month for volumes.

Showing that with $146m DV01 traded, March 2019 was a thoroughly unspectacular month for volumes.

Volumes by Tenor

What about looking at these Spreads by Tenor – has there been anything significant happening?

Again, the answer is no. The activity in the 5y tenor has increased slightly in the past year – now averaging 37% in Q1 2019, compared to 33% for previous years – but hardly anything ground-breaking.

Again, the answer is no. The activity in the 5y tenor has increased slightly in the past year – now averaging 37% in Q1 2019, compared to 33% for previous years – but hardly anything ground-breaking.

But…it was a record month for USD swaps reported to the SDRs

Swap Spreads have therefore been characterised more by their price action (i.e. happening to pass through the somewhat arbitrary barrier of zero vs LIBOR) rather than anything significant in terms of volumes.

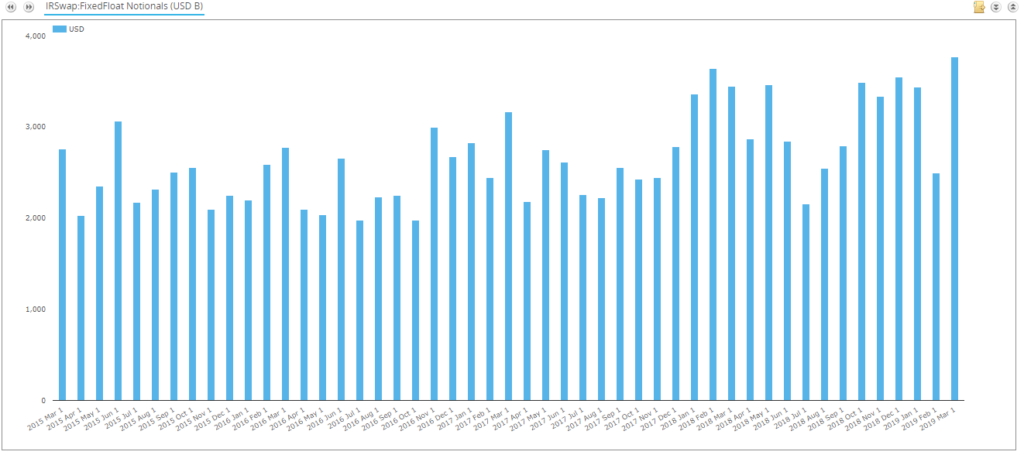

If we cast our net a little further and look at all USD IRS reported to the US SDRs, we find that March 2019 set a new notional record for Fixed-Float swaps reported:

Showing a total of $3.77trn reported.

Showing a total of $3.77trn reported.

Referencing this versus CCPView, we find that this record was not quite repeated on a global level, where December 2018 remains the all-time record for USD swaps at $8.2trn of notional cleared:

Swap Spreads vs SOFR

Finally, I cannot write an article these days without mentioning RFRs and the possibility that LIBOR will cease to exist post 2021. What does this mean for Swap Spreads (Spreadovers?).

I started thinking about this after I saw the article in Risk Magazine – Jumbo SOFR swaps herald new world of repo betting. The specific swaps that the headline refers to are some 3 day trades executed on March 20th and captured in my SDR SOFR alerts below. These were emails sent directly to my inbox when the trades happened:

If you are also interested to receive these SOFR email alerts, please contact us about a subscription to SDRView Pro.

If you are also interested to receive these SOFR email alerts, please contact us about a subscription to SDRView Pro.

The most likely USD Libor fallback, if it ceases to be published, will be SOFR plus a spread. Given that SOFR is a repo index, what does this imply for swap spreads? Can I really buy a bond, repo it each day, and earn SOFR plus a spread in the swaps market? All to compensate me for the cost of capital of holding a cleared IRS and posting daily VM against it at a clearing house? This maybe helps to explain why 30y spreads are negative (versus LIBOR remember!).

End users – hedge funds, real money – may yet therefore become the real end users in this swap spread market. They can repo out their holdings and maybe get a positive return versus SOFR. Sounds like a great trade to me….

In Summary

- $3.77trn of notional was reported to US SDRs in March 2019, an all-time record month.

- This compares to an all-time record month for the global cleared USD swap market of $8.2trn in December 2018 (and almost matched in March 2019).

- Swap Spreads headed through zero as all of this activity was taking place, but versus the LIBOR index.

- We ponder whether Swap Spreads should converge to zero versus SOFR in a post-LIBOR world.