Client clearing open interest is steadily increasing right?

One would be forgiven for thinking that client clearing open interest is steadily increasing given the 2013 CFTC clearing mandate which impacts US clients directly (as well as any non-US client that trades with a US person). Not true I am afraid. The stats below show that open interest has plateaued and client clearing volumes are below their mid-2014 peak.

Firstly, to simplify the stats, it’s worth pointing out that apart from LCH (UK) and CME (US) all the other CCPs in Rates don’t really figure in the client clearing stakes – e.g. in Feb they were less than 0.2% of all client cleared volume. So for simplicity I have excluded them from the following analysis. Nothing against LCH (US), CME (UK), Eurex, NASDAQ OMX, JSCC, SGX etc. and things may change when the EU Rates mandate hits – allegedly in 2016 for clients.

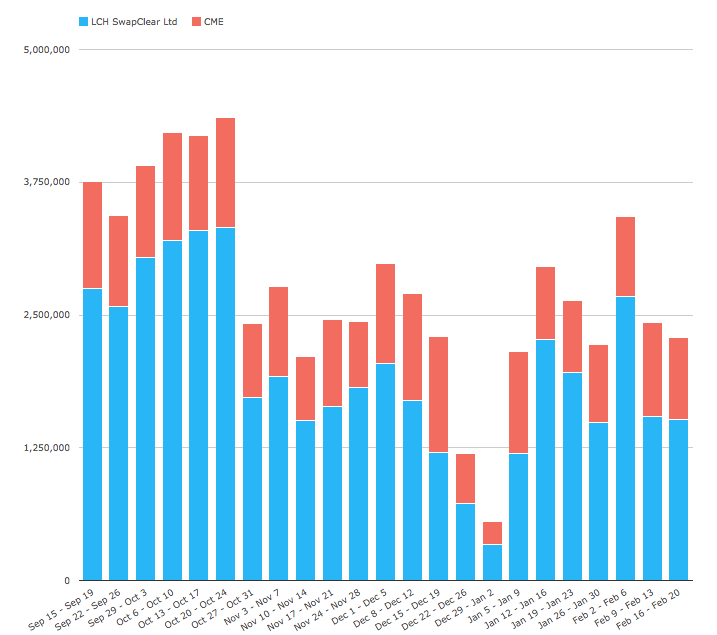

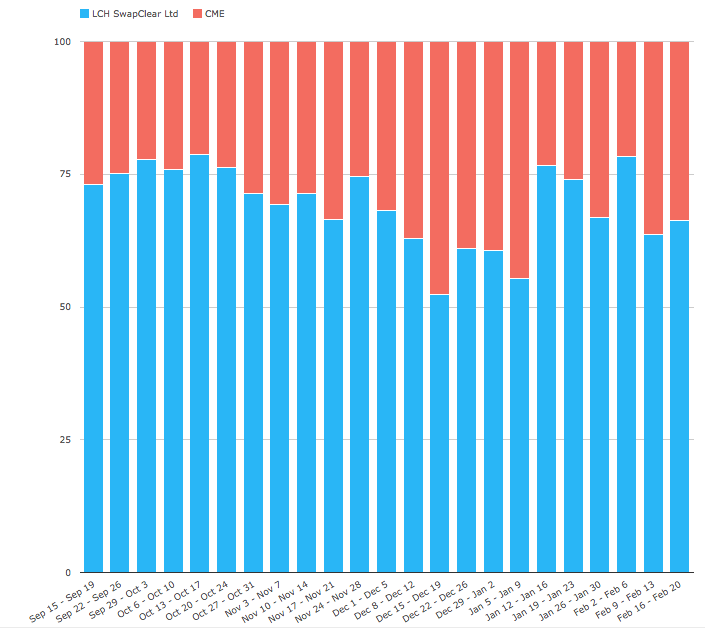

Secondly, if we look at cleared notional volume close up what’s noticeable is that LCH is dominating market share although CME is perhaps picking up share.

Weekly Cleared Notional Volume 15 Sep 2014 to 20 Feb 2015 ($m and % of total)

(Source: CCPView – Volume (USD millions) in all interest rate products, all currencies)

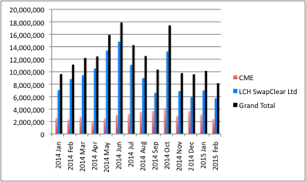

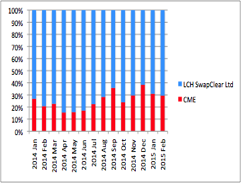

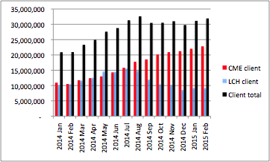

Thirdly, if we look at a longer date range a clearer perspective emerges. We can see that total client cleared notional volume tailed off from a peak of $18 trillion in mid 2014 (aside from a spike in October) and seems to be settling around $10 trillion a month. Market share is led by LCH SwapClear but seems to be shifting towards CME who are just broaching the 30% level. If you look at the first SwapClear graph below it shows that most of the total downturn in volume happened there whilst CME if anything increased through the year but to a smaller extent.

Monthly Cleared Notional Volume Jan 2014 to Feb 2015 ($m and % of total)

(Sources: CCPView, SwapClear website – all interest rate products / currencies) (Note: February is a week short of a complete month)

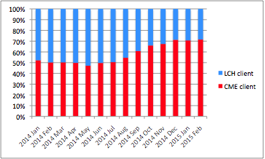

Fourthly, if we look at open interest as opposed to new trades cleared we can see that CME has recently moved into the majority share and most noticeably a plateau in total client open interest at about $31 trillion. (The SwapClear website has monthly open interest numbers which I used to supplement the series starting in mid September in CCPView).

Rates Client Cleared Open Interest ($m and % of total)

(Sources: CCPView, SwapClear website – all interest rate products / currencies)

What could explain this?

An explanation needs to fit the following recent phenomena:

- LCH client cleared volume and open interest shifted sharply downwards after mid-2014

- CME showed steady volume / open interest increase but volume tailed off at year end

- Market share of cleared volume shifted only slightly to CME

- Market share of open interest shifted massively to CME

Perhaps one or more of the following:

- Maturing trades?

- Dealer bank balance sheet withdrawal?

- Client margin optimisation?

- Client shifting portfolios to CME?

None of these looks plausible and I am left with the idea that clients at LCH are compressing notional perhaps working with FCMs or original dealers or SEFs. Before we look at compression let’s recap the capital incentives.

Capital Incentives

Dealers have bank funding and capital incentives in clearing are several (funding, mRWA, portfolio cRWA, default fund risk capital, leverage ratio denominator, liquidity coverage ratio denominator). These apply in different ways to both the trading business and the clearing business (FCM in the US). Flavor of the month is very much leverage ratio denominator and there has been a lot of press on the use of compression by bank clearing members to reduce notional.

Clients have much simpler capital incentives to optimize CCP IM funding. There are no regulation-driven capital implications unless the client is a bank subject to Basel III. It is possible that a mandated clearing client could be a bank that is subject to the above funding and capital incentives in general and the leverage ratio in particular. However, it would appear that regional banks may get a bye from leverage ratio disclosures initially because they are not “advanced approaches banks” in the regulatory parlance.

FCMs are caught in the middle. Whilst clients have no incentive to restrain cleared notional and only slow acting incentives to optimize IM funding, FCMs incur capital costs even though they don’t in general fund the client’s IM. Both the IM and the notional in client portfolios worsen the leverage ratio and therefore the capital usage of the clearing business. (There are other capital costs but this is the current focus). There has been quite a bit of press on this recently (e.g. this article by Citi in Risk magazine (subs. required) Nov 25th 2014) and there is public lobbying by ISDA and CME among others to change the treatment of IM and adopt SA-CCR instead of CEM in the leverage ratio calculation. Meanwhile the current rules prevail for the big bank FCMs which dominate client clearing.

Given it will take a while to change the rules and leverage ratio public disclosures for the big banks begin at end Q1 2015, perhaps FCMs are working with clients and/or the original dealers on their trades to optimize notional?

How to optimise notional? Riskless portfolio compression

To do this you have to replace a bunch of trades with a smaller bunch of trades with the same net risk. The simplest case is to simply unwind a risk neutral portfolio (if you can find one). The more powerful case is to add (much fewer / lower notional) new trades to the mix to offset the (more voluminous) portfolio being unwound. This can be used in theory on any portfolio whether risk neutral or not.

It’s also worth noting that client clearing doesn’t have a concept of a conventional unwind trade where a trade is terminated at a particular date. The only way for a client to unwind (in CME or SwapClear at least) is to trade an equal and opposite trade which then position nets against the trade being unwound. Why I point this out is that it means that riskless compression would show up in the volumes as new trades.

What forms of Compression are there?

From my knowledge combined with earlier posts by Tod, Chris and Amir’s prior posts indicate there are a few ways to go about reducing notional:

- TriReduce multilateral compression serviceis the market leading compression service and does aim to target buy side firms. The SwapClear website shows $56tn reduction or $28tn in open interest terms reduction between July and January. This is enough to explain the reduction of LCH client open interest above (and TriReduce doesn’t work for CME portfolios to my knowledge). Anecdotally clients are not yet involved though.

- SEF based compression services (mainly from Bloomberg, TradeWeb and TrueEx) are showing up actual volume – around $130bn per month in SEFview and SDRview(according to Chris’s post here). The portfolio unwind RFQ can be riskless or “risky”. The volumes Chris inferred may not be enough on its own to explain the open interest reduction. Also the offerings may not be that sophisticated yet as the SEFs don’t to my knowledge calculate risk on the client portfolios input and therefore cannot achieve particular risk tolerance goals or replace trades automatically.

- CCP-provided coupon blending(from both CME and LCH) have been marketed heavily recently – volumes not directly available. It’s possible that LCH significantly outperformed CME’s equivalent service.

- Bank-led compaction– a client with help from an FCM could bid around his open portfolio (manually in a spreadsheet) for pricing of termination and replacement in an OTC rather than SEF based approach. This approach could skirt the SEF MAT rules provided the new trades were not within the narrow start date criteria for SEF MAT. Clearing would then be somewhat manually initiated given off SEF.

Why in particular have clients reduced notional in LCH but not CME?

This is a particular puzzle. Perhaps TriReduce or LCH coupon blending service in combination with SEF compression explain this? Perhaps CME’s compression offering has not yet taken off? Perhaps CME has stolen clearing clients / market share from LCH? Perhaps EU clients having geared up for clearing are trading purely bilaterally given the mandate was delayed and these EU clients were gearing up predominantly in SwapClear? Or perhaps something else is going on?

Whatever it is I don’t have evidence that clients are turning away from trading cleared products. I just know that client open interest has plateaued temporarily and FCMs have a clear incentive to restrain open interest.

I would be interested in people’s views, so please comment below or send them to us.

This article is authored by Jon Skinner.