Calculate your own RFR Adoption Indicators

The ISDA-Clarus RFR Adoption Indicator provides a set of monthly metrics that firms can use to monitor the progress of RFR trading in IRD markets, both ETD and OTC. In this article, I explain why firms should also calculate RFR Adoption Indicators for their own trading. Background For those of you not yet familiar, below […]

YouTube: Markets and COVID-19

The presentation that I gave at the CFTC’s Market Risk Advisory Committee on July 21st is now available to view. The section on Derivatives Markets during COVID-19 is well worth a watch, covering content from ourselves, Bloomberg and Tradeweb. Have a click through to watch it all, and make sure to listen to the closing […]

RFR Data: SOFR Sees Record Risk Traded

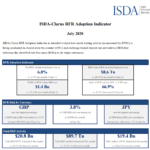

The ISDA-Clarus RFR Adoption Indicator has been published for July 2020. The headlines are: The RFR Adoption Indicator was at 6.8% in July 2020. This moved higher from 4.7% the prior month, reaching the highest level since February. Of particular note, 3.8% of all USD risk was traded in SOFR. This was higher than the […]

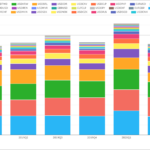

CCP Volumes and Share in CRD and FXD – 2Q 2020

I recently looked at CCP Swap Volumes and Share – 2Q 2020 for Interest Rate Swaps, so today I will do the same analysis for Credit Derivatives and FX Derivatives. USD CRD Starting with Credit Derivatives in USD, both Indices and Single-names. 2Q 2020 with $2.65 trillion, up from the $2 trillion in 2Q 2019 […]

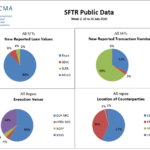

SFTR Public Data

In April I covered Securities Finance Transaction Reporting (SFTR) and ended that article by stating that I would check back end July for the first set of public reports from Trade Repositories. As there are four authorized Trade Repositories (DTCC, Regis-TR, UnaVista and KDPW), I had expected to look for the weekly data files published […]

ISDA-Clarus RFR Adoption Indicator Analysis – June 2020

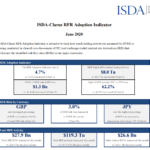

4.7% of derivatives risk was transacted versus an RFR in June 2020. June 2020 was a record month for the proportion of risk transacted versus SOFR in USD markets. €STR is at the beginning of adoption following the CCP discounting switch last week. JPY TONA sees a significant proportion of risk transacted in longer maturities. […]

ISDA-Clarus RFR Adoption Indicator

The ISDA-Clarus RFR Adoption Indicator was at 4.7% in June 2020. This indicator measures the risk-weighted (DV01) percentage of trading activity that takes place in RFR products. Five further sub-indicators have been developed in conjunction with ISDA, providing market participants with granular transparency into RFR activity. Check out the first publication to learn about RFR […]

Managing IBOR Transition – Fallback Spreads

Last month I wrote about the potential for a very non-linear transition when LIBOR is discontinued. This was also covered in a recent Risk article: ‘Beware the cliff edge in Libor fallbacks’. The impending announcement on the timing of LIBOR cessation process was covered by Chris Barnes earlier this month, Also with the potential for […]

€STR Discounting Switch

I’m sure that I am not the only one sat here wondering how the switch from EONIA to €STR discounting went at the CCPs over the weekend? As far as I understand it, the change in valuation (cash compensation) amounts should have settled on Monday (July 27th) morning. Will this switch lead to activity in […]

Clarus at the CFTC

Clarus were invited along to the CFTC’s Market Risk Advisory Committee on July 21st, for which we are very thankful. It was a great session, and we hope provided an opportunity to highlight to all market participants how vital transparency was to the smooth functioning of markets during March 2020. We presented on “Rates OTC […]