There Are Now Over 1,000 Clarus Blog Posts!

The Clarus blog has recently published its 1,000th blog. We run through our early blog posts and highlight some of our most popular posts. The blog had over 500,000 page views in 2020. We are looking forward to the next 500,000. I realised a little too late last week that we have just gone over […]

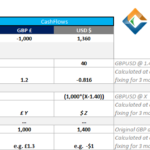

Mechanics and Definitions of RFR Cross Currency Swaps

Cross Currency Swaps exchange a funding position in one currency for a funding position in another currency. Markets have transitioned to trading RFR vs RFR since September 21st 2021 in three major currency pairs. The interbank market continues to trade a resettable floating-floating swap, incorporating a USD cash payment to reset the mark-to-market close to […]

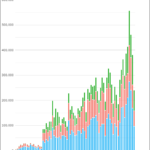

What Is The Outlook for Trading Volumes From Here?

Clarus CCPView provides insight into volumes across Swaps, Bonds and Futures. We look at the evolution of volumes in different parts of the yield curve. H2 2021 saw some extremely large volumes, with certain tenors showing more activity than in March 2020. Are these elevated volumes here to stay? CCPView includes volumes covering Swaps (OTC […]

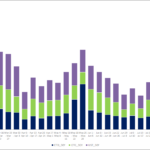

G3 Inflation Swap Volumes are on the up

Monthly volumes of cleared inflation swaps topped $500 Billion for the first time in March 2021. That is basically double the monthly volumes that we were seeing as recently as a year ago. This blog will take a look at the volume data available to us. It serves as a great reminder of just how […]

What’s New in USD Rates?

USD Rates volumes have returned to the levels we saw in March 2020. We look at whether these volumes are being driven by US Treasuries, bond futures or OTC swaps. Clarus provides volume data by tenor for all of these asset classes under a single data subscription. CCPView provides granular data on traded volumes across […]

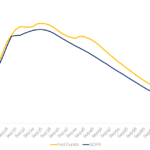

Here is what is happening to derivatives market liquidity right now

The price of liquidity in USD swaps has risen in 2021 relative to 2020 when measured by Price Dispersion. However, USD Swap markets saw huge volumes traded during February 2021, showing that liquidity has still been available. Our analysis shows that the price of liquidity has increased as volatility increased. Everyone is talking about the […]

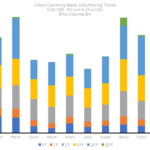

Cross Currency Swap Review 2020

I was fortunate enough to be able to write about Cross Currency Swaps a few times during 2020. At the height of the market turmoil in March and into April, I wrote about: Cross Currency Swaps Trading During a Crisis Mechanics of Central Bank FX Swap Lines Central Bank Responses to COVID-19: FX Swap Arrangements […]

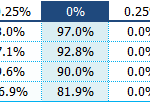

Spreadovers vs SOFR

LIBOR swaps traded on spread to US Treasury bonds make up about 70% of interdealer liquidity. The floating leg of these swaps is about to be discounted at SOFR. This could lead the Spreadover market to start trading versus the SOFR index itself. We look at the differences between a LIBOR spreadover and a SOFR […]

US Treasury Quarterly Refunding: Traded Volume Data

Clarus data for August 2020 shows a big increase in 30Y traded volumes in Rates products. This was specifically in USTs and exchange traded derivatives. Long-dated OTC derivatives did not see the same increase. The 20Y and 30Y US Treasury auctions, as part of the quarterly refunding cycle, were clear drivers of this volume. However, […]

Will GBP Interest Rates go negative in the UK?

Over £55bn in SONIA OIS swaps have traded at negative rates. The lowest recorded rate so far was close to minus 6 basis points. Swaps all the way out to 4 year maturities have traded in negative territory. When does the market expect negative rates and how large will the cut be? Negative Yields on […]