- The RFR Adoption Indicator hit new all time highs in November of 26.3%.

- 45% of the USD Swaptions market is now traded versus SOFR on IDB SEFs.

- 100% of the GBP, JPY and CHF XCCY markets vs USD are now traded RFR vs RFR.

- We have seen a $7Trn+ increase in the Open Interest of RFRs in JPY and CHF due to CCP conversion processes.

As we speed toward the final cessation of LIBORs (other than USD), we continue to see very healthy adoption of RFR trading. We now have 9 trading days to go!

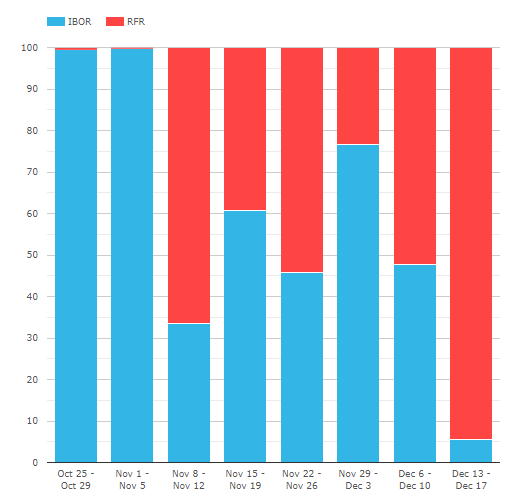

Let’s take a look at the data behind the November ISDA-Clarus RFR Adoption Indicator , and what has happened in the 10 trading days since we cut the data at the end of Nov.

All Time Highs

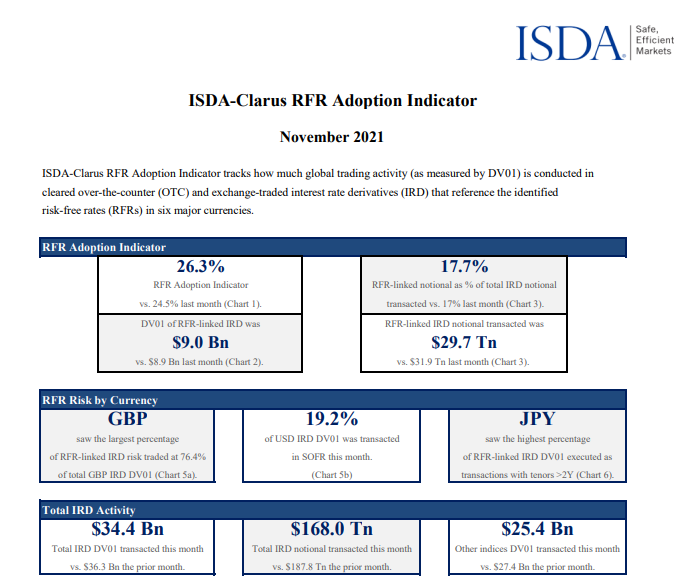

The ISDA-Clarus RFR Adoption Indicator stood at 26% at the end of November 2021:

Showing;

- A new all-time high of 26.3% for the overall RFR Adoption Indicator.

- That is the 9th consecutive monthly increase in RFR adoption. The transition really is happening in the data.

- SOFR adoption increased to 19.2% – nearly one fifth of risk is now traded vs SOFR.

- 76.4% of GBP risk was versus SONIA (a new high).

- 73% of JPY risk was versus TONA (wow!).

- 62.2% of CHF risk was versus SARON.

- $9.0bn of RFR DV01 was traded, 52% higher than when we last wrote about it in September, and a huge 2.3 times the August levels!

This all leaves the overall RFR Adoption Indicator looking very healthy. The charts now show that very pleasing “up and to the right” trend:

We do still have questions to ask the market, such as:

- Why is 25% of risk in GBP still being traded versus LIBOR? Is this a mad rush, is it risk reducing, will it stop in December, or is it all versus Futures (see later)?

- CHF with 38% raises similar questions, but of course is a much smaller market overall.

- USD markets are largely expected to stop trading any USD LIBOR generating exposures from 1st Jan. Dealer markets seem well placed for this now.

“RFR First” Initiatives since we last blogged

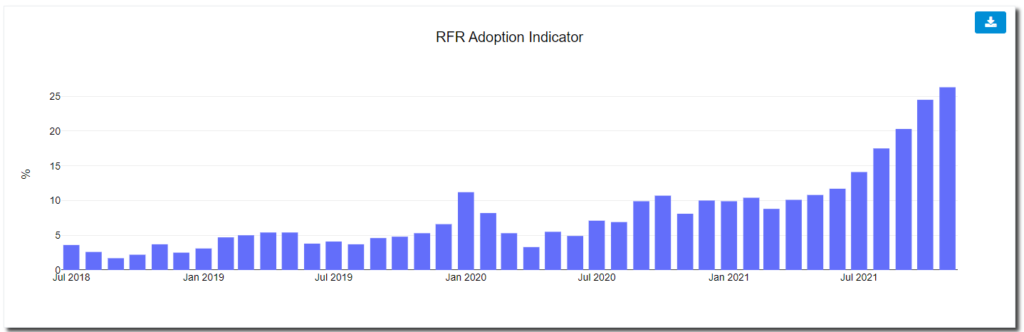

As keen followers of the blog will know, we have looked in-depth at SOFR First for Swaptions in USD Markets. From SDRView, we see that around 30% of Swaptions reported to SDRs are now versus SOFR:

As the chart shows, this is still relatively early days in SOFR Swaption adoption, with the weekly stats quite variable. 46% of Swaptions (and Caps/Floors) were traded versus SOFR in the low volume week of November 22nd. However, in the more typical weeks, LIBOR-linked volumes have continued to be over $100bn.

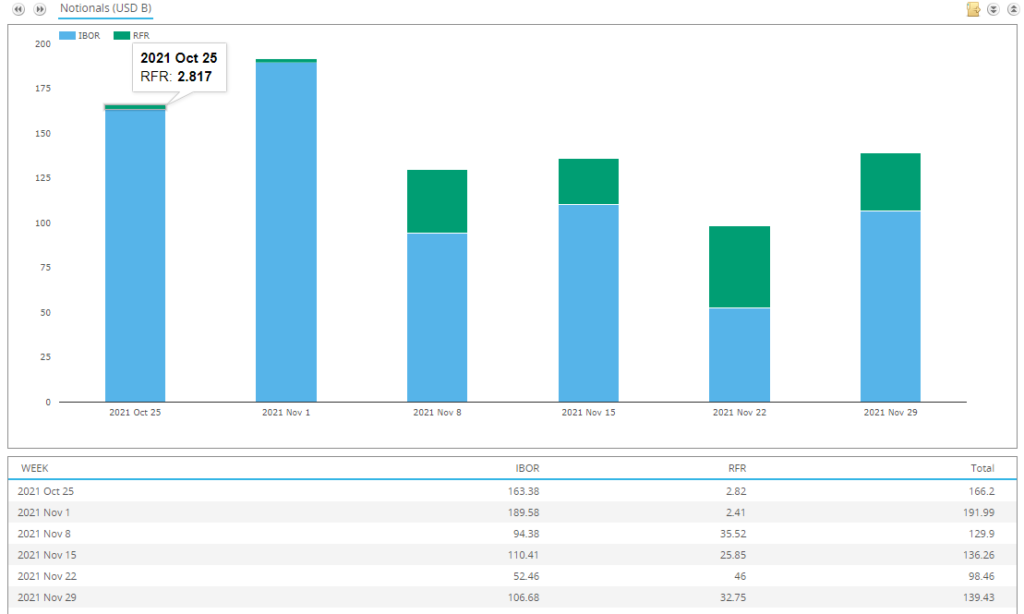

Interdealer SEFs are still leading the charge on SOFR Swaption adoption. Just this week, 95% of Swaption volumes have been versus SOFR (!), up from previous highs of 66-78% (as we reported previously):

The chart above excludes client activity on BBG and Tradeweb SEFs – it is only the IDB SEFs.

There has been another RFR First initiative too. This is “Part II” of Cross Currency RFR first, covering all other currency pairs. Encouragingly, the EUR RFR Working Group also backed this for EURUSD:

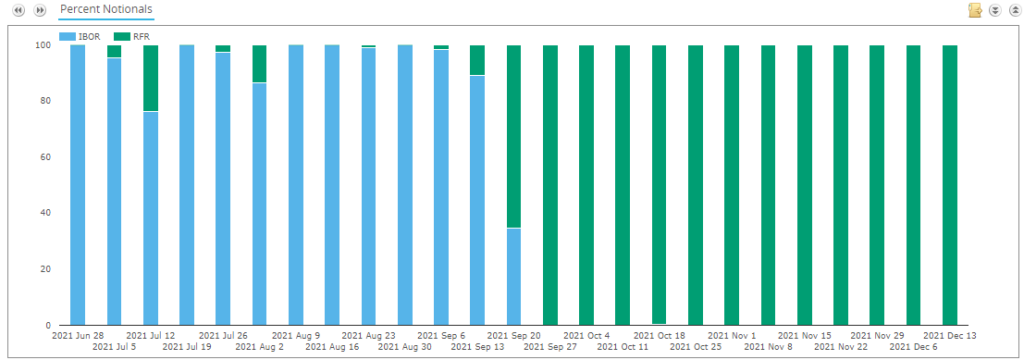

When we look at Cross Currency Swaps reported to SDRs, we now see most are traded with an RFR leg. First, we can see the huge success of the first round of RFR First for XCCY by looking at only CHF, GBP and JPY vs USD:

It’s very satisfying for me that I can look at my old market and see that LIBOR trading switched-off at the end of September. For these 3 currency pairs, trading is literally now 100% vs RFRs. Nice.

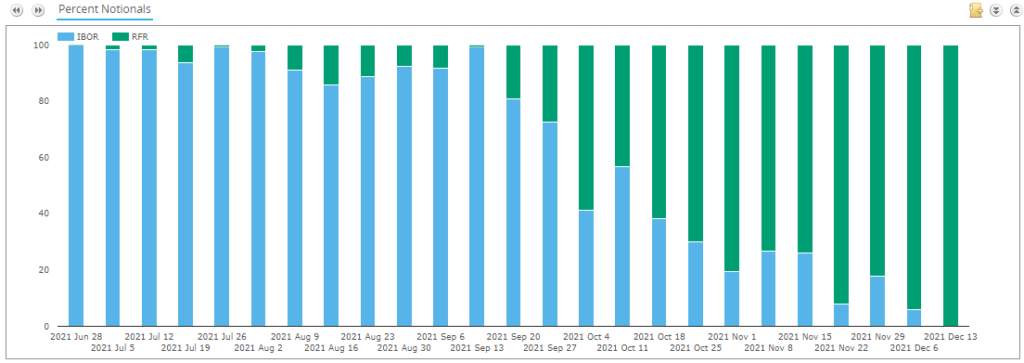

Turning our attention to the currencies covered this week, we see two things:

- EURUSD was somewhat swept up in the first wave already.

- There has been a marked increase in other currency pairs trading vs RFRs this week already.

First up, in EURUSD:

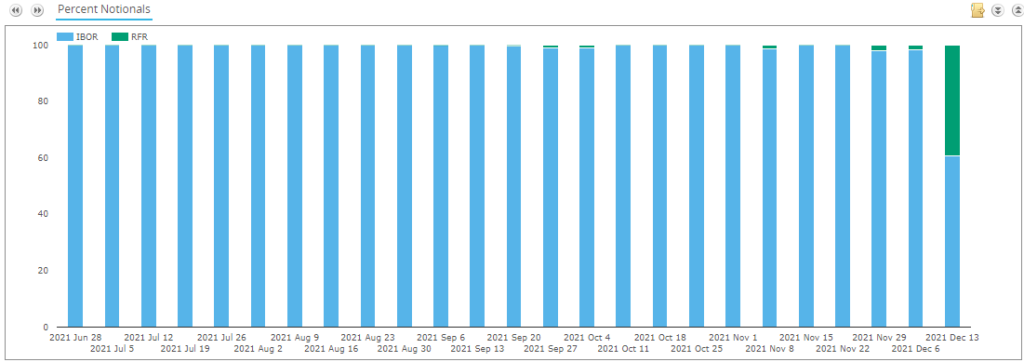

And secondly, in some of the other major currencies: AUD, CAD, SEK and NOK:

Worth noting, that these RFR volumes are almost all in AUD and CAD. I think all have been traded as term domestic rate (i.e. CDOR or BBSW) vs USD SOFR.

There are of course loads more currency pairs to look at, but let’s save those charts for a Cross Currency specific blog at a later date.

CCP Conversion Activities

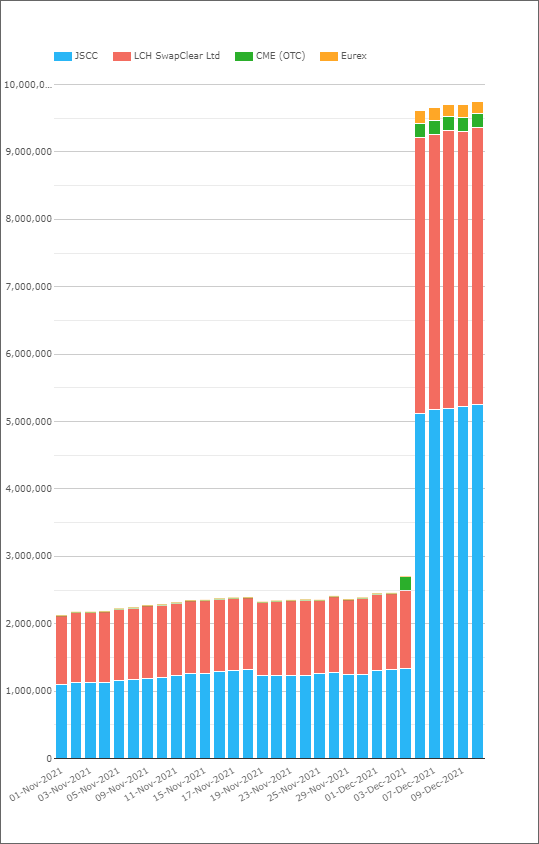

As reported in Risk here, the first weekend in December saw a huge coordinated conversion of JPY & CHF LIBOR trades at the major CCPs. We believe this involves converting outstanding LIBOR positions into corresponding OIS at LCH, JSCC, CME and Eurex. In CCPView, we see the corresponding massive increase in Open Interest in OIS in these two currencies:

I’ve not seen any specific press from the CCPs regarding these conversions. My guess is that this is because they also want to convert GBP positions before communicating with the market.

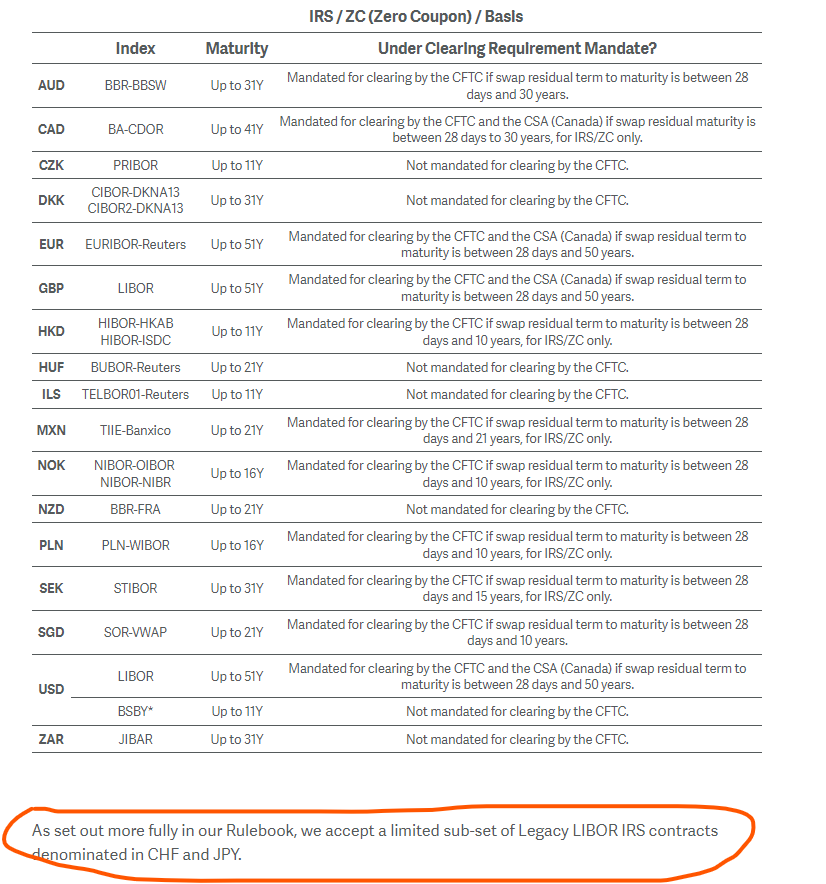

What I did note is that CHF and JPY LIBOR are now no longer eligible for clearing at LCH SwapClear (apart from some specific cases):

Given that we are concerned with cleared volumes for the ISDA-Clarus RFR Adoption Indicator, this means we should see 100% of volumes in these currencies move to RFR. Let’s wait for the data to confirm that in the new year.

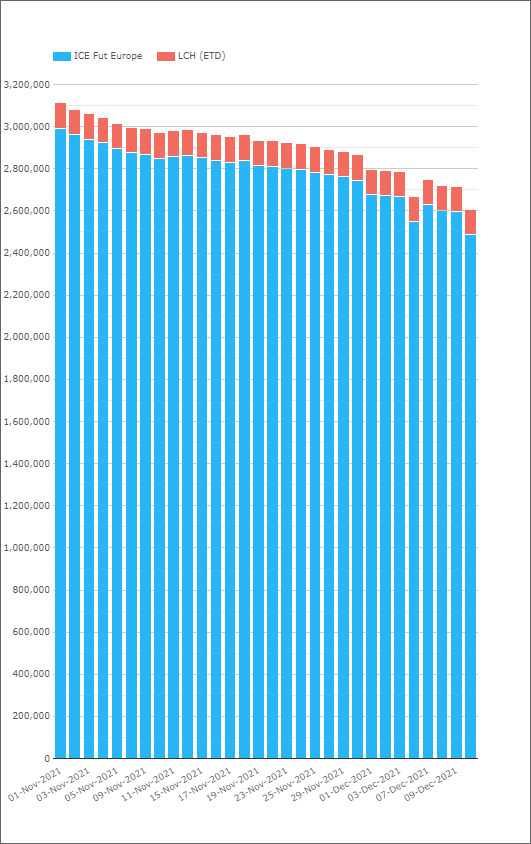

Finally – anyone know when “RFR First” is coming for ETD derivatives?! We still have $2.6Trn of Open Interest in Short-Sterling. I guess all of this gets rolled into SONIA today, the 3rd Wednesday of December?

In Summary

- The RFR Adoption Indicator hit new all time highs in November of 26.3%.

- 45% of the USD Swaptions market is now traded versus SOFR on IDB SEFs.

- 100% of the GBP, JPY and CHF XCCY markets vs USD are now traded RFR vs RFR.

- We have seen a $7Trn+ increase in the Open Interest of RFRs in JPY and CHF due to CCP conversion processes.

- When will futures markets move to RFRs?