Our Top Blogs and Stats of 2020

For our last blog of the year, I wanted to highlight our top blogs and share a few statistics. Top New Blogs in 2020 Starting with a list of the most popular new blogs that we published in 2020. The top three with > 2,000 views each and a total of 30,000 views for the […]

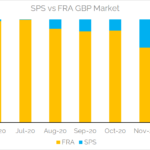

Toxic FRAs, Fallbacks and Single Period Swaps

Whilst we continue drafting responses to the pivotal ICE consultation on LIBOR cessation, I have been looking through the data to see how LIBOR cessation is already changing trading behaviour. Away from the global RFR Indicator, which looks at all linear derivatives, there are certain products that have already been affected. Most notably, the FRA […]

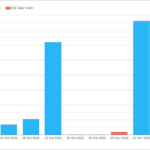

Credit Index Options – Dec 2020

Clearing of Credit Index Options is a product to watch in 2021 with recent announcements from both ICE Clear Credit and LCH CDSClear. In early November, ICE launched clearing for Options on CDX NA.IG and CDX.NA.HY In early December LCH CDSClear went live with Options on CDX.NA.IG and CDX.NA.HY To add to those on iTraxx […]

Libor pre-cessation announcement – how wrong was the market?

In November I looked at the risk implications of a LIBOR pre-cessation announcement which was widely expected in December 2020. Basis markets such as SOFR/USD LIBOR and SONIA/GBP LIBOR clearly priced the spread to be fixed at the announcement in December (i.e. over the next month or so) and that the fallbacks would take effect […]

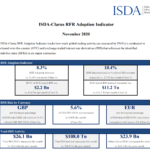

RFR Trading November 2020

The ISDA-Clarus RFR Adoption Indicator has been published for October 2020. The headlines are: The RFR Adoption Indicator was 8.3%, a decline from the previous month (which saw an all-time high). This is the fourth highest reading on record. 5.6% of all USD risk was traded in SOFR vs 9.7% last month, reflecting the impact of the CCP discounting change. The switch to […]

GSIBs in 2020

The same 30 banks as in 2019 have been defined as GSIBs in 2020. JP Morgan, Wells Fargo and Goldman Sachs have all managed to move into lower tiers, requiring less capital. We look at the data behind the GSIB indicators using GSIBView, our latest data offering. Optimisation of the GSIB metrics is evident in […]

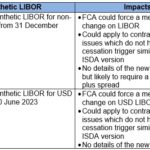

Will anyone trade LIBOR after 2021?

US regulators have announced that banks should cease entering into any new contracts referencing USD LIBOR from 31st December 2021. This is consistent with the announcement last week from the UK regulators, who pointed out that LIBOR fixings may be published after end-2021 but that no new business could be written against them. These announcements […]

Margin Calls Q2 2020

Public disclosures from CCPs reveal the maximum variation margin (VM) called each quarter. In the quarter to June 2020, VM has stayed at elevated levels compared to 2019. VM is running about 34% higher than Q4 2019 and 66% higher than this time last year. Funding daily VM puts complex demands on the industry. Understanding […]

Anonymous Trading on SEFs

The 1st November 2020 heralded a fundamental change in swaps markets. SEFs executing trades in specific products were no longer permitted to disclose the identities of the counterparties (to each other) after the trade: At the moment, this rule only applies to MAT swaps – i.e. those products subjected to the execution mandate and required […]