Dutch regulators have today stated with regards to European transparency data:

- Significant regulatory changes are needed to simplify the current fixed income post-trade deferral regime.

- Common data standards [are required], to set required data fields, and to agree on data access.

- Trading venues and APAs [need] to contribute the required data fields and supporting commercial models.

We could not have put it better ourselves. With the European Commission’s review of MIFIR set to be published imminently, we highlight that a consolidated tape for derivatives using European Transparency data is eminently possible, if only we were allowed to use and access the data.

AFM Consolidated Tape Work

Many thanks to Dan Barnes (no relation!) for sticking the below onto my Twitter feed this morning:

This is the direct link to the Dutch regulators report. (For the purposes of disclosure, Clarus are NOT one of the fintechs involved in this pilot). It states that the review of MIFIR by the European Commission is expected to be published on 23rd November 2021. Has anyone seen it yet this week? I’ve delayed this week’s blog as much as possible expecting to see it!

ETA: See here for the report publication details.

So this may well be out of date by the time you read it, but please bear in mind we wrote two years ago what we think needs to be done to make transparency work in Europe:

The key takeaways were:

- EUR IRS trades reported in real time represented only 11% of notional in September 2019.

- This is because so many trades are either deemed “Illiquid” or are above the “SSTI” threshold for EUR IRS.

- There are no trades reported after T+2.

- Almost all volume is reported with a 4-week delay.

This all results in most volumes in Europe being considered “dark” by any reasonable assessment of transparency:

Scrap Deferrals

Can a “Consolidated Tape” therefore ride to the rescue? If we just stick to “post trade” prices, the pure concept can be distilled as:

- Every time a security trades, the price, volume and timestamp are recorded against that security for that day.

- This works if each trade has a security identifier – such as an ISIN.

- For this to be useful, the primary economic terms of each trade would need to be published within a reasonable time period – let’s copy the US and suggest within a maximum of 15 minutes.

- There may need to be an element of volume masking for very large, block trades. Again let’s assume that the trade is reported within 15minutes, but the full volume is not known until T+1 – just like the US uses for derivatives. Remember that the block threshold for US markets will now move to be calibrated so that 75% of all notional is reported in “real-time” (within 15 minutes).

I think the AFM must read our blog…..

As the AFM report duly notes:

- Significant regulatory changes are needed to simplify the current fixed income post-trade deferral regime.

- Define common data standards, to set required data fields, and to agree on data access.

- Trading venues and APAs [need] to contribute the required data fields and supporting commercial models.

(Emphasis is mine).

I mean, I could not have put it better myself if I was allowed to write these regulatory reports! The only thing I would note on (3) is that why do Trading Venues and APAs need to “support commercial models” for anyone actually publishing a Consolidated Tape? So long as the data is made public and unencumbered, people should be able to do whatever they want with the data. This would surely remove a load of complications from the regulatory process, and all ESMA would have to do is put up with some carping from the APAs and Trading Venues. Well, the TVs and APAs could have avoided that by playing ball with the spirit of the regulations from day one.

A Consolidated Tape for Derivatives

Our eagle-eyed and well informed readers will no doubt have realised that all of the AFM commentary related to Fixed Income markets. In a cleared and standardised world, I largely consider this to cover vanilla interest rate swaps as well, but I understand ESMA may consider cash and derivatives as different ball games.

So I want to make it clear that the Clarus view aligns with that of AFM for derivatives as well. If the data were made available within 15 minutes, we believe that we could create a consolidated tape for derivatives, using the ISIN identifiers.

How Would That Work Exactly?

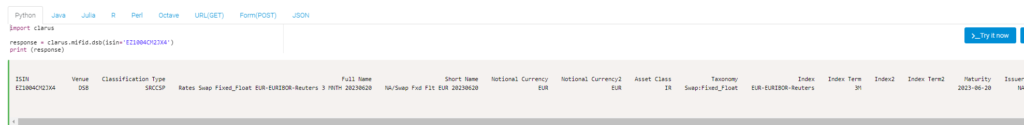

Of course, ISINs are far from ideal. We covered that on the blog, and we note that there are now nearly 70 million ISINs in existence, which undoubtedly hampers transparency. WHY ANNA/DSB would proudly advertise this on their website is beyond me. IT IS NOT A GOOD THING!

Fortunately, derivatives market participants are used to distilling complexity into something simple to understand (a bit like the ethos of this blog).

Therefore, we can rely on existing standardised identifiers of derivatives trades to create a more meaningful Consolidated Tape for derivatives.

At Clarus, we already take data from Bloomberg, Nasdaq, Tradeweb. We are not allowed to sell it on, but that doesn’t stop us from still making a damn good data product from it.

Our (internal only) MIFIDView therefore assigns “Tickers” that are recognisable to all market participants to most linear Rates trades we see reported in MIFID data:

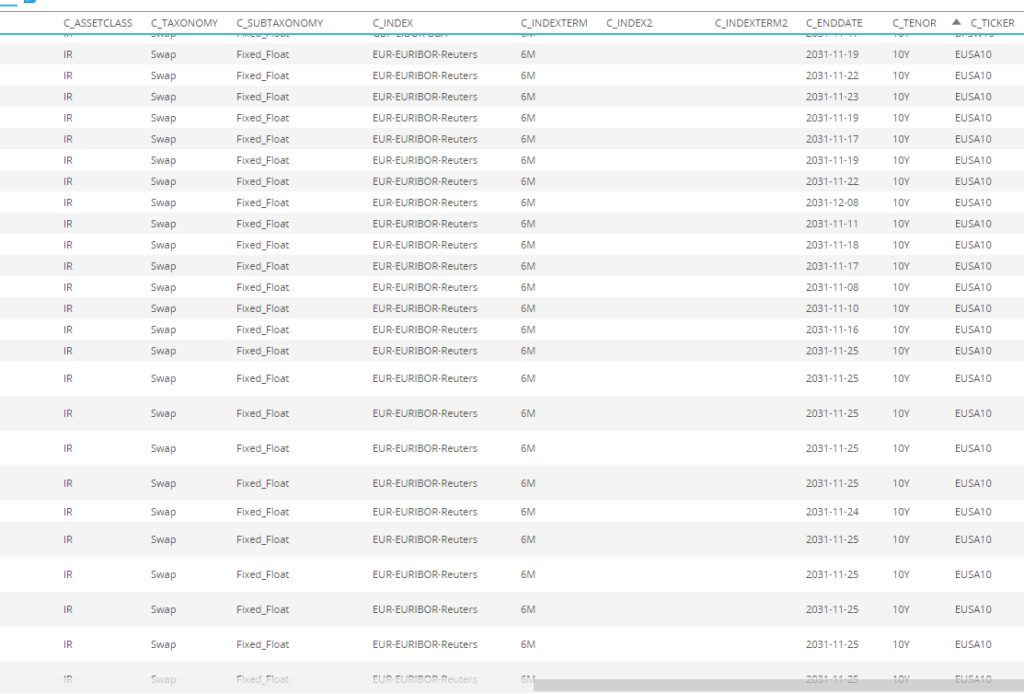

Showing;

- 10Y EUR IRS swaps reported as traded on 23rd November 2021.

- We choose to asign the ticker “EUSA10” to trades that fall within ~10 days of the maturity date of a spot starting 10Y IRS on that day.

- This is because our main utility is monitoring volumes traded, as opposed to prices.

- With the deferrals in place, some of these trades are reported without any price information anyway, so using it to create a price time-series at the moment isn’t realistic.

- However, we can easily tighten the logic for price discovery in the future.

The main point here is yes, we can align ISINs with recognisable tickers with the data as it stands today.

Perfection as the enemy of good

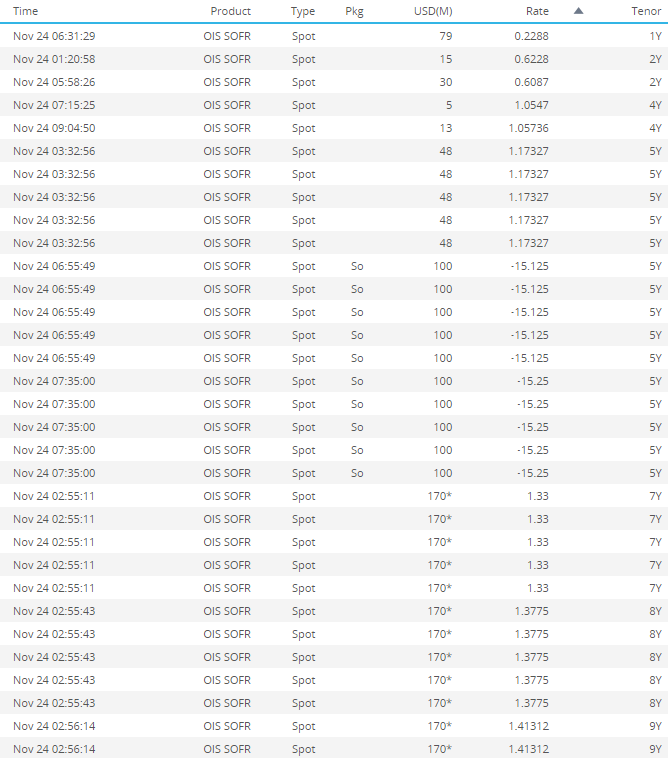

We know that a “tape” of this sort would be appreciated by the market. How do we know? Because we create exactly this for our SDRView Pro clients using US data. It is used across the market by both brokers and market-makers:

We have a simple filter allowing market participants to look at any combination of:

- Spot, Forward, IMM starting

- Non standard

- Single Period Swaps

- Packages covering butterflies, spreads, spreadovers, spreads of spreadovers etc

Some filters are based on the start date of the swap. That specific data field isn’t explicitly included in the ISIN description right now, but there are plenty of pragmatic solutions that can be applied to make sure this isn’t a problem. For example:

- The Maturity Date field is published by the DSB. The worry is therefore that a sport-starting 10Y becomes a 9Y in 365 days time and messes up the old “10Y” tape. This really isn’t a concern for us. At the point the trade is published we mark it as either a 9Y or 10Y. The tape would not be muddied by this concern in our Clarus data.

- How do we identify a 5y5y forward versus a spot starting 10Y is another concern as both might have the same maturity date. And how do we identify an “old” 5y5y versus a now current spot starting 5Y when we finally get there 5 years down the line? There are pragmatic data solutions to this:

- It is straightforward to filter out any prices outside a typical price increment from the previous known trade. We do so for SDR trades already.

- When we run a time-series of 5Y trades back for 5 years, the original 5y5y would not be included as a vanilla “5Y” trade. It would algorithmically marked as “non-standard” and removed from the time-series.

- Yes, we lose some data that way, but let’s not think that perfection is the goal here. Don’t let perfection be the enemy of good!

- Labelling a trade as a “Fwd” or “Old” or “Non standard” would be sufficient to filter trades out of the price series.

- If there are zero changes to ISINs possible, it is still straightforward to filter out any prices outside a typical price increment from the previous known trade.

- Remember, there are multiple uses of a Consolidated Tape over and above analysing the prices per se. Transparency is the aim of the game.

We urge regulators to make the data available, for free and unencumbered, and let market participants such as Clarus solve these problems using our analytics.

Let’s get it right this time

This blog is obviously way too late in the game to serve any influential purpose. We just really want European markets to be able to operate on an equal footing with the gold standard in the US. Let’s not waste this opportunity. Get the data out there, accessible for free and unencumbered, and we can be confident that a usable consolidated tape for derivatives will follow.

In Summary

In the words of AFM, the Dutch financial regulators:

- Significant regulatory changes are needed to simplify the current fixed income post-trade deferral regime.

- Common data standards [are required], to set required data fields, and to agree on data access.

- Trading venues and APAs [need] to contribute the required data fields and supporting commercial models.

Make European transparency data available publicly, for free and unencumbered and a consolidated tape for derivatives will follow. We firmly believe that.